📉 Record Options Coming Due Weigh on Crypto

Hello Defiers! Here’s what we’re covering today,

Beeple cashing out has some people feeling betrayed

Crypto options expiring might be adding selling pressure

ETH fundamentals still strong amid correction

Nifty’s wants to bring social media to NFTs

and more :)

💗 The Defiant Gitcoin Grant: LAST CHANCE!

Please consider contributing to our Gitcoin grant; TODAY IS THE LAST DAY! We’re using everything raised on this round towards gifting Defiant subscriptions. You can nominate whoever you think would benefit the most from full access to the best DeFi information and journalism out there —including yourself!

📺 Quick Take: Uniswap V3

📺 Tuesday Tutorial: Earn Fixed Interest on UST

🎙Listen to this week’s podcast episode with Antonio Juliano here:

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

BEEPLE SELLS ETH

😈 The Betrayal of Cashing Out

BOTTOM LINE After a New Yorker profile on Beeple revealed that the NFT-megastar converted $53M worth of ETH into USD from the sale of his record-breaking “Everydays: The First 5000 Days,” some members of the crypto community seemed to feel betrayed.

HEAVY BAGS This is a space where people are tied to their bags, both financially and technologically. For most of the world, turf wars between maximalists of competing blockchains would be the stuff of dystopian cyberpunk fiction. For us, that’s just Tuesday. So certainly a person who makes their money on a specific platform with a specific cryptocurrency should be actively supporting that platform’s continual success, right?

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

SELLING PRESSURE

📉 Record Bitcoin Options Expiring Weigh on Price

TLDR The highest amount of Bitcoin options ever is set to expire this Friday, which may put some temporary selling pressure on the largest cryptocurrency.

DETAILS PLS $5.5B in options contracts come due tomorrow, according to derivatives data platform Bybt. Expiring options have historically impacted the spot price: BTC has dropped an average of 2% in the week leading up to the last three months’ last Fridays, days which have the highest monthly open interest due. The weeks following have averaged 12% gains.

MAX PAIN The “max pain” level is $40K. Max pain is defined as the price of an asset at which option sellers (of both calls and puts) will owe the least amount of money to option buyers. The max pain price incentivizes option sellers to push an asset’s price towards it as the options approach expiry, minimizing the option writers’ losses.

SELLING PRESSURE The max pain price is more than 10K below BTC’s current price, a sign there may be selling pressure until Friday.

ETH PAIN POINT Ether has a max pain point of $1,120 for Mar. 26 according to options analytics platform CoinOptionsTrack, compared with its current price of $1,576. As with Bitcoin, this means that this downward pressure is set to dissipate on Friday.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

INTOTHEBLOCK REPORT

💪 ETH Fundamentals Improve Despite Correction

TLDR Ethereum’s demand and store of value proposition continue to grow, unaffected by the recent price volatility, IntoTheBlock found.

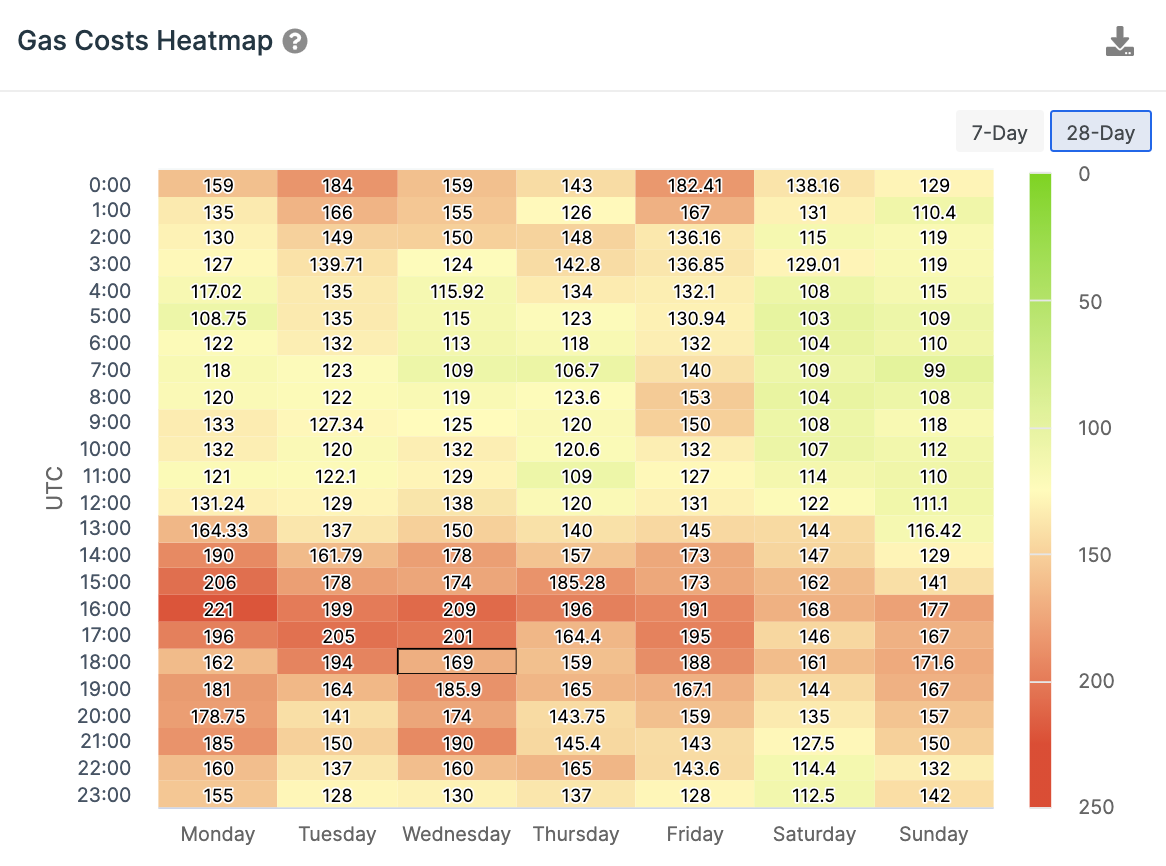

GAS COSTS RISE Throughout the last 4 weeks, average gas costs have sustained well above 100 gwei, even during the weekends. While detrimental to some users, the high fees also showcase the value being generated by Ethereum. Specifically, the willingness to pay for blockspace highlights the demand to use Ethereum and decentralized applications built on top of it.

As of March 24, 2021 using IntoTheBlock’s DeFi Network Insights

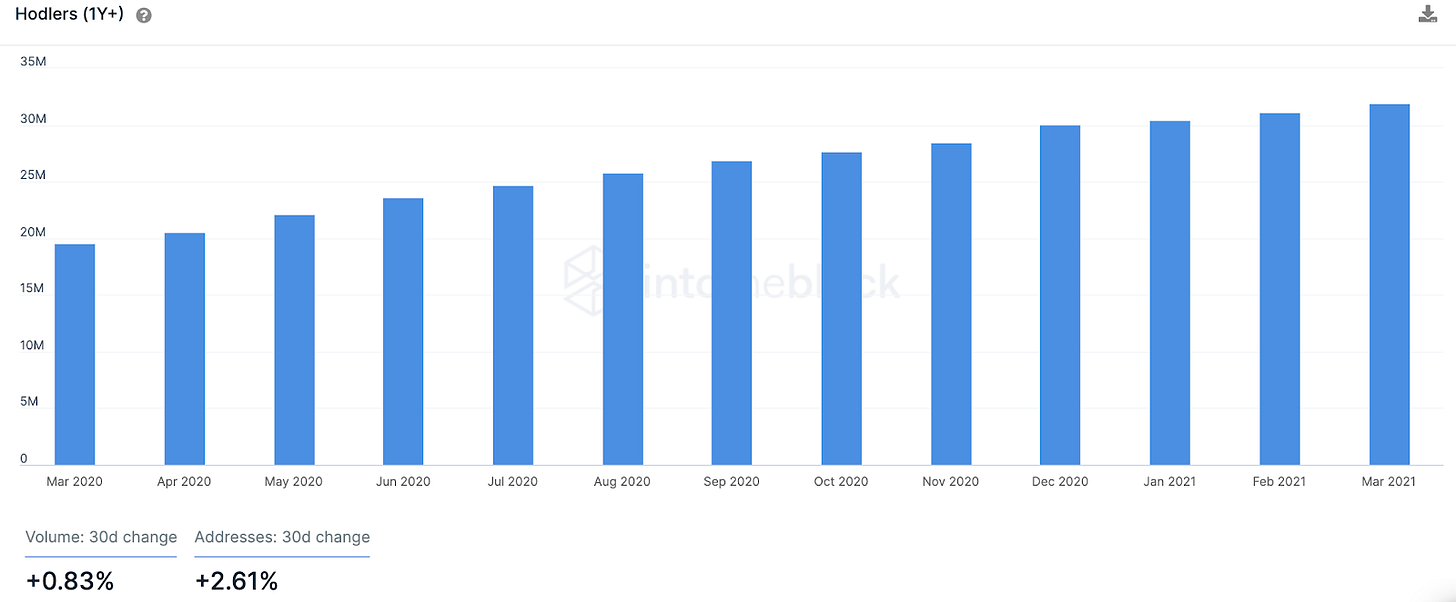

LONG TERM HODLERS Ether’s narrative as a store of value continues to propagate. One indicator that reflects this is the number of long-term holders. IntoTheBlock classifies as hodlers all addresses that have been holding an asset for a weighted average time of at least one year. In Ether’s case, the number of hodlers has increased consistently over time regardless of price volatility, managing to even increase throughout the price plunge in March 2020.

As of March 24, 2021 using IntoTheBlock’s Ethereum ownership indicators

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

NFT BOOM

😺 Nifty’s Wants to Bring Social Media to NFTs

TLDR The NFT boom has yet a new twist: social media. Nifty’s, which is led by NBA’s former SVP of new media Jeff Marsilio, is creating an NFT-focused social media platform. Members will be able to create, collect, and display all sorts of NFTs under one community.

FUNDRAISE Nifty’s recently closed pre-seed round secured support from Mark Cuban, Draper Dragon, ConsenSys founder Joseph Lubin, and the pseudonymous DeFi whale known as “0xb1,” amongst others.

MEME Nifty’s used part of the funds raised to acquire the technology stack of MEME Protocol. MEME’s co-founders Jordan Lyall, Chris Your, and Eric Tesenair will be joining the Nifty’s team as co-founders.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 Don’t defy DeFi: @elonmusk

🔗 Very excited to announce the Staked ETH Trust!: @staked_us

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr).