🦄 Recap: DeFi Week of April 3

Hello Defiers! Happy Weekend!

Who knew stablecoins could pack so much drama? This week we watched agog as the Waves, aka “Russia’s Ethereum”, suffered a reversal of fortune as accustations of Ponzi schemes and market skullduggery engulfed the platform. Yyctrader covered how USDN, an algo stablecoin collateralized by Waves, depegged. Our story highlighted how the episode raised questions about Terra’s stablecoin model. Gulp.

Owen Fernau was on firmer ground as he explored Bitcoin 2022. As a Defier in Bitcoin land, Owen was struck by how maximalist turf was more open to DeFi than he expected. His Miami Journal ponders whether coexistence between the two giants of crypto is possible.

As for Ethereum, Sam Haig reported on a number of developments linked to The Merge. He covered the astounding ETH burn triggered by a stealth NFT drop. Sam also chronicled the mighty surge in Layer 2 fortunes in anticipation of a new Proof of Stake era. Plus there was news on a new standard being introduced to clean up the mess (Yearn Finance’s term) in yield-bearing tokens.

Meantime, Camila Russo did some exploring of her own through Cosmos, the ambitious “internet of sovereign blockchains” in our weekly podcast. Co-founder Ethan Buchman shared how the network is connecting the likes of Terra and Osmosis, and what comes next.

And check out Robin Schmidt & Crew’s revamped NFT segment: The Open Metaverse Show. This week they delve into the marvels of digital rendering. The Real Vision episode this week takes a look at global crypto hubs — are they doable, and desirable?

Enjoy!

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

SynFutures is a DeFi derivatives exchange that enables permissionless futures trading, allowing anyone to list and trade any asset with a price feed. Learn more!

Nexo is a wallet where you can easily exchange between 300+ unique market pairs, receive up to 0.5% cashback or get instant liquidity against your crypto assets with flexible credit lines. Get started!

Sperax has created $USDs, the stablecoin that generates passive income for holders. Thanks to the Auto-Yield feature, it pays to hold $USDs. Try it yourself here!

APWine is a pioneering yield tokenisation protocol, allowing users to get their future yield in advance. Hedge your risk on APY volatility or speculate on yield with their native AMM.

⍺ DeFi Alpha Newsletter

Check out and subscribe to DeFi Alpha, a weekly newsletter by The Defiant and DeFi Dad, packed with tutorials and tips on how to earn yield in DeFi.

This week:

⍺ DeFi Alpha: Triple-Digit Yields With Starlay & Arrakis

Podcast

🎙 Cosmos Co-Founder Ethan Buchman on Building an Internet of Sovereign Blockchains

Ethan Buchman is the co-founder of Cosmos, an ecosystem of interoperable blockchains which includes Terra, Osmosis and Crypto.org, and has the most value locked after Ethereum. It's a complex network with many moving parts, and it has exploded with activity in the past year. Cosmos was born out of Ethan’s research into a switch from proof of work to proof of stake, and his idea to enable each project and community to be able to build and secure their own blockchain. It was Ethan’s goal to bring about a community computer revolution, stemming from the personal computer revolution.

Using the Cosmos sovereignty model gives all blockchain users an incredible amount of freedom to build their platform as they see fit. But with that comes a trade-off, as they are more susceptible to attack than a larger chain such as Ethereum. Ethan says while each community should be able to decide on its security model instead of having a single system for all, the goal for the Cosmos Hub will be to provide this single source of security if needed, and it also provides tooling for chains to launch. We also talk about the role of the Atom token and where Ethan sees Cosmos in the long term.

The Tube

📺 The Open Metaverse Show: In the future everything will be rendered

📺 Real Vision vs. The Defiant: NEW CRYPTO HUBS, THE CHIEF MEME OFFICER, AND LEDGER JUMPS INTO THE SANDBOX

📺 First Look: Move2Earn - is Stepn the future of crypto powered fitness?

📺 Tuesday Tutorial: 0xSplits - power is nothing without control

📺 Quick Take: The EU wants to know EVERYTHING about you and your crypto (+ Pengu news)

DeFi Journal

🌴Bitcoin 2022 Reveals the Inevitable Draw of DeFi and NFTs

A Defier in Bitcoin Land Finds Signs of Coexistence... Maybe

In which Owen Fernau explores the boudaries of Bitcoin dominance.

Wow. Bitcoin is big now. Maybe an obvious statement for anyone who attended Bitcoin 2021, in Miami, Florida, but for a first timer whose main experience with crypto gatherings has been ten-person meetups, the sheer size of Bitcoin 2022 is striking.

Bitcoin 2022 is drawing 35,000 attendees, according to the conference’s website. The space’s center of gravity has grown so much that people not known for their work in the field have jumped in. And celebrities are headlining — Jordan Peterson, the provocative public intellectual is here, and so is tennis superstar Serena Williams.

In some ways, the people who have joined in recent years appear to be attracted to the politics of Bitcoin and decentralized money. After all, only a handful of people in the 1990s were working on the cryptographic systems required to create self-sovereign money. Many people still don’t understand the fundamentals of hash functions that underpin the Bitcoin blockchain. Then again, maybe crypto’s inner workings can be safely ignored now. This has become a cultural phenomenon as much as a technological one.

Tennis star Serena Williams (center) and NFL quarterback Aaron Rodgers (right) talk BTC.

Deep Dive

👀Waves’ USDN Stablecoin Loses Peg as Accusations of Ponzi Schemes Fly

Waves' Market Turbulence Sparks Worries About Stablecoins

In which yyctrader reports on strange doings in ‘Russia’s Ethereum’…

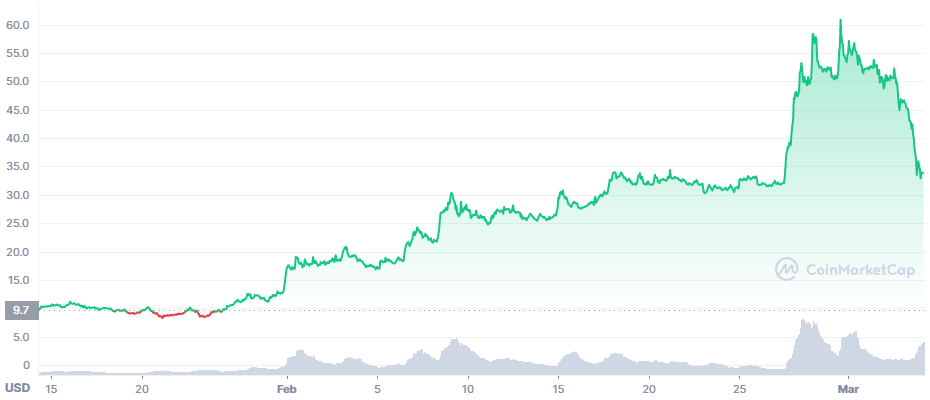

Waves, a Layer 1 blockchain known as ‘Russia’s Ethereum’, has suffered a reversal of fortune as accusations Ponzi schemes and market manipulation fly in a wild week of action. Sam Bankman-Fried, the CEO of crypto exchange FTX, even got swept into the drama as one of Russia’s major crypto plays went sideways.

The project’s native token WAVES began to surge a few days after Russia invaded Ukraine in February. This led to speculation that Russians were using the platform to circumvent Western sanctions after several of the nation’s banks were cut off from the Swift messaging system.

WAVES soared 600% to an all-time high of $62 on March 31.

Opinion

💡Why DeFi Should Make Markets Like Wall Street Banks

The DeFi Ecosystem Needs to Solve the Liquidity Challenge

Guest writer Tarun Chitra makes a provocative case for emulating one of TradFi’s most basic features.

The core promise of DeFi is a global financial system, open to all. It eliminates the need for banks and central control, saving consumers and small businesses tens of billions of dollars in fees collected by intermediaries from everyday financial transactions like buying a cup of coffee or sending money across borders.

Like every paradigm-shifting innovation, the DeFi ecosystem has experienced growing pains, but its long-term value is already coming into focus. With new protocols introduced each month that offer higher returns with fewer barriers to entry than traditional finance, DeFi is attracting new users at a rapid clip.

However, a core challenge has already emerged for DeFi developers: attracting consistent, long-term liquidity. Exchanges in DeFi (decentralized exchanges or dexes) require a flow of assets to enable the efficient exchange of tokens — many of which raise seed funds through token issuance to support DeFi platform development. To date, the easiest way for dexes to attract liquidity has been to incentivize participation through high yields that generate rewards for investors in return for the capital that powers the protocol.

DeFi Primers

🌊 How to Connect OpenSea to MetaMask

A Step-by-Step Guide to Using an Ethereum Wallet and NFT Marketplace

By Arya Ghobadi

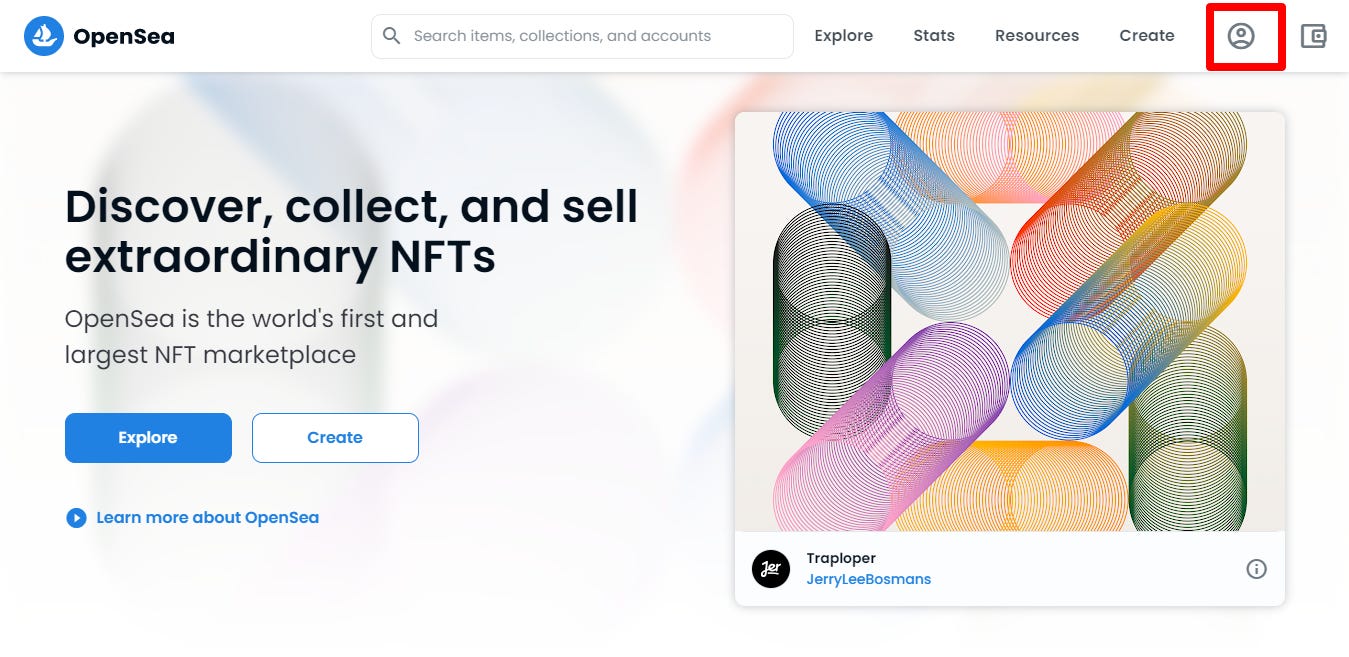

OpenSea NFT is the largest non-fungible token (NFT) marketplace in the world that supports Ethereum and Polygon blockchains. Often called the eBay of NFTs, OpenSea allows you to create and sell your own NFTs on their decentralized platform as well as discover new ones to add to your collection.

Founded in 2017, OpenSea typically handles between $30M to $100M a day in volume. You may be confused about what exactly an NFT is in the first place. NFTs are digitally unique files that memorialize art, video, objects, documents, and other things. Perhaps the most popular form of NFTs are avatars such as CryptoPunks, Bored Apes and SpaceDoodles.

In this tutorial, we walk through how to connect MetaMask to OpenSea. Before we start you need to know that in this tutorial we assume that you have read What is MetaMask and How to Use MetaMask guides and you have a MetaMask account!

Go to the OpenSea official website and click on the profile icon:

☑️Five Tips To Elevate Your DeFi Research

By river0x

DeFi has the potential to be a wild place at times. Seemingly bulletproof protocols can rug in an instant or suffer exploits that token prices will never recover from.

In line with The Defiant’s security awareness mission, I will outline a few pointers on how to identify a potential disaster before it unfolds. I spend my days identifying how projects conduct development and measuring how they end up deploying their code. After assessing over 200 protocols, we’ve picked up a few insights to identify poor development practices in DeFi.

And Axie Infinity recently suffered exploits resulting in significant losses of funds. Katana, the only decentralised exchange on Axie’s Ronin chain that was developed by the same team (with the same development practices), scored 5% in our appraisal. Inverse scored much better but still lagged in some critical areas. Both were unaudited, had no bug bounties and provided extremely limited proof of testing or none at all. Katana was especially opaque when it came to explaining how it worked. Despite identifying these issues, these exploits still happened and users still lost their life savings.

CHECKLIST With this checklist, I want to arm you – the humble ape/farmer/degen – with a few tips and tricks that are personalised to your risk profile as you navigate the DeFi minefield.

🧐 How to Transfer Tokens to MetaMask from Trust Wallet

A Step-by-Step Guide for Ethereum Wallet Users

By Arya Ghobadi

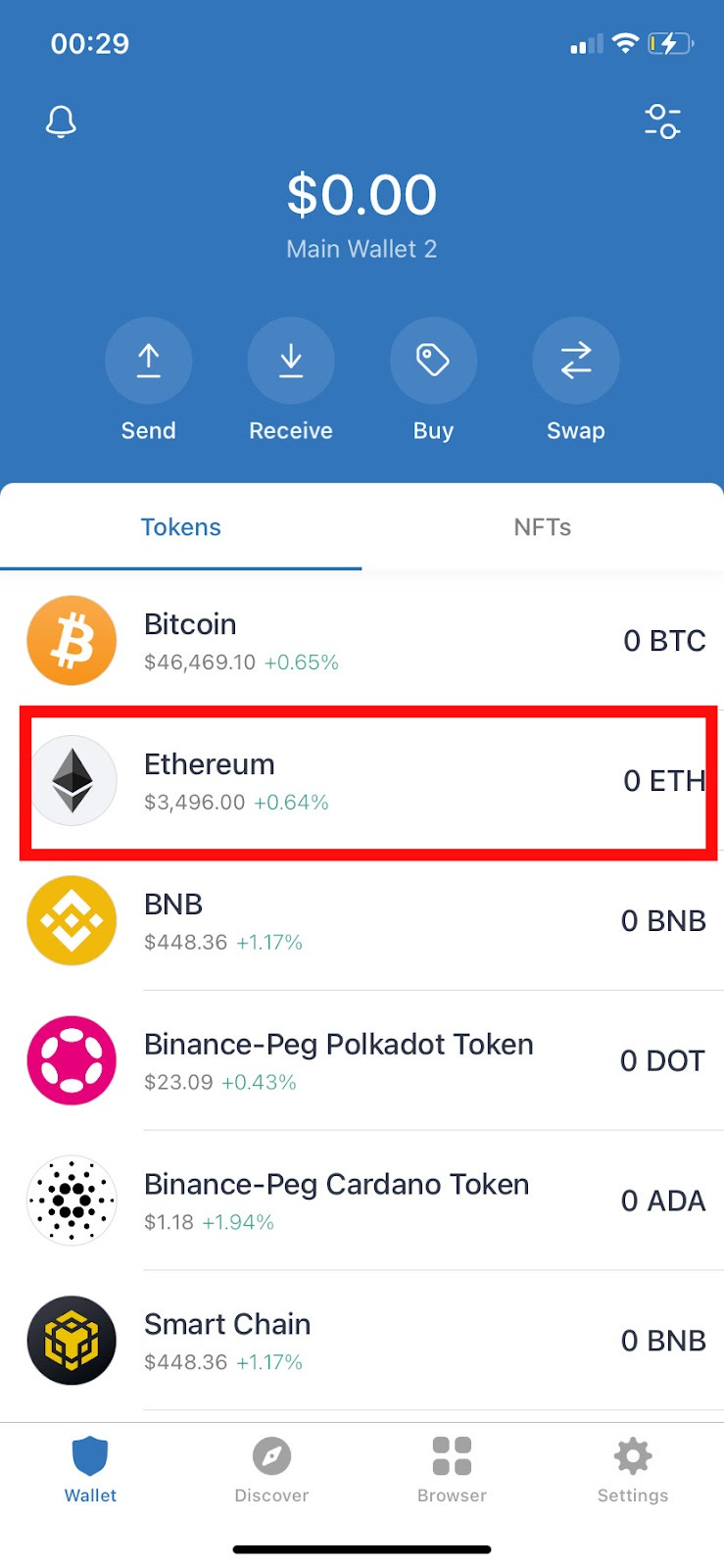

It’s a common misunderstanding: Many beginners believe that cryptocurrencies are stored in MetaMask, Trust Wallet, or other crypto wallets. This is incorrect — a crypto wallet only stores your public key and your private key, then uses your private key to sign and approve transactions.

Your wallet is on blockchain and it’s secured by your seed phrase, which means that if you place your Trust Wallet seed phrase into your MetaMask you will be able to get your tokens! In this tutorial, you will learn how to transfer cryptocurrencies from Trustwallet to MetaMask and also how to import your Trust wallet to MetaMask.

Open your trust wallet and Select the token that you want to send. We use ETH in this tutorial:

Friday

News

Stealth NFT Drop Triggers Record ETH Burn Ethereum’s network activity is heating up to record levels. And it looks like the work of one NFT player.

New Standard Promises to Clean Up ‘Mess’ in Yield-Bearing Tokens The mess in yield-bearing tokens is about to be cleaned up. At least, that’s the plan.

Friday Wrap: ETH and Other DeFi Coins Shake Off Looming Rate Hikes Crypto markets started the week with bulls in control but turned lower on Wednesday after minutes of the Federal Reserve’s March meeting indicated that officials plan to move more aggressively to tackle inflation.

Elsewhere

Decentralization for Web3 Builders: Principles, Models, How: a16z

Origin's Early Access launch is going smoothly! In 12 hours we've seen: Axie Infinity

A premium report on Yearn from @MessariCrypto is now available for all: Yearn Finance

Thursday

News

Terra’s Do Kwon Takes Aim at DAI With Pool of Four Stablecoins “By my hand DAI will die.” So tweeted Do Kwon, the co-founder of the Terra ecosystem on March 22.

Ethereum Layer 2 Networks Hit ‘Critical Mass’ as The Merge Approaches All eyes are on The Merge. When Ethereum’s mainnet joins with the beacon chain Proof of Stake system everything will change — the Proof of Work era will draw to a close and a new period will dawn for the most important blockchain network in DeFi.

Yellen: No Evidence Russia is Bypassing Sanctions with Crypto U.S. Treasury Secretary Janet Yellen said Wednesday there is no evidence that Russian government officials or oligarchs are using digital assets to skirt sanctions imposed by Washington in response to the invasion of Ukraine.

Elsewhere

Sky Mavis Raises $150M Led By Binance, Funds to be Restored on the Ronin Bridge: The Lunacian

UST: New Paradigm or Ticking Time Bomb? | Terra Bear vs Bull: Bankless

Binance.US raises over $200 million at a $4.5 billion pre-money valuation: The Block

NEW BLOG POST! Read about our first official vote for Government Toucan holders: Shell Protocol

Wednesday

News

Pudgy Penguins Fly as Floor Price Triples It’s been quite the roller-coaster ride for Pudgy Penguins. This week the collection’s floor price has tripled, briefly surpassing its peak in September 2021 with a high of 3.73 ETH ($12,000) yesterday, according to data from niftyprice.io.

Near Protocol Sitting on $500M After Latest Funding Round Near Protocol has become the darling of heavyweight venture capitalists in the Layer 1 race.

Elsewhere

Nifty News: Solana NFT sales pass $1.6B, wash trading on LooksRare and more: CoinTelegraph

FTX.US backs 'Flash Boys' exchange IEX as firm maps out crypto strategy: The Block

Elon Musk: a new kind of media baron charges into Twitter: The Financial Times

Tuesday

News

MetaMask Update Allows Apple Pay Users to Buy Crypto Mainstream adoption of cryptocurrencies just got a boost. MetaMask has announced that the popular crypto wallet will now support direct digital asset purchases with debit and credit cards by way of Apple Pay.

U.K. Embraces Stablecoins as ‘Valid Form of Payment’ As an early mover on embracing fintech, the U.K. pioneered the use of sandbox regulatory development for startups. It was an approach that sought to find common ground between entrepreneurs and regulators.

DeFi Kingdoms Goes Live On Avalanche Subnet One of crypto’s most prominent GameFi projects, DeFi Kingdoms, now has its own subnet on the Avalanche blockchain.

Elsewhere

💜Community Love💜

Thanking all the amazing Defiers for the support and love this week (and always)!

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.