✅ Test Passed. DeFi Protocols Show Resilience Amid Market Crash

Hello Defiers! Here’s what we’re covering today,

DeFi Outperforms Post Crash as On-Chain Indicators Remain Strong

Yearn Finance Ecosystem Breakdown — Pushing the Boundaries of Human Coordination

and more :)

🎙Listen to this week’s podcast episode with Preston Van Loon here:

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, a capitalization-weighted index that tracks the performance of selected DeFi assets across the market.

🧘♀️ DeFi Protocols Show Resilience Amid Market Crash

TLDR In a selloff which saw Ethereum’s ETH and the DeFi Pulse Index basket of DeFi tokens dropping over 20% in an hour and more than 40% overall yesterday, DeFi protocols never stopped running and generally behaved as designed.

SO WHAT As Ethereum DeFi grows to hold $100B in assets with millions of users, yesterday was a test on whether the space that aims to become the future of finance can withstand extreme volatility without breaking –and it passed. DeFi’s resilience shows it has strengthened since the latest similar crash in March 2020, when flaws in MakerDAO’s liquidations system caused the protocol to become under-capitalized.

DEX VS CEX Decentralized exchanges like Uniswap, SushiSwap, Curve and 0x didn’t experience any downtime and were able to handle record volumes, according to data compiled by Dune Analytics. Meanwhile, Centralized exchanges like Binance, Coinbase, and Kraken however, didn’t fare so well, with users reporting issues with simple functions like logging in and adding to leveraged positions so they don’t get liquidated.

CEFI LIQUIDATIONS As some users were prevented from adding to their collateral or closing out their loans, centralized exchanges offering crypto futures liquidated almost $7.6B worth of positions Wednesday, according to bybt, the second-highest ever.

DEFI LIQUIDATIONS DeFi protocols liquidated over $700M between May 18 and 19, a record. But the protocols’ smart contracts functioned as programmed ––albeit at very high gas prices. This contrasted sharply with Black Thursday last year when liquidators made off with $4.5M in ETH for essentially free as they were able to take advantage of Ethereum’s congested network, high gas fees and lags in oracle price feeds.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

📊 DeFi Outperforms Post Crash as On-Chain Indicators Remain Strong

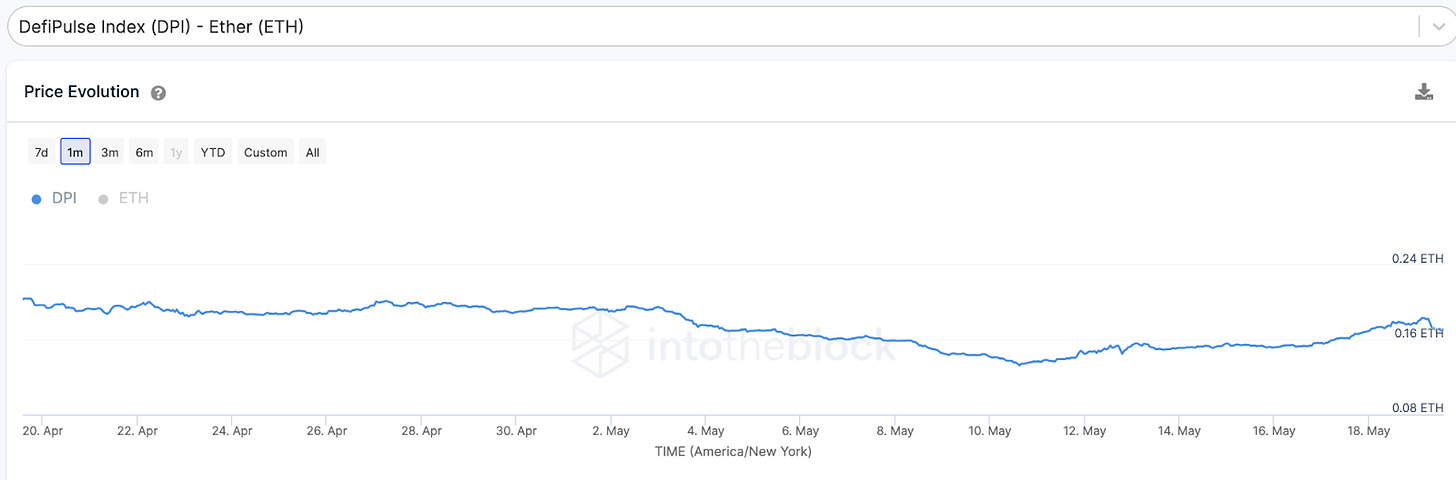

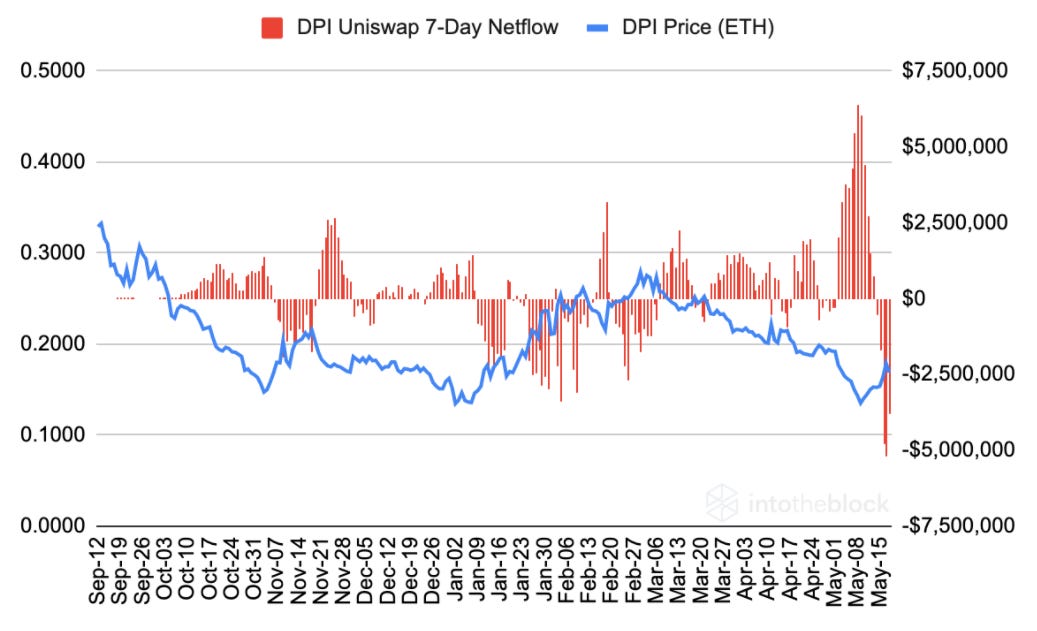

TLDR DeFi tokens in the DeFi Pulse Index dropped 50% versus ETH from March to early May. Since then, we have seen a reversal over the past few weeks with DPI rebounding over 30% with on-chain activity turning bullish for DeFi.

As of May 19, 2021 through IntoTheBlock’s Uniswap protocol insights

NETFLOWS REVERSAL On-chain, we also see a strong reversal in the netflows of DPI on Uniswap V2. Netflows in this case refers to the inflows entering Uniswap minus the outflows for a particular token. Since traders remove liquidity from a trading pair, negative netflows for an asset point to high demand for it relative to the other asset. In DPI’s case, netflows went from record highs to record lows within a week.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

☠️ BSC’s Venus Protocol Left With Bad Debt After Liquidations

TLDR Binance Smart Chain’s most popular lending protocol, Venus, experienced a massive string of market liquidations totaling over $200M on May 18, and Venus, itself, has been left with $100M in bad debt because of it.

XVS PRICE SWINGS The liquidations were primarily caused by the massive price swing of Venus’ governance token, XVS. The token jumped 88% from $76 to $143 and then crashed 50% to $72, all over the course of six hours on May 18. The price of XVS has further spiraled since, hitting lows of $32 on May 19.

LOAN DEFAULTS Because the price swings were so huge, some borrowers realized they would be better off permanently defaulting on their loan, keeping the tokens they borrowed and permanently losing their now-diminished XVS collateral.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🤝 Yearn Finance Ecosystem Breakdown — Pushing the Boundaries of Human Coordination

Yearn Finance surprised the DeFi world late last year when the project announced a flurry of mergers with Cream, Pickle, SushiSwap, Akropolis, and Cover in the span of a week. While the Cover merger ended, the remaining teams continue to collaborate at top speeds enabled by the shared goal of capital efficiency, belief in Yearn’s deeply meritocratic values, and the low-friction integrations enabled by interoperable smart contracts.

Andre Cronje developed Yearn last year initially as a way to invest his family’s savings. The platform allocates stablecoins to lending protocols that are generating the most yield. Cronje introduced the concept of vaults, into which any Ethereum user could deposit in order to take advantage of the vault’s specific yield generating strategy. Last July, he released YFI, a token which had no pre-sale, no offering, and could only be earned in the initial distribution by using the Yearn platform.

YFI’s market cap would reach $1B less than a month after its distribution and Yearn has $3.40B in total value locked (TVL) according to DeFi Pulse, placing it first among yield aggregators, and eighth among all DeFi protocols.

YFI’s fair launch and Cronje’s “test in production” ethos have become models to follow in the space, while the project has attracted 30 full-time contributors, yielding one of the most successful financial decentralized organizations, or DAOs, to date.

Demonstrating similar values to the community-driven YFI launch, no tokens, fiat, or equity were exchanged and no paperwork was filed for the mergers. They “were as simple as saying that we want to do it and then we do it,” said the anonymous Tracheopteryx, a member of the Yearn core team in an interview with Yearn ecosystem members . With bureaucratic hurdles cleared, the teams are “able to work together at the speed of trust. Which is about as fast as you can go in the world.”

While the mergers were well-publicized, the nature of the integrations were less so, so we dug into how the teams work together, on both a technical and social level.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 More and More ‘Normies’ of Finance Are Getting ETH-Pilled: Bloomberg

“Ethereum is a totally different beast. Whereas Bitcoin is considered to be “digital gold,” Ethereum aspires to be a world computer, capable of being a platform for markets and distributed applications. It’s complicated. It aims to do many things. It aims to run smart contracts. It’s not meant to just be hodled. (…) Anyway, it’s clear that to a current crop of people in traditional finance (TradFi), the idea of a cryptocurrency that does something holds a lot of appeal and is drawing people in.”

🔗Jack Dorsey Says Bitcoin Can Make the World Greener. Could He Be Right?: New York Magazine

“The day before Earth Day this year, Jack Dorsey, Twitter’s CEO, tweeted that “#bitcoin incentivizes renewable energy.” It was a counterintuitive, provocative assertion as cryptocurrency critics and environmental advocates have decried bitcoin — and were especially noisy about it that week — for using too much electricity. So it seemed exactly backward what Dorsey was saying, that bitcoin was actually positive for the environment. (…) Beyond the 17,500 people who liked Dorsey’s tweet, there was one particularly interesting reply: Elon Musk, the ecocentibillionaire CEO of Tesla, answered simply, “True.”

🔗“PANCAKEBUNNY: REKT”

“$45 million gone from Pancake Bunny Finance. This was made possible due to a bug in the protocol that uses PancakeSwap to retrieve the prices of PancakeSwap liquidity providers (BNB-BUSDT / BNB-BUNNY). 8 flash loans were used to manipulate the price on various PancakeSwap pools, creating a skewed calculation of BUNNY from the VaultFliptoFlip vault.”

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Dan Kahan, Owen Fernau, and edited by Bailey Reutzel and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).