🦄 Uniswap Mic Drop: V3 Pledges 4,000x Improvement

Hello Defiers! Here’s what we're covering today,

Long-awaited Uniswap V3 launches

BitClout launch overshadowed by pre-sale

Gen 2 stable assets gain steam with Float

💗 The Defiant Gitcoin Grant

Also, please consider contributing to our Gitcoin grant! We’re using everything raised on this round towards gifting Defiant subscriptions. You can nominate whoever you think would benefit the most from full access to the best DeFi information and journalism out there —including yourself!

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

🦄 Uniswap V3 Drop Features L2 Move and 4,000x Gain in Capital Efficiency

TLDR Uniswap has mapped out what is perhaps the most anticipated DeFi product launch of the year with its post introducing its version three (V3) iteration.

The team confirmed what many hoped: Following a targeted May 5th launch, a deployment to Optimism’s Layer 2 scaling solution is “set to follow shortly after.” Uniswap’s V3 will also allow liquidity providers to take “Concentrated Liquidity” positions: Instead of contributing capital to an entire range of prices for a trading pair, users will be able to provide liquidity for a specific range.

“LPs can provide liquidity with up to 4000x capital efficiency relative to Uniswap v2, earning higher returns on their capital,” the post said.

NFT-BASED LP TOKENS A result of custom price curves is that liquidity positions are no longer represented as ERC20 tokens as they are not fungible. Instead,they will be represented by non-fungible tokens (NFTs). Common shared positions can be made fungible (ERC20) “via peripheral contracts or through other partner protocols,” the post said.

COPYRIGHT Surprisingly, the launch also included a proprietary software license. The software license prevents Uniswap’s core V3 code from being used “in a commercial or production setting for up to two years,” according to the launch post, after which time the code will become open source. Uniswap was notoriously forked by SushiSwap last September, with the latter recently surpassing the former in terms of total value locked (TVL) according to DeFi Pulse.

LIMIT ORDERS Uniswap’s V3 also allows LPs to “deposit a single token in a custom price range.” If the market price enters the range LPs can sell into the opposing asset, which the release’s post says “feels like a limit order.” Limit orders have thus far been exclusive to order book exchanges.

PROTOCOL FEES Uniswap V3 protocol fees will be off by default but can be turned on by governance on a per-pool basis and set between 10% and 25% of LP fees.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🧐 BitClout Insiders-Only Pre-Launch Overshadows Social Media Revamp

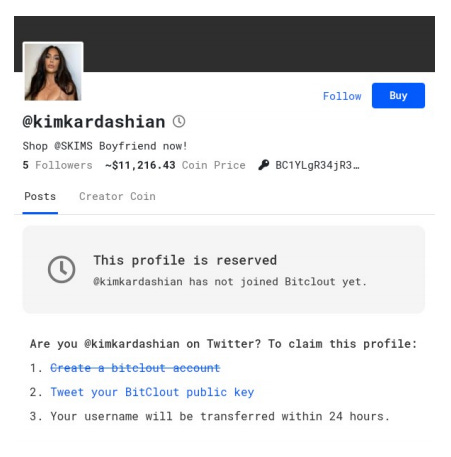

TLDR BitClout wants to be the open-source, creator-centric rebuke to ad-driven social networks. But its password-protected pre-launch with influencers' profiles pre-populated on the site is overshadowing those lofty goals.

DIAMONDHANDS According to BitClout’s founder, who asked to remain anonymous to highlight the decentralized nature of the project, BitClout is the open-source, decentralized, creator-centric rebuke to centralized, ad-driven social networking platforms like Twitter.

“Public discourse shouldn’t be controlled by a handful of companies who are optimizing for ad revenue,” the founder, who uses the pseudonym “Diamondhands,” told The Defiant.

OWN BLOCKCHAIN BitClout is built on a custom proof-of-work blockchain with similar architecture to Bitcoin, but with the additional complexity to support social network data, like posts and profiles. The network had been running on 12 nodes as of Monday, but the team expects that number to grow after the launch. The code will be open source after an audit is concluded within the next few weeks, Diamondhands said.

BITCLOUT TOKENS BitClout can be exchanged for Bitcoin through a “Buy BitClout” page and must be spent to fuel any action on the platform, from liking a post to contacting their automated help system (featuring the famous Microsoft Office avatar, Clippy).

CREATOR COINS “Creator coins” are unique to each individual person on the platform (ie: an Elon Musk creator coin or an Ariana Grande creator coin). They can be purchased in exchange for BitClout, and are priced based on a supply curve where buying creates the creator coin and pushes the price up, and selling destroys the creator coin and pushes the price down.

PRE-LOADED PROFILES To kick off the market, BitClout developers scraped the top 15,000 influencers from Twitter and pre-loaded their profiles into the platform. Some were willing to claim their profile and start using the network, but others weren’t particularly happy about their profiles being co-opted, especially in a manner where other people could trade on and profit off their tokenized likenesses.

The way Diamondhands sees it, these profiles have been pre-loaded for the creators’ own good.

“Fundamentally, the only reason why they’re pre-loaded into the platform is to prevent squatters and impersonators from taking over their handles,” said Diamondhands.

LEGAL QUESTIONS But that’s raised some legal questions. There's a “strong argument” that BitClout is violating the rights of the thousands of people who were added to the platform without their permission, Jake Chervinsky, lawyer and Compound Finance GC, told The Defiant.

“US law recognizes a ‘right of publicity,’ which says that each person has the exclusive right to control the economic value of their name, image, and likeness,” Chernivsky said. “If BitClout is trying to profit on people's names, images, and likenesses without consent, then those people could sue BitClout for violating their right of publicity.”

ONE WAY ONLY Notably, while BitClout and creator coins can be swapped back and forth, Bitcoin to BitClout transactions are one-way only. This means that any BitClout profits cannot currently be pulled from the system. Holders will be able to trade it once it is listed on exchanges.

A16Z & SEQUOIA BitClout’s veritable who’s who of investors include Sequoia, a16z, Social Capital, TQ Ventures (record executive Scooter Braun’s VC firm), Coinbase Ventures, Winklevoss Capital, Distributed Global, BlockChange, Arrington Capital, PolyChain, Pantera, DCG, North Island Ventures, Long Journey Ventures, Abstract, Huobi, Digg.com founder Kevin Rose, and Reddit founder Alexis Ohanian.

$170M The market for both BitClout and creator coins has been open for about two weeks prior to its launch. VCs only hold BitClout tokens, and not equity in a company, Diamondhands said, adding that due to the anonymity of the buying process, he isn’t sure exactly how many tokens have been distributed to investors. A single-signature Bitcoin account traced back to BitClout holds about $170M.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

⚖️ Float Attracts $1.3B of Assets Locked as Non-Pegged Stable Assets Gain Steam

TLDR Float Protocol has over $1B of cryptocurrency locked in its contracts after less than a day since the project’s phase two distribution event began.

BANK & FLOAT The BANK token will be used in auctions to stabilize demand for FLOAT, the protocol’s stable asset, and also to govern the protocol. BANK’s price has tripled to about $950 since it was listed on CoinGecko on Feb. 27, with wild spikes to as high as $1,515 over the past couple of days.

NEXT-GEN STABLE ASSETS Another project taking aim at the USD stablecoin market, OlympusDAO, launched yesterday. A stablecoin called FEI, which is pegged to the dollar using novel incentive mechanisms, will also ship next week. Meanwhile, Reflexer Labs’s RAI token, a stablecoin that is pegged to itself, and not the USD, shipped last month.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr).