Authereum's Dai-First Wallet; Matter Labs Wants to Solve Eth's Major Problems

Also, first public, multi-client Eth2 testnet, and Brave browser and BAT token gains traction

Hello defiers and happy Friday! Lots going on in decentralized finance:

Authereum is creating an Ethereum wallet that doesn’t need ETH

Matter Labs announces insanely ambitious ZK Sync

There’s a public, multi-client Eth2 testnet

Brave crosses 10m monthly active users

Ethereum Wallet That Doesn’t Make Users Hold ETH

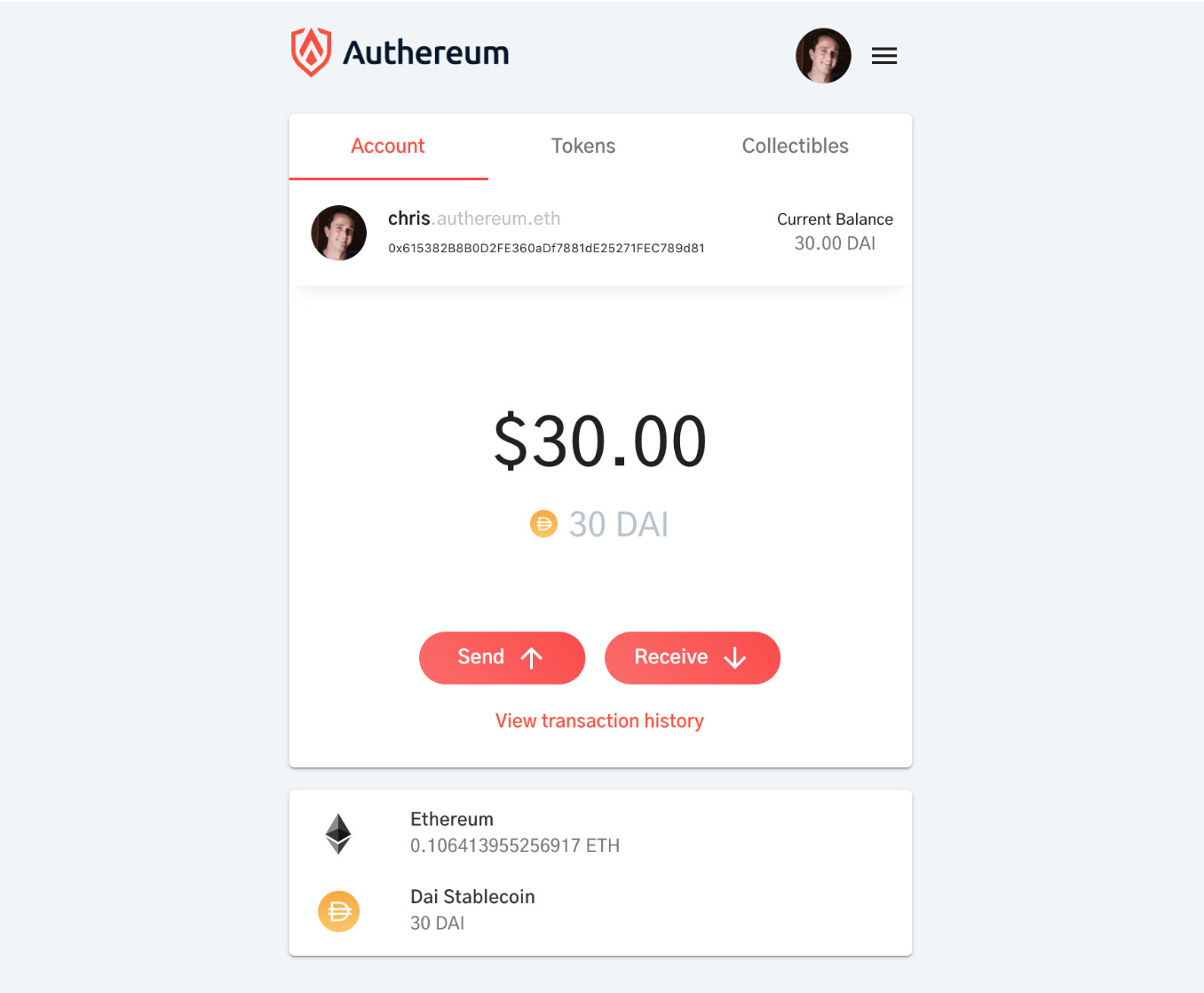

Authereum is building an Ethereum wallet that doesn’t require users to hold ether.

MakerDAO’s stablecoin DAI will be the primary asset displayed upfront by default, unlike ETH is on most other Ethereum wallets. Users can buy DAI with their debit cards directly on the app, as it’s integrated with Wyre.

Transaction fees can also be paid in DAI. The Ethereum network is maintained with fees users pay in ether for miners to process transactions. This means users need to hold ETH before they can do anything on Ethereum, which imposes an entry barrier. Authereum is getting around this by using meta-transactions, in which relayers pay for users’ fees in ETH (and take a small spread), so they don’t have to.

Image source: Authereum

Authereum, which is not live yet, is a non-custodial wallet, meaning users are in control of their funds and don’t risk losing them if Authereum’s server gets hacked. Users sign up only with a username and password, with no KYC and no need to download an app. It uses Ethereum’s contract-based accounts with account recovery options to eliminate the need for seed phrases.

No need to hold ETH, no downloads, no seed phrases. This is one example of how Web3 applications, and open finance as a key part of this new internet, can be easier and more seamless than the current system.

Matter Labs Promises VISA-Like Scalability With ZK Sync

If the Matter Labs team solution works as they claim, it has the potential to solve major roadblocks that has stopped Ethereum from becoming the “world computer” (or Infinite Machine if you will :)) it set out to be: Scalability and privacy, without compromising on decentralization or security.

ZK Sync is designed to bring a VISA-scale throughput of thousands of transactions per second (TPS) to Ethereum while keeping the funds as secure as in the underlying L1 accounts and maintaining a high degree of censorship-resistance.

Another important aspect of the protocol is its ultra-low latency: transactions in ZK Sync will provide instant economic finality.

Image source: Matter Labs

Ethereum is handling on average 15 transaction per second versus Visa’s 2k, so Matter Labs is promising a throughout that’s orders of magnitude bigger.

But the challenge and holy grail is doing that while maintaining security and censorship-resistance. Other chains, like Tron and EOS, have achieved high throughput, but they’ve compromised decentralization as nodes are controlled by a few parties, which means they’re very susceptible to being corrupted. This is unacceptable in a system that wants to handle trillions of dollars.

Privacy is another key piece in a blockchain that wants to appeal to mainstream users, because who wants their counterparts in transactions to be able to see exactly how much they own, and their entire transaction history. But this has been a challenge because private transactions are more costly , especially in a system that supports full programmability, not just value transfers.

Lastly is user experience. For mainstream users to use blockchain-based applications, UX needs to be even better than what they’re already using.

Matter Labs’ ZK Sync proposes to solve these challenges with a variety of new and mind-boggling technologies. A main one is called ZK Rollup, a L2 scaling solution in which all funds are held by a smart contract on the mainchain, while computation and storage are performed off-chain. This means funds are controlled by users and keep the mainchain’s level of security. Meanwhile, computation and transactions being verified off chain, provides faster throughout, including instant transaction receipts, to make in-store purchases feasible.

Head to their blog post for more details on how they plan to solve all these challenges. They announced the launch of the v0.1 devnet, “the first step on the long journey of bringing the ZK Sync vision to life.” It will be one to watch.

There’s Now a Public, Multi-Client Eth2 Testnet

Ethereum 2.0 development continues making strides.

Shasper, Parity Technology’s Eth2 client, joined Prysmatic’s Sapphire Testnet, “marking the first public multi-client eth2 testnet,” Ethereum developer Danny Ryan wrote in a blog post. Prysmatic is another Eth2 client. “This is the exciting start of many multi-client testnets to come in the next month.”

Ethereum has many software clients, which has ensured that the network can keep running in the case one of the software implementations gets attacked. The goal is to have the same framework on Eth2, and this is a step towards that happening.

Brave Crosses 10m Monthly Active Users

Brave browser crossed 10 million monthly active users and almost one fourth of them have a BAT token address.

Brave keeps track of the time and attention users spend on sites, protecting their privacy by using devices’ local storage, and sends BAT tokens once a month as a reward. Advertisers and content creators get paid with BAT tokens too. Brave has nearly 340,000 creators and almost 217,000 users with BAT token addresses.

BAT is the first non-ether token to be accepted in MakerDAO’s multi-collateral Dai system, which means Brave browser users who are getting rewarded in the platform’s token are one step away from onboarding into DeFi.

Sign up to get the best and only near-daily newsletter focusing on decentralized finance news, complete with analysis, exclusive interviews, scoops, and a weekly recap.

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.