🦄 Recap: DeFi Week of May 1

Hello Defiers! Happy weekend!

Or is it??? For those of us who dared to hope the bear market would be short-lived this week was a serious bummer. The Federal Reserve raised its benchmark interest rate by 0.50 percentage point to combat inflation, and while that wasn’t a surprise given the surge in inflation to 39-year-highs, the market got spooked by fears that a recession may be in the offing as well. Owen Fernau reported on the carnage in the crypto market.

It’s still rather strange to see crypto respond to the very institution it’s supposed to disregard (or, more precisely, replace), but that’s the reality of the situation: crypto is a risk asset just like stocks, and when fear grips the market investors run for the hills and hunker down. Still, let’s not forget that DeFi is about so much more than market action, and our writers fanned out to cover a flurry of developments in the space this week.

Yyctrader fired in with a fascinating dispatch on a new breed of NFT aggregators that enable traders to scale action in the most dynamic precinct of crypto, despite OpenSea’s rather static approach. Jason Levin traveled to the outer edge of crypto culture to report on how moribund brands such as Radio Shack and Blockbuster are reanimating as crypto plays. And Owen Fernau wrote about Yuga Labs’ unhinged metaverse NFT sale last weekend, an episode marked by soaring gas fees, and suspicions Yuga is priming a new blockchain of its own.

Meanwhile, Camila Russo spoke with BoredElonMusk, the crypto gaming master and personality, about his new venture, Bored Box, a curation platform for blockchain games. Swinging to other side of the spectrum, IntoTheBlock delved deep into the mechanics of Layer 2s and Optimism.

Robin Schmidt and his team landed an outstanding interview with Yoni Assia, the co-founder and CEO of eToro, the Israeli-British online trading juggernaut that’s was very early in crypto. Yoni is fusing social networking with investing in an innovative way.

Enjoy!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Chainalysis, the leading blockchain data platform. Sign up now for access to their free API to quickly screen against sanctioned crypto wallet addresses. Get free access now!

Hashflow, the first to provide bridgeless cross-chain swaps, lets you trade seamlessly across chains with guaranteed execution, MEV-resistance and the lowest gas fees in DeFi. Try it now!

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Acquisition Royale is an M&A-themed battle royale P2E game by prePO (the pre-IPO & pre-token trading platform). Unlock exclusive prePO items and rewards by playing now!

⍺ DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

This week:

Tips for Rethinking Your DeFi Portfolio in Bearish Times

Podcast

🎙 BoredElonMusk Talks Crypto Gaming and Growing a Twitter Following to the Millions

BoredElonMusk is one of the most prominent Twitter personalities in the crypto space with over 1.7M followers at the time of recording. With decades of online gaming experience, he is now taking his skills offline with his new venture, Bored Box, a curation platform for blockchain games.

BoredElon grew his Twitter profile by consistently tweeting wacky but relatable inventions. We talk about how he built out his brand on Twitter, at what point he was able to leverage and monetize his audience, and also his take on the OG Elon’s move to try to buy the social media platform. We also get into how he was able to transition to crypto, first through NFT artist collabs, next by investing in startups and now building his own project.

The traditional gaming community is a place that BoredElon identifies with. However, we’ve seen a systemic negative reaction from that community when it comes to NFT’s and blockchain-based gaming initiatives. We discuss where that negative outlook from the gaming community stems from, and how BoredElon reconciles these 2 opposing views.

The Tube

📺 The Defiant Weekly: Head to Head with Yoni Assia II a Defiant SPECIAL

📺 Real Vision vs. The Defiant: Blockchain is broken. Solana and Ethereum busted by NFTs

📺 Hot Stuff: BendDAO Degen Strategy - Franklin's Big Bet

📺 Tuesday Tutorial: Airdrop opportunity? Bridgeless Cross-Chain Swaps with Hashflow

📺 Quick Take: Otherside Hangover - what the hell happened?! BAYC-hem

Weekend Read

🧟 Dead Brands Attempt Resurrection With Crypto

Blockbuster Video Reborn as a DAO in Nostalgia Play

Jason Levin catches up with one of the stranger trends in branding.

My journey into the world of crypto’s nostalgia for the ’90s started with a simple tweet. A few months back, I tweeted out “nostalgia-as-a-service”. At the time, I was referring to Spotify charging me $6.99 a month to listen to ‘90s grunge-punk bands like Nirvana and Green Day.

But now I realize nostalgia-as-a-service is so, so much more. Over the last two years, we’ve been swarmed by zombie companies. RadioShack and Blockbuster Video, left for dead long ago, have somehow come back to life to haunt our consumer dreams once again.

The catch? They’ve gone crypto. The latest: Limewire, the defunct website known for distributing free music, raised $10.4M in April to build a music-focused NFT platform. Monetizing the familiar is rapidly becoming a web3 play.

“Nostalgia is a hell of a drug,” Greg Isenberg, founder of web3 design firm Late Checkout and advisor to Reddit, told me. “Nostalgic IP strikes an emotional chord in people and makes it a community-owned brand. This trend is just beginning. Every day new brand owners are reaching out to us looking to leverage web3 with the trust they’ve built over years.”

Deep Dive

🤯 Soaring Gas, Simmering Suspicion, and 50,000 NFTs: Inside Yuga’s Zany Metaverse Mint

Creator of Bored Ape Yacht Club May Build its Own Blockchain

In which Owen Fernau takes stock of an unhinged land sale and the glory of boredom in the buzziest ape club around.

Ungodly hype creates ungodly expectations. That’s what happened when Yuga Labs, the creators of Bored Ape Yacht Club, launched the balleyhooed mint of their Otherside NFTs on May 1.

Yuga, which is worth $4B, raised hundreds of millions of dollars from the mint of 50,000 NFTs called Otherdeeds. They were designed to let owners claim land in Otherside, Yuga’s forthcoming metaverse world. Yet the sale, with soaring gas prices, thousands of failed transactions, and profuse apologies made the offering instantly infamous. There were plenty of unhappy customers.

“They managed to do terribly in both the minting process and the ‘sorry’ thread aspects,” hildobby, a data scientist who builds Dune Analytics dashboards, told The Defiant. In the wake of the stormy mint, Bored Apes and associated assets haven’t been doing too well. APE, the newly introduced token, is down 7.7% in the past 24 hours compared to a 0.4% slip by ETH. The floor for Bored Apes NFTs has skidded 24% since Sunday, according to CoinGecko.

Market Mover

💥 NFT Aggregators Scale Trading as OpenSea Treads Water

New Breed of NFT Platforms Crank Up the Volume

In which yyctrader gets a grip on the latest effort to securitize NFTs.

If you’ve bought an NFT in the past two years, chances are you purchased it on OpenSea. The NFT marketplace leader leveraged its early mover advantage and now absolutely dominates the sector with an astonishing 95% share of sales.

Even so, NFT traders constantly complain about OpenSea. The website goes down at inopportune moments, newly revealed NFTs sometimes take forever to update, and the feature set and interface have remained pretty much unchanged.

Most importantly, you still can’t buy or list multiple NFTs from a single page, a feature sorely needed by active traders. Well, things are starting to change in 2022. Welcome to the dawn of NFT aggregators and the scaling of trades in the burgeoning marketplace. This new breed is plying traders with a way to buy and sell NFTs at volume in one go instead of scrolling and picking through reams of offerings.

Research

👨🏻🏫 IntoTheBlock: Diving into Optimism and the Promise of Layer 2s

By IntoTheBlock

On-Chain Markets Report by Pedro Negron, IntoTheBlock

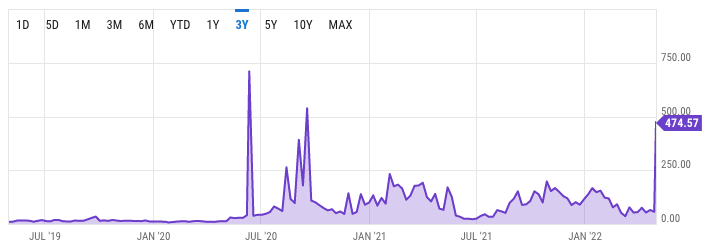

Optimism’s release of the OP token has led to an increase in activity in the network, as speculation grows about its price and future airdrops. By looking at other Layer 2 tokens and sidechains, this piece examines the potential growth and valuation of Optimism following the release of the OP token.

Boba Network and Metis Andromeda are two competing universal Ethereum Layer 2 chains which use optimistic rollup technology. Both Layer 2 chains have already launched their governance tokens and recorded a significant increase in their total value locked (TVL).

Similar scenarios happened with Ethereum Virtual Machine sidechains. Since their tokens were already live due to validation purposes, the sidechains bootstrap liquidity by offering liquidity mining incentives. The chart below shows a historical comparison.

Despite their similarities, sidechains and Layer 2s are not apples to apples. Due to the lack of historical data on token airdrops and incentives campaigns on Layer 2 ecosystems, these comparisons in particular bring meaningful data, even though they may not paint the full picture.

Friday

News

P2E Game Illuvium Preps Auction of 20,000 Virtual Plots Illuvium, the highly anticipated play-to-earn game, plans to sell 20,000 virtual plots on June 2, the venture said Thursday. The sale is part of a push to sell 100,000 lots in the game.

Ethereum Dev Maps Out ‘Safe and Seamless’ Transition to Proof of Stake The roadmap to The Merge just became clearer. On May 5, Ethereum developer, Tim Beiko, published a new update detailing what must be completed before the highly anticipated Eth2 chain-merge can be implemented on the mainnet.

Gucci and Starbucks Go Crypto to Bond with Customers The crypto markets may be swooning, yet mainstream companies continue to embrace blockchain technology to deepen their connection with customers.

Elsewhere

Elon Musk expected to serve as temporary Twitter CEO after deal closes: CNBC

The Chopping Block: Did Andre Cronje Pull an Epic Crypto Rug Pull?: Unchained

The first LBP auction on #Avalanche is being launched by @FinanceHexagon in a few hours: Do Kwon

Thursday

News

Polkadot Upgrade Locks in Parachain Messaging Polkadot’s parachain network has now become a fully interoperable multi-chain ecosystem. On May 4, Polkadot completed an upgrade allowing parachain-to-parachain messaging via the XCM “cross-consensus messaging” format.

Coinbase NFT Draws Fire as a ‘Web3 Instagram’ After two weeks in private beta, Coinbase NFT launched to the public on May 4. Straight away skeptics weighed in with concerns the platform’s embrace of social media functionality might backfire.

Ribbon Finance Gives Half its Protocol Revenue to Stakers Ribbon Finance, a decentralized protocol offering structured crypto products, is now redistributing half of protocol revenue to stakers.

Elsewhere

Chainlink set to power Latin American real estate platform: CoinTelegraph

Solana Pay Adds Customized Transaction Request for Merchants: CoinDesk

Wednesday

News

Genie Accuses Rival Gem After DDoS Attack NFT aggregator Genie may be named after a magical wish-granting character, but Genie’s wishes were not granted this week. On May 1, Genie’s website was attacked – and founder Scott Gray accused competitor Gem of being behind it.

Yearn Keeps Chugging With V3 of Vaults Aggregator Yield aggregators are a strange breed. They generate earnings by pushing capital strategically through DeFi protocols and they have largely fallen out of the limelight in a crypto world engulfed by Bored Apes and multi-chain ecosystems.

SEC Signals Crypto Crackdown with Beefed Up Enforcement Arm Gary Gensler means business. That’s the takeaway from the news yesterday that the U.S. Securities and Exchange Commission is increasing the headcount of its newly formed Crypto Assets and Cyber Unit to 50 positions from about 30.

Wall Street’s Jane Street Borrows $25M Via DeFi Lending Platform TradFi leaders are increasingly cozying up to DeFi. Case in point: Jane Street, a Wall Street quantitative trading firm with more than $300B in assets, has taken out a 25M USDC loan from BlockTower Capital.

Elsewhere

Buterin: L2 transaction fees need to be under 5c to be ‘truly acceptable’: CoinTelegraph

RAC and David Greenstein on Why Music NFTs Are Better Than Spotify: Unchained

Tuesday

News

Solana Reckons With Seven-Hour Outage After Bot Swarm When Solana’s prices skyrocketed last summer, the period became known around the internet as Solana Summer. It’s only May, but Solana Spring 2022 is off to a shaky start.

SuperRare is Coming to SoHo A few years before NFTs captured global attention, NFT marketplace SuperRare hosted pop-up art exhibits at major tech conferences like DevCon. People were mostly confused and uninterested.

Ethereum Name Service Domains Surpass 1M and Stoke Burn Rate Demand for Ethereum Name Service domain names is surging. On May 2, the blockchain-based naming protocol known as ENS surpassed the milestone of one million created names.

Exploits & Liquidations

Fantom Shakes Off Fears of a ‘Catastrophic Liquidation Cascade’ The Fantom network has dodged a near miss. For the last few days, the low-cost Layer 1 blockchain has been the subject of fearful speculation it couldn’t handle the liquidation of a whale in its native token, FTM, and might trigger a wave of liquidations.

Spate of Exploits Snares Rari Capital and Saddle Finance for $90M While all eyes were on Yuga Labs’ Otherside mint over the weekend, the malicious actors that prowl DeFi didn’t take any time off.

Elsewhere

NFTs Are Dead? OpenSea Just Set a New Daily Trading Record of $476M in Ethereum: Decrypt

Crypto Stories: Ethan Lou shares experience of crypto conference in North Korea: CoinTelegraph

Devconnect recap, Optimism token and much more: The Daily Gwei

Uniswap V3 is conceived as the most successful AMM protocol: Uniswap

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.