😩 Voyager Delivers Painful Lesson on Perils of Counterparty Risk in Bankruptcy Drama

Hello Defiers! Here’s what we’re covering today:

News

MakerDAO Members Vote on Issuing $30M Loan To Societe Generale

Ethereum Closes In On Proof-of-Stake After Sepolia Testnet Merge

Crypto Crash

Podcast

🎙Listen to the exclusive interview with Joseph DeLong here:

Video

Elswehere

Uprise lost 99% of client funds while shorting LUNA during its price crash: SE Daily: The Block

How a fake job offer took down the world’s most popular crypto game: The Block

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Thirdweb: Build web3 apps easily, for free, with easy smart contract deployment, powerful SDKs and UI components from thirdweb. Create NFT drops, marketplaces, social tokens, DAOs and more on Ethereum, Polygon, Avalanche, Fantom, Arbitrum and Optimism.

Crypto Crash

😩 Voyager Delivers Painful Lesson on Perils of Counterparty Risk in Bankruptcy Drama

Exposure to Three Arrows Sinks Crypto Exchange as Dominoes Fall

DEEP TROUBLE In late June, the top executives at Voyager Digital, a cryptocurrency exchange with 3.5M users, knew they were in deep trouble. Three Arrows Capital, the Singapore-based hedge fund, owed it hundreds of millions worth of crypto and showed no signs of servicing the debt.

HAVOC Voyager CEO Stephen Ehrlich and his team embarked on a mad scramble to save their four-year-old company from the type of bank run that is wreaking havoc across the crypto sector. They hired lawyers. They hired a Wall Street Investment bank to rustle up a potential savior.

CREDIT LINE And they reached out to Alameda Research, the trading firm co-founded by Sam Bankman-Fried, the billionaire crypto impresario. It agreed to provide Voyager with $200M in cash and a revolving credit line financed by 15,000 Bitcoin even though Voyager was under enormous stress.

PROMISE What happened next is a cautionary tale about the perils of counterparty risk, and how crypto, despite the promise of blockchain technology, is not immune to the same dangers and mistakes that have long plagued traditional finance.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi + TradFi

🏦 MakerDAO Members Vote on Issuing $30M Loan To Societe Generale

MakerDAO Embrace of Real World Assets Poised for Big Step

By Samuel Haig

SHIFT MakerDAO is intensifying its strategic shift to embrace real world assets. The Maker community will soon vote on whether to issue a 30M DAI loan to SG Forge — a blockchain-focused subsidiary of Societe Generale, the No. 3 bank in France with €1.5T ($1.5T) in assets.

HOME LOANS If passed, SG Forge will use the loan, worth $30M, to refinance €40M worth of bonds on its balance sheet. The loan would be backed by OFH tokens, which are issued by Societe Generale and supported by corporate obligations and a pool of French home loans — both of which have AAA credit ratings.

DAI VAULT The move comes as an on-chain governance poll appeared poised to close in favor of creating a 100M DAI vault for Huntingdon Valley Bank, a Pennsylvania lender.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

The Right Place for Your Crypto

Those running full steam ahead today are bound to thrive tomorrow. Nexo is a security-first platform built for the long run with everything you need for your crypto.

Buy Bitcoin, Ethereum, and more than 30 other altcoins with a debit or credit card, easily in a few clicks. On the Nexo Exchange, you can swap 300+ pairs in a simple way at real-time prices. Every purchase or swap gets you up to 0.5% back in crypto, with rewards being added straight to your portfolio.

Borrowing cash or stablecoins against your crypto can get as low as 0% APR, and you get approved instantly.

The right place puts you first and plays the long game with you. Get started at nexo.io and bring your friends. For every successful referral, you get $25 in Bitcoin plus a chance to win rewards from a $50,000 prize pool.

Blockchains

🧐 Industry Insiders Weigh In On dYdX’s Planned AppChain

By Owen Fernau

PROTOCOL dYdX’s decision to deploy its own blockchain took much of the crypto world by surprise. On June 22, the derivatives trading protocol laid out plans to use Cosmos’ SDK and the Tendermint Proof-of-Stake consensus protocol. Both these technologies are fundamental to the broader Cosmos ecosystem and fall outside of the Ethereum-centric DeFi space.

DEPLOYMENT dYdX’s move away from Ethereum comes after its previous iteration, called V3, is a flagship deployment on StarkEx, which is a Layer 2 scaling solution for Ethereum.

COSMOS Now, with its team planning to build out its next version on Cosmos, experts around the industry are mulling over what dYdX’s move means for the broader crypto industry.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Crypto Lending

💰Celsius Pays Down 183M DAI in Debt to Stave Off Liquidation

By Samuel Haig

LOCKED Celsius, the embattled CeFi lending platform, is aggressively paying down its debt and freeing up assets previously locked in MakerDAO, a collateralized debt protocol.

WRAPPED This month Celsius paid down 183M DAI owed to MakerDAO and withdrew 2,000 Wrapped Bitcoin, worth nearly $21M, according to DeFi Explore, an analytics platform. Celsius still owes about 41.2M DAI to the permissionless MakerDAO protocol.

REPAYMENT By making the repayment, Celsius reduced the position’s liquidation price to $2,722.27 from around $13K. That means the WBTC deposited as collateral will be liquidated to repay the debt only if BTC drops below $2,722. BTC was at $20,489 in early morning trading New York time.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Proof of Stake

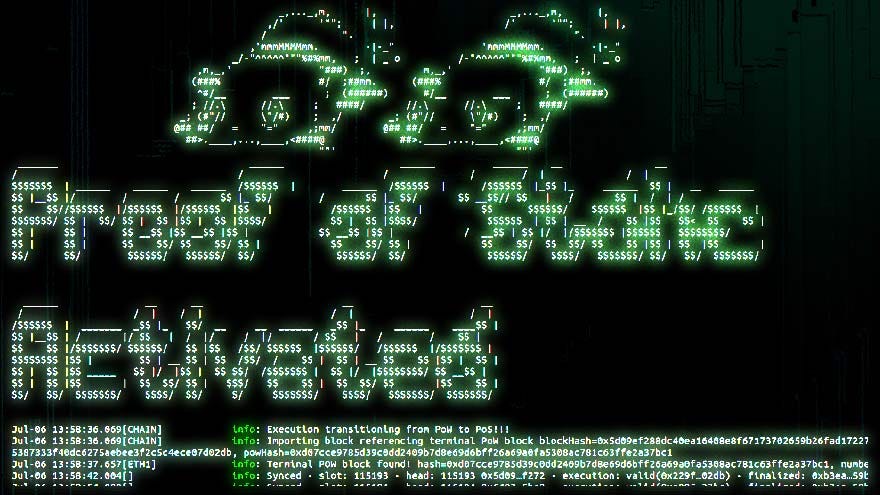

👀 Ethereum Closes In On Proof-of-Stake After Sepolia Testnet Merge

The Sepolia testnet activated PoS consensus on Wednesday at block number 1,450,409.

By yyctrader

NEWS Ethereum is one step closer to The Merge, the network’s highly anticipated transition to a proof-of-stake (PoS) consensus mechanism.

TESTNET Ethereum’s Sepolia testnet activated PoS consensus on Wednesday at block number 1,450,409. Sepolia is the second of three testnets to merge their proof-of-work (PoW) execution layers with their PoS consensus layers before the upgrade can take effect on Ethereum’s mainnet.

MERGE The Ropsten testnet was the first to merge on June 8. The next and final testnet is Goerli, expected in about a month. “Happy to see another test that’s looking to be successful so far,” Ethereum co-founder Vitalik Buterin said in a livestreamed core developers’ call discussing the testnet merge.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Quick Take: Voyager files for bankruptcy but Otherside load test is a smash

📺 Hot Stuff: META ditches Novi - is the Web 3 dream over?

Elsewhere

🔗 Uprise lost 99% of client funds while shorting LUNA during its price crash: SE Daily: The Block

Korean crypto startup Uprise lost virtually all of its client funds by shorting luna (LUNA) during its price crash and getting caught on the bounces, Seoul Economic daily reported on Wednesday.

🔗 How a fake job offer took down the world’s most popular crypto game: The Block

Rarely has a job application backfired more spectacularly than in the case of one senior engineer at Axie Infinity, whose interest in joining what turned out to be a fictitious company led to one of the crypto sector’s biggest hacks.

🔗 Reddit to Launch NFT Avatars Built on Polygon: Decrypt

In the coming weeks, Reddit will be launching a new Collectibles Avatar marketplace leveraging non-fungible tokens (NFTs) hosted on Polygon’s blockchain.

Trending in The Defiant

NFT Lending Volume Soars on Action by Whales NFT lending volume surged to its highest level in two months over the weekend, with $3.5M worth of nonfungibles changing hands on July 3 via NFTfi, a marketplace for loans collateralized by NFTs.

Compound Goes Multi-Chain in Major Upgrade Compound Finance, the pioneering DeFi money market, published the code for its forthcoming third iteration, called Comet, on June 30.

Make NFTs a Gaming Tool Instead of a Sales Hustle Decentralized technologies such as blockchain networks, cryptocurrencies, and non-fungible tokens (NFTs) are swiftly becoming an inextricable part of the internet, media and gaming sectors.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.