🔥 To Infinity and Beyond: Axie is Beating Even Ethereum in Network Fees

Hello Defiers! Here’s what we are covering today,

News

Axie Infinity Has Beaten Even Ethereum in Network Fees Thanks to its Sidechain

Something Fishy is Happening on OpenSea as Bots Upset NFT Auctions

Sushi Won’t Launch on L2 Optimism, Citing Preferential Treatment of Uniswap

Links

Poly Network attacker returns $256 million of the stolen cryptocurrency: The Block

Zapper Product Update #2: Wallet Bundles, Zapper Fees, NFT Season 2 Alpha Leak: Medium

Soccer star Messi’s latest contract reportedly includes crypto fan tokens: CoinTelegraph

Every game developer should be able to achieve financial success from their games: Stardust

Podcast

🎙Listen to the interview in this week’s podcast episode here:

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Axie Infinity

🔥 Axie Infinity Has Beaten Even Ethereum in Network Fees Thanks to its Sidechain

LEDE Facebook may be grabbing headlines with its talk about the metaverse as the basis for the company’s future, but blockchain game Axie Infinity already has a metaverse up and running and it’s grabbing something longer-lasting: revenue.

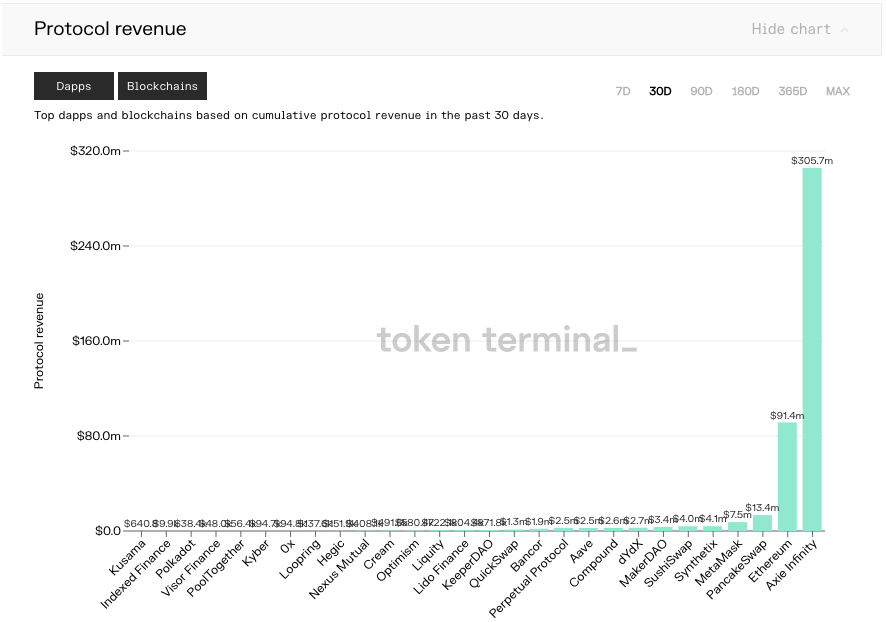

REVENUE Protocol revenue on Axie Infinity yielded $305 million over the last 30 days, compared with $91.4 million for Ethereum, according to Token Terminal. Axie Infinity went from $100,000 in platform revenue in January 2021 to $196 million in July, Aleksander Leonard Larsen, Sky Mavis’ chief operating officer, told the Defiant.

SIDECHAIN Sources The Defiant spoke to all attribute this success to one shift in particular: the launch of Sky Mavis’s Ronin sidechain. Once the company moved players’ characters over to Ronin, the game became appreciably less expensive. In particular, players weren’t forking over expensive Ethereum gas fees to breed new Axies, the in-game characters users need to play.

“In the end it’s just kind of numbers on a screen,” Aleksander Leonard Larsen, Sky Mavis’ chief operating officer, told the Defiant. “It’s not like we take that money anyway. We put it in the treasury.”

DAO Axie Infinity will eventually become a decentralized autonomous organization, or DAO. It took the first step in that direction this year with the release of Axie Infinity Shards (AXS), the governance token that controls the aforementioned treasury.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

SPONSORED POST

Molly Wintermute Releases Hegic V8888: 0% Trading Fees and Gas Fee-Free Options Trading

Hegic V8888 is live in mainnet:

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum. With Hegic, DeFi and crypto users can trade 24/7 American, cash-settled, on-chain ETH and WBTC call / put options with no KYC or registration required for trading.

Hegic was founded 1.5 years ago in February, 2020. Hegic V888 (the previous version) was live for 10 months. The results achieved by V888:

● $492,075,000 total volume

● $22M record daily volume

● 6,450 options traded

● 2,825 unique users

● $10,415,000 earned by HEGIC staking lots holders

Introducing Hegic V8888

Trading Options on Hegic V8888

● 0% trading fees: pay only a premium

● 100% gas fee-free options trading

● The lowest prices for ETH and WBTC call / put options

● Auto-exercising of in-the-money options

● Tokenized options for trading on the secondary market

● 90 days is the new maximum period of holding options

Earning Yield on Hegic V8888

● Zero-loss options selling pools with auto-hedging

● x2 higher capital efficiency with flexible collateralization

● Independent pools for selling call and put options

● Individual lock-ups for each liquidity tranche deposited

● Pools’ unrealized profits front-running prevention

● Real-time data on pools APY and P&L per each option sold

Use Hegic now:

Markets

📈 The Bulls are Back Despite Crypto’s Washington Woes

NEWS The crypto rally is raging even as regulation that has the potential to clampdown on the industry looms in the U.S.

ETHER Digital assets are up across the board — Bitcoin has surged 14% in the last seven days, hitting a high of $46,704 in the last 24 hours before settling around $45,000 in early morning trading U.K. time. Ether has done even better, spiking more than 15% in the last week and cresting at $3,267 on Wednesday.

ARC Still, it looked like investors were keen to take profits early Thursday morning as the the DeFi Pulse Index (DPI) skidded 3%, with leading tokens from Uniswap, Aave, and Maker backsliding a bit. Yearn, Ren and Harvest’s tokens were bucking the mini-selloff with gains. But DeFi’s overall arc is light years away from the bearish bent that prevailed earlier this summer — the benchmark index has rocketed more than 28% in the last seven days. Whew.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Dive

🐟 Something Fishy is Happening on OpenSea as Bots Upset NFT Auctions

TLDR The NFT marketplace OpenSea has been a tear — at 14.61%, its primary smart contract has consumed more gas than any other on Ethereum in the last 24 hours, according to block explorer Etherscan.

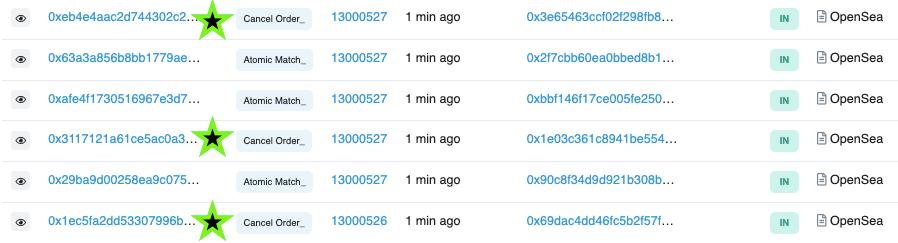

WALLETS But there’s something strange going on in OpenSea’s waters. Ethereum wallets appear to be canceling orders at a surprising rate on the NFT marketplace. More than a quarter of the last 1,000 transactions using the OpenSea contract were cancelled as we went to press. Most other transactions involve matching NFT buyers and sellers.

BOTS Mike Dudas, the founder of digital asset research firm, The Block, suggested a possible explanation for the mysterious cancellations: bots.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Byte

🍣 Sushi Won’t Launch on L2 Optimism, Citing Preferential Treatment of Uniswap

NEWS Sushi is drawing back from plans to deploy on Optimism after a dispute over the Ethereum L2 solution’s launch process.

SO WHAT On August 11, SushiSwap CTO Joseph Delong announced that Sushi would be taking a wait-and-see approach to deploying on Optimism due to what he described as “non-preferential treatment.” According to Delong, Sushi had already deployed on Optimism’s testnet to debug, but discovered during a meeting with L2 provider that they wouldn’t be able to launch on Optimism’s mainnet until after Uniswap launched first.

TOKEN BRIDGES In March, Optimism announced they would be delaying plans for open access to mainnet in order to make sure that foundational projects, infrastructure providers, block explorers, wallets and token bridges had time to integrate.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Links

🔗 Poly Network attacker returns $256 million of the stolen cryptocurrency: The Block

The attacker of the $611 million Poly Network exploit has started returning the stolen crypto assets, less than a day after their ID information was reportedly obtained by blockchain security firm Slowmist. They have now sent back $256 million in tokens out of the haul.

🔗 Zapper Product Update #2: Wallet Bundles, Zapper Fees, NFT Season 2 Alpha Leak: Medium

Things move quickly in the DeFi space. To help our community stay on top of the latest developments at Zapper, we share regular product updates that recap Zapper’s newest features, protocol integrations, and upcoming initiatives.

🔗 Soccer star Messi’s latest contract reportedly includes crypto fan tokens: CoinTelegraph

Argentine soccer superstar Lionel Messi, regarded as one of the game’s greatest players of all time, has reportedly made crypto fan tokens a part of the payment deal in his financial package with French club Paris Saint-Germain. The information comes from sources close to the matter, according to Reuters.

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Brady Dale, Dan Kahan and Owen Fernau, and edited by Bailey Reutzel and Edward Robinson. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).