🦄 Recap: DeFi Week of July 24

Hello Defiers! Happy weekend!

It’s hard to think of another week where we saw such a dramatic clash of DeFi’s past and future.

On the one hand, the news was brimming with conflicts as projects struggled to settle old business. SushiSwap, for instance, was keen to finally resolve its leadership crisis. Yet the exchange triggered quite the dustup by nominating a new ‘head chef’ with a pay package many members of the community deemed exorbitant. Sam Haig spoke with members to learn what was going on and came back with a finely reported dive on the tensions roiling Sushi, including allegations of manipulating governance votes. It was a story only The Defiant covered in such detail.

Likewise, Harmony struck quite the discordant note when it sought to reimburse users who lost money in a $100M hack several weeks ago. As Aleks Gilbert reported, by proposing the minting of new ONE tokens the Layer 1 drew the ire of holders who feared serious dilution. Aleks and Sam also teamed up on an excellent dive into the legal machinations at work in the Voyager Digital bankruptcy. Rather than simply report Voyager’s rejection of FTX’s buyout bid, the pair showed how the case is poised to define the rights of tokenholders in bankruptcies. A fine piece of legal analysis.

On the data analysis front, Jason Levin, with an assist from our Defiant Terminal team, produced a fascinating dive into the efficacy of airdrops. Crunching the numbers, Jason found that airdrops have some marketing utility but may not be worth the trouble that they’re worth unless they focus on core tokenholders. Expect more of these Defiant Data Dives as we search for hidden patterns and development in DeFi!

Meanwhile, on the other side of the ledger, we reported loads of stories on DeFi’s emerging story. Much of that is tied up in The Merge, which has been driving a rally in Ether in recent weeks. Sam Haig has been covering the series of shadow fork tests of the merged Beacon and mainnet blockchains, and he delivered another report on the 10th trial run to pass muster this week. Speaking of market action, Cami Russo spoke with UMA’s Hart Lambur in this week’s podcast about how the bear market is actually quite the pitch for DeFi.

Picking up on that theme, guest columnist David Liebowitz delivered another provocative dispatch from the conference circuit. In his EthCC Journal, DeFi Dave skteched out a decentralized future of network states organized by blockchain. In the same vein, guest writer Hatu Sheikh drew on the dotcom crash of 2000 to argue that bear markets are the ideal time to build breakthrough projects.

And be sure to check out Robin Schmidt’s Defiant Weekly segment on how CeFi failed in the crash but DeFi did not. If there’s one major takeaway from the week’s news it’s this emerging theme. Robin, as ever, nails it.

Enjoy!

⍺ DeFi Alpha Newsletter

Check out DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi. DeFi Alpha is exclusive to paid subscribers.

This week:

⍺ DeFi Alpha: How To Refuel Your Wallet If You Get Stranded On A New Chain

Podcast

🎙 UMA's Hart Lambur Says The Current Market Crisis Is A Sales Pitch For DeFi

This week on The Defiant Podcast we speak to Hart Lambur, co-founder of the UMA protocol. UMA is an optimistic oracle on Ethereum that aims to record any knowable truth onto a blockchain. He was previously CEO of Openfolio, a personal finance tracking platform, and also a US treasury trader for Goldman Sachs.

We discuss his take on the crypto market and how the current crisis is not a DeFi crisis, but rather a failure of risk management at centralized institutions.

He talks about co-founding UMA, which stands for Universal Market Access, in 2018 with the goal of making financial products and services accessible to everyone.

We discuss Optimistic Oracles, which let any application make requests for any piece of knowable data and allow anyone to respond to those questions, and how they enable decentralized dispute resolution.

There is constant discussion regarding the mismanagement of DAOs and issues surrounding governance. Hart believes that DAOs rely far too heavily on multi-sigs that are cumbersome and inefficient. We discuss Outcome Finance, an upcoming brand that will encompass all the DAO tooling that the UMA team has been building.

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides increased insurance on custodial assets of $775 million. Learn More!

Zetachain is a public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Thirdweb: Build web3 apps easily, for free, with easy smart contract deployment, powerful SDKs and UI components from thirdweb. Create NFT drops, marketplaces, social tokens, DAOs and more on Ethereum, Polygon, Avalanche, Fantom, Arbitrum and Optimism.

The Tube

📺 The Open Metaverse Show: Juicebox supercharges funding, guest starring Metatope

📺Hot Stuff: Everything Wrong With The Degen Trilogy

📺 Tuesday Tutorial: Zapper is now the frontpage of Web3. About time...

📺 The Defiant Weekly: CeFi failed. DeFi did not. But is that the whole story?

📺 Quick Take: zkEVM - who's announced what and wtf is it?

Special Report

⚔️ Voyager Rejection of FTX Buyout Leaves Investors Searching for Answers

Stricken Platform and Bankman-Fried Jockey for Advantage as Bankruptcy Unfolds

By Aleksandar Gilbert and Samuel Haig

Thanks but no thanks. That was the message Voyager Digital, a bankrupt crypto lender and exchange, delivered to FTX and Alameda Ventures on Sunday.

On July 22, Sam Bankman-Fried, the CEO of digital asset exchange FTX, proposed a restructuring deal to Voyager. The stricken platform’s customers would get immediate relief in the form of liquidity and the option to join FTX, one of the top crypto exchanges worldwide.

But two days later, Voyager rejected the proposal out of hand as “a low-ball bid dressed up as a white knight rescue,” according to a court filing. Translation: FTX was attempting a takeover adverse to Voyager’s interests. The bankrupt firm also described the proposed deal as “a liquidation of cryptocurrency on a basis that advantages AlamedaFTX.”

Alameda Ventures is an affiliate of Alameda Research, a crypto trading firm founded by billionaire Bankman-Fried. While the crypto mogul has relinquished day-to-day control of the Alameda companies, they and FTX have occasionally acted in concert during this year’s digital asset meltdown, extending credit to or buying distressed companies.

Defiant Data Dive

💸 Airdrops are Mostly Fool’s Gold…But They Have Their Uses

Data From Nine Major Airdrops Show That Rewarding Core Users Has Delivered The Best Results

In which Jason Levin crunches a lot of numbers and produces a definitive take on the value of airdrops.

Who doesn’t love free money? Airdrops have become one of the most popular features of crypto. By giving away free tokens to investors, they epitomized the easy money to be made in the blockchain world. Airdrops also became a potent way to draw users and build critical mass on platforms.

Yet there is a downside no one is talking about. Many of crypto’s brightest minds suspect airdrops create buzz but fail to create long-term value and attract real customers to web3 protocols instead of tourists.

“Airdrops are effectively an expensive customer acquisition tool that hasn’t proven to lead to long-term users,” Messari analyst Dustin Teander told The Defiant.

More worrisome, airdrops have been criticized as being little more than pump-and-dump schemes. Rabbithole, a web3 education platform, recently airdropped NFT NYC attendees an NFT that said “Airdrops are killing web3”.

“We need to focus on the long term with web3 with high-value contributors – not necessarily scaling via mass airdrop,” Brennen Schlueter, Head of Marketing at Rabbithole, told The Defiant.

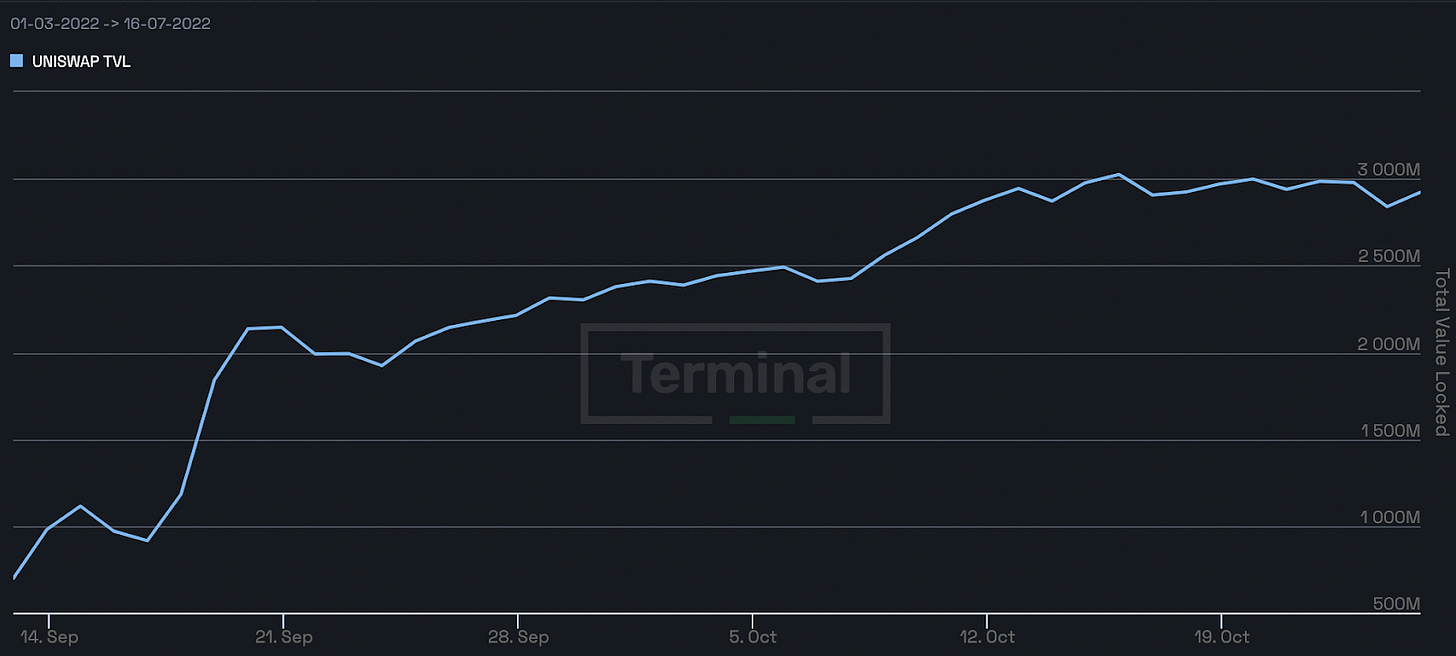

Uniswap TVL. Source: The Defiant Terminal

DeFi Drama

👨🏼🍳 SushiSwap ‘Head Chef’ May Pocket a Third of All Tokens Paid to Staff

Battle Over Howard's Hiring Intensifies Amid Vote by DAO

Samuel Haig owned the story of the tense debate surrounding the DEX’s attempt to resolve its leadership travails.

The proposed new “head chef” of SushiSwap could pocket more than a third of the crypto exchange’s total SUSHI coins allocated to staff over the next four years, according to an analysis of the compensation package by The Defiant.

The token would have to hit some ambitious targets and trigger performance bonuses to reach that level. If you add up salary, guaranteed SUSHI, and incentives, using current prices, the tally comes to a potential $10.6M payday.

The news may enflame tensions in the SushiSwap community as it clashes over the proposed hiring of Jonathan Howard to head the fifth-largest decentralized exchange and ease a leadership crisis that’s been brewing since last year.

The donnybrook also casts a spotlight on the thorny governance challenges DAOs are grappling with as the bear market cranks up fiscal pressure on projects. SushiSwap is governed by a decentralized autonomous organization.

NFT Roundup

💰 Yuga Labs to Collect 5% Royalty On Meebits

In this week’s edition, yyctrader hopscotches from Meebits to Unstoppable Domains to augmented hoodies.

MONETIZE It was bound to happen eventually. After buying the rights to CryptoPunks and Meebits from Larva Labs in March and bringing on Noah Davis from Christies to manage the Punks brand, Yuga Labs is making moves to monetize its purchase.

ROYALTY On July 28, Yuga Labs said that it would immediately start collecting a 5% royalty on all secondary sales of Meebits. Following the move, CryptoPunks is now the only major NFT collection that doesn’t charge royalties on secondary sales, though perhaps not for long.

FUNDING Web3 identity startup Unstoppable Domains has raised $65M in Series A funding. The round was led by Pantera Capital and values the company at $1B. Similar to ENS domains, Unstoppable allows users to purchase NFT-based domain names for their blockchain wallets.

Opinion

🌇 EthCC Journal: Exploring the Network State and a Decentralized Future

Guest writer David Liebowitz muses on the power of blockchain to organize societies in a completely new ways.

As the summer sun shone down on the Parisian streets, builders, creators, and everyone in between made their way to this year’s edition of EthCC. The tone of this year’s conference, held July 19 to 22 in the City of Light, was marked by anticipation and uncertainty. Anticipation in the sense that a plethora of research and development are finally coming to fruition with The Merge, zkEVM compatibility, and more.

Yet in the background is a world that is seemingly growing more unstable. Soaring inflation in the U.S., a war in Europe, bank runs in China, supply chain shortages everywhere, and even an all out coup in Sri Lanka have us all anxiously questioning what will come next.

As traditional institutions struggle to adapt to a digital world, there are several crucial questions: Is there a system that can succeed the nation-state just as the nation-state succeeded the feudal system? Can said system cut out the extensive power intermediary platforms that are run by large conglomerates have over our lives?

Opinion

🏗 There’s No Time Like a Bear Market to Build Breakthroughs

Heed the Lessons of the Web2 Boom Following the Dotcom Crash

Guest writer Hatu Sheikh urges Defiers to bear down and focus on their projects during this challenging period.

In the 1990s, the dot-com bubble drove a five-fold jump in the value of technology stocks and the Nasdaq index. But the bubble burst in 2000, leading to a crack up that felt like the end of the great dream of the internet.

But it was only the beginning. The dot-com crash, and more importantly, its aftermath, taught us essential lessons about the challenges and opportunities of a bear market. Companies such as Dell, Cisco, Intel, Amazon.com, and eBay not only weathered the storm, they reaffirmed the conviction that promising technology sustains itself in the long run, weeding out unnecessary frills.

In many ways, the dot-com bubble is similar to the current scenario in the blockchain-cryptocurrency industry. There’s no doubt the crypto industry is going through a terrible phase. The market has lost $2T, about 67% of its value, since all-time highs in November.

Friday

News

MakerDAO’s Quest for ‘The One, True DAI’ Drives Development of New Feature Do you really own DAI? If you aren’t on Ethereum or a handful of select Layer 2 blockchains, the answer is likely “no,” according to MakerDAO, the organization behind the fourth-largest stablecoin by market capitalization.

Synapse to Roll Out Blockchain as Part of Major Upgrade There’s long been a debate in crypto about when a token is needed for a project to flourish. Now, more projects are asking themselves when a blockchain is needed, and the answer increasingly appears to be yes.

Markets

Summer Rally Spurs Hopes Bear Market is Shifting into Bull Run — But is It? When does a bear morph into a bull? That’s the question crypto investors are asking as the fire and brimstone of the last three months has suddenly given way to a rally.

Elsewhere

Crypto Lender Voyager Ordered by US Regulators to Stop Misleading Customers: Coindesk

Variant raises $450 million for two new venture funds: The Block

"StarkWare isn't Leaving Ethereum" - Eli Ben-Sasson and Uri Kolodny | EthCC Experience: Bankless

Thursday

News

The Merge Draws Ever Closer as Ethereum Passes Another Critical Test Passing the latest in a series of critical tests ahead of The Merge, Ethereum completed the tenth mainnet shadow fork on July 27. The result: It went off without a hitch.

Web3 Publisher Takes a Page from TradFi with Subscription Model Subscriptions, long a popular business model in the traditional web and media sectors, are coming to crypto. Mirror, the web3 publishing platform, launched subscriptions on July 26.

Markets

Ethereum Pops 10% as Fed Signals Rate Hikes Are Working Crypto markets rallied on Wednesday and Thursday after the U.S. Federal Reserve raised its benchmark interest rate by 0.75% for the second time in two months in a widely telegraphed move.

DeFi Explainers

What Is Liquidity Providing? Anyone who has participated in the real estate market understands the value of liquidity. The longer it takes to match a buyer with a seller and finalize that transaction, the lower the housing market’s liquidity. Because homes are inherently scarce due to land size limits and building materials involved, they are inherently illiquid assets.

Elsewhere

Vitalik Buterin - "The Merge Isn't Priced In" | EthCC 2022 Experience: Bankless

European banking regulator ‘concerned’ about finding staff to oversee crypto: The Financial Times

Wednesday

News

SushiSwap Pay Package for New ‘Head Chef’ Sparks Outcry as Community Votes In an effort to resolve a leadership crisis, SushiSwap, the fifth-largest decentralized exchange by capital locked, is currently polling its community on a candidate to take over as its new “head chef”.

Harmony Strikes Discord With Plan to Mint Tokens in Response to $100M Hack Users of Harmony, a Layer 1 blockchain, are fuming over its leaders’ proposed solution to last month’s $100M hack.

Velodrome Surprises Investors with Surge on Optimism Blockchain Velodrome, a decentralized exchange deployed on the Optimism blockchain, is giving Uniswap a run for its money. Velodrome’s trading pairs held four of the top ten slots in terms of 24-hour volume on Optimism as of July 26, according to DEX Screener.

DeFi Explainers

What Is Yield Farming? It could be said that yield farming is a quest for lifelong fulfillment. One doesn’t have to go farther than to remember the quote from the billionaire investor Warren Buffett: “If you don’t find a way to make money while you sleep, you will work until you die.”

Elsewhere

Why the Messy 3AC, Celsius, and Voyager Bankruptcies Will Drag on for Years: Unchained

Treasury Investigating Kraken for Alleged Iran Sanctions Violations: Report: Decrypt

What Happens to Celsius Creditors if Crypto Prices Recover?: CoinDesk

Great news for our European friends, @AngleProtocol has just deployed on Arbitrum!: Arbitrum

Tuesday

News

Lido DAO Rejects Token Sale To Dragonfly With help from an anonymous whale, Lido rejected a proposed deal with Dragonfly Capital on Monday.

Aptos $150M Fundraising Breathes Life into Layer 1 Prospects The Layer 1 trade still appears to have some life in it. Aptos Labs, the web3 startup developing the Aptos blockchain, has raised $150M in Series A funding.

Bancor TVL Drops 30% Since Suspending Protection from Impermenent Loss Total value locked (TVL) in Bancor, one of DeFi’s first decentralized exchanges, has plummeted 30.2% since the protocol paused impermanent loss protection on June 19, according to data from The Defiant’s newly released chart feature.

Uniswap Will Integrate Sudoswap To Access Deeper NFT Liquidity Uniswap is diving deep down the NFT rabbit hole. The automated market maker is integrating decentralized NFT marketplace Sudoswap to allow for efficient NFT swaps when it launches its NFT platform. The news was shared by Scott Gray, head of NFT product at Uniswap Labs.

Markets

Ether and Bitcoin Slide Ahead of Expected Interest Rate Hike Wednesday All eyes are on the Federal Reserve this week as the U.S. central bank is widely expected to increase benchmark interest rates by another 0.75% on Wednesday, following a similar move in June, the largest hike since 1994.

DeFi Explainers

What Is Staking? One of the key benefits of blockchain technology is that it can offer banking services without banks. Instead of banking clerks, there are smart contracts. Instead of offices and guards, there is a decentralized network secured by its consensus mechanism. This is the foundation for Finance 2.0, or Decentralized Finance (DeFi).

Elsewhere

The SEC is investigating Coinbase over its coin listings: Bloomberg: The Block

ETH at the merge, Social decentralization and more: The Daily Gwei Refuel

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.