🦄 Recap: DeFi Week of March 27

Hello Defiers! Happy weekend!

If you suffered whiplash this week you weren’t alone. We, too, were amazed at the way Terra’s embrace of Bitcoin pumped the market and then in the same moment agog at the $600M hack of Axie Infinty’s Ronin bridge. Wow. It was a tale of two markets — the bold and the bad. Owen Fernau tackled Do Kwon’s decision to build a $10B Bitcoin treasury for the Terra ecosystem and the impact on LUNA. And yyctrader covered the Ronin exploit in all its audacity. The big question: How did this missing loot go missing for so long?

Meanwhile, there was a flurry of bullish news that hit the tape — Sam Haig covered Polygon’s embrace of zero-knowledge proofs to bolster its ID capabilities in anticipation of Ethereum’s shift to PoS. Sam also reported on OpenSea’s deal with Solana, a move that boosted the latter’s token considerably this week.

One of the most profound developments underway is multi-chain and the base layer. Be sure to check out Camila Russo’s podcast with Ken Seiff of Blockchain Ventures for a nuanced and deep chat about these innovations. Robin Schmidt and his intrepid crew posted their much-anticipated dispatch on why there are buried NFTs in the Arctic Circle. Pretty, ahem, chill stuff.

We also began rolling out a series of primers explaining how to use the most popular platforms in DeFi. Written by Arya Ghobadi, these handy guides cover MetaMask, Polygon and BSC. We have also posted the first in a series of new, updated explanatory articles on important DeFi features. Kurt Ivy and Rahul Nambiampurath have penned posts on Compound, Uniswap, and stablecoins. More are on the way.

Finally, if you’re in New York, stop to say hi, co-work and chill at our IRL web3 hub in Dumbo! This week we had the first of what we plan will be monthly Colony Conversations with a stellar panel and crowd.

Enjoy!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

SynFutures is a DeFi derivatives exchange that enables permissionless futures trading, allowing anyone to list and trade any asset with a price feed. Learn more!

Nexo is a wallet where you can easily exchange between 300+ unique market pairs, receive up to 0.5% cashback or get instant liquidity against your crypto assets with flexible credit lines. Get started!

Sperax has created $USDs, the stablecoin that generates passive income for holders. Thanks to the Auto-Yield feature, it pays to hold $USDs. Try it yourself here!

APWine is a pioneering yield tokenisation protocol, allowing users to get their future yield in advance. Hedge your risk on APY volatility or speculate on yield with their native AMM.

⍺ DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

This week:

50-1700% APY Yield Farming With Stablecoins On Spool

Podcast

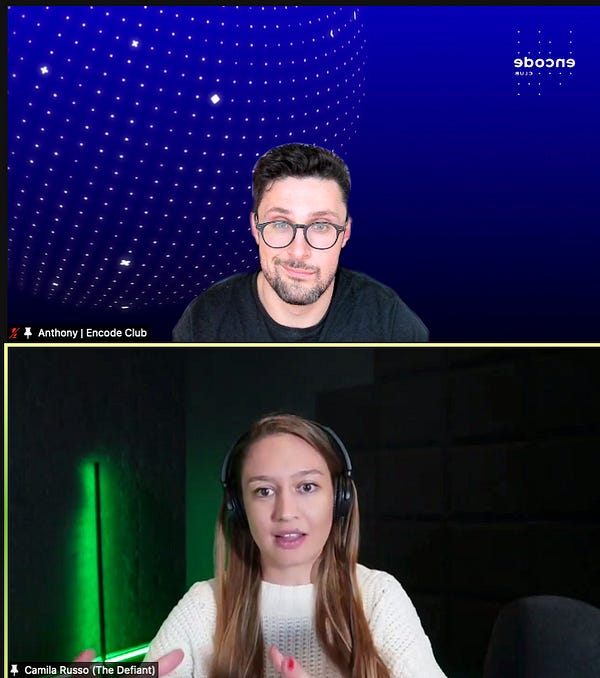

🎙 Blockchange Ventures' Ken Seiff: Betting on Crypto's Base Layer and a Multi-Chain Future

Ken Seiff is the managing partner of Blockchange Ventures, one of the longest-standing venture funds focusing on early-stage blockchain startups. One of his very first forays into crypto was as one of the investors in Ethereum’s token sale. He went on to focus on various other Layer 1s at Blockchange, investing in Polkadot, Solana, Near and Flow, among others.

Ken’s investments look to capture not just the potential value of the venture itself, but the overall growth of a space that is still in its infancy, and his bet is that taking exposure at the base protocol layer is the best way to do that. We talk about how having invested in early internet startups influences his thinking about the blockchain space, what he looks for in teams, and how DAOs are changing and disrupting the landscape for VCs.

The Tube

📺 First Look: Testnet Turbo Booster - DeFiLlama Token Faucet

📺 Tuesday Tutorial: Stargate Finance is open for business. Omnichain: fast, cheap and on Layer Zero

📺 Quick Take: Cashio - The $52M hack nobody's talking about

📺 The Defiant Weekly: There are NFTs buried in the Arctic. We went to find out why

Deep Dive

✊🏼 Do Kwon’s Treasury Play Allies LUNA and BTC Maxis in a Pumped Market

Skeptics Question Security and Wisdom of UST Backstop

In which Owen Fernau delves into Terra’s game-changing move.

Earlier this month, Terra ecosystem co-founder Do Kwon bet $11M that its token, LUNA, would be higher a year from its March 14 price of $88. With LUNA hitting an all-time-high of $109 on Mar. 29, according to CoinGecko, it looks like Kwon is well on his way to winning the bet.

The token’s ascent comes at a time when the Terra ecosystem co-founder has made a splash in deFi with his commitment to acquire $10B of BTC to serve as a reserve currency for UST, Terra’s flagship stablecoin.

At a high level, users will be able to redeem their UST for roughly an equivalent amount of BTC, though the details of the system appear to be still up in the air — Terra tweeted a proposal by Jump Crypto, outlined specifics of how the BTC reserves could be used on March 22.

Opinion

👀 Why Democratizing Access to Pre-chain Data is Critical for Web3

The Battle for Digital Truth Starts in the Mempool

Guest writer John Jefferies makes a case for liberating data before hitting blockchains.

We are in the midst of a web renaissance based on user and pre-chain data. Cryptocurrency and web3 promise new forms of ownership, access, and transparency. Indeed, anyone with an internet connection can now go on-chain and see verifiable, permanent digital truth.

But there’s a battle being fought in the dark and chaotic moments leading up to this truth. That’s where expectations are being dashed in a pre-chain layer known as the mempool.

In world where each on-chain interaction is categorized as a transaction, ceding this pre-chain data isn’t that different from the Web2 model, where data is commoditized and controlled by a few big players. The stakes are high. To construct platforms integral to the Web3 philosophy of transparency and decentralization, builders need equal access to the same pre-chain infrastructure.

DeFi Primers

👻 How to Add Fantom to MetaMask

A Step-by-Step Guide to Using Two Key DeFi Protocols Together

By Arya Ghobadi

Fantom was launched in 2019 by South Korean blockchain development scientists, Ahn Byung Ik, and Matthew Hur. It’s another second generation smart contract platform that offers high scalability and extremely low fees. The developers of Fantom claim that smart contract interactions on the network have been reduced to a maximum of two seconds waiting time.

This is a step-by-step guide on how to add Fantom to MetaMask. Read more! MetaMask supports Ethereum and all of the ERC20 tokens, such as Tether, MANA, DAI, and the Uniswap token. But we can add specific tokens or Blockchains to the MetaMask manually, even if they aren’t officially supported or immediately compatible. Read more about MetaMask here.

🛣 How to Connect MetaMask to Polygon

Here's How to Put Your Ethereum Wallet on a Layer 2 Network

By Arya Ghobadi

Polygon is an Ethereum-based Layer 2 scaling solution. That means Polygon runs a souped up version of Ethereum that is faster and cheaper than the original network. Polygon helps Ethereum handle more transactions by processing them on various new ‘side chains’.

This frees up some space on the Ethereum blockchain and is similar to multi-chain projects like Polkadot and Cosmos. All of the transactions on Polygon are bundled together, checked for validity, and then written to the Ethereum mainnet, which also provides Polygon with robust security and “blockchain integrity”.

🦊 How to Use MetaMask

A Step-by-Step Guide to Using the MetaMask Ethereum Wallet

By Arya Ghobadi

MetaMask is a free cryptocurrency and NFT wallet that comes as a browser extension or a mobile app to interact with the Ethereum network, BSC or any other layer 2 networks. MetaMask lets you send or receive digital assets, and also make direct transactions within the app.

In this article, we will show you how to install and how to use MetaMask. If you want to learn more about MetaMask and understand what it is, be sure to check out our article here. To get started with MetaMask, we need to download the MetaMask app on our browser. In this case, we use Chrome browser, but you can also use Firefox, Brave or Edge.

🧐 What Are Stablecoins?

A Step-by-Step Guide to Stablecoins and Their Role in DeFi

By Rahul Nambiampurath

Electronic cash is nothing new. In fact, over 150 years has passed from the first wire payment made by Western Union in 1871. Since then, people have gotten used to cashless payments via e-banking, credit, and debit cards. But electronic money is not digital money.

It may feel like you’re using digital cash when you buy something with a smartphone app. However, these are just communication systems interacting with traditional banks and their supply of paper money issued by a central bank. Stablecoins differ from this in that they are true digital money, native to the internet.

Here’s a primer on what that means and why stablecoins are so important for the future of finance:

Anyone familiar with penny stocks knows how volatile they are. Because these companies have low market capitalization, it doesn’t take much for a whale to drastically shift their stock’s price in either direction. The same is true of cryptocurrencies.

A large cap cryptocurrency less susceptible to swings in price would have to be worth at least $500M. Bitcoin has been mainstreaming the concept of cryptocurrencies since 2009. Since then, over 10,000 crypto coins have popped into existence.

Friday

News

European Parliament Passes Bill Requiring Crypto Firms to KYC Non-Custodial Wallets

The European Parliament’s Committee on Economic and Monetary Affairs (ECON) has approved provisions to Europe’s Transfer of Funds Regulation that restricts Virtual Asset Service Providers (VASPs) from transacting with unhosted wallets without verifying their owners’ identities beforehand.

Tesla Taps MakerDAO-Powered Lender for $7.8M Real Estate Deal

On March 30, 6s Capital, a commercial lender powered by MakerDAO, closed a real estate financing deal worth $7.8M for Tesla, the world’s leading electric vehicle company and the second-largest publicly-traded Bitcoin holder.

Thursday

News

Vitalik Muses on How PoS Could Have Come Sooner

All eyes are on Ethereum’s coming transition to Proof of Stake (PoS) consensus. It’s a historic moment in the history of crypto. Vitalik Buterin, Ethereum’s co-founder and muse, weighed in this week with his thoughts on what’s to come, and poignantly, the significance of decisions not made in the network’s evolution.

Polygon Taps Zero-Knowledge Proofs to Enhance Privacy for Users On March 29, Polygon unveiled an identity service as the latest addition to its upcoming suite of zero-knowledge (ZK) protocols, the project announced in an official blog post.

Elsewhere

Can Avalanche Win Over Wall Street and 'Degens' Alike?: CoinDesk

Solana Surges as NFT Trading Rises 80% Following OpenSea Reveal: Decrypt

Wednesday

News

Axie Infinity’s Ronin Bridge Exploited For More Than $600M The Ronin Bridge that connects Axie Infinity’s Ronin sidechain to Ethereum has been drained of 173,600 ETH ($590M) and 25.5M USDC in what may be DeFi’s biggest exploit yet.

OpenSea Adds Solana to Its Quiver of Networks OpenSea is already the No. 1 NFT marketplace with $2.3B in monthly volume. Now it may be about to get a lot bigger. OpenSea will launch on Solana, a leading rival to the Ethereum network, in April, the company tweeted on Tuesday.

Gumi Cryptos Launches Fund to Back 50 Web3 Startups On March 30, early-stage venture capital firm, Gumi Cryptos Capital (GCC), launched its second fund targeting web3 startups. The new fund aims to back 50 start-ups during their earliest stages.

Elsewhere

Community Alert: Ronin Validators Compromised: Ronin’s Newsletter

Introducing Polygon ID - a self-sovereign identity solution powered by zk cryptography: Polygon

Tuesday

News

MakerDAO May Hook Up With Traditional Bank The line between DeFi and the traditional finance world continues to blur. An application to onboard loans originated by Huntingdon Valley Bank (HVB), for use as collateral in MakerDAO, has gone live on the platform’s forum.

Cashio Hacker Asks Victims To ‘Apply’ For Refunds After $52M Heist As DeFi exploits go, this may be a first. Cashio, a stablecoin protocol on Solana, was exploited on March 23 to the tune of $52M. Now, the hacker is asking victims to justify why they should be refunded, saying their “intention was only to take money from those who do not need it, not from those who do.”

Elsewhere

Terra's LUNA Sets New All-Time High Following $135 Million Bitcoin Buy: Decrypt

Most Traded Projects on Terra Ecosystem Last 24 Hours: Terra Daily

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.