🦄 Recap: DeFi Week of June 19

Hello Defiers! Happy weekend!

It was a tale of two crypto worlds this week. One was engulfed by anxiety, threats, and a lot of ghosting. The crisis at Three Arrows Capital and more broadly in crypto lending truly hit home. Fears ran high that the $10B hedge fund was poised to default on its mammoth debt load. Sam Haig reported a scoop on how the fund was ghosting Kyber Network, prompting its co-founder to decry the ‘lost trust’ between the two onetime partners and to threaten legal action if Three Arrows didn’t respond to its entreaties.

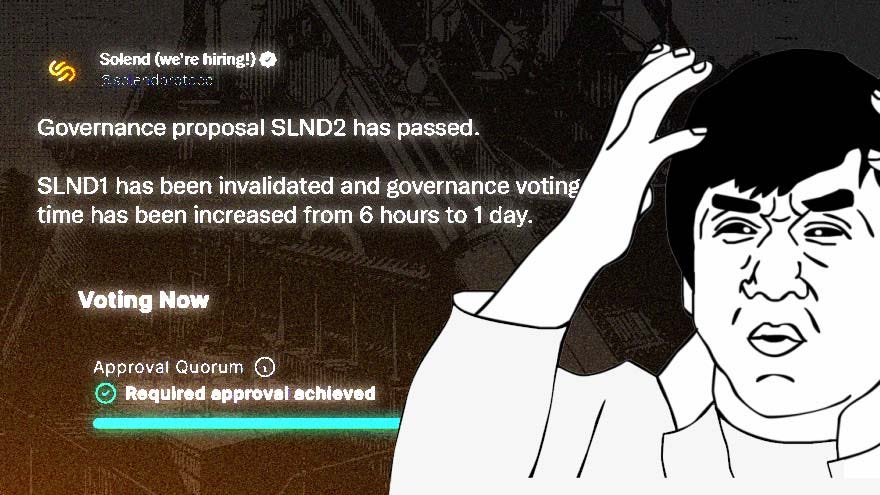

The threats didn’t end there. Aleks Gilbert wrote about Voyager Digital’s extraordinary ultimatum to Three Arrows to pay $658M in debt by June 27 or face default. Yikes. Meanwhile, contagion spread to Solana where Solend and Mango Markets teamed up to handle the whopping $207M debt of a whale who may be beaching. Sam Haig has owned this story since breaking news on the stress confronting the No. 1 lending protocol on Solana’s network. What’s truly interesting about the Solend drama is how it shows the crisis-level decision-making by a DeFi community.

Then there is other crypto world… the one that concentrated in New York this week around NFTs. Don’t miss Aleks Gilbert’s weekend read on the scene at NFT.NYC with week. With an assist from Jason Levin, Aleks braved goblins, illuminati festivities and anxieties about the bear market to bring home a scintillating tale about the febrile state of play in the space. The biggest takeaway? The optimism…

So, too, did Robin Schmidt and his crew, who decamped from Amsterdam to the Big Apple to take the temperature of an industry that is defying the malaise in the rest of the crypto market. Robin’s take on the implications of NFTs for intellectual property is a must-watch, as is his tangle with Apefest and the mega mutant.

Rounding out our NFT coverage this week, Cami Russo spoke with uber-collector Gmoney about how he sizes up pieces and what the crypto crash means for the market. Gmoney shares his insights on a side of crypto that looks as promising as ever.

Enjoy!

⍺ DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

This week:

How to Set Sail On The Arbitrum Odyssey

Podcast

🎙 Gmoney on NFT Projects That Will Make it Through the Bear

Gmoney is one of the most prominent NFT collectors in the space, breaking into the scene with a splash when he bought a crypto punk for 140 ETH last year. He rose to become one of the best-recognized NFT collectors and is now becoming a creator himself with his Admit One project.

Gmoney dives into how the current market crash is affecting NFTs. In his previous life, he was a trader in traditional finance and we talk about how he went from trading stocks to trading non-fungible tokens full-time. The state of the bear market has rapidly spread a sense of fear, but NFT creators are still innovating. Gmoney talks about the most exciting trends and projects.

NFTs are a form of representing digital identity and an access point to communities. But what more can NFT’s do? In the grand roadmap of NFT’s, where will the space go in the next 5-10 years? And will they grow to become more than art and collectibles?

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

The Tube

📺 The Open Metaverse Show: NFT IP is the frontline for the soul of digital assets feat. fity.eth and fringe

📺 Hot Stuff: Apefest, Amy Schumer and the latest mega mutant is revealed

📺 Quick Take: BAYC Nazi story threatens to overshadow NFT.NYC on the ground report

📺 Quick Take: NFT:NYC - where is everybody?

📺 The Defiant Weekly: Head to head with Sam Kazemian of Frax Finance

NFT Saga

👹 Fear and Reveling in Goblintown: A Savage Journey into NFT Land

An After Hours Odyssey Through NFT.NYC Reveals Pyramids, McGoblinBurgers, and a Hefty Dose of Optimism

In which Aleksandar Gilbert jumps into the nether world of NFT machinations at the annual confab…

Just before midnight in Hell’s Kitchen, we snuck out the backdoor at Terminal 5 and boarded a slapdash, wooden bus befitting mythical creatures associated with dirt, bugs, and the macabre. We were, after all, among the “VERY few” who’d been chosen to go down, down to Goblintown.

But the interior was more college dorm than earthen lair, strung with Christmas lights, the walls decorated with a mishmash of stickers and the ceiling sprayed with graffiti. The occupants, kids, really, sat almost one on top of the other, proud of what they’d just accomplished and excited about what would come next. One of them was seemingly passed out beside a mattress in the back.

They were the creative minds behind IlluminatiNFT and the Goblintown NFT collection, the latter a computer-generated collection of charmingly hideous goblins that, almost immediately after their debut last month, began trading for thousands of dollars a pop. Their guests at Terminal 5 in New York that night were treated to a mysterious, interactive art exhibit that climaxed with a Cirque du Soleil-esque performance.

Deep Dives

🐳 Solend and Mango Markets Team Up to Handle Whale’s $207M Debt

In which Samuel Haig reports on the scramble by the No. 1 lender on Solana to manage exposure to a massive trader.

Risky debt is spreading across Solana’s DeFi ecosystem as the drama around a whale and Solend shifts into a new phase. Solend, the top lending protocol on Solana, has agreed with rival, Mango Markets, to share the debts of its largest user — an unidentified whale holding $207.3M of SOL, according to governance proposals.

The sum comprised one quarter of Solend’s total value locked (TVL) and posed a threat to the protocol. On June 22, the whale paid down $11.5M of the debt, according to Solend. It’s unclear exactly how much has been paid back in the last few days.

“This shows commitment to working things out and solves Solend’s USDC utilization problem… We’re in touch with the Mango team and [the whale] to figure out a long-term plan,” Solend posted. “This doesn’t completely solve the problem however, since the large liquidation wall still exists,” the team added, meaning a big chunk of the position may still be subject to a margin call.

🐋 Solend to Not Freeze Whale’s $216M Account After Move Decried as ‘Opposite of DeFi’

The Money Market dApp on Solana is Anxious About Liquidation Exposure

By Samuel Haig

Solend, a money market dApp and the largest Solana-based protocol, is scrambling to address exposure from a whale that’s holding 5.7M SOL worth $215.7M, according to governance proposals.

Over the last three days, Solend’s community has approved a plan to take control of the whale’s account, then reversed course after the move was criticized by decentralization advocates, and is now weighing a third proposal to introduce account limits that will result in borrowed positions exceeding $50M being progressively liquidated.

The flurry of action comes as fears of liquidations continue to roil the DeFi market. Solana has rallied alongside Ether, jumping 34% in the last seven days, according to CoinGecko. Yet investors and protocols remain jittery about fallout from loanbooks backed by digital assets. Solend’s token, SLND, has tumbled almost 16% in the last seven days.

NFT Roundup

😁 Pharrell Williams Makes NFT Fans Happy with Doodles Move

Rapper Caps Big Week for NFTs with Music Push

By yyctrader

Rapper and entrepreneur Pharrell Williams is diving headlong into web3. The Doodles NFT project announced that he’s coming on board as its chief brand officer at an event held during the NFT.NYC conference on June 22.

“We’re going to build from the core community outward and bring Doodles to new heights, new levels,” the entertainer said via video at the holders-only event. The project is planning a foray into music NFTs, with Pharrell slated to produce an album titled “Doodles Records: Volume 1”, which will be sold as NFTs but also made available for streaming on various platforms.

Doodles also unveiled plans for a new NFT collection at the event. CEO Julian Holguin, who joined the project in May after an impressive tenure at Billboard, said that the new collection will be far larger than the original collection of 10,000 avatars. It will be launched on a yet to be specified “more accessible” blockchain.

Opinion

🚀 Time to be Boring: How Crypto Goes 100x From Here

Guest writer Blake West roadmaps a way to reignite explosive growth for DeFi.

How does DeFi go 100x? There are two basic approaches. One is to focus on banking “crypto native” activity. This means that NFTs, crypto gaming (”GameFi”), web3 social, and other uniquely-web3 innovations could all be DeFi’s savior.

The idea is that as these markets grow, they will need financial services. DeFi is primed to capture 100% of that growth. The problem? Even if these activities 10x from their current states, it still puts a low ceiling on DeFi’s growth.

The other approach is to go non crypto-native. Specifically, DeFi should go after boring, everyday economic activity — sectors such as payments, lending, e-commerce, salaries, or savings. That’s right, be boring! When you look at the numbers, this is actually DeFi’s only viable path to 100x growth. And like all major disruptive technologies from the past, DeFi must do so by solving the same old problems in a better way.

Friday

News

Three Arrows Ghosts Kyber Network As Threats of Legal Action Fly Kyber Network has become the latest web3 team to reveal that the struggling hedge fund Three Arrows Capital (3AC) was managing a portion of its treasury.

Harmony Hit by $100M Hack in Latest Exploit of Cross-Chain Bridges Cross-chain bridges are continuing to prove themselves as DeFi’s weakest link.

Solana to Develop Smartphone to Speed Web3 Adoption In an audacious move to jump start web3 adoption, Solana announced on June 23 it is developing a smartphone.

Hackers Step Up Attempts to Hijack DeFi Websites Hackers are increasingly targeting the front-end websites of DeFi protocols in a bid to steal users’ funds.

Elsewhere

Coinbase rolls out Polygon support for transfers of ETH, USDC: The Block

GitHub users respond to Gillibrand-Lummis bill with 'Bitcoin bill' idea: CoinTelegraph

Digital Identity opening at the #SuperRareGallery: SuperRare

Thursday

News

dYdX To Deploy Own Blockchain On Cosmos Pivoting to build an independent blockchain isn’t often done by established DeFi projects. But that’s exactly what’s in the works as derivatives-focused decentralized exchange dYdX has released plans to develop its own chain.

Crypto May be Down But Thiel, Andreessen, and Cuban Still Love NFTs Venture capitalists are famed for being patient. It often takes more than a decade for them to realize gains from their moves. That may be why 1confirmation, a venture firm backed by Peter Thiel, Marc Andreessen, and Mark Cuban, launched a $100M fund to double down on NFTs during the worst bear market in crypto in four years.

Tether To Issue Sterling-Denominated Stablecoin Tether, the issuer of USDT, the largest stablecoin by market capitalization, plans to launch a new stablecoin on Ethereum pegged to the British Pound next month.

Lending Stress

Creditor Slaps Three Arrows With Ultimatum to Pay $658M in Debt or Face Default Three Arrows Capital has until June 27 to cough up $658M or it will be pushed into default by a lender that is running out of patience. That’s the latest challenge the embattled $10B hedge fund is confronting as its vast loanbook goes sideways under pressure from the historic crash in cryptocurrencies.

Elsewhere

Coinbase to Phase Out Trader-Friendly ‘Pro’ Exchange: Decrypt

US Fed Evaluating SEC’s Position on Digital Assets Custody, Powell Says: CoinDesk

eBay Acquires Leading NFT Marketplace, KnownOrigin: Yahoo Finance

Wednesday

News

Uniswap Buys Marketplace Genie to Integrate NFT Trading Into its DEX Uniswap Labs is planning to integrate NFTs into the largest decentralized exchange via the acquisition of Genie, an NFT marketplace aggregator, according to a post on the company’s website.

Maple Provided $10M In Unsecured Loans To Babel Finance The DeFi primitive of uncollateralized lending is undergoing its first major stress test. On June 17, Babel Finance, a Bitcoin financial services company offering lending and asset management services, suspended redemptions and withdrawals citing “unusual liquidity pressures” amid recent market volatility.

‘All Operations Are Normal’ Says Bankman-Fried as FTX Provides $250M Credit to BlockFi BlockFi, a crypto lending platform, has secured a revolving line of credit of $250M with FTX, the second-largest crypto exchange by trading volume, leaders of both companies said Tuesday.

Synthetix Now Among Top-Earning Crypto Protocols After Atomic Swaps Take Off Synthetix is taking off after a proposal to increase trade speed was approved. Synthetix’s token SNX, fees generated by the protocol and volume are soaring after Synthetix Improvement Proporsal 120 passed, removing a previous buffer between trades of synthetic assets, called Synths and increasing trading speed.

Bancor Suspends Impermanent Loss Protection in ‘Hostile Market’ Bancor, one of the first DeFi trading platforms, suspended its impermanent loss protection program over the weekend due to “hostile market conditions,” prompting cries that it was decentralized in name only.

Markets

Celsius Defies Fear of Implosion as Token Soars 218% After crypto lending platform Celsius suspended withdrawals of deposits last week, it seemed unlikely that its native token would move higher. Yet the crypto bank’s CEL token has soared 218% since June 13. What gives? A short squeeze, that’s what.

Metaverse

Time Magazine and The Sandbox to Rebuild NYC in Metaverse Mainstream media outlets just can’t get enough of NFTs. First it was the Associated Press, then The New York Times. Now Time magazine, the 99-year-old publication that once set the agenda for the most powerful people in the world, is taking a bite from the, ahem, apple.

Elsewhere

Doodles NFTs Announces Pharrell as Chief Brand Officer, Fundraise Led by Alexis Ohanian: Decrypt

Alex Mashinsky, Celsius founder feeling the heat: The Financial Times

Tuesday

News

Uniswap Tops Ethereum in Terms of Daily Fees There’s always a bull market somewhere. Today, that somewhere may be Uniswap, one of DeFi’s most recognizable decentralized exchanges.

Lido Proposes ‘Dual-Governance’ Scheme to Quell Ethereum Centralization Fears Wary of “cartelization”, core members of the Lido team have proposed changing the way the liquid staking protocol is governed.

MakerDAO Token Holders Vote to Add Rocket Pool’s rETH as Collateral to Back DAI MakerDAO, the largest DeFi lender by total value locked, could soon allow another Ether derivative as collateral on its network. As a decentralized autonomous organization, or DAO, the proposal to add rETH was put to a vote among holders of MakerDAO’s governance token, MKR. People holding almost 41,000 MKR voted in favor of the proposal, while those holding 22,000 MKR voted in opposition.

NFTs

Yuga Vows ‘Slow and Thoughtful’ Approach to Reviving CryptoPunks CryptoPunks are done playing second string. That’s the upshot of the news that Yuga Labs, the NFT studio that manages the CryptoPunks collection as well as the blockbuster Bored Ape Yacht Club franchise, has poached Noah Davis from Christie’s as a brand lead for the punks.

Markets

TVL in DeFi Fails to Keep Pace with Rebounding Ether In a sign that investors may be losing confidence in the long term prospects of DeFi, the total value locked in the sector’s protocols has increased just 5% even though the p

Elsewhere

Bitfinex and Tether say they have no plans to cut jobs amid market turmoil: The Block

Cardano Developers Delay 'Vasil' Upgrade Citing Bugs: Coindesk

Ape #8522 was purchased for 233.33 ETH: Bored Ape Yacht Club

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.