🚦 The Merge Draws Ever Closer as Ethereum Passes Another Critical Test

Hello Defiers! Here’s what we’re covering today:

News

The Merge Draws Ever Closer as Ethereum Passes Another Critical Test

Web3 Publisher Takes a Page from TradFi with Subscription Model

Markets

Opinion

Podcast

🎙Listen to the Exclusive Interview with UMA’s Hart Lambur in this Week’s Podcast:

Video

DeFi Explainers

Elsewhere

Vitalik Buterin - "The Merge Isn't Priced In" | EthCC 2022 Experience: Bankless

European banking regulator ‘concerned’ about finding staff to oversee crypto: The Financial Times

Trending in The Defiant

Defiant Data Dive: Airdrops are Mostly Fool’s Gold…But They Have Their Uses

SushiSwap Pay Package for New ‘Head Chef’ Sparks Outcry as Community Votes

Velodrome Surprises Investors with Surge on Optimism Blockchain

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Thirdweb: Build web3 apps easily, for free, with easy smart contract deployment, powerful SDKs and UI components from thirdweb. Create NFT drops, marketplaces, social tokens, DAOs and more on Ethereum, Polygon, Avalanche, Fantom, Arbitrum and Optimism.

The Merge

🚦 The Merge Draws Ever Closer as Ethereum Passes Another Critical Test

By Samuel Haig

TESTS Passing the latest in a series of critical tests ahead of The Merge, Ethereum completed the tenth mainnet shadow fork on July 27. The result: It went off without a hitch.

TESTNET In the last month, devs have executed three shadow forks and one testnet chain-merge. Shadow forks are trial runs of changes that are designed to be implemented on the live Ethereum blockchain.

EFFICIENCIES DeFi investors and users are watching their progress closely to see whether the next iteration of Ethereum will commence this year and deliver huge efficiencies and faster transaction processing speeds.

LIVE Moreover, the Eth2 beacon chain went live on the Goerli testnet last week in preparation for The Merge’s final dress-rehearsal before it hits the mainnet in mid-September.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

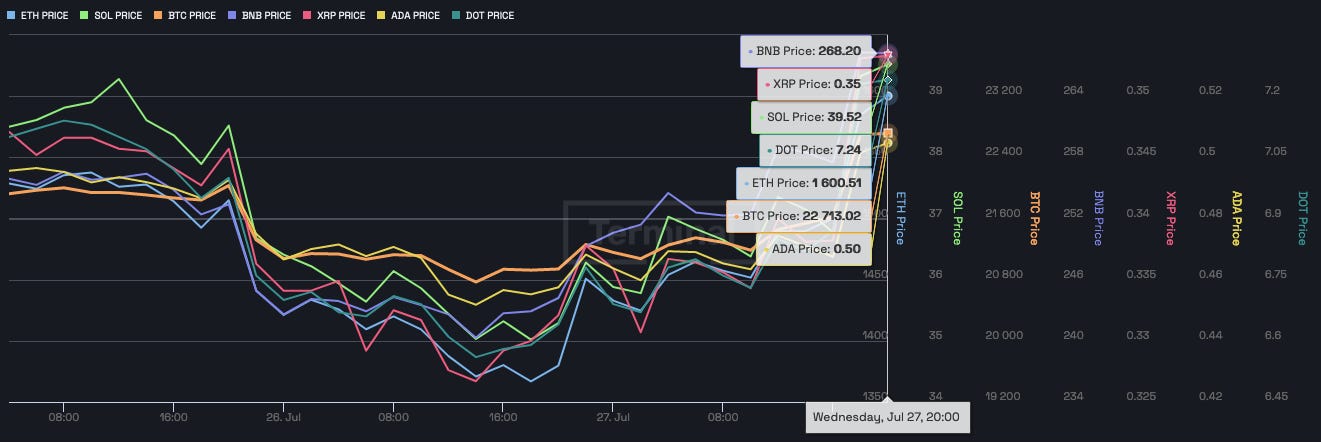

📈 Ethereum Pops 10% as Fed Signals Rate Hikes Are Working

Markets Rally Despite Another Rate Hike of 0.75%

RALLY Crypto markets rallied on Wednesday and Thursday after the U.S. Federal Reserve raised its benchmark interest rate by 0.75% for the second time in two months in a widely telegraphed move.

UP 10% Ether is up 10% to $1,616 in the past 24 hours in early morning trading U.K. time, according to data from The Defiant’s newly released charting tool. Bitcoin rose 7.4% to $22,897. Solana and Polkadot also rallied 16.5% and 11% respectively.

SOFTENED Repeated interest rate hikes this year by the Fed and other central banks may be working, the Fed said in announcing its decision. “Recent indicators of spending and production have softened,” it said in a news release. Investors love the sound of that and the S&P 500 Index, the leading bellwether for stocks in the U.S., jumped 2.6% on Wednesday. Cryptocurrencies have been correlated with equities fas a risk asset or several quarters now, and investors have been buying and selling both types of assets in tandem.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Card-based onramps only work 30% of the time. Ratio works 100% of the time.

How?

Ratio is a direct connection between any crypto wallet and bank account. Now, instead of high decline rates and high processing fees, your users can buy crypto directly from their bank account using ACH, direct deposit, or a linked debit card. There are no processing fees for ACH and direct deposit.

Give it a try.

Sign up directly at ratio.me.

Use their API to offer the new standard.

Ratio is setting a new standard for onramp user experience. If you are a wallet provider looking to improve user activation, retention, and monetization, reach out to their CEO at jeremy@ratio.me. Your team can integrate their white label API in just a few weeks.

Web3

📖 Web3 Publisher Takes a Page from TradFi with Subscription Model

By Owen Fernau

NEWS Subscriptions, long a popular business model in the traditional web and media sectors, are coming to crypto. Mirror, the web3 publishing platform, launched subscriptions on July 26. This means users can now subscribe to a Mirror publication with their crypto wallet, and forward posts to their email address.

WALLETS Alex Atallah, the co-founder of NFT marketplace OpenSea who is stepping down from the company, was happy with the development. “Great to have newsletter subscribers center on wallet addresses rather than accounts,” he tweeted. “Reinforces them as the first cross-platform unit of identity for people on the Internet.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion

🌇 EthCC Journal: Exploring the Network State and a Decentralized Future

Guest writer David Liebowitz muses on the power of blockchain to organize societies in a completely new ways.

ANTICIPATION As the summer sun shone down on the Parisian streets, builders, creators, and everyone in between made their way to this year’s edition of EthCC. The tone of this year’s conference, held July 19 to 22 in the City of Light, was marked by anticipation and uncertainty. Anticipation in the sense that a plethora of research and development are finally coming to fruition with The Merge, zkEVM compatibility, and more.

UNSTABLE Yet in the background is a world that is seemingly growing more unstable. Soaring inflation in the U.S., a war in Europe, bank runs in China, supply chain shortages everywhere, and even an all out coup in Sri Lanka have us all anxiously questioning what will come next.

CRUCIAL QUESTIONS As traditional institutions struggle to adapt to a digital world, there are several crucial questions: Is there a system that can succeed the nation-state just as the nation-state succeeded the feudal system? Can said system cut out the extensive power intermediary platforms that are run by large conglomerates have over our lives?

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Hot Stuff: Everything Wrong With The Degen Trilogy

Shoutout

NEARCON is back and better than ever! Join the NEAR community and Web3 ecosystem in Lisbon, Portugal from Sept 12-14 to network with 2,000+ attendees, listen to influential speakers across industries, and immerse yourself in hackathons, workshops, blockchain experiences, and more!

DeFi Explainers

💦 What Is Liquidity Providing?

LIQUIDITY Anyone who has participated in the real estate market understands the value of liquidity. The longer it takes to match a buyer with a seller and finalize that transaction, the lower the housing market’s liquidity. Because homes are inherently scarce due to land size limits and building materials involved, they are inherently illiquid assets.

FOREIGN EXCHANGE By the time it takes to convert real estate into cash, a price change is unavoidable. Yet, even assets that are not inherently illiquid reside on a liquidity spectrum. If there are not enough dollars to convert into euros, the foreign exchange market for that particular trading pair has low liquidity.

DEMAND In that situation, the lopsided demand for dollars raises its value. Over time, various institutions have been created to increase the market’s liquidity. This begs the question, how can liquidity be maintained in a decentralized market based on blockchain’s smart contracts?

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Vitalik Buterin - "The Merge Isn't Priced In" | EthCC 2022 Experience: Bankless

Welcome to the Bankless EthCC 2022 Experience.

🔗 Sky-High Yields and Bright Red Flags: How Alex Mashinsky Went From Bashing Banks to Bankrupting Celsius: Coindesk

Alex Mashinsky likes to wear a T-shirt. The T-shirt is black and carries a simple slogan: “Banks are not your friends.”

🔗 European banking regulator ‘concerned’ about finding staff to oversee crypto: The Financial Times

A key regulator charged with overseeing Europe’s landmark bid to regulate cryptocurrencies views its ability to hire specialised staff as a “major concern”, highlighting worries over authorities’ capacity to supervise digital asset markets.

Trending in The Defiant

Defiant Data Dive: Airdrops are Mostly Fool’s Gold…But They Have Their Uses Who doesn’t love free money? Airdrops have become one of the most popular features of crypto. By giving away free tokens to investors, they epitomized the easy money to be made in the blockchain world. Airdrops also became a potent way to draw users and build critical mass on platforms.

SushiSwap Pay Package for New ‘Head Chef’ Sparks Outcry as Community Votes In an effort to resolve a leadership crisis, SushiSwap, the fifth-largest decentralized exchange by capital locked, is currently polling its community on a candidate to take over as its new “head chef”.

Velodrome Surprises Investors with Surge on Optimism Blockchain Velodrome, a decentralized exchange deployed on the Optimism blockchain, is giving Uniswap a run for its money. Velodrome’s trading pairs held four of the top ten slots in terms of 24-hour volume on Optimism as of July 26, according to DEX Screener.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.