🦄 Recap: DeFi Week of Sept. 5

Hello Defiers!

This was the week the NFT blob truly subsumed everything in its path. We reported on Christie’s, the venerable auction house, accepting ETH on live bids for the first time. We saw FTX, the mammoth trading exchange, make a move to let customers withdraw NFTs on the red hot Solana blockchain. Camila Russo got insights on trends from SuperRare’s John Crain in our weekly podcast and Robin Schmidt and Alp Gasimov dove into the phenomenon that is the Loot project in our Weekly, Tutorial and Quicktake.

And Bailey Reutzel returned from her expedition into Art Blocks auctions with a tale to tell about what it takes to mint coveted pieces on the hottest platform in the space. It involves gas drama, scalping, and some revelations about greed and beauty in the NFT world. A great read.

On the more sober side of DeFi, Cami hosted our Jam Session #6 on making the jump from TradFi to DeFi, an important theme as financial institutions gauge how to get in on the action at the same time SEC Chair Gary Gensler is tightening the screws on crypto. At the top of the week, Brady Dale reported on Coinbase’s disclosure that the SEC is poised to sue the company in connection with a new lending product it plans to bring to market. The regulatory drama in Washington feels like it’s only begun — and the markets are reacting. yytrader reported on the massive liquidations triggered by this week’s volatility.

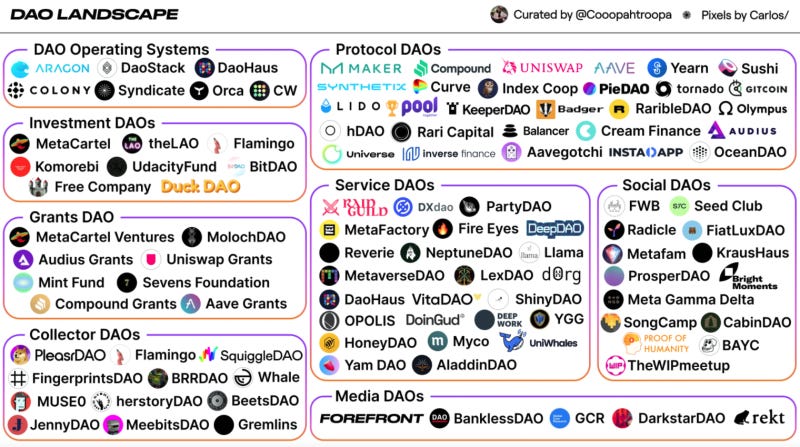

There was a lot of fundraising on the blockchain infrastructure beat, too. Owen Fernau and Brady covered a raft of stories involving Harmony, Terraform, and Lido making big moves, while contributor Sydney Lai wrote about how DAOs are poised to disrupt VCs altogether.. Enjoy your weekend!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

With:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Podcast

🎙 "NFTs are Giving Way to The First Art Revolution Since the Internet:" SuperRare's John Crain

In this week’s episode, I speak with John Crain, the co-founder & CEO of SuperRare, one of the top NFT marketplaces. SuperRare wants to differentiate itself by being the NFT marketplace that best curates art, specifically. John believes the natural evolution for NFT platforms will be to specialize in verticals. For example, the interface for art should be different than the one for real estate, or domain names, and so on. The team recently launched a token and a DAO, and John explains how the move will be instrumental for SuperRare to scale its curation, as the original team gives up control and other participants propose and vote on what should go on the platform.

Video

📺 Jam Session #6: TradFi to DeFi

📺 The Defiant Weekly: Loot (for Adventurers): Game or Garbage?

📺 First Look: How to prioritize Ethereum transactions with Eden Network

📺 Tuesday Tutorial: How to mint NFTs directly from the contract | Etherscan tutorial

📺 Quick Take: What is LOOT? - new gen. NFTs and $BTC now Legal Tender in El Salvador

Weekend Read

In this feature, Bailey Reutzel embarks on a quest to buy the latest works on Art Blocks, the red hot NFT auction site, without losing her sanity. Along the way she talks at length to Snowfro and addresses pressing questions about the strange economics and market mania driving the NFT art story.

😵💫 Digital Beauty, Asset Flipping, and a Bad Case of the Shakes: Inside the Chase for Art Blocks NFTs

I started chasing Art Blocks NFTs on Aug. 25 during Radix’ Eccentrics 2: Orbits drop. That may sound like gobbledygook to some, but others, including Art Blocks founder Erick Calderon, AKA Snowfro, will know that I picked the worst time to begin my quest to mint generative digital art NFT on the platform.

But three months ago I’d minted an Art Blocks piece and its value has skyrocketed by 5,000%. Needless to say, that made me emboldened to become a real degen, to become a flipper. It wasn’t about the art at all this time.

Legions of collectors have poured into Discord servers and hit the auction circuit as NFTs envelop crypto. While this hype cycle might have started with art — Beeple’s $69M sale via Christie’s left jaws on the floor — it’s now engulfed electronic gaming, professional sports, fine art museums, the mainstream media, and even Hollywood. And for sure, it feels more and more like the ICO boom every day. But even as detractors have laughed at the absurdity of million dollar JPEGs, Art Blocks has emerged as a sensible yet edgy platform for digital forms of expression that truly exploit the properties of technology.

Deep Dive

❤️ Opolis Deal Deepens Venture Capitalists’ Love Affair with DAOs

In this Deep Dive, contributing writer Sydney Lai delves into the cross pollination of DAOs and venture capital.

You probably missed it. It was a deal that didn’t involve a big NFT marketplace or a new decentralized crypto exchange. Yet the vote by members of Opolis, a digital employment cooperative, to launch a DAO is significant. Why? Because it’s the latest instance of venture capitalists’ love affair with decentralized autonomous organizations. It also shows the rapid financial maturation of this innovative new business model.

Opolis raised $5.5M earlier this year from a community of angels and syndicate DAOs including Metacartel Ventures, Senary Ventures, and Clemens Wan, a solutions architect at ConsenSys. Under the terms, the VCs did not receive voting rights and only members of the cooperative can vote. The community DAO has now launched a liquidity pool to bring Opolis’s WORK tokens on an exchange. The DAO members have contributed $300K to date with a target of $1M in pool collateral. This economic collaboration is a huge feat of self-directed social participation.

Market Intelligence

This week, Juan Pellicer of IntoTheBlockproduces an on-chain markets update analyzing the ripple effects of the recent crash.

📉 A Deep Dive on the Lessons and Surprises of the Recent Crash

DeFi protocols, apps and their stablecoins are a key area of the whole crypto markets. Even though the average daily trading values of DeFi are 80 times lower than in centralized exchanges, their smart contracts enable open financial services that impact the whole market by providing key functionalities like price stability and liquidity. This is thanks to primitives like lending, borrowing or trading protocols.

For this reason it is worth taking a look at the data available to quantify the reaction within the blockchain with the biggest stake in DeFi, Ethereum, and some of its key DeFi protocols during highly volatile episodes like the ones of Sept. 6.

In this piece, we’ll focus particularly on the effects the crash had on fees and total value locked (TVL). A variation in fees can explain how profitable each of these different DeFi protocols or even Ethereum are during these types of rapid price moves. Additionally, TVL variations besides being mostly affected by price, can be used to estimate the impact in allocation and thus confidence that traders deposit in a DeFi protocol.

DeFi Dad Tutorial

👨🏻🏫 Defiant Degens: How to Earn Future BETA Tokens Lending, Borrowing, and Short-Selling with Beta Finance

This is a weekly tutorial on the most compelling opportunities in yield farming, written by our friend DeFi Dad, an advisor to The Defiant and Head of Portfolio Support at Fourth Revolution Capital (4RC).

Background on Protocol: Crypto markets have always struggled to manage overinflated token prices thanks to an abundance of ways to go long and go short. The resulting volatility can be detrimental to attracting new participants whether retail or institutional.

Despite the viral uprising against hedge funds shorting the stock market (ie GameStop saga), the truth is every market needs a counter-balance to buying pressure, including the DeFi markets. In case you’re unfamiliar with how shorting works, it’s when you borrow an asset to sell now and then buy it back later at a lower price. Just like in traditional global markets, we need new permissionless and trustless DeFi products to short tokens and help mitigate unrelenting upward pressure on the markets.

About two weeks ago, Beta Finance launched as a new protocol on Ethereum for permissionless lending, borrowing, and short-selling. What’s most novel about Beta is the ability to open a short position more easily, in less time, and eventually with any token. To open a short position in DeFi would normally require quite a bit of work, if you check out the diagram below.

Research

In this special research report,Momir Amidzic of IOSG Ventures analyzes how decentralized exchanges have defied their centralized rivals and demonstrated the value of using Ethereum-inspired blockchains to trade tokens. Now they are poised to bring the same efficiencies to other tradable assets. This primer is chock full of datapoints, definitions, and explanations of the forces at work in DEXes and will be a handy reference for all Defiers.

📈 Beyond Crypto: Why Decentralized Exchanges May Eventually Trade Everything

Early on, many believed DEXes would stand no chance against CEX giants in terms of cryptocurrency trading. How in the world could simple constant product AMM replace the likes of Binance and Coinbase. Moreover, DEX is so expensive to use. Doomed to failure, right?

Wrong. Fast forward two years, DEXes are still inefficient relative to CEXes and trading is still expensive. Even so, few question the value of the AMM model and DEXs combined market cap is worth tens of billions of dollars with Uniswap alone being valued at $15B. The moral of the story: Many failed to see how DEXes can outperform CEXes.

Still, even now we continue to see the same pattern of doubt. This time it’s all about derivative exchanges. Can DEXes compete with giants such as FTX? FTX, after all, has an amazing user experience, efficient and robust liquidation, and cross margin engines, it is available 24/7, provides fair and non-exclusive access to services (upon completing the KYC process) with extremely low cost for the users.

Indeed, centralized exchanges such as FTX will likely remain the most efficient derivatives venues in the medium term. But does that mean DEXes will have to become as efficient as FTX to get significant traction? This time we should avoid making the same wrong assumptions or underestimate the advantages of smart contract-based exchanges. What are those advantages?

Friday

News

Harmony Opens the Throttle on Layer 1 with $300M Fund for Myriad Projects The Layer 1 blockchain Harmony unveiled a $300M ecosystem fund today to back startups working on applications and protocols.

Terraform Labs Creates $150M Fund to Advance Inter-blockchain Communication Blockchain communities may never get along on Crypto Twitter, but that doesn’t mean the blockchains themselves can’t. Striving towards a world where all blockchains can seamlessly communicate, Terraform Labs has put forward $150M worth of its LUNA tokens. They are calling the fund Project Dawn.

Links

101 Bored Apes NFT auction at Sotheby's closes at more than $24M: CoinTelegraph

European Finance Regulator Calls Crypto ‘Volatile,’ but Innovative: CoinDesk

Fidenza artist Tyler Hobbs: NFTs are 'going to play a huge role in the art world': The Block

Sushi Co-founder @0xMaki will be speaking at @MessariCrypto’s #Mainnet2021 summit in NYC: SushiSwap\

Thursday

News

Solana Attracts Oracles as Momentum Builds for Next Phase of DeFi Oracles are essential to decentralized finance (DeFi), so the fact that leading oracle projects are expanding their territory to a new blockchain, Solana, could be taken as a good sign for DeFi growing soon within that ecosystem.

Christie’s to Accept Live Bids in ETH for Art Blocks NFTs Wall Street and Washington may be in a panic about the advent of a crypto world. But not the venerable institutions in fine art — they love DeFi.

Links

OpenSea bug destroys $100,000 worth of NFTs, including historical ENS name: The Block

Large Investors Are Behind Binance Smart Chain’s Rapid Growth: Nansen: CoinDesk

Wednesday

News

Coinbase Braces for SEC Action as Regulatory Crackdown on DeFi Intensifies Less than a week after news broke that the U.S. Securities and Exchange Commission was investigating Uniswap, Coinbase, the publicly traded crypto exchange that’s become a bellwether for the burgeoning industry, said it expected to be sued by the agency in connection with its forthcoming offering, Coinbase Lend.

Crypto Markets Keep Sliding As Traders Brace For A Volatile Autumn Crypto markets continued to swoon in mid-morning trading New York time Wednesday, with top DeFi names such Ethereum and Solana skidding more than 8% in the last 24 hours.

FTX Taps Solana and Sports Legends to Score Big in NFTs OpenSea better watch its back. Crypto investors have known for weeks that FTX, the offshore exchange that handles about $40B in daily trading volume, was spooling up an NFT minting operation. Then word came early this week that the Hong Kong-based platform was going to enable its customers to withdraw NFTs from FTX on either the Ethereum or Solana blockchains.

Lido Brings Liquid Staking to Solana, Its Third Blockchain Staking assets on a blockchain helps to secure the network, but losing that liquidity can be painful for traders and investors. So the team behind the derivatives protocol, Lido, created a staking derivative that allows investors to stay liquid while also supporting the security of the networks they rely on. So far, Lido has enabled almost $6B to be staked on Ethereum 2.0 and almost $2B of LUNA to be staked on the Terra blockchain.

Links

Brian Armstrong responds to SEC threats to shut down Coinbase yield product: The Block

SEC threatens to sue Coinbase over crypto yield program it considers a security: CoinTelegraph

Arbitrum Launches! Founders Steven Goldfeder & Harry Kalodner: Bankless

The first footage from #TheMatrixResurrections has arrived: Variety

Tuesday

News

Two DeFi Projects Shut Down and Pledge to Return Users’ Funds Two DeFi projects tasked with helping traders in the space hedge risk announced they are shutting down on Saturday.

$830M Burned: A Month Into EIP-1559 It’s been a month, almost to the day, since Ethereum’s EIP-1559 upgrade went live, and the milestone was met with the first-ever deflationary day for ETH, where more of the cryptocurrency was burned than issued.

Links

El Salvador purchases first 200 BTC, President Bukele confirms: CoinTelegraph

Caitlin Long takes aim at The New York Times over crypto 'alarm' article: CoinTelegraph

Core Developer Apprenticeship Program: The Second Cohort: Ethereum Foundation

Urban Anomalies. 50 images shot primarily in NYC over the span of a decade. Weird AF: OpenSea

The disastrous voyage of Satoshi, the world’s first cryptocurrency cruise ship: The Guardian

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr