🦄 Recap: DeFi Week of Jan. 30

Hello Defiers! Happy Weekend!

Exclusives are the coin of the realm in the news biz and this week we had a few. First up was Brady' Dale’s article on the curious case of the couple who actually beat the IRS. They have been earning income from staking and after a tangle with Uncle Sam obtained a tax refund, a decision with broader significance for the crypto community.

We were delighted to feature IntoTheBlock first exclusive report for The Defiant this year. The esteemed Juan Pellicer weighed in with a deep dive on how DEXs like Uniswap, Osmosis and SushiSwap garner revenue. Likewise, Mason Marcabello turned his gaze on DeFi 2.0 with an exclusive primer — much in the news in recent weeks with the plunging fortunes of OlympusDAO ecosystem tokens.

Speaking of SushiSwap… wow. The crisis unfolding at the popular exchange has gripped the attention of Defiers and Brady Dale chronicled its struggle to overcome its management challenges and the canceled deal with Frog Nation in a must-read feature. And yyctrader plumbed the fallout for Daniele Sesta’s ecosystem and especially Wonderland.

There was also drama at the intersection of gamers and NFTs — Sam Haig reported on how Team17’s rejection of a deal with a partner shows the antipathy many gaming devs have toward nonfungible tokens.

Meanwhile, Owen Fernau chased the $320M exploit at Wormhole, a hack that couldn’t have come at a worse time given the fragility of the crypto market. Then Owen reported on Jump’s amazing bailout of the project on Thursday.

Rounding out the week, Camila Russo spoke with Avalanche’s Emin Gun Sirer about the scalability of blockchains. And Robin Schmidt and his fearless video crew turned their cameras on money legos, NFT doubters, and India’s CBDC.

Enjoy!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

$WEB3, by Arch is the best of Web3 in a token. This methodology-first tokenized-index provides broad-market exposure to Web3. Its constituents represent roughly 70% of the ecosystem. Learn more!

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Synfutures List and trade any futures contracts based on popular cryptocurrencies, altcoins, indices, NFTs and real-world assets — you name it!

DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

📬 Inbox Dump #41

Our Inbox Dump newsletter, which is exclusive to paid subscribers, is where we include the updates and announcements that flood our DMs each week and didn’t make it to The Defiant’s content platforms. Sometimes announcements here didn’t meet the bar to become a news story, sometimes they may have slipped through the cracks, or they came late and we haven’t had a chance to cover. We also include a compilation of DeFi and crypto funding rounds in the past week so you have these in one handy place.

Podcast

🎙 AVAX's Emin Gun Sirer Says Blockchains Should be Scalable at Their Core; Layer 2s Mean Giving Up

When Emin Gun Sirer first came on The Defiant in May 2020, Avalanche was not even on mainnet yet. Since then, it has risen to become one of the leading smart contract networks, while the AVAX token has risen over 7x in the last 12 months. We talk about how the project got here and how it wants to create a path for faster and more scalable decentralized network, amid heavy competition from other Layer 1 blockchains.

Emin makes the case for Avalache’s novel consensus mechanism, paired with subnets with their own virtual machines, and he also has scathing criticism for Ethereum and other Layer 2 scaling solutions. To him, once a platform starts building Layer 2s, it means they’ve run out of ideas on how to make a good Layer 1. We also discuss the big picture goal for Avalanche; Bitcoin centers around digital gold, Ethereum strives to create the world computer, and Avalanche wants to digitize all assets. If it's on a balance sheet, Emin says, it can be on a blockchain, and we discuss what it will take for it to get there.

The Tube

📺 Real Vision vs. The Defiant: Camila Russo responds to Dan Olson

📺 First Look: Did India just legalise crypto? Unpacking the Digital Rupee

📺 Tuesday Tutorials: Confused by money legos? Let's build some (for free!)

📺 Quick Take: The line is not a line - the real problem with NFTs

Weekend Read

🍣 SushiSwap Struggles to Overcome Lack of Management and Nixed Frog Nation Deal

In which Brady Dale delves into the crucible at SushiSwap…

SushiSwap doesn’t just need leadership, it also needs to sort out where all its keys are. It can be hard for organizations to priortize who controls what (like the many web-based tools it relies on) when times are good. But when times are bad it’s easy for the same organizations to lose control of essential services after staff suddenly leaves.

SushiSwap is going through this challenge right now in the wake of the exits of its top leaders and an apparently failed union with Frog Nation, the newly formed collective from Daniele Sestagalli and his allies.

Case in point: one of the most important services for any decentralized autonomous organization (DAO) today is its Discord server. The SushiSwap community has lost admin access to its server, which means scammers can openly run social engineering campaigns against the less sophisticated SushiSwap users right out in the open. No one has the power to ban these people right now.

Over the course of an audit of the key SushiSwap resources, remaining members determined that former CTO Joseph DeLong must be the one who has admin control of the Discord. Today, a poll went up on the SushiSwap governance forum calling on DeLong to turn admin access over to Tangle, from Sushi’s customer success team.

DeFi 2.0 Primer

🌱 Decentralized Finance is Poised to Expand its Reach But Challenges Loom

In this special DeFi 101 report, Mason Marcabello explains DeFi 2.0 and how it’s designed to make decentralized finance more accessible to newcomers.

FLAWS Compared to the walled gardens of traditional finance the benefits of DeFi offer a more ubiquitous range of financial tools for consumers. But with that said, the very nascency of its ecosystem has led to a plethora of flaws, like impermanent loss and shortcomings with liquidity mining that require many users to compromise on risk.

This is where DeFi 2.0 comes in.

What Is It:

In essence, and as with any iteration of technology (not just blockchain), DeFi 2.0 is a movement focused on improving on the shortcomings of its forebears. While a more detailed insight will be covered in the following DeFi 101 article, key differences between DeFi 1.0 and DeFi 2.0 have centered on liquidity, scalability, security, and centralization.

Why Does It Matter:

At the risk of generalising, one shared aspect of any successful business or service (regardless of industry) is that it helps create (or reinforce) a path of least resistance for end-users.

For example, Amazon helps its customers save time by automating the delivery of its products. Uber and Airbnb help streamline and save time on the cost and effort of transportation, accommodation, etc.

Research

⚙️ IntoTheBlock Exclusive Report: How DEXs Use Incentives and Tokenomics to Generate Revenue

Juan Pellicer of IntoTheBlock explains the mechanics at work inside DeFi exchanges.

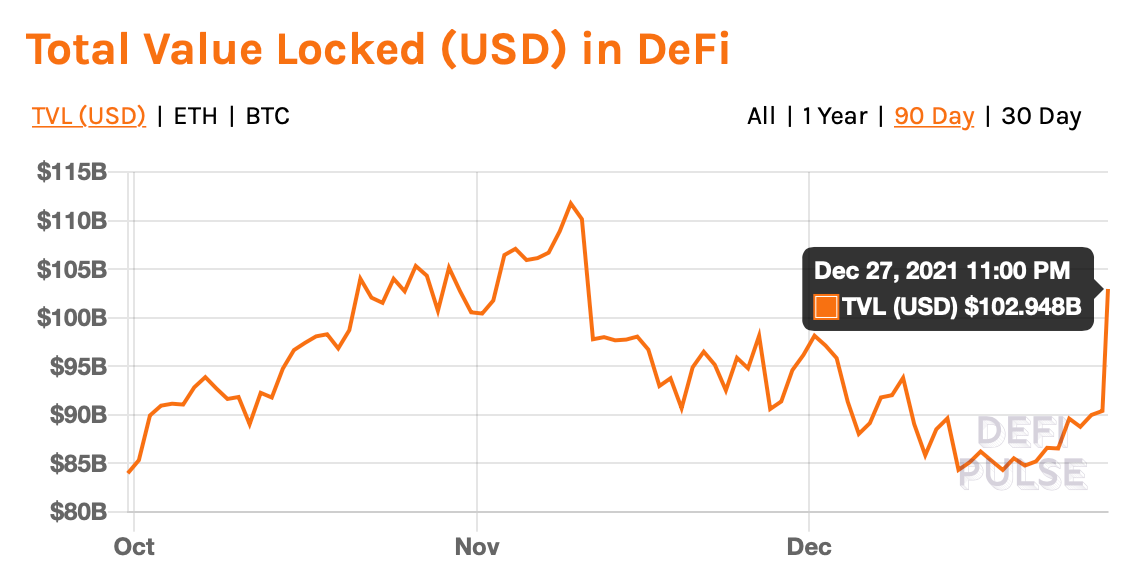

Web3 is all about value transactions, and exchanges are in the best position to provide that utility and capture value. But where does that value go?

The most basic need that DeFi users demand is an exchange of tokens. Charging a small fee for this exchange is one of the most direct ways to generate cash flow for a DeFi protocol. These protocols are decentralized exchanges, and nowadays some of them are generating hundreds of millions of dollars in daily trading volume and generating daily revenues that exceed $1M in certain cases. These are the three exchanges that produce the most revenue:

Revenues come from the fees that traders pay for the exchange of tokens. So the fees accrued are proportional to the value traded on each decentralized exchange. These fees tend to vary from 0.30% to 0.01% depending on each protocol and pool in particular.

Beyond comparing these figures, it is interesting to explore how these revenues flow differently on each protocol, since these can be distributed very differently among all the parties involved with the protocol: the liquidity providers, the DAO/team supporting the protocol, or holders of the protocol’s token. Incentivizing these parties correctly is critical in a successful decentralized exchange. And that process can turn a wavering exchange into a steady revenue machine.

Friday

News

Jump Crypto Replaces Over $320M of Wormhole Wrapped ETH in DeFi Bailout It’s almost like it never happened. Wormhole, a bridge which facilitates asset transfers across seven different blockchain, got hacked on Feb. 2 to the tune of over $320M as a hacker minted 120,000 worth of a version of wrapped Ethereum on Solana. One day later, the funds are back.

Mainstream Embrace of NFTs Tightens With Olympics, GameStop, Cameo Offerings Big brands are clamoring to ride the NFT bandwagon.

On Feb. 3, the International Olympic Committee (IOC), Cameo, and GameStop all dropped significant news about their respective forays into NFTs.

Links

Bored Ape Yacht Club Creators in Funding Talks With Andreessen Horowitz: Report: CoinDesk

Meta plunges and sets off Wall Street’s worst drop in nearly a year: The New York Times

We are super stoked to announce that we are joining @Balancer

Thursday

News

Crypto Stakers’ IRS Tax Refund Marks Milestone for PoS Validators There may be good news ahead for those looking to earn new tokens by providing security to major blockchains that operate using proof-of-stake.

Wormhole Cross-Chain Bridge Exploited For $320M Wormhole, a protocol which lets users bridge assets between Solana and other blockchains, has been exploited to the tune of over $320M. News of the exploit was first shared on Twitter by samczsun, a research partner at crypto investment firm Paradigm.

0x’s New Offering May Drive NFT Action to Avalanche, Fantom, Other Chains So far, NFTs have thrived mostly on Ethereum. A new release shows that may be changing. On Jan. 31, 0x, a four-year-old protocol that facilitates token trades, rolled out a swap feature for NFTs compatible with any chain compatible with Ethereum Virtual Machine (EVM).

Gamers’ Loathing of NFTs Deepens After Team17 Reversal on MetaWorms Deal The gaming community’s opposition to NFTs cranked to full boil this week when Team17, the British development studio famed for Blasphemous, accepted and then cancelled a deal to launch NFT collectibles a few days ago.

Markets

Decoupling of NFTs and Crypto Spurs Debate About Future of New Asset Class Just a month into the new year, the crypto market is confronting a riddle: Why are NFTs soaring while digital assets plunge into bear territory?

Links

Dune Analytics raises $69.42 million in Series B, now valued at $1 billion: The Block

US Federal Reserve is making some analysts bullish on Bitcoin again: CoinTelegraph

New awesome use case page for running a node for Ethereum led by

Yearn Finance is excited to be a sponsor of #ETHDenver 2022!: Yearn Finance

Wednesday

News

Axie Infinity Sidechain Token RON Slides 35% in Debut Sky Mavis, the company behind the play-to-earn game Axie Infinity, launched the RON governance token for its Ronin sidechain on Jan. 27.

Permissionless Index Protocol Kuiper Goes Live Today Kuiper, a permissionless protocol for creating indices has been released on Ethereum mainnet today in what the team behind it is calling a soft launch.

Links

Jack Dorsey: Diem was a waste of time, Meta should’ve focused on BTC: CoinTelegraph

SEC Asks Bitwise to Address Concerns About Proposed Spot Bitcoin ETF: CoinDesk

Devconnect: 18-25 April 2022 in Amsterdam: Ethereum Foundation

Calling all art lovers - Art Blocks is hiring an Artistic Coordinator!: Art Blocks

Tuesday

News

Questions Swirl Around Wonderland’s Fate After Frog Nation Crisis It’s been a tumultuous week for the Frog Nation, the collective of DeFi projects led by Daniele Sesta.

Ape DAO Collectors Seek to Liquidate $26M Treasury of Bored Ape NFTs In a move that may be call on the top of the NFT market, the community behind Ape DAO, a group of collectors that holds 81 Bored Ape Yacht Club (BAYC) and 81 Mutant Ape tokens, is rallying behind a governance proposal to dissolve and liquidate its treasury.

Curve Finance Hit Record Volume as Investors Scrambled To Trade Out of MIM Curve Finance, an automated market maker and DeFi’s second-largest protocol, had a record-breaking day on Jan. 27 with $3.2B in volume, according to the project’s stats page.

How Friends With Benefits Uses Utopia to Manage Contributor Payroll Crypto is inventing a new way to organize people, work and money: decentralized autonomous organizations, or DAOs.

Markets

Links

Venture froth catapults FTX to $32 billion valuation: The Block

Arcade Launches NFT Lending Platform as Blue Chips Hold Strong: CoinDesk

Facebook parent Meta joins crypto group promoting open patents: The Block

Bitcoin market cap dominance hits 2-month high as altcoins struggle: CoinTelegraph

The first cross-chain governance proposal has successfully updated the Aave Polygon Market!: Aave

Price Performance of Native @Arbitrum Tokens Last 24H: Arbitrum Daily

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Sanuel Haig and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.