🌪 Questions Swirl Around Wonderland’s Fate After Frog Nation Crisis

Hello Defiers! Here’s what we’re covering today:

News

Questions Swirl Around Wonderland’s Fate After Frog Nation Crisis

Ape DAO Collectors Seek to Liquidate $26M Treasury of Bored Ape NFTs

Curve Finance Hit Record Volume as Investors Scrambled To Trade Out of MIM

How Friends With Benefits Uses Utopia to Manage Contributor Payroll

Markets

Video

Links

Venture froth catapults FTX to $32 billion valuation: The Block

Arcade Launches NFT Lending Platform as Blue Chips Hold Strong: CoinDesk

Facebook parent Meta joins crypto group promoting open patents: The Block

Bitcoin market cap dominance hits 2-month high as altcoins struggle: CoinTelegraph

The first cross-chain governance proposal has successfully updated the Aave Polygon Market!: Aave

Price Performance of Native @Arbitrum Tokens Last 24H: Arbitrum Daily

Trending in The Defiant

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down

‘Believe It!’ How a Manga-Loving Geek Exposed the Scam Targeting Naruto NFTs

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

$WEB3, by Arch is the best of Web3 in a token. This methodology-first tokenized-index provides broad-market exposure to Web3. Its constituents represent roughly 70% of the ecosystem. Learn more!

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Synfutures List and trade any futures contracts based on popular cryptocurrencies, altcoins, indices, NFTs and real-world assets — you name it!

DeFi Fiasco

🌪 Questions Swirl Around Wonderland’s Fate After Frog Nation Crisis

OUSTED It’s been a tumultuous week for the Frog Nation, the collective of DeFi projects led by Daniele Sesta. Sifu, the group’s CFO, was ousted after it came to light that he was a co-founder of QuadrigaCX, a Canadian crypto exchange that went under in 2019 with over $150M of client funds lost.

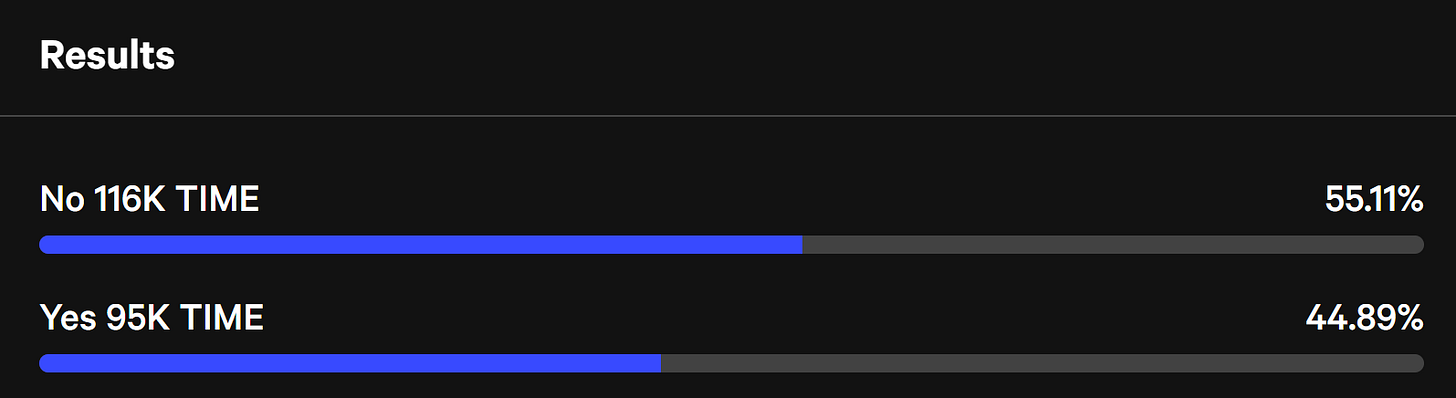

VOTE Subsequently, a vote was called to determine the future of the Wonderland project. Token holders were asked if they would want the project to continue under new management, with the alternative being to dissolve the treasury and distribute the proceeds pro-rata.

RESULTS Over 22,000 votes were cast, representing the largest turnout in the protocol’s history.

The results show that a slim majority wish to continue with the Wonderland experiment.

PROPOSAL Prior to the conclusion of the vote regarding dissolution, a new proposal outlining ‘Wonderland 2.0’ was posted on Medium. It includes an option for holders to redeem their portion of the DAO treasury if they so choose. Those who choose to remain would become members of a remodeled investment DAO looking to make VC-style investments in the crypto space.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFTs

🦍 Ape DAO Collectors Seek to Liquidate $26M Treasury of Bored Ape NFTs

PROPOSAL In a move that may be call on the top of the NFT market, the community behind Ape DAO, a group of collectors that holds 81 Bored Ape Yacht Club (BAYC) and 81 Mutant Ape tokens, is rallying behind a governance proposal to dissolve and liquidate its treasury.

GROWTH The move comes amid surging growth in the NFT markets, and one month after BAYC’s floor price surpassed CryptoPunks’ for the first time. With BAYC’s floor price sitting at 118.7 ETH ($325,000), Ape DAO may soon dump more than $26M worth of NFTs.

DISSOLUTION The proposal was submitted by a community member and is set to expire on Feb. 3. Its author wants the DAO’s treasury to be sold for Ether and then distributed and then distributed to tokenholders. Approximately 86.5% of voters support Ape DAO’s dissolution.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Trading

🎢 Curve Finance Hit Record Volume as Investors Scrambled To Trade Out of MIM

NEWS Curve Finance, an automated market maker and DeFi’s second-largest protocol, had a record-breaking day on Jan. 27 with $3.2B in volume, according to the project’s stats page.

VOLUME When daily volume hit $2.8B, Curve’s Twitter account teased that the mark was an all-time high for the protocol.

Volume was primarily driven by Curve’s Magic Internet Money (MIM) pool which accounted for over $1B in volume, according to protocol statistics.

SIFU The MIM pool dominated volume as users looked to trade out of the stablecoin in light of the news that Sifu, as he’s known in crypto, is actually Michael Patryn, the co-founder of QuadrigaCX, a controversial crypto exchange that lost its customers over $100M.

COLLATERAL Sifu was the chief financial officer of Frog Nation, a network of projects which include Abracadabra, which issues the MIM stablecoin to users against their crypto assets pledged as collateral. He was ousted following the revelations.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DAOs

👯♂️ How Friends With Benefits Uses Utopia to Manage Contributor Payroll

CASH Crypto is inventing a new way to organize people, work and money: decentralized autonomous organizations, or DAOs. DAOs have cash – a recent Consensys report used data from Open-Orgs to estimate that DAOs have more than $14B in their collective treasuries – but they don’t have great methods for paying people in crypto-native ways.

CLOSED BETA Enter Utopia, a payroll and expense management system built to integrate directly with multisig crypto wallets, making it easier for the large DAOs to pay their chief contributors. Utopia is coming out of its closed beta today, opening up its tools to DAOs who want to get beyond Google Sheets as a way to manage who needs to get paid what, and who needs to be repaid for covering which expenses.

METRICS “Paying people regardless of the kind of DAO you are is still a pain when you hit a degree of scale,” Kaito Cunningham, Utopia’s CEO and co-founder said. “Paying and retaining core contributors is going to be one of the most important metrics.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Markets

📈 JonesDAO Raises $52M in 24 Hours Amid Surging Demand for Crypto Derivatives

RISK Volatility in the capital markets has long driven financial engineers to fashion new forms of managing risk. The same is true in crypto.

ON-CHAIN With perpetual swaps and other derivative instruments long available to investors, the crypto market is now producing more sophisticated on-chain offerings such as Dopex, and Lyra, which deal in options and build on Ethereum Layer 2s,

DEMAND Now a new project called JonesDAO, which bills itself as offering one-click access to institutional grade options strategies, is jumping into the fray. It raised an astonishing $52M in 24 hours on Jan. 29, underscoring the demand for sophisticated instruments in a market that’s teetering on the edge of bear territory. (Options enable investors to preset prices for buying securities).

👉READ THE FULL STORY IN THE DEFIANT.IO👈

🎢 Market Action: Taking Stock of a Brutal Month in DeFi

PLUNGE It’s time to sort out the damage from the January plunge. And take note of a silver lining. Terra (Luna), the DeFi sector’s largest asset and second-ranked network, was among the hardest hit, with its price crumbling by half while TVL dropped more than a third over the past month. The combined capitalization of DeFi assets has failed to bounce alongside leading cryptocurrencies this past week.

LOCAL LOW DeFi assets are at $109B according to CoinGecko, up just 3.3% since a four-month low of $105.3B on Jan. 28. By contrast, Ether is up 24% from its Jan. 24 bottom, while Bitcoin is up nearly 15% since its local low on the same date.

The DeFi market cap is down 37% since its all-time high of $174.7B on Nov. 12. DeFi assets currently represent 6% of the global crypto capitalization.

Leading networks’ relative share of DeFi TVL. Source: The Defiant chart

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Quick Take: The line is not a line - the real problem with NFTs

Links

🔗 Venture froth catapults FTX to $32 billion valuation: The Block

The frothy venture capital market continues to buoy the empire of billionaire trader and entrepreneur Sam Bankman-Fried.

🔗 Arcade Launches NFT Lending Platform as Blue Chips Hold Strong: CoinDesk

Lending platform Arcade has introduced on Pawn Protocol in a bid to bring liquidity to the non-fungible token (NFT) market, the company announced Monday.

🔗 Facebook parent Meta joins crypto group promoting open patents: The Block

Meta, formerly known as Facebook, has signed up to a trade body that promotes the free use of innovative technology in the crypto sector, according to an announcement.

🔗 Bitcoin market cap dominance hits 2-month high as altcoins struggle: CoinTelegraph

Bitcoin (BTC) is retaking market share from altcoins after its market capitalization dominance hit its highest since November 2021 last week.

Trending in The Defiant

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up Terra’s DeFi protocol for savers is burning through its savings account.

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down

93% and Called a ‘Ponzi’ OlympusDAO held so much promise when it exploded on the DeFi scene in 2021.

‘Believe It!’ How a Manga-Loving Geek Exposed the Scam Targeting Naruto NFTs “It’s almost like they joined a cult. The more I question, the more they think I’m hating. I just want to protect them.”

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)