🐧 Pudgy Penguins Fly as Floor Price Triples

Hello Defiers! Here’s what we’re covering today:

News

Opinion

DeFi Primers

Podcast

🎙Listen to the exclusive interview with Cosmos’ Ethan Buchman in this week’s episode:

Video

Elsewhere

Nifty News: Solana NFT sales pass $1.6B, wash trading on LooksRare and more: CoinTelegraph

FTX.US backs 'Flash Boys' exchange IEX as firm maps out crypto strategy: The Block

Elon Musk: a new kind of media baron charges into Twitter: The Financial Times

Trending in The Defiant

Cosmos Co-Founder Ethan Buchman on Building an Internet of Sovereign Blockchains

Waves’ USDN Stablecoin Loses Peg as Accusations of Ponzi Schemes Fly

Do Kwon’s Treasury Play Allies LUNA and BTC Maxis in a Pumped Market

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

SynFutures is a DeFi derivatives exchange that enables permissionless futures trading, allowing anyone to list and trade any asset with a price feed. Learn more!

Nexo is a wallet where you can easily exchange between 300+ unique market pairs, receive up to 0.5% cashback or get instant liquidity against your crypto assets with flexible credit lines. Get started!

Sperax has created $USDs, the stablecoin that generates passive income for holders. Thanks to the Auto-Yield feature, it pays to hold $USDs. Try it yourself here!

APWine is a pioneering yield tokenisation protocol, allowing users to get their future yield in advance. Hedge your risk on APY volatility or speculate on yield with their native AMM.

NFTs

🐧 Pudgy Penguins Fly as Floor Price Triples

Topsy Turvy World of Pudgy Penguins is Back on the Upswing

By yyctrader

PEAK It’s been quite the roller-coaster ride for Pudgy Penguins. This week the collection’s floor price has tripled, briefly surpassing its peak in September 2021 with a high of 3.73 ETH ($12,000) yesterday, according to data from niftyprice.io.

FAVOR The NFT collection featuring 8,888 flightless denizens of the Antarctic in various forms has once again found favor with investors after closing a deal with US-based entrepreneur Luca Netz for 750 ETH ($2.4M).

CONTROL Announced on Apr. 2, the sale had been in the works for some time, and will see a team headed by Netz take over operational control and royalty rights from the original team of four co-founders. “Everything is aligned to make this one of the most prevalent projects of all time,” Netz told CoinDesk.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Fundraising Rounds

💰Near Protocol Sitting on $500M After Latest Funding Round

By Samuel Haig

NEWS Near Protocol has become the darling of heavyweight venture capitalists in the Layer 1 race. On April 6, the high-speed Layer 1 network announced it had raised $350M in a round led by Tiger Global, the venture fund led by billionaire financier Chase Coleman. FTX Ventures, Blockchange Ventures, and Dragonfly Capital, also joined the raise.

$500M Combined with its previous investment round in January, Near has now raised half a billion dollars this year so far. The previous round was led by Three Arrows Capital, with Alameda, A16z, and others also backing the protocol. Near has not disclosed its valuation.

LAYER 1s Near is a high throughput network supporting smart contract execution. It seeks to rival the likes of Ethereum and other low-cost Layer 1s such as Solana and Avalanche. In addition to fast and cheap transaction execution on its own Layer 1, Near also offers EVM compatibility through its sister-chain, Aurora.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion

💡Why DeFi Should Make Markets Like Wall Street Banks

The DeFi Ecosystem Needs to Solve the Liquidity Challenge

Guest writer Tarun Chitra makes a provocative case for emulating one of TradFi’s most basic features.

CENTRAL CONTROL The core promise of DeFi is a global financial system, open to all. It eliminates the need for banks and central control, saving consumers and small businesses tens of billions of dollars in fees collected by intermediaries from everyday financial transactions like buying a cup of coffee or sending money across borders.

HIGHER RETURNS Like every paradigm-shifting innovation, the DeFi ecosystem has experienced growing pains, but its long-term value is already coming into focus. With new protocols introduced each month that offer higher returns with fewer barriers to entry than traditional finance, DeFi is attracting new users at a rapid clip.

TOKEN ISSUANCE However, a core challenge has already emerged for DeFi developers: attracting consistent, long-term liquidity. Exchanges in DeFi (decentralized exchanges or dexes) require a flow of assets to enable the efficient exchange of tokens — many of which raise seed funds through token issuance to support DeFi platform development. To date, the easiest way for dexes to attract liquidity has been to incentivize participation through high yields that generate rewards for investors in return for the capital that powers the protocol.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Primers

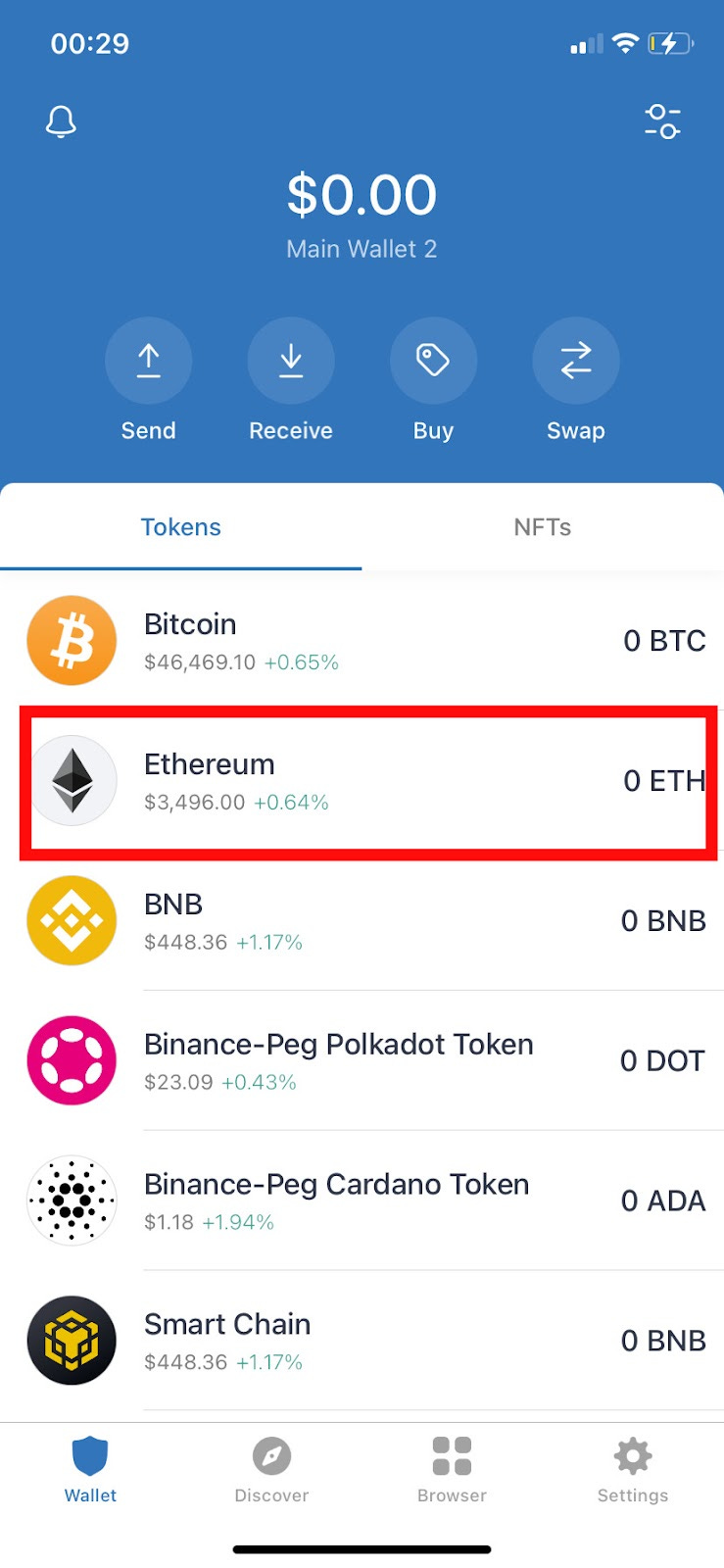

🧐 How to Transfer Tokens to MetaMask from Trust Wallet

A Step-by-Step Guide for Ethereum Wallet Users

By Arya Ghobadi

PUBLIC KEY It’s a common misunderstanding: Many beginners believe that cryptocurrencies are stored in MetaMask, Trust Wallet, or other crypto wallets. This is incorrect — a crypto wallet only stores your public key and your private key, then uses your private key to sign and approve transactions.

SEED PHRASE Your wallet is on blockchain and it’s secured by your seed phrase, which means that if you place your Trust Wallet seed phrase into your MetaMask you will be able to get your tokens! In this tutorial, you will learn how to transfer cryptocurrencies from Trustwallet to MetaMask and also how to import your Trust wallet to MetaMask.

Open your trust wallet and Select the token that you want to send. We use ETH in this tutorial:

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

The Automation in DeFi - Is It Possible or Not?

DeCommas is building a Multi-Chain DeFi Automation Layer as a gateway to profitable and risk-mitigated DeFi.

It is possible to reach this goal by making advanced orders, automated strategies, structured products, and any automation more accessible and composable in DeFi. Sounds great - let’s get closer to it!

Smart contracts are an extremely important breakthrough for finance on top of the blockchain. However, sometimes they’re not so smart after all. There is no internal mechanism for the smart contract to trigger itself or initiate its function based on some irregular condition. They’re not time-based or connected to other smart-contract calls.

And this is exactly where automation is needed, which opens up incredible new possibilities for DeFi to move even further forward. A significant increase in the quality of life of average DeFi users lies in the automation of their daily actions, such as purchasing an asset when it reaches a certain price or condition, automating various trading and farming strategies to eliminate emotions, and constantly having to monitor them. And all of that can be found in a convenient and simple dApp.

After all, there’s more to life than sitting at a desk.

ReDeFine automation with DeCommas!

The Tube

📺 Tutorial: 0xSplits - power is nothing without control

Sponsored Shoutout

WIP - We’ll Let You Know When Ready to Go

Phuture is a crypto index platform, that simplifies investments through automated, themed index products. We’ll give you 3 reasons to invest in Phuture indices:

You’ll ride the trends, not the extremes.

Gain exposure to key sectors with one token.

Your discipline will beat timing the market.

Want to know know more? Check us out at phuture.finance

Elsewhere

🔗 Nifty News: Solana NFT sales pass $1.6B, wash trading on LooksRare and more: CoinTelegraph

The Solana network is gaining traction among nonfungible token (NFT) traders as total sales have surged past $1.6 billion, making it the third most active blockchain by NFT sales volume.

🔗 FTX.US backs 'Flash Boys' exchange IEX as firm maps out crypto strategy: The Block

Nearly a decade ago, IEX Group set out to transform markets by launching a new kind of trading venue to topple traditional equity venues.

🔗 Securing Ronin: Ronin’s Newsletter

Last week’s security breach has served as a potent reminder of the importance of truly distributed networks. We have considerable long-term ambitions for Ronin.

🔗 Elon Musk: a new kind of media baron charges into Twitter: The Financial Times

Tech billionaires have used their wealth before to make a mark in the news business. They include Amazon’s Jeff Bezos, owner of the Washington Post, and Salesforce’s Marc Benioff, who, with his wife, acquired Time in 2018.

Job Board

⚙️ prePo: Smart Contract Engineer (Solidity)

prePO is looking for a Smart Contract Engineer to take ownership over the development of novel DeFi-related smart contracts.

For more info, click here.

✒️ pre:Po Executive Assistant

prePO is looking for an exceptional Executive Assistant to work with the founder to perform a wide variety of operational, administrative and strategic tasks.

For more info, click here.

🚀 Liquity Head of Growth (Crypto)

Liquity is seeking an experienced Head of Growth that can help grow its user base, boost LUSD adoption and overall stablecoin market share.

For more info, click here.

Trending in The Defiant

Cosmos Co-Founder Ethan Buchman on Building an Internet of Sovereign Blockchains Ethan Buchman is the co-founder of Cosmos, an ecosystem of Interoperable blockchains which includes terra, osmosis and crypto.org, and has the most value locked after ethereum.

Waves’ USDN Stablecoin Loses Peg as Accusations of Ponzi Schemes Fly Waves, a Layer 1 blockchain known as ‘Russia’s Ethereum’, has suffered a reversal of fortune as accusations of Ponzi schemes and market manipulation fly in a wild week of action.

Do Kwon’s Treasury Play Allies LUNA and BTC Maxis in a Pumped Market Earlier this month, Terra ecosystem co-founder Do Kwon bet $11M that its token, LUNA, would be higher a year from its March 14 price of $88.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Signest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)