🖼 A16Z’s Latest Bet on NFTs: Free Licenses for Everyone

Hello Defiers! Here’s what we’re covering today:

News

Markets

👀 Defiant Premium Story for Paid Subscribers (📜Scroll to the end!)

Podcast

🎙Listen to the exclusive interview with Zcash’s Zooko in this week’s episode:

DeFi Explainers

Elsewhere

Celsius files to reopen withdrawals for a minority of customers: CoinTelegraph

Ethereum Name Service Touts Third-Highest Monthly Revenue as Merge Approaches: Decrypt

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

NFTs

🖼 A16Z’s Latest Bet on NFTs: Free Licenses for Everyone

Venture Capital Giant’s Move Signals Outsize Ambitions in NFT Market

By Owen Fernau

STOLEN Who owns what when someone owns an NFT? It’s not always clear. When Actor Seth Green’s Bored Ape was stolen, for instance, it brought plans for a show with the animated character into question.

CODE There’s the ambiguity of whether the metadata, the code that creates NFT images, is actually stored in a way owners can rely on. And then there is the more general mystery of how someone can “own” digital images or characters that are only a right-click away from duplication.

MORASS Now Andreessen Horowitz, the Silicon Valley venture capital firm that closed a $4.5B crypto fund in May, is wading into the NFT ownership morass. On Aug. 31, a16z, as the firm is known, launched six new NFT licenses under the brand “Can’t Be Evil” that purport to help artists monetize the new technology. The licenses have been released to the public gratis. According to the VC firm, the licenses aim to accomplish three goals:

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

📈 Crypto Markets Hold Up As Stocks Swoon

Ether Has Rallied 5.4% Since Monday

OUTPERFORMED Despite moving in unison for much of the year, Ether has outperformed major U.S. stock indices this week. The S&P 500 and the tech-heavy Nasdaq Composite were on track for five consecutive days of losses before rallying late Thursday, dropping 1.4% and 1.7% respectively since they opened on Monday.

GAINS Several major cryptocurrencies, meanwhile, have eked out gains over the week. Ether has rallied 5.4% since Monday, according to data from The Defiant Terminal. Cardano is up 1.1%, and Polkadot is up 0.4%.

LOWS Bitcoin, Binance and Ripple have also fared better than the stock market, having dropped 1.1% or less since Monday. While stock markets hit fresh weekly lows earlier today, major cryptocurrencies held above their Aug. 28 lows.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

🚀 Build your NFT app in hours instead of months

Ever wanted to deploy your own contracts or build NFT products and apps without having to learn the complex Web3 stack?

NFTPort lets you do exactly that with simple-to-use APIs and SDKs built for developers. NFTPort takes care of all the complicated NFT infrastructure so you can build your NFT project in just a few hours instead of months.

The APIs cover everything you need for NFT development:

Mint NFTs at scale and easily integrate them with your existing product

Deploy and monetize your fully owned NFT contracts

Get the highest quality NFT data (metadata, assets, ownership, transactions) from Ethereum, Polygon, and Solana (launching soon)

You can create an endless variety of innovative NFT products by combining these building blocks from NFTPort. Launch NFT collections, build your own dd NFT user portfolios to your existing app, etc.

Excited to build your NFT app? Grab your free API key

DeFi Explainers

🧐 What Is DAI?

A Step-by-Step Guide to One of DeFi’s Most Important Stablecoins

URGENT After the collapse of Terra’s UST stablecoin in May and the wipeout of $60B in market capitalization it has become increasingly urgent to see how stablecoins are backed. DAI, one of the earliest stablecoins, is one of the most important such tokens in DeFi.

RESERVES On a spectrum between fully algorithmic and backed by cash reserves, DAI stablecoin lies somewhere in between. Let’s learn more about DAI.

INTERMEDIARIES DAI stablecoin is supported by MakerDAO, a DeFi lender. Founded by Rune Christensen, the Maker Foundation launched open-source MakerDAO in 2014 to spearhead decentralized finance. Like other protocols, Maker runs on Ethereum’s smart contracts to replicate traditional finance without intermediaries such as banks.

LENDING As a lending protocol, MakerDAO was missing a key component — money that is digital but not as volatile as cryptocurrencies. This is where stablecoins come in.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Celsius files to reopen withdrawals for a minority of customers: CoinTelegraph

Celsius has motioned for $50 million worth of the total $225 million held in the Custody Program and Withhold Accounts to be released to owners.

🔗 Ethereum Name Service Touts Third-Highest Monthly Revenue as Merge Approaches: Decrypt

The Ethereum Name Service reported its third highest month of revenue in August, with 2.17 ENS domain names created on the service.

🔗 When White Hat Hackers Go Bad: CoinDesk

In most cases, cybersecurity can be achieved through ethical hacking – an established practice used to identify weaknesses and offer guidance on vulnerabilities.

Trending in The Defiant

Bitcoin Dominance Drops Under 40% For The First Time Since January Bitcoin dominance (BTC.D), which is the market capitalization of BTC relative to that of all digital assets, has fallen below 40% for just the second time since 2018 and stands at an eight-month low, according to data from CoinMarketCap.

Moonbirds Fly High On $50M Round and New Collections Institutional investors continue to place bullish bets on NFTs despite the current bear market in digital assets.

Christensen Calls For MakerDAO to Float Stablecoin In what would mark a dramatic strategic reversal, Rune Christensen, the founder of MakerDAO, is calling for the DeFi stalwart to reduce its exposure to real-world assets and freely float the value of its stablecoin, DAI, against the dollar.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Samuel Haig, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

Free subscribers to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

👑Prime defiers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Weekly live DeFi Alpha call with yyctrader

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

You can start a prime membership for free right now with this link. You’ll get full access for 7 days. It’s 100% risk-free.

Defiant Premier for Paid Subscribers

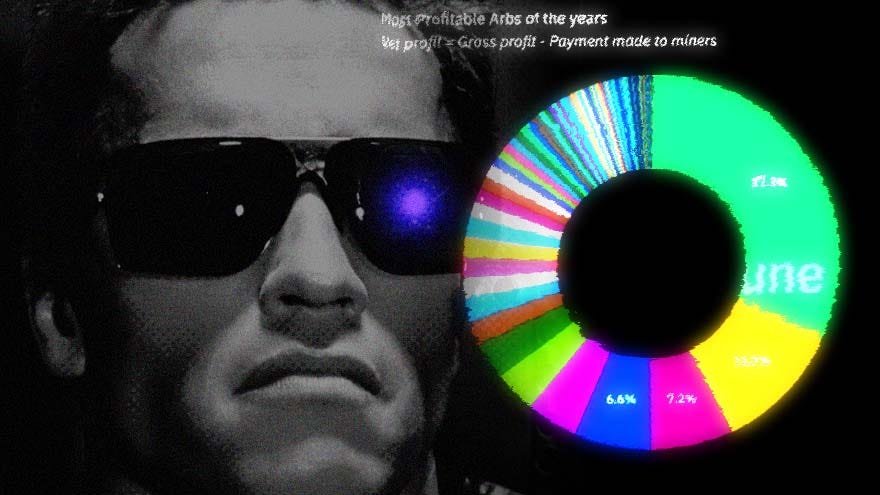

🤑 Seven Traders Raked in $114M in Profits via MEV Stratagem

Trading Bots Quietly Make a Killing in a Market That is Supposed to Be 'Democratizing'

By Samuel Haig

ANALYSIS Just a handful of players are profiting handsomely from Maximal Extractable Value at the expense of ordinary Ethereum users, an analysis of Dune Analytics data shows. In the last 12 months, six transactions account for half of the $163M extracted by bots through MEV, an arcane trading strategy in the crypto market.

To read the full story subscribe to The Defiant newsletter.

Keep reading with a 7-day free trial

Subscribe to WE'VE MOVED TO thedefiant.io to keep reading this post and get 7 days of free access to the full post archives.