$1 Billion Milestone, DEX's Flash Boys

Hi defiers :) here’s my take on the most interesting stuff in DeFi land today:

Flash boys on decentralized exchanges will scare off geo-fenced users

Money locked in DeFi lending platforms reaches a new milestone but it’s raising a red flag

DEXs’ Flash Boys Likely to Scare Off Binance Slack

Cryptocurrency exchange Binance is blocking U.S. customers from its main website. Trading platforms Bittrex and Poloniex announced similar actions. It should be a huge boon for decentralized exchanges.

After all, this is exactly what DEXs are good for. Welcoming anyone with an internet connection to trade any alt-coin in the crypto casino. Maybe some disgruntled arm-chair investor will end up using the most cypherpunk version of a token exchange, but high-frequency traders running amok on these platforms will likely scare off any serious volume.

At roughly 30,000 ETH (~$7.8million) traded per day, according to DEXWatch, versus more than $1 billion just on Binance, they could really use it.

The main problem with DEXs is also what was supposed to make them great: Trading happens on chain. This means trades are visible so there’s more order book transparency and volume can’t be easily manipulated. But the process of executing trades is also slow, making the system vulnerable to front-running. In the time it takes the blockchain to confirm a transaction, other traders are able to place their own orders with higher fees to make sure they’re mined first, Cornell University’s Philip Daian, Steven Goldfeder, Tyler Kell and others co-wrote in an April 10 paper.

It isn’t academic theory. These “flash boys” are actually making money off this tactic right now. Daian and his fellow authors made a real-time tracker of gas auctions in the Ethereum network, which are “often bids by frontrunners, arbitrageurs, and other programmatic network actors that seek to exploit inefficiencies in on-chain systems.” Gas consumed by arbitrage has been trending upwards:

The number of arbitrage transactions per month crossed 20,000 in 10 of the last 12 months, according to data tracked by Bloxy. Note: The last bar is misleading as it’s for the first two weeks of June compared with full months previously.

Still, as the number of arbitrage traders increased, they traded away the big price differences and profit has declined from a record in January 2018.

But there’s still almost risk-free money to be made and in theory, that could be a draw for the OG flash boys. Except it’s unlikely the’d be willing to trade in this Wild West, without knowing who their counterparts are and with the responsibility of holding their own crypto. It would be a regulatory nightmare for most hedge funds.

Of course, as with many of the roadblocks we’re seeing in crypto and DeFi, developers are working on ways to fix this. StarkWare is one promising example.

By the time these projects are up and running, we’ll have seen other examples like the “geo-fencing” parade. More cases of censorship and hacks for DEXs to prove their value. But for now, they’re not that much better for the individual investor than the tilted game played on Wall Street.

DeFi Platforms Break $1 Billion Mark

The top three decentralized finance platforms made another milestone but the data is flashing a bearish sign about the broader crypto market.

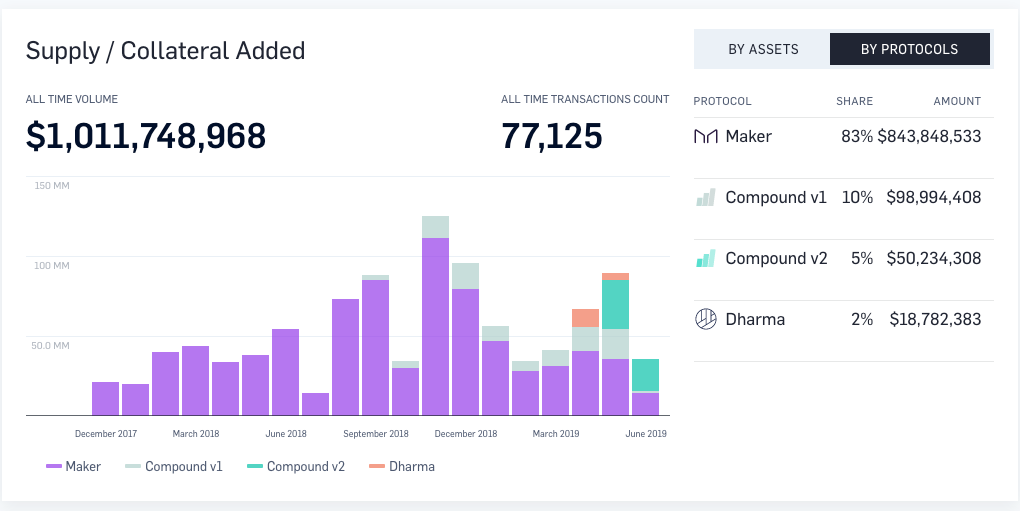

A total of $1 billion in cryptocurrencies like ETH and DAI has been deposited in the three most used DeFi platforms, Maker, Compound and Dharma, since December 2017, according to LoanScan, which tracks the data. Collateral is used to lend (and receive interest payments), or borrow. This excludes other lending platforms like Nuo and dydx.

Breaking this milestone signals decentralized finance platforms are starting to handle real money, though still just a small sliver of what traditional markets do – for perspective, almost $140 billion just in personal loans were issued in the U.S. last year.

The monthly peak for collateral added was in November 2018, with money locked in Maker making up for the majority of it. People go to Maker to borrow DAI (a stablecoin pegged at 1 to 1 with the U.S. dollar) against ETH they use as collateral, and usually use that DAI to buy more crypto; it’s a bullish move as it’s effectively a way to do a leveraged long trade.

On the other hand, when traders use protocols like Compound to gain interest for lending out their crypto, it signals more bearish behaviour as they’re choosing a steady but relatively low return instead of taking the risk to borrow and add more crypto.

The market has been rallying lately with ETH about to hit that $275 resistance level over the weekend, but the lending markets may be flashing a red flag. Collateral in Maker (used to go long) is at the lowest in 11 months, even after borrowing rates were cut, while there’s more money locked up and gaining interest in Compound.

It could be that traders are hedging in case the recent rally went too far. They were right once before, when they loaded up on DAI at the bottom of the market.

Still trying things out in the beta version of this newsletter and switched up the format a bit today. Let me know what you think!