🦄 Recap: DeFi Week of Jan. 23

Hello Defiers! Happy weekend!

Selloffs, scandals, scams… Those were the watchwords this week as a flurry of unsavory news whipped the crypto markets. There was the fiasco at Frog Nation when news broke that the influential group’s CFO, Sifu, was none other than Michael Patryn, co-founder of failed Canadian crypto exchange QuadrigaCX. Yyctrader followed with a nice piece of analysis on how the fallout was affecting Wonderland and other names in the Frog Nation pond, and triggering death threats against impresario Daniele Sesta. All this comes right on the heels of Frog Nation’s move to take the reins at SushiSwap, as Brady Dale reported.

In a juicy scoop, Robin Schmidt landed a one-on-one interview with Andre Cronje, the brains behind Yearn Finance, to discuss his recently unveiled joint venture with Sesta in Solid Swap.

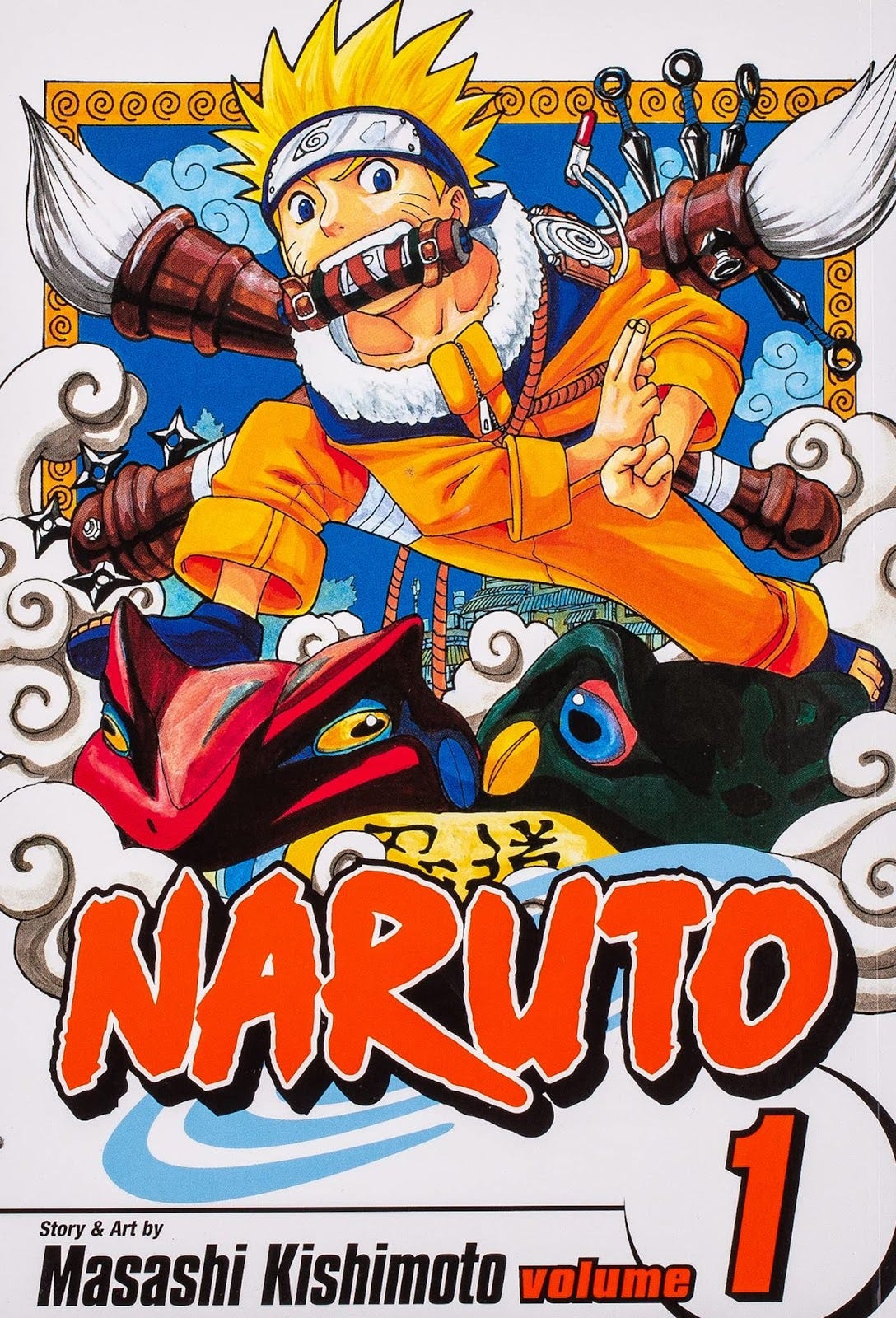

We were delighted to welcome our old friend and colleague Dan Kahan back to the The Defiant with an amazing saga about the unraveling of a would-be NFT play involving Naruto, one of the biggest-selling mangas of all time. Dan uncovered a licensing scam that had duped the entrepreneurs behind a project called Bejutsu. In his telling, this type of grift is very easy to perpetrate in the untamed borderlands of NFT creation.

Meantime, the markets were tanking. Owen Fernau delved into how MakerDAO and Aave were coping with liquidations. Owen also reported how MakerDAO broke new ground on the governance front by expelling its content production team in a narrow vote of members. The story is a preview of how DAOs may deal with thorny issues as they mature.

If all that wasn’t enough drama, The Defiant Chiefess Camila Russo sat down with Kain Warwick, a DeFi OG and founder of Synthetix to talk about synthetic assets.

Enjoy!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Step Finance is the portfolio management dashboard for Solana users to visualise, analyse, execute and aggregate transactions across all Solana contracts in one place. Get started now!

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Cryptex Finance (CTX) the fully decentralized creators of TCAP, The World’s First Total Crypto Market Cap Token.

Concordium is made for the future economy. It’s the first fully compliant blockchain with Layer 1 ID, predictable fees valued in FIAT and private and public transactions. Discover more.

DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

📬 Inbox Dump #40

Our Inbox Dump newsletter, which is exclusive to paid subscribers, is where we include the updates and announcements that flood our DMs each week and didn’t make it to The Defiant’s content platforms. Sometimes announcements here didn’t meet the bar to become a news story, sometimes they may have slipped through the cracks, or they came late and we haven’t had a chance to cover. We also include a compilation of DeFi and crypto funding rounds in the past week so you have these in one handy place.

Podcast

🎙 Synthetix's Kain Warwick: What it Takes to Scale an Ethereum DeFi Protocol

This week, we sit with Kain Warwick, DeFi OG and founder of Synthetix. In some ways, last year wasn’t a great one for the synthetic assets protocol. As many DeFi projects boomed, SNX’s price and TVL dropped. Kain says he was too optimistic about how soon Synthetix would be able to scale with optimistic roll-ups. If he were to do things again, he would probably use Polygon first and move to Optimism once the solution was ready.

But last year was also a time to build on a strong foundation. He’s looking forward to the months to come, when all of that effort hopefully comes to light, with the protocol fully live on Optimism, with perpetual swaps expected to be launched too. He’s a firm believer that Ethereum and its Layer 2 solutions will capture the most value being built in DeFi and web3.

Defiant Interview

EXCLUSIVE: Head to Head with Andre Cronje || a Defiant SPECIAL

The Tube

📺 Real Vision vs. The Defiant: CAN DEFI WITHSTAND BIG LIQUIDATIONS? w/ RAOUL PAL

📺 First Look: Cardano's first DEX is here. Does it work? | SundaeSwap First Look

📺 Tuesday Tutorials: NFT Scams - How To Avoid Them

📺 Quick Take: Market Dump, NFT pump + Metaverse giants roll in

📺 The Defiant Weekly: DeFi 2.0 is dead, its spirit lives on in Fantom ve(3,3)

Defiant Saga

🥷🏻 ‘Believe It!’ How a Manga-Loving Geek Exposed the Scam Targeting Naruto NFTs

In this exclusive feature for The Defiant, Dan Kahan reveals how he uncovered a copyright scam targeting one of the most beloved mangas of the last quarter century.

“It’s almost like they joined a cult. The more I question, the more they think I’m hating. I just want to protect them.”

By the time I received this message on Dec. 30, I’d already spent a month investigating Bejutsu — a massively hyped NFT project claiming to hold the official license for intellectual property from Naruto, one of the most popular manga series ever published. Fueled by a lifelong passion for anime and manga and a gut feeling, I was convinced Bejutsu was a scam. But I couldn’t prove it beyond a shadow of a doubt.

Until now. The message came from a friend of one of the artists working for Bejutsu. Suspicious about the project’s legitimacy, he sent me a copy of Bejutsu’s purported licensing agreement. As soon as I saw the contract—an elusive piece of evidence that, by this point, I’d been hunting down for days—I knew I’d found Bejutsu’s smoking gun.

Nearly everyone I spoke to who was involved with the project asked me to wait before going public. That included artists, staff, and Clay Taylor, Bejutsu’s self-assured co-founder. They gave me the same cryptic response: Bejutsu’s proof will come on Jan. 7. Just wait until Jan. 7.

But in the hype-fueled NFT space, even unknown projects can sell out within minutes of an unannounced stealth launch. Naruto sits at the intersection of pop culture nostalgia and rabid anime fandom. Officially licensed Naruto NFTs possessed the potential to skyrocket. And Bejutsu was designed to turn its characters and imagery into NFTs that would sell for millions. At least, that was the plan. And Clay’s instincts were spot on — Bejutsu attracted 40,000 followers to its Twitter account before it even launched. And 10,000 users flooded its Discord server within a minute of opening. I wanted to stop the scam before it reached wider audiences.

Research

🖼 Exclusive DappRadar Report: Why are NFTs Sidestepping the Crypto Crash?

It’s one of the most intriguing questions in the market during this turbulent period. Our friends at DappRadar unpack the forces that are charting a separate course for NFTs.

In recent weeks, a combination of macroeconomic events has shaken the markets, reminding everyone about the industry’s latent risks and ubiquitous volatility. The problems in Kazakhstan around Bitcoin mining made waves. With a new COVID outbreak, the unease about a likely rise in the interest rates by the Federal Reserve and the latest political issues in Ukraine created a hostile environment dragging capital markets down.

The correlation between crypto and traditional markets made the effect widely felt in blockchain assets, with Bitcoin and Ethereum’s ETH losing half their value since all-time highs in November. The same goes for BNB, ADA, SOL, AVAX, SAND, MANA, GALA, and several other cryptocurrencies performing well historically. The total crypto market cap shrunk to $1.6T from $2.9T in that period.

Without question, the crypto market is currently experiencing a challenging period. The sentiment in the market signals fear. However, the metrics related to the performance of specific blockchain verticals like NFTs might suggest otherwise.

Understanding NFT Macroeconomics

While a group of events has hampered the crypto market, a series of factors have positively impacted the outlook of NFTs at a macroeconomic level.

Firstly, the inclusion of celebrities and big brands in the NFT world appears to be growing by the day. Stars with a massive social reach like Neymar Jr. (+200M followers on Twitter and Instagram) and Kevin Hart (+192M followers on Twitter and Instagram) have publicly announced their recent entries into the Bored Ape Yacht Club (BAYC), one of the premiere NFT projects.

Friday

News

Links

Fireblocks raises $550 million in Series E funding, now valued at $8 billion: the Block

Genesis is exploring institutional hedging and liquidity products for NFTs: The Block

White House reportedly preparing executive order on crypto: CoinTelegraph

Thursday

News

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up Terra’s DeFi protocol for savers is burning through its savings account. Anchor is the DeFi protocol meant to offer a safe, predictable return for DeFi’s conservative investors. It’s widely considered the benchmark yield for the whole industry and currently sits at 19.33%.

Frog Nation Hops into SushiSwap to ‘Clean Up’ Tumultuous Exchange The Frog Nation, a collective of crypto protocols meant to work together across multiple chains, has added SushiSwap to its ranks. What this means remains to be seen, but in a blog post from Frog Nation lead Daniele Sesta, it seemed that the team behind protocols such as Abracadabra and Wonderland will be taking over top level management at SushiSwap.

Google Searches for ‘NFT’ Outrun ‘Crypto’ As Asia Dominates Action In a sign that nonfungible tokens are picking up serious mojo despite market angst, Google searches for the term “NFT”are now firmly ahead of ‘crypto’ and “Ethereum”, according to Google Trends.

Links

Bitcoin moves in lockstep with US stocks as big traders enter market: The Financial Times

Facebook’s Cryptocurrency Venture to Wind Down, Sell Assets: the Wall Street Journal

Wednesday

News

MakerDAO’s Expulsion of Content Team Stirs Debate About Tougher Governance MakerDAO is DeFi’s oldest and arguably most effective protocol, punching well above its weight of $1.6B in market cap. Yet it’s still going through growing pains.

Messaging App May Bolster NFT Market by Connecting Ethereum Users Block explorer Etherscan has just launched Blockscan Chat, a messaging app that allows Ethereum users to chat with each other simply by connecting their wallets. Metamask and Wallet Connect are currently supported.

Investors Pile Into Opyn’s ‘Crab Strategy’ to Profit from a Sideways Market On Monday, the DeFi derivatives platform Opyn offered a way to bet on a sideways market, and investors took the wager.

Links

Eth2 is no more after Ethereum Foundation ditches name in rebrand: CoinTelegraph

Decentralized Data Sharing Network ‘Project Galaxy’ Raises $10M: CoinDesk

Crypto exchange FTX US valued at $8 billion as first fundraise draws SoftBank, Temasek: Reuters

$LOOKS Day 15 trading rewards have been distributed: LooksRare

Don't miss this great news, @arbitrum community! @MEXC_Global

now supports deposits and withdrawals on @arbitrum mainnet: Arbitrum

Tuesday

News

DeFi Investors Brace for Liquidations as MakerDAO and Aave Call in Collateral Now comes the liquidation phase. As crypto investors reckon with a 45% plunge in the value of the crypto market since November’s all-time high, the focus is now turning to the impact on leverage many investors use to amplify their earnings.

Cancel Your Old OpenSea Listings Or Risk Your Precious NFTs Being Spirited Away A ‘bug’ discovered a few weeks ago in OpenSea, the leading NFT marketplace, enabled more than $1M worth of non-fungible tokens to be bought at huge discounts on Jan. 24.

Startup Aims to Give Crypto Investment Clubs a Web3 Makeover People are teaming up all over crypto, but, according to the founders of Syndicate Protocol, investors lack web3 native ways to do so. “I’ve been an investor for eight years in the crypto and fintech space, and I’ve come to realize that literally builds the world,” Ian Lee, co-founder of Syndicate, told The Defiant in a phone call.

Polymarket Shuts Out U.S. Traders to Comply with CFTC Settlement Polymarket has shut U.S. traders out of its bets, but the prediction market remains live everywhere else. That’s the company’s solution following its recent settlement with the Commodity Futures Trading Commission (CFTC).

Links

Fantom Becomes Third-Largest DeFi Protocol by Value Locked: CoinDesk

The great renaming: what happened to Eth2?: Ethereum Foundation

JPMorgan Chase closes Uniswap founder's bank accounts: The Block

5 reasons to be excited for the bear market [LITE]: Bankless

Maker Protocol Changes DIRECT-AAVEV2-DAI debt ceiling: 133.815M → 183.815M DAI: MakerDAO

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Sanuel Haig and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.