😳 Trader May Have Lost $9M in Exit from USDT

Hello Defiers! Here’s what we’re covering today:

News

Terra Network Restarts After Second Shutdown; Binance Delists LUNA and UST Pairs

Lido Increases Liquidity Incentives as stETH Trades at Discount to ETH

Terra Temporarily Halts Blockchain To Prevent Governance Attack

Podcast

🎙Listen to the exclusive interview with Diego Fernandez:

Elsewhere

SEC's Hester Peirce says new stablecoin regs need to allow room for failure: CoinTelegraph

Terra blockchain has officially halted at the block height of 7607789: Terra Daily

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Chainalysis, the leading blockchain data platform. Sign up now for access to their free API to quickly screen against sanctioned crypto wallet addresses. Get free access now!

Hashflow, the first to provide bridgeless cross-chain swaps, lets you trade seamlessly across chains with guaranteed execution, MEV-resistance and the lowest gas fees in DeFi. Try it now!

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Acquisition Royale is an M&A-themed battle royale P2E game by prePO (the pre-IPO & pre-token trading platform). Unlock exclusive prePO items and rewards by playing now!

😳 Trader May Have Lost $9M in Exit from USDT

Data Indicates Bots Made Off With Huge Sum on Arbitrum

By Samuel Haig

NEWS Opportunistic bots may have made off with millions of dollars worth of profits after one trader hastily tried to exit an enormous USDT position.

ARBITRUM On May 12, Twitter user gzeon flagged that one USDT holder on the Arbitrum network appeared to have incurred a $9.4M loss after hastily trying to convert $15.5M USDT for USDC via Curve’s deployment on the Arbitrum blockchain. Curve is a decentralized exchange designed to facilitate efficient stablecoin trading.

BOTS Transaction data from Arbiscan shows that the user sold 15.5M USDT and received just 6.14M USDC in exchange. Analyzing the data, Gzeon estimates that MEV bots made off with $3M from the transaction. Curve didn’t immediately respond to a request for comment.

VALIDATORS MEV refers to Maximal Extractable Value, which describes the practice of miners or other network validators manipulating the order of transactions in a network’s blockchain to extract profits.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Terra Fallout

🔌 Terra Network Restarts After Second Shutdown; Binance Delists LUNA and UST Pairs

By Samuel Haig

HALTED Terra has restarted as of 8:45am ET after halting for a second time. On-chain swaps have been disabled and users are asked to bridge non-Terra assets like bETH back to their native chains.

VALIDATORS “Terra blockchain has officially halted at the block height of 7607789,” Terra Daily tweeted. “Team validators have temporarily paused the network to come up with a plan for reconstituting it.”

SUSPENDED Meanwhile, the collapse of Terra’s ecosystem has prompted several leading centralized exchanges to delist LUNA and UST pairs, including Binance, Bybit, and BitMEX. Binance has also suspended all deposits and withdrawals for the Terra network.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

"Liquidation-free long-term leveraged tokens. That's what is coming fresh out of Tracer DAO's Perpetual Pools.

Deployed on Arbitrum, you can take long or short positions with leverage to trade anything - commodities, cryptocurrencies, equities; even NFTs.

Dive into Perpetual Pools at tracer.finance and learn more about this exciting release with The Voyage - a 6-week journey in Tracer’s Perpetual Pools to earn TCR rewards and explore the potential.

Head over to tracer.finance today and take a look for yourself.”

Terra Fallout

💦 Lido Increases Liquidity Incentives as stETH Trades at Discount to ETH

By Owen Fernau

POOL UST’s collapse continues to reverberate around crypto markets. Curve’s largest pool is out of whack — the stETH pool, which pairs ETH with stETH, a staking derivative of ETH, shows stETH trading at a 2% discount to ETH.

IMBALANCE The imbalance may indicate that investors are dumping illiquid assets, such as a derivative of ETH locked in Ethereum’s proof-of-stake chain, and rushing to cash.

UNLOCKS stETH is a token issued by Lido Finance. Users stake their ETH via Lido in exchange for stETH, on a one-to-one basis. Later when Lido unlocks the ETH after withdrawals from Ethereum’s Beacon Chain are live, users should be able to redeem their stETH for their ETH, plus the accrued staking rewards.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Stablecoins

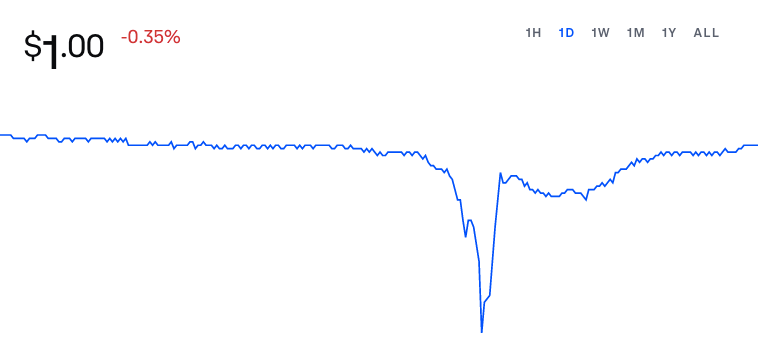

💸 USDT Briefly Slips Below $1 Peg as Terra Contagion Spreads

By Owen Fernau and Jason Levin

NEWS As Terra’s UST stablecoin continues to unravel, Tether, the crypto market’s largest stablecoin is also showing signs of stress. Stablecoin Tether (USDT) briefly lost its $1 USD peg in early morning trading and dropped to as low as $0.95 at 3:24 AM New York time before returning to $1, according to CoinGecko.

REFERENCE ASSET As a stablecoin, USDT is meant to be pegged to the price of the US dollar – an attempt to form a stable reference asset that is not as volatile as other major cryptocurrencies. Tether is by far the largest stablecoin in crypto, with a $80.7B market capitalization, and $150B of volume traded in the last 24 hours, according to Coingecko. USDC, the second-largest stablecoin, has about half the market cap.

RIPPLES Jitters around USDT follow the recent implosion of the Terra ecosystem’s stablecoin UST and its sister coin Luna. UST fell from its $1 peg and now sits at $0.43 while Luna has fallen 99% from $15 to $0.01 in the last 48 hours alone. And while Terra’s crash sent ripples throughout the market, a prolonged slide in Tether would likely cause a tsunami.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Blockchains

✋🏼 Terra Temporarily Halts Blockchain To Prevent Governance Attack

By yyctrader

NEWS The Terra blockchain has resumed block production after being halted for around 2 hours.

INFLATION The ongoing UST crisis has caused the LUNA supply to rise exponentially to nearly 34B tokens as UST holders rush to redeem their tokens, from around 350M on May 9. The resulting runaway inflation has seen the price of LUNA fall 98% to just $0.02 at the time of writing.

VALIDATORS Terra uses a Proof-of-Stake consensus mechanism that requires the majority of LUNA tokens to be staked with trustworthy validators who secure the network and process legitimate transactions.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 David Marcus unveils new startup focused on Bitcoin and Lightning backed by a16z and Paradigm: the Block

David Marcus, the former head of Meta's crypto and digital finance operations, has unveiled his latest endeavor: a company aimed at expanding the use cases of bitcoin.

🔗 The Merge - with Danny Ryan, Tim Beiko, and Hasu (Part 1)

Listen to conversations between two veterans of the crypto industry: Su Zhu, CEO and CIO of Three Arrows Capital, and Hasu, Strategy lead at Flashbots. Exploring the big ideas in crypto from first principles.

🔗 SEC's Hester Peirce says new stablecoin regs need to allow room for failure: CoinTelegraph

The SEC’s “crypto mom” Hester Peirce has said the regulatory “movement” around stablecoins needs to allow for “trial and error” and room for failure.

Trending in The Defiant

Update: UST & LUNA Crash Harder, 8000 ETH Moved by Azuki? t’s been less than 24 hours and things have changed, for the worse. UST went as low as 22 cents, Luna goes under 1 dollar, Do Kwon announced a recovery plan, and team Azuki is on the move.

Do Kwon Humbled as LUNA Spirals and UST Suffers ‘Lehman Moment’ “I understand the last 72 hours have been extremely tough on all of you,” Do Kwon tweeted Wednesday morning. “Extremely tough” will be an understatement for users who trusted their savings on a stablecoin – emphasis on the word “stable” – to now own only a small fraction of their initial holdings.

Coinbase Will Keep Customer Balances in Event of Bankruptcy Coinbase will take your coins if it goes bankrupt. That was the rather jarring message in the first quarter earnings release for the leading U.S.-based centralized exchange.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason, Levin, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Signest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)