🦄 Recap: DeFi Week of Aug. 7

Hello Defiers! Happy weekend!

If you have a pain in your neck don’t feel bad. We are all suffering from whiplash after one of the most tumultuous weeks in crypto in some time.

First came the bombshell that the U.S. Department of the Treasury was sanctioned Tornado Cash, a staple of the industry for years, for laundering $7B worth of digital assets, including $455M stolen by North Korea’s notorious Lazarus Group and the loot from the Harmony hack in June.

Our reporters fanned out to cover the story: Jason Levin covered the breaking news on Monday, then joined forces with Claire Gu to report on how the DeFi community was reacting to the Tornado whirlwind with a mix of online civil disobedience and a whole lot of angst. Owen Fernau covered dYdX’s move to ban accounts as a result of the sanctions, and also reported on Centre’s similar move with USDC addresses.

All that drama was offset by the news that Ethereum has cleared the final stage before The Merge with the completion of the Goerli chain’s intergration into the network’s mainnet. Owen Fernau reported on the significance of this dress rehearsal for The Merge, which is set for Sept. 15. The Defiant has been covering all the angles on Ethereum’s upgrade, including the push by die-hard PoW folk to hard fork and maintain pre-Merge Ethereum. Claire Gu reported on the exchanges set to trade a token ostensibly called ETHPoW.

Meanwhile, Aleksandar Gilbert kept his eye on two big summer stories: he took us inside Solana’s crisis management through an exploit earlier this month, and in a superbly reported deep dive he unpacked the crucible at Harmony, the Layer 1 blockchain struggling to resolve a $100M hack in June. The key: Aleks talked with a lot of validators.

In another deeply reported piece, Sam Haig delved into the tumult at MakerDAO, the DeFi OG that was already going through a bout of soul searching before the Tornado sanction forced it to weigh new vulnerabilities. Sam learned the protocol is considering an “emergency shutdown” if the Feds start tagging addresses holding DAI. Yikes.

Whew… Rounding off the week, the indomitable Robin Schmidt and his crew interviewed Jessie Dickson-Lopez about the metaverse in Hollywood, and produced a cool tutorial on sudoswap.

Enjoy!

⍺ DeFi Alpha Newsletter

Check out DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi. DeFi Alpha is exclusive to paid subscribers.

This week:

⍺ DeFi Alpha: Trade NFTs Royalty-Free On Sudoswap

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

The Tube

📺 The Defiant Weekly: Major Ethereum Rebellion Will Fail

📺 The Metaverse goes Hollywood w/ Jessie Dickson-Lopez (MV3)

📺 Tuesday Tutorial: No Service or Creator Fees on sudoswap

📺 Quick Take: Moonbirds Rugged?

📺 The Defiant Weekly: Coinbase Blues - SEC, COIN, Layoffs, NFT marketplace, & Degen Trilogy

Defiant Investigation

😤 Harmony Validators Decry Litany of Problems

Flawed Response to $100M Hack Exposes Crisis of Confidence in Layer 1

Aleksandar Gilbert interviewed validators to get the inside scoop on the travails at Harmony…

Last week, after near-universal condemnation, leaders of the Harmony blockchain scrapped their proposal to reimburse community members who lost money in a $100M hack in June.

The Layer 1 network, which sports a $346M market cap and competes with other high-speed blockchains such as Solana, has been struggling to stabilize its situation ever since.

Now co-founder Stepehen Tse is offering a pair of new proposals. One would use the Harmony Foundation’s treasury to partially reimburse tokenholders over a period of months, and replenish its coffers by minting new ONE coins over several years. The other proposal would increase fees from transactions and fund reimbursement and “ecosystem growth.”

“The last few days we held many calls to discuss options and tradeoffs, engaging over 20 validators, 20 community members, and 15 bridge and DeFi partners,” Tse wrote in a governance forum debating the original proposal. “We sincerely value engaging and gathering support from our community, partners, validators, and their delegators.”

Behind the Headlines

🚨 MakerDAO May Execute ‘Emergency Shutdown’ If Sanctions Hit DAI

DeFi Lender’s Stablecoin Under Pressure From USDC Contagion

In which Samuel Haig goes deep in the DeFi stalwart’s reckoning with the Tornado storm…

Now it’s MakerDAO’s turn. The DeFi blue chip is the latest protocol to be struck by shock waves from the U.S. Treasury Department’s decision Monday to sanction Tornado Cash, a so-called “mixer” that lets crypto users anonymize their transactions.

Maker is making contingency plans to execute an emergency shutdown should core contracts underpinning DAI, its stablecoin, be sanctioned by Washington, according to posts from MakerDAO founder, Rune Christensen, in the project’s Discord channels. “If we get nuked by the U.S. government, we simply die,” Christensen warned.

The move to blacklist Tornado Cash, which the Feds say laundered $7B worth of virtual currency, has already rocked USDC, the No. 2 stablecoin in terms of market value.

On Tuesday, Centre, the consortium behind USDC, blacklisted 38 wallet addresses and froze the USDC tokens they held. Centre, which was set up by Circle and Coinbase, has now banned 81 wallet addresses in total since USDC was launched in September 2018.

Weekend Read

☀️ Inside Solana’s ‘Textbook’ Response to Exploit

Crisis Management Becomes a Key Exercise as Crypto Exploits Mount

In which Aleksandar Gilbert explores the increasingly urgent practice of crisis management in DeFi.

On the night of Aug. 2, Austin Federa was at dinner with friends when notifications started pouring in through the Slack messaging app. “I was like ‘Oh, no – I have to go,’” Federa, the Solana Foundation’s communications chief recalled in a recent interview.

News of the second major crypto hack in two days had just broken, and Federa was on the front lines. Exactly 24 hours after the $200M Nomad protocol was stripped bare in a “crowd-looting”, thousands of people – the vast majority of them Solana users – had their wallets drained in a hack that sparked panic across the entire crypto industry. Solana, a he No. 9 cryptocurrency with a market cap of $15.6B, is leading a new generation of high-speed blockchains challenging Ethereum.

As word spread and users took measures to protect their assets, the pilfering ground to a halt. Experts believe there were four attackers, who exploited a vulnerability in Slope Finance’s crypto wallets and made off with an estimated $4M, pocket change by industry standards.

Nevertheless, fear that Solana or its network of partners had been compromised — theories that were quickly debunked — spurred Federa and his counterparts into an episode of crisis management.

Market Analysis

⛽️ Ethereum Gas Fees Fall to Lowest Level in Two Years

Sharp Decline May Cast Doubt on Summer Rally in DeFi

Samuel Haig crunches the numbers and goes into the weeds to unearth some telling datapoints…

With network activity plunging, Ethereum’s transaction fees are now at their lowest level since the heady days of ‘DeFi Summer’ in mid-2020, according to data from Ycharts.

Ethereum’s average fees are at their lowest level in two years, with transactions executing for less than 13 gwei a pop. The sharp decline in on-chain activity may also cast doubt on the bullish signal that’s been driving a summer rally in Ethereum and other DeFi names: The Merge.

Investors may have to reckon with the likelihood that more Ether may not be destroyed than new coins are issued after the network shifts to Proof-of-Stake consensus in September.

In August 2021, Ethereum’s EIP-1559 upgrade went live, introducing the burning of base transactions fees. From then on, a portion of each Ethereum transaction fee is permanently destroyed.

NFT Roundup

🐧 Pudgy Penguins Waddle Higher After Unveiling Physical Toys

Old Friends Return to the Forefront This Week

By: yyctrader

The penguins are back. Once on life-support before a community-led revolt led to the ouster of the founding team, the ever-popular NFT collection has seen its floor price surge 55% to 2.75 ETH ($5,200) in the past week.

On Aug. 10, the project revealed that some NFTs from the collection of 8,888 will be showcased in a physical toy collection, called Pudgy Toys.

Most of the chosen penguins belong to community contributors, leading one penguin holder to call them ‘pseudo honoraries’. Honoraries are NFTs usually awarded to community members for exceptional contributions, as in the case of BAYC Honorary Members. The collection generated over 575 ETH ($1.1M) in secondary sales on OpenSea in the past seven days, an increase of 329% over the previous week.

Friday

News

MakerDAO’s Founder Ponders Move Away From U.S. Dollar Rune Christensen, the outspoken co-founder of DeFi stalwart MakerDAO, triggered a bout of angst in crypto after suggesting the protocol’s stablecoin, DAI, might drop its peg to the U.S. dollar.

Tornado-Linked Arrest in Europe Riles Crypto Mavens Dutch police have arrested an alleged developer of Tornado Cash, the cryptocurrency mixer popular with hackers and privacy-minded users, FIOD, the Netherlands’ financial crimes investigative unit, announced today.

dYdX Bans Accounts In Wake Of Tornado Sanctions Contagion from the U.S. Department of the Treasury’s move to sanction privacy protocol, Tornado Cash, continues to spread.

DeFi Explainer

What Are NFTs? Figuring out non-fungible tokens (NFTs) has become a joke. People are agog at how a .jpeg monkey image can cost the same as a mansion? By the end of this NFT tour, you will wonder how it was possible to ever be confused about NFTs.

Elsewhere

BlackRock launches private trust offering direct bitcoin exposure: The Block

Sam Bankman-Fried: 'Disappointing' Others Haven’t Helped Us Give Bailouts: Decrypt

Binance froze/recovered $450k of the Curve stolen funds, representing 83%+ of the hack: Binance

Thursday

News

Ethereum Completes Goerli Testnet Merge The final installment of the testnet Merge trilogy is complete. On Aug. 10 at 945pm ET, Ethereum’s Goerli testnet transitioned to Proof-of-Stake consensus.

Degens Tweak Feds to Protest Tornado Cash Ban There’s been no letup in the whirlwind unleashed by the U.S. Treasury’s sanction of Tornado Cash. One of the more eye-opening responses involved degens testing the government’s security monitors by continuing to pump transactions through the sanctioned protocol.

Markets

Goerli and Cooling Inflation Drive Ether to Two-Month High Crypto markets have reversed earlier losses and are rallying after softer than expected Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics.

Exchanges Welcome Ethereum PoW Die-Hards The DeFi community is pumped. Ethereum just completed its dress rehearsal before The Merge — the Goerli testnet passed on Wednesday — and ETH has soared 72% in the last 30 days.

DeFi Tutorials

What Is Polygon? Running a decentralized blockchain network, where each transaction has to be verified across thousands of nodes, demands massive computing resources.

Elsewhere

Goerli Merge LIVESTREAM | Bankless, ETH Stakers, and Friends!: Bankless

Coinbase Exchange Faces SEC Probe Over Crypto Yield, Staking Products: CoinDesk

#NEARCON 2022 is back and better than ever, coming to Lisbon, this Sep 11-14th: Near Protocol

Wednesday

News

Centre Bans USDC Addresses After Tornado Sanctions Stablecoins are in the spotlight yet again. Centre, the consortium behind USDC, the world’s second-largest stablecoin, banned 38 addresses on Aug. 8. This means that the USDC tokens in those addresses are frozen and cannot be moved. 81 addresses have been banned in total.

Reddit Taps Layer 2 and FTX For Community Token Arbitrum Nova, a Layer 2 blockchain that aims to improve the gaming and social media experience on Ethereum, debuted Tuesday alongside Reddit’s Community Points program.

Curve Finance Scrambles to Repel Exploit Curve Finance, DeFi’s second-largest decentralized exchange with $6B in total value locked, has been hit by a frontend exploit. As of 530pm ET on Tuesday, the issue has been resolved, according to the Curve team.

DeFi Explainer

CeFi Versus DeFi: Which One Is Better? Blockchain technology is well on its way to expanding financial access. Pioneered by Ethereum, smart contracts are a breakthrough innovation in computer science that treats finance in a permissionless and non-custodial manner.

Elsewhere

Coinbase Betting Big On Staking Ahead of Ethereum Merge: Decrypt

At ETHSeoul, Ethereum Developers Turn Attention to Privacy and Users: CoinDesk

Tuesday

News

Crypto Mixer Tornado Cash Added To US Sanctions List Crypto mixing service Tornado Cash is now banned in America. On August 8, the Office of Foreign Asset Control (OFAC), an enforcement agency of the U.S. Treasury Department, added Tornado Cash to its Specially Designated Nationals (SDN) list.

Buterin Backs Proposal For Stealth NFT Transfers Ethereum co-founder Vitalik Buterin likes the idea of ‘stealth addresses’ for NFTs. Using a new ERC721 extension proposed by Ethereum researcher Anton Wahrstätter, users would be able to transfer NFTs with only the new owners being able to see who owns the NFTs.

BlackRock Partners With Coinbase To Offer Crypto To Institutional Investors BlackRock, the largest asset manager in the world with more than $8T in assets under management, has partnered up with Coinbase to offer cryptocurrency services to its clients.

Markets

Wall Street Traders Love The Merge… For Now The Merge has emerged as the storyline of the summer. And DeFi bulls couldn’t be happier as anticipation for Ethereum’s historic upgrade crowds out the doomstruck headlines of the bear market.

Ether Heads For Highest Weekly Close In Two Months As Merge Nears Crypto markets are rallying ahead of the weekend as investors digest a better-than-expected jobs report from the world’s largest economy.

Layer 2 News

Optimism and Arbitrum Storm DeFi Rankings As TVL Rises Layer 2 networks are boosting Ethereum’s DeFi market share amid downturn. Arbitrum and Optimism now rank as the fourth and sixth-largest smart contract chains respectively, according to data from L2beat.

Arbitrum To Launch Nitro Upgrade on August 31 Arbitrum, a Layer 2 scaling solution for Ethereum, has said that its network will undergo a significant upgrade, called Nitro, on Aug. 31 — its one-year anniversary.

DeFi Explainers

What is the Difference Between Market Cap and Fully Diluted Market Cap? Companies and blockchain projects represent value in different ways, typically via stocks and digital assets. In both cases, their values differ based on their value being fully accounted for, or just partially. This is the difference between market capitalization (cap for short) and fully diluted market cap.

Elsewhere

U.S. Treasury sanction of privacy tools places sweeping restrictions on all Americans: Coin Center

Michael Lewis teases new Wall Street book: ‘You’ll learn all about crypto’: Financial News

Circle freezes USDC funds in Tornado Cash's US Treasury-sanctioned wallets: The Block

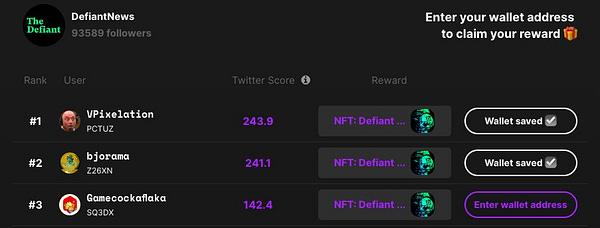

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.