🦄 The Road to Uniswap’s $100B

Hello Defiers! Here’s what we’re covering today:

Uniswap competing in crypto big leagues with $100B volume

Recap of CREAM & Alpha $37.5M hack

NFT Sales Boom Past $100M in 30 Days

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

🎙Listen to this week’s podcast episode with Mark Cuban here:

📺 Check out the latest Tuesday Tutorial, How to Yield Farm, and subscribe to our channel!

And watch this week’s Quick Take on EIP-1559 ICYM!

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Ledger, a hardware wallet combined with the Ledger application to securely buy, sell, exchange, stake, lend & manage your crypto

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

🦄 Uniswap Hits $100B in Trading Volume

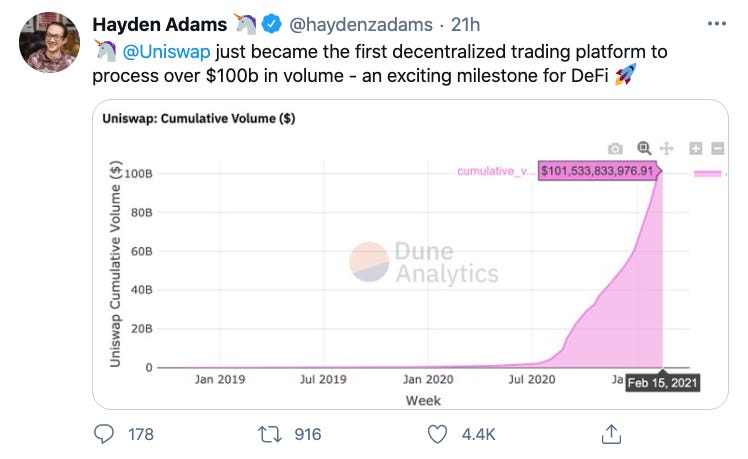

TLDR Uniswap became the first decentralized trading platform to process over $100B in trading volume.

SO WHAT The milestone for the DEX, which launched just over two years ago, shows that automated market makers, based on token liquidity pools instead of centralized order books, are handling volume that’s coming to rival trading on centralized exchanges. The success bodes well for DeFi as the center for mainstream finance.

CONTEXT PLEASE While Uniswap is still far from Binance’s daily trading activity of over $20B, daily volume of about $1B, makes it the 20th largest exchange, beating centralized exchanges including Bitstamp and FTX, according to data by CoinGecko. Weekly trading volume climbed to a record $7B in the seven days ending Feb.13, according to uniswap.info.

UNI PUMPS Uniswap’s growth has helped push its governance token UNI to an all-time high of $23 in February, a 481% change in just 6 months. UNI token was distributed in September with 400 UNI allocated to 250K+ past users.

BACKSTORY The current team of 11 is backed by renowned venture funds including a16z and Union Square Ventures, raising an $11M Series A round in August. But it was an Ethereum Foundation grant of $100k that helped propel its October 2018 launch. Founder Hayden Adams created Uniswap on the back of a 2016 Reddit post by Ethereum creator Vitalik Buterin.

WHAT’S NEXT More and more projects are being built on Ethereum, therefore more ERC20 tokens are being issued and Uniswap has become the de-facto listing site, as anyone can create a market for their token, and anyone too, can trade . Uniswap is currently working on V3, an update which is expected to increase the capital efficiency of the protocol. But DeFi traders aren’t waiting around as volume continues to climb.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🏴☠️ CREAM and Alpha Finance $37.5M Hack Recap

TLDR DeFi experienced one of its more complex exploits over the weekend. An attack which resulted in ~$37.5M drained from CREAM Finance’s Iron Bank using Alpha Homora’s leveraged debt.

USERS NOT AFFECTED No user funds were lost, and Alpha and CREAM teams are working on how to heal the debt between the protocols. The loophole that made the exploit possible has been closed and the project is going through peer review and another security audit —Alpha Homora V2 had been audited by Quantstamp and Peckshield.

HOW DID IT HAPPEN An attacker was able to use Alpha’s sUSD contracts which had not yet been released to the public or made available in the UI to act as the sole lender in the pool. With CREAM’s Iron Bank, whitelisted protocols (in this case Alpha Finance) can take undercollateralized loans, allowing the attacker to recursively borrow ETH from CREAM against a growing sUSD debt using flash loans.

The attacker leveraged a rounding miscalculation in Alpha’s borrow function, and the fact that the function, intended for collecting revenue to the reserve pool can be called by anyone, according to Alpha’s post mortem.

Rather than pay off the sUSD debt, the attacker used Tornado Cash - an Ethereum privacy mixer - to make off with the funds.

MARKET REACTION CREAM and ALPHA tokens have crashed by around 30% since the hack.

Total value locked on CREAM has yet to recover, dropping to just over $2M from $30M before the exploit.

WHAT’S NEXT Users cannot open new leveraged positions, as borrowing has been disabled, but can add collateral, repay debt, harvest farmed tokens, and close positions. Borrowing will be re-enabled once Alpha has gone through these security measures.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

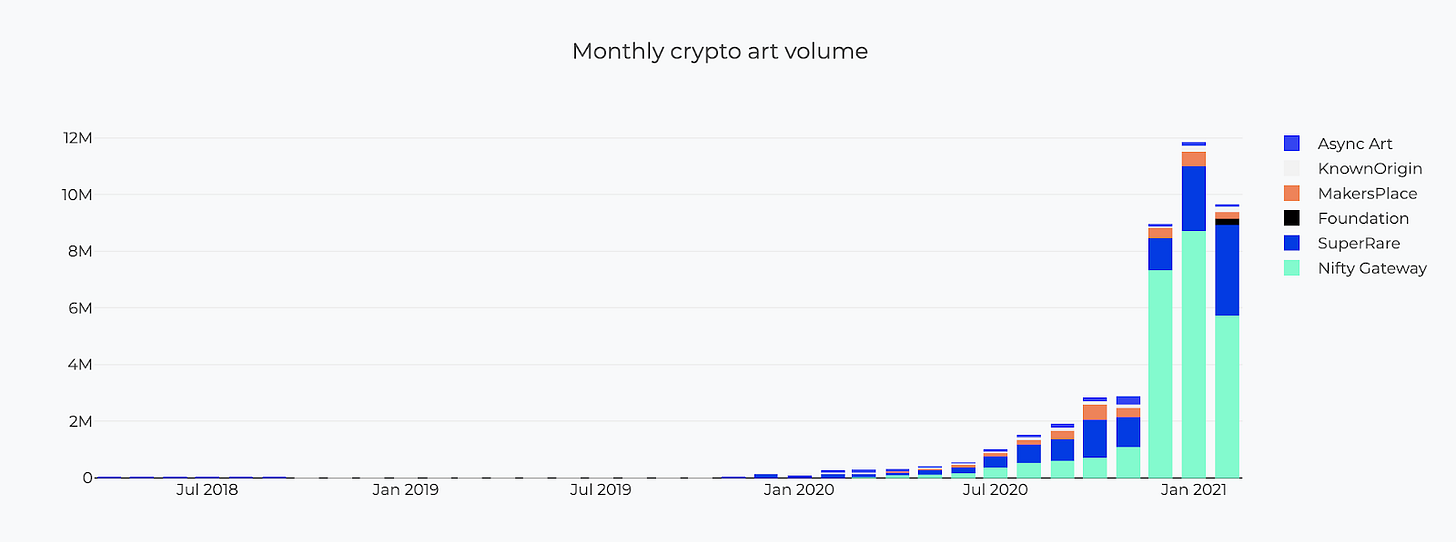

💎 NFT Sales Boom Past $100M in 30 Days

TLDR In the midst of a growing NFT boom, marketplaces like OpenSea, SuperRare and Nifty Gateway are experiencing record-breaking volumes. There was over $100M in NFT sales over the last 30 days, according to Crypto Slam, which tracks the data, and a large part of the trading action is taking place on secondary markets.

SO WHAT This means that beyond the primary sale of NFTs, there is a vibrant number of participants collecting listed assets. The growing activity signals a maturing market.

LEADING ETHEREUM MARKETS

Volume on OpenSea, the leading marketplace for NFT resales, increased by 400% in February from one month ago, up to $32M from $8M.

SuperRare recently broke $10M in total sales volume, broken down as $7.87M Primary Sales And $2.19M Secondary Sales.

Nifty Gateway, the leading crypto art marketplace by volume, is set to break it’s previous record of $8.72M in 30 day volume as it nears $6M in volume just halfway through February.

NBA TOP SHOT But it’s not all just on Ethereum. The new kid on the block, NBA Top Shot has sold over $70M worth of moments since its October launch, the most out of all NFT markets ever, according to Crypto Slam. Flow is the blockchain supporting NBA Top Shot. Wax is another blockchain supporting NFT sales.

TOP SELLERS CryptoPunks and Hashmasks are the highest priced sales, with CryptoPunk 2890 topping the list at $747k, followed by Hashmask 9939 at $640k. The top 17 highest-priced sales of crypto collectibles have happened in the last 30 days.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 Love & coordination at the frontier of governance: How Yearn minted $300 million: CoinTelegraph

“A core Yearn contributor gives the behind-the-scenes account of what may be the most consequential vote in decentralized governance history.” Cointelegrpah reports.

🔗 Bitcoin Trust Launched Today Takes Aim At $37 Billion Grayscale: Forbes

“Greg King, 46, is the controlling shareholder in Osprey Funds, manager of what is likely to become the second freely traded pure play bitcoin fund in the U.S. The first one, Grayscale Bitcoin Trust, is coining money. If King can siphon off just a little of the assets pouring into Grayscale, he’s got a hit,” Forbes reports. “Selling point for the Osprey Bitcoin Trust: a dramatic price cut. Grayscale takes 2% of its trust shareholders’ money every year. Osprey charges just under 0.8%.”

🔗 MicroStrategy To Offer Another $600 Million Of Convertible Notes To Buy More Bitcoin: Bitcoin Magazine

“Gigachad CEO Michael Saylor announced on Twitter this morning that his company, software intelligence firm MicroStrategy, has proposed a private offering of $600 million in convertible senior notes so it can ‘use the net proceeds from the sale of the notes to acquire additional bitcoins,’ according to the press release Saylor shared,” Bitcoin Magazine reported.

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Sydney Lai and Cooper Turley, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila and edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr).