📉📈 The Riddle of Ethereum: Bullish Signals Abound as Price Starts and Stops

Hello Defiers! In this week’s research dive we delve into the conundrum that is Ethereum… On the one hand, Ethereum has never looked more robust when it comes to advancing innovation and utility in DeFi. Yet the price has sunk into a bear market funk for weeks. What gives?

Arash Ghaemi, our guest author this week, delves into the duality that is Ethereum and comes back with a thoughtful and provocative take on the mysteries of DeFi’s substrate. Don’t miss a great read.

Arash Ghaemi is the founder of Galaxy Growth, a Denver-based firm that makes websites, and the director of strategy at Two Prime, where he manages SEO, social media and public relations. He is also an advisor to the Darwin & Goliath project, which enables companies to build loyalty programs.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

Kyber DMM, an automated market maker which prioritizes permissionless liquidity contribution and high capital efficiency

The Riddle of Ethereum: Bullish Signals Abound as Price Starts and Stops

By Arash Ghaemi

Bullish news continues to circulate as ETH price keeps dropping or moving sideways at best. Are we merely in an accumulation phase, or has the bear market started, and we’re all in denial?

Ethereum’s Ether is down 11% in the past 30 days and has plunged 46% since its $4,357 high reached in May. It has been inching its way up from this month’s low of $1,718 and is trading at around $2,300 currently. So the question investors are asking is: Is the bull market back or are we at the gates of a bearish cycle?

Let’s review the last month’s on-chain data from both a bullish perspective and a bearish perspective to find out.

Underlying Fundamentals

The underlying fundamentals of Ethereum have never been more robust. EIP 1559 is live on the Ropstein testnet. You can even watch ETH getting burned in real-time. Israel is also using Ethereum for an internal pilot run of the digital shekel.

No matter what happens with price, Ethereum developers continue to build and have a massive head start on the competition.

It’s somewhat surreal to watch an entire continent turn into Bitcoin bulls but not see any sort of sustained price rally in the crypto markets as a whole. Nevertheless, that is the most bullish narrative possible – If several countries adopt Bitcoin, others could do the same or are now considering it.

itionally, several states are adopting crypto-friendly laws, with Florida and Texas leading the way. Miami is making a move to become the world’s Bitcoin hub, while Texas just passed a bill to recognize cryptocurrencies under commercial law in the state.

Wyoming also passed a law so DAOs can become incorporated under state law.

s an emerging trend in crypto among political parties. The left appears to be anti-crypto while the right is pro-crypto. However, no matter what side you’re on, more states and countries adopting crypto-friendly laws are bullish for Ethereum.

Bitcoin may be the gateway drug, but most eventually graduate to Ethereum due to its bustling developer ecosystem, utility, and outright disruption of the legacy financial system.

When states and an entire region adopt Bitcoin it builds more onramps as employees get paid in tokens and businesses operate entirely on crypto infrastructure. In addition, it could spur r more crypto-friendly bank laws, and even prompt a future presidential candidate to promise to pass crypto-friendly laws if he or she should win the campaign.

This magnitude of on-chain activity should lower volatility and make ETH a more stable store of value and inflation hedge. The institutions are here, and we have large-scale mass adoption with thousands of different use cases, but the price keeps dropping.

Bullish On-Chain Indicators

Institutional adoption, in theory, was supposed to create a price floor and lower volatility. So was mainstream adoption and more people getting paid in crypto. None of that has proven to be true yet – Ethereum is as volatile as ever and is down 55% from its all-time high.

There has been a strong narrative circulating on Twitter that institutions were selling their BTC for ETH thanks to the frictionless and permissionless world of DeFi. Why sit and hold Bitcoin when you could rotate into Ethereum and earn?

Additionally, you can create a digital version of your hedge fund with ETH and a bunch of DeFi protocols.

This narrative continues to play out with the continued divergence of the number of addresses with 10K ETH vs. the number of addresses with 10K BTC. The latter addresses continue to drop while those with ETH continue to rise.

There have been 13 new addresses holding at least 10,000 ETH added in June, roughly $255M. Total addresses with at least 10,000 ETH currently sit at an all-time high of 1,202, approximately $23B.

A total of 784,102 ETH was transferred to exchanges while 1.4 million ETH left exchanges in June with a net of negative 615,898 – June 4th saw the most significant net outflow with 435,000 ETH leaving exchanges.

However, there was also a massive inflow on June 17th and June 22nd that saw a combined total of 543,000 ETH hit exchanges, resulting in a dump in price on both days.

This massive accumulation of 10,000 ETH signals more institutional adoption than anything else, as 10,000 ETH is roughly $22 million USD.

There is also a mysterious Bitfinex whale accumulating ETH with conviction he’s currently long 550,000 ETH.

in age metric from Santiment also points to accumulation – A rising slope indicates accumulation while a downward slope indicates ETH movement between addresses.

The upward trend is almost higher than when ETH hit a new all-time high.

Why would people accumulate ETH?

Because there are more ways to earn ETH than ever before, thanks to the growing DeFi ecosystem, this is evident with the percent of ETH in smart contracts at an all-time high of 23.64%.

If ETH is circulating through smart contracts there’s a delayed liquidity effect, which means it won’t be sold on exchanges anytime soon.

As much as 5% of the total supply is also locked up in ETH 2.0, making me think that the stars are starting to align for a supply shock.

happen no one knows – it could be as soon as the fall if we truly are in an accumulation phase, or it could happen after the next halving cycle.

Legacy Finance Disrupted

DeFi on Ethereum also continues to explode in popularity, with Uniswap V3 hitting $3 billion in cumulative volume.

Uniswap currently has 64% of the total DEX market share, and that won’t slow down anytime soon and also accounts for 25% of all transactions Ethereum.

Uniswap has an average seven-day volume of close to $9 Billion and the next closest at $1.4 Billion.

Legacy finance understands the current disruption, which is why so many big banks are rolling out Bitcoin and Ethereum offerings. For example, Goldman Sachs is currently “exploring” Ether Options, which is essentially another way of saying it’s inevitable.

iqued the interest of legacy finance. A good example of that is Mastercard investing in ConsenSys and Visa partnering with Blockchain Capitals $300 million fifth venture fund.

As more money flows into Ethereum, more developers will be needed to build.

Even with such an insane run-up and significant pullback, it’s hard to be bearish when you look at the underlying fundamentals of Ethereum. Ethereum continues to build a new, more inclusive, open financial system as the price fluctuates up and down.

Options traders are bullish on the EIP 1559 release in late July and $28 million in calls for $5,000 ETH and $45 million in calls for $3,000 ETH for the July 30th expiration.

Still, ETH at $5K does seem to be a long shot given the current state of the market. Still, that’s a lot of money betting that ETH finds a way to get close to that price.

Developer activity is a precursor to innovation, disruption, and eventually mass adoption. When price rises, it brings speculators into the industry and with it awareness. Price action is a form of organic marketing, and when the price crashes, speculators scatter and what’s left are the actual builders.

For example, HackMoney currently has 1,000 hackers staked to participate.

top developer talent away from big tech, and that won’t slow down anytime soon. Developer activity, like interest, compounds over time which accelerates the mass adoption curve.

Bearish On-Chain Data

With all that bullish accumulation you’d think it would positively impact the price of ETH. For years people have been saying as soon as institutions adopt Bitcoin and Ethereum, volatility would subside.

The theory was that if institutions were buying, they would not sell anytime soon and create a price floor.

However, with ETH down 55% from all-time highs, that’s proven to be incorrect.

ETH continues to gain ground on Bitcoin as 1 BTC now equals 15 ETH but recently has given a large percentage of those gains back. After an epic run-up to 0.082, ETH/BTC currently sits at 0.065. If people are genuinely dumping BTC for ETH, this should have maintained strength during major Bitcoin pullbacks.

Everyone attacks Ethereum for high fees, but I’ve always thought that was a short-term bullish indicator until the upgrades rolled out. Besides, if 100 other chains have the same low fee, faster transaction speed sales pitch, it’s not an actual feature upgrade if no one uses it.

Higher fees mean higher activity and more prominent players using Ethereum.

However, low fees are bearish in the current environment, which signals shallow network activity. This is an excellent environment for ETH whales with no intention of selling anytime soon but bearish for just about everyone else, especially if your portfolio is in the red.

Daily active addresses are also decreasing in lockstep with average fees. All that development activity doesn’t matter if no one is using Dapps. Speculators either blew up their trading accounts, sold for profit or sold for a loss and moved on. They were never interested in anything, but price action as profits are all that mattered to them.

In 2017, ICOs were considered a scam, and several ran away with billions in investor money. In the current bull run, many deemed NFTs the new ICOs with soaring valuations after Beeple sold a piece of digital art for $69 million.

ETH locked in DeFi also continues to decline from a peak of 11 million to 8.6 million. At its peak, there was $86B worth of ETH locked in DeFi – Now there’s $54B, which is a 37% decrease!

The big question is if all that ETH is leaving exchanges and going into DeFi protocols, why is locked ETH declining?

DeFi summer 2020 is when degens were born, and many people were looking towards 2021 to be even more epic! However, with the markets in disarray and DeFi tokens tanking, it wasn’t looking too promising.

To top it off, Iron Finance implodes after a bank run, sending its token to $0:

had in mind for DeFi summer 2021 – It also adds a level of doubt in people who want to hold ETH and earn.

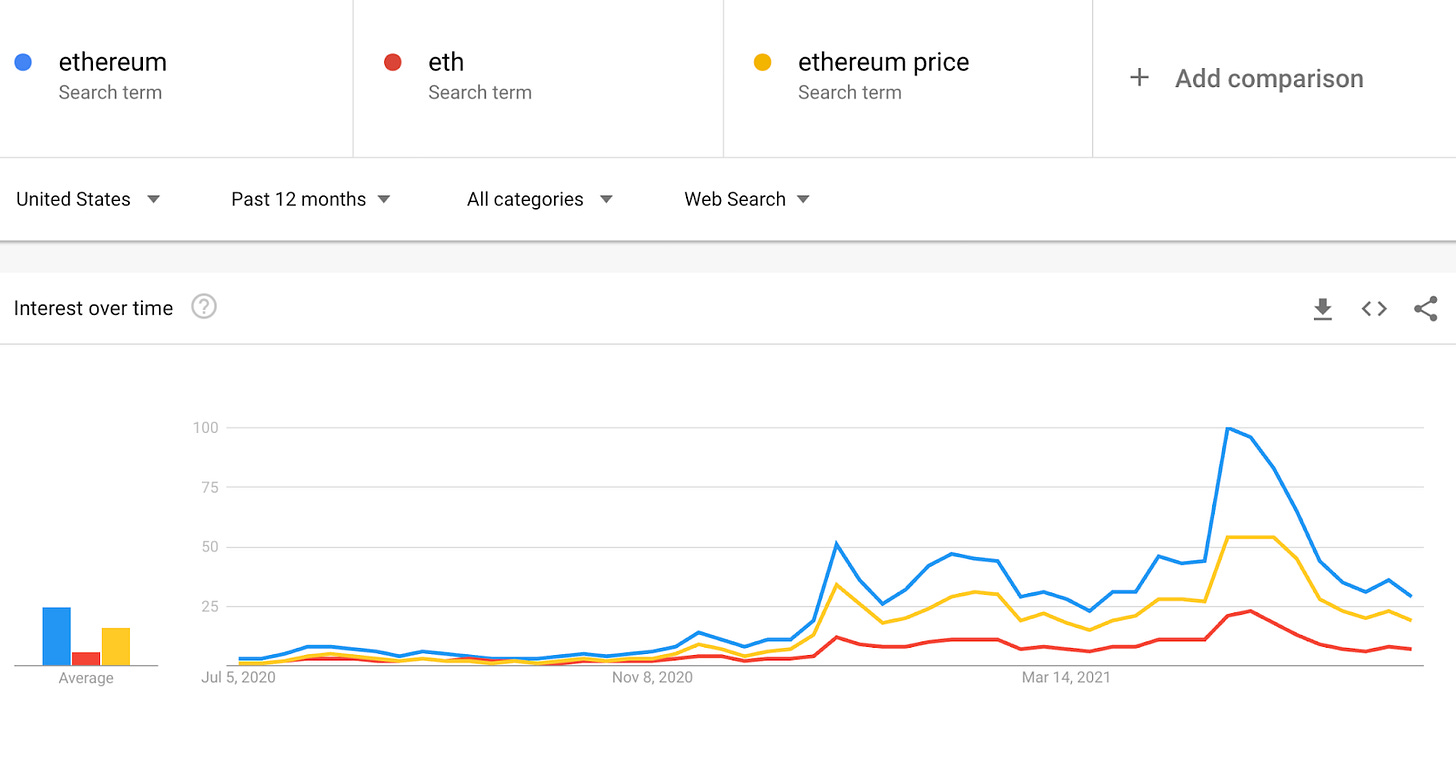

Google trends data also shows waning search interest – Which is highly correlated to price action. Price action is the organic marketing campaign of crypto. When the price rises rapidly, people FOMO in adding fuel to an already burning fire.

If retail traders lose money then there’s no real reason to search as they don’t have anything to invest. The May crash was a blood bath with 800,000 crypto traders liquidated – That’s a lot of money that most likely won’t re-enter the market anytime soon.

All the on-chain data and media narratives scream bullishness, but the price continues to drop. Several key metrics point to large-scale ETH accumulation, and a mysterious Bitfinex whale is doing so with incredible conviction.

History says this is one of the shortest bull markets ever, and some think that we are in a mid-term bear market and that the bull market will continue this fall.

To sum it up, no one knows what happens next as the on-chain data screams bullishness, but price action says bearish. More than anything, reading through crypto Twitter screams total uncertainty of what happens next.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Spread the word and share!