🧦 $SOCKS is Worth $85k. That’s it. That’s the Headline.

Hello Defiers! Here’s what we’re covering today:

Uniswap’s $SOCKS token has soared to $85K

MakerDAO is on track to generate $71M in annual stability fees

Dissecting the meme-enomics of Dogecoin

Vesper comes out of beta with $28M in TVL

HiFi is latest fixed-rate DeFi lender

Bitwise launches DeFi index

and more :)

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($10/mo, $100/yr).

🎙Listen to this week’s podcast episode with Mark Cuban here:

📺 Check out the latest Tuesday Tutorial, How to Yield Farm, and subscribe to our channel!

And watch this week’s Quick Take on EIP-1559 ICYM!

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Ledger, a hardware wallet combined with the Ledger application to securely buy, sell, exchange, stake, lend & manage your crypto

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

🧦 $SOCKS is Worth $85k. That’s it. That’s the Headline.

TLDR Right now, one single $SOCKS token (redeemable for one real pair of Unisocks, which are cotton socks with printed Unisocks branding) will set you back $85k. That’s down from the Feb. 16’s previous high of nearly $93k.

BUT WHY $SOCKS owners may be driven by the same urge to flex as NFT owners spending thousands on what some say are just jpegs. It’s a status symbol, a way to show, “I was here in the early days of DeFi, when all the cool kids were buying tokens linked to a clothing item sold by an exchange with a unicorn logo.”

SOCKS FOR WHALES In January, $SOCKS leaped from $5.8k on the 15th all the way to over 20k by the end of the month. In a Jan. 29 tweet, Uniswap’s founder Hayden Adams wrote: “If anyone is wondering why SOCKS jumped to ~$22k its because this whale bought $220k worth. We're going to need to put outstanding Unisocks in a bank vault soon.”

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

💰 MakerDAO is Piling on Fees

TLDR MakerDAO backend and oracles engineer Nik Kunkel tweeted that if the current market conditions remain stable, the protocol would generate ~$71M in annual stability fees. Stability fees paid by Maker borrowers (similar to borrowing costs), are then burned by the protocol, indirectly benefiting MKR holders by reducing the token supply.

Fees would result in the equivalent dollar amount of $28K worth of MKR burned. As that burning cuts into the remaining supply of MKR, holders are betting that the remaining ~995K tokens would accrue value.

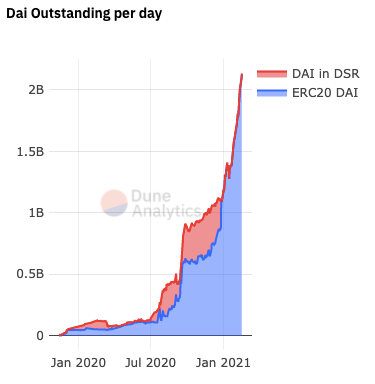

DAI DEMAND More DAI minted means more stability fees in aggregate, and outstanding DAI supply has grown to almost $2.2B, up more than 17 times what it was Feb. 17 last year at $125M. The future is bright for MKR holders if demand for DAI continues to explode.

PROTOCOL INCOME The protocol’s income is up 1106% from Jan. 2020 to Jan. 2021, while the token’s price has only increased 179% in the same period, said Sébastien Derivaux, a cryptoeconomist at Maker, on Twitter, referring to a January presentation of the DAO’s financials.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🐕 The Meme-enomics of Dogecoin

TLDR Another week, another wild, Elon Musk-tweet driven, Dogecoin gyration. The latest one has chart arrows pointing down. But beyond what’s behind the most recent swing, let’s look at what’s driving the whole pendulum: hype.

Thanks to wider access to trading than ever before, memenomics are on the rise. Dogecoin is the perfect case study: an asset which has become completely divorced from more traditional fundamentals.

WHAT IS DOGECOIN Dogecoin is, in essence, a joke asset. It bills itself as an “internet currency” and uses the famous Doge meme as its mascot.

THE RISE OF DOGE At the beginning of 2021, out of every cryptocurrency, Dogecoin was ranked 38th in market cap at $726M. Dogecoin is ranked 13th with a market cap of almost $7B. Just days ago it was as high as 11th on the CoinMarketCap ranking.

That’s an absolutely whopping growth rate of 10x within less than two months.For context, within the same timeframe BTC’s market cap grew 52% from $546B to $830B and ETH grew 138% from $83B to $198B.

“FUNDAMENTALS” Prior to January, Doge consistently had 50-70k active users (measured by unique wallets active within a 24-hour period) per day. Roughly 25-40k Doge transactions took place per day, and the average transaction value was below $1k USD, according to BitInfoCharts. Doge’s daily active users and transaction count have stayed relatively consistent throughout 2020 and 2021

By the same metrics, BTC has around 800k-1M+ daily users making around 350k transactions per day at an average value of $160-200k+ USD.

MEMENOMICS “Memenomics,” as defined here, is the economy of meme-driven markets detached from fundamental value.

“Memes defy the tyranny of reality, and for that, they hold immense power in shaping today's world,” says Peter Pan, an investor at 1kx. “They can come from anyone and anywhere. Memes take power away from the establishment, which only understands what control is.”

Every DOGE spike corresponds to a Doge-related hashtag trending on Twitter.

To be sure, it’s possible that Doge prices started trending upwards before the Twitter trends hit on the aforementioned dates. At the same time, hype plays into hype. Regardless of whether the jumps started naturally or not, the data proves that meme trains kept the momentum going.

LATEST MOVE On Feb. 14, Elon Musk tweeted: “If major Dogecoin holders sell most of their coins, it will get my full support. Too much concentration is the only real issue imo. I will literally pay actual $ if they just void their accounts.” The perception that Musk is telling people to drop Doge has contributed to a significant downturn.

Considering Musk has frequently advocated for Doge as the “people’s crypto,” he actually seems to be saying that whales losing their majority positions in Doge would be better for the longevity of the market. But there’s only so much nuance that can come across in a tweet about the king of meme coins.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🪙 Vesper Comes Out of Beta With VSP Token

TLDR Vesper, a DeFi investment platform, came out of beta and launched its VSP governance token. Following a beta period with $28M in total value locked, Vesper aims to bridge the gap between traditional DeFi users and investment industry professionals who are new to the space. Users are able to choose to deposit crypto in different investment strategies.

TOKEN REWARDS Vesper, which is led by early Bitcoin dev Jeff Garzik, is allocating 1M VSP tokens to liquidity providers. Of those, 600k VSP (60%) are reserved for SushiSwap rewards over the course of 12 months, the project said in apost. Liquidity providers to the VSP-1INCH pool on DEX aggregator 1Inch will be distributed 400k VSP and 150k 1INCH tokens, on top of the pool fees LPs receive from trading activity.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

💸 Fixed-Rate Lending Protocol HiFi Launches

TLDR The field for fixed-rate lending protocols is becoming more dense as HiFi has joined the fray.

YTOKENS HiFi is able to offer fixed rates by locking in a specific duration by which the loan will mature. The debt will be represented with a “yToken,” which refers to tokenized debt backed by collateral. yTokens will function like a zero-coupon bond. For example, in taking out a loan, a borrower will receive yDAI, which will trade as a discount relative to DAI, representing the interest rate if the yDAI were held to maturity.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

The Waitlist for Ethereum 2.0 Staking Rewards on Coinbase is Live

The waitlist to earn staking rewards with ETH2 on Coinbase went live yesterday. Staking allows customers to earn a yield of up to 7.5% for simply holding ETH2, Coinbase said in a blog post.

Bitwise Launches Decentralized Finance Crypto Index Fund

Bitwise Asset Management, creator of the world’s largest crypto index fund, the $800 million AUM Bitwise 10 Crypto Index Fund (OTCQX: BITW), today announced the launch of the Bitwise DeFi Crypto Index Fund.

“DeFi is the story of 2021,” said Matt Hougan, chief investment officer for Bitwise Asset Management. "The growth and activity in the market is incredible.”

Initial constituents and weights of the Index as of 4 p.m. ET on Feb. 16, 2021, were:

The Fund’s custodian is Anchorage Digital Bank, N.A., which became the first federally chartered digital asset bank in U.S. history in January, and today secures over $5 billion in cryptoassets. The Fund’s expense ratio is 2.5%.

Beeple NFT to Be Auctioned by Christie’s: CoinDesk

“The 255-year-old auction house is partnering with digital marketplace MakersPlace to sell works from Mike "Beeple" Winkelmann, a digital artist who made $3.5 million in NFT auctions late last year.” CoinDesk reported. “The Beeple work being auctioned by Christie's is a collage of the thousands of pieces of art he has posted online since 2007.”

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila and edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr).