🙌 The Great ETH Decoupling: ETH Rises Faster Than Both BTC and Gas Prices

Hello Defiers! Here’s what we’re covering today,

Ether and the most popular DeFi metrics are all smashing through new records

Low-ish Ethereum gas fees point to flashbots adoption

MakerDAO will soon hold real-world assets as collateral

ShapeShift integrates THORChain

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

Be Sure to Check Out This Week’s Video Content👇

📺 First Look: Meme V2 is Live! What’s New?

📺 Quick Take: Cross Asset Swap

📺 Tutorial: How to Bridge Assets From Ethereum to Polygon

📈 It’s “Up Only” For ETH and DeFi

ETH & TVL RECORDS Ether and the most popular DeFi metrics are all smashing through new records. Ether continues to push higher, hitting a record of $2487 earlier today, according to CoinGecko. Rising ETH prices is pushing total value locked in DeFi to a new high in dollar terms of $55.9B

ETH IN DEFI ETH locked in DeFi hit an all-time high of 10.78M on Apr. 3 according to DeFi Pulse, largely because of the 639K ETH contributed to the Fei Protocol. ETH accounts for about 45% of assets deposited in DeFi smart contracts.

DEFI TOKENS The DeFi Pulse Index, DeFi’s leading index in terms of assets under management (AUM) is also at an all-time high of $504 at the time of writing. MakerDAO’s MKR is the best performing DeFi token in the past week, gaining 87%, according to CoinGecko.

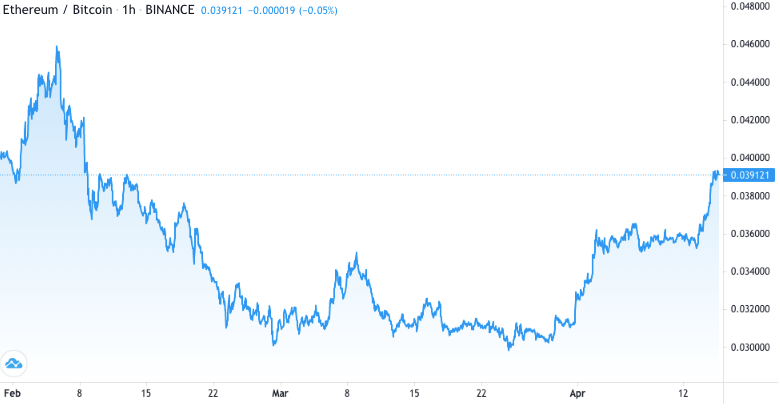

ETH/BTC Ether’s price relative to Bitcoin has also gained 10% on the week, despite BTC’s 8.6% pump. The ETH/BTC ratio is 0.039 at the time of writing, highest point since Feb. 5, when it hit 0.045. The highest ETH/BTC has ever been is 0.11, which came on on Jan. 18, 2018.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

SPONSORED POST

AnRKey Climbs Rarible Charts

AnRKey X hits #1 twice & #2 chart positions on the leading NFT marketplace Rarible. The innovative company AnRKey X combines Defi, NFTs, and Esport gaming with its arcade coin $ANRX.

So far, the company generated almost $800Kin NFT sales, and $2.8M in $ANRX has been staked for its NFTs. Every second week new NFTs with high utility rewards are available on Rarible. The native currency of the platform, $ANRX, has 12 individual utilities within the AnRkey X gaming NFT ecosystem. They achieved mainnet in Q1 2021 and recently announced the start date of the Public Beta Test (26th April 2021), where 50 lucky members of their community will have the chance to play their flagship game Battle Wave 2323. The AnRKey X community has grown to over 50,000 users across three social media platforms to date.

Token holders have grown by 2,000 last month with the token price peaking at $0.52 corresponding to a 600% surge and over 20 million USD in exchange volume. Trade $ANRX on Uniswap and Bithumb Global and join the AnRKist Army today.

🤖 Low-ish Ethereum Gas Fees Point to Flashbots Adoption

TLDR As ETH reaches new highs and the larger DeFi market booms, average gas prices have remained surprisingly stable throughout April, and that may be all thanks to Flashbots Alpha, a project working at the very core of the Ethereum chain.

EFFICIENT BIDDING WARS Flashbots Alpha is a proof-of-concept communication channel between traders and miners that allows formerly inefficient on-chain bidding wars to take place off-chain. Some Ethereum analysts are saying the project is keeping transaction costs low as it incentivizes miners to bundle transactions without arbitrarily inflating gas prices.

MINING ON FLASHBOTS Recently, Flashbots reported that 12 mining pools accounting for over 58% of Ethereum network hashrate are now mining on Flashbots, with 90 unique active MEV searchers successfully getting their bundles mined in March up from only 23 successful searchers in February. By April 1, 13.9% of the total number of ethereum blocks included flashbots transaction bundles.

This has coincided with a marked decrease in high-gwei transactions with fees over 2 ETH in the mempool.

(Flashbots: Flashbots, Etherscan, comparing trend over time of 2+ ETH miner tips txs with number of 2+ ETH gas fee txs. Date range: Jan 1-Apr 1, updated as of UTC 09:00, Apr 12, 2021)

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🏡 MakerDAO to Hold Real-World Assets as Collateral

TLDR A MakerDAO proposal to accept an ERC-20 token which represents shares in a pool of real estate assets as collateral in the Maker protocol passed yesterday. The use of real-world assets in DeFi is a first and is a major step in bringing the trillions of dollars worth of physical assets into the open finance ecosystem.

“MakerDAO onboarded the first Real Word Asset originated on Centrifuge in their executive this week,” Lucas Vogelsang, the co-founder of Centrifuge, the company which developed the protocol for tokenizing RWAs, told The Defiant, “This connects DeFi to the trillions in assets in the real world.”

UNDER THE HOOD The Tinlake protocol, which Centrifuge built, serves as a bridge between RWA companies, which the project calls “Asset Originators,” and Maker. Tinlake onboards RWA companies, turns their individual deposits into NFTs, batches those NFTs into a pool and issues two tranches of interest-bearing ERC-20 tokens against these assets.

NEW SILVER The first of these pools’ DROP tokens to be accepted by Maker consist of loans underwritten by New Silver, a company which makes loans to real estate investors who want to “fix and flip” or otherwise invest in residential properties. New Silver can use the DAI minted by Maker against the DROP collateral to finance new loans for real estate renovations. The debt ceiling for New Silver’s DROP tokens will be five million DAI.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔁 ShapeShift and THORChain Enable BTC-to-ETH Trading

TLDR ShapeShift’s mobile platform has integrated with multi-chain liquidity protocol THORChain to offer native Bitcoin trading without KYC. THORChain’s recently launched multichain “chaosnet” enables cross-chain swaps amongst the Ethereum, Bitcoin, Bitcoin Cash, Litecoin, and Binance Chain networks. THORChain’s native token, RUNE, exploded 111% over the past two weeks building up to the launch.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 Guide to Bancor Limit Orders

Bancor now supports limit orders using KeeperDAO and 0x Protocol!

Traders can perform limit orders on bancor.network between any two tokens in the network

Placing the order requires no gas. Gas is paid by the user who eventually fulfills the order.

Limit orders are one of many new trader-focused features designed to make Bancor a one-stop shop for trading and farming any token

🔗 Normies getting Frenchpilled on the future of #DeFi $ETH: @basedkarbon

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).