🔥 Proposal Aims to Shake up MakerDAO’s Tokenomics and Light a Fire Under MKR

Hello Defiers! Here’s what we’re covering today:

News

Proposal Aims to Shake up MakerDAO’s Tokenomics and Light a Fire Under MKR

ConsenSys Notches $7B Valuation Amid Flurry of Legal Challenges

Opinion

Podcast

🎙Listen to the exclusive interview with Fabian Vogelsteller here:

Video

Links

Trending in The Defiant

Degen Who Slammed Terra as ‘Ponzi’ Dares Founder to Bet $1M on LUNA — and He Did

Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community

Ukraine

Do you want to make a real difference in the Ukraine crisis? Until March 24th, if you donate to help improve the situation in Ukraine on Gitcoin your funds will be matched by a pool of over $700,000 using the power of quadratic funding.

In some cases, 1 DAI can be matched up to 50x, so even small amounts are meaningful. Peace is a global public good, and it's become increasingly clear that we have to work to collectively maintain it. For more details, check out http://gitcoin.co/grants and go to the "Support for Ukraine" category.

Public goods are good.

Gitcoin grants sustain web3 projects with quadratic funding

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Verse Network by STP, is a Layer 2 for DAOs. Redefining value one DAO at a time.

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection.

Unstoppable Domains, Unstoppable Domain is the #1 provider of NFT domains. One domain, the entire metaverse - your Unstoppable domain is all you need to verify your humanity and access sites and apps on the decentralized web. Get yours today!

DAO Tokenomics

🔥 Proposal Aims to Shake up MakerDAO’s Tokenomics and Light a Fire Under MKR

By Owen Fernau

HARD LESSON Utility doesn’t always lead to value. That’s the hard lesson holders of MKR, the token of MakerDAO, have been learning in the past year. MKR has dropped 11% in the last 12 months even as DAI, the protocol’s stablecoin, has increased by a multiple of 3.5 times.

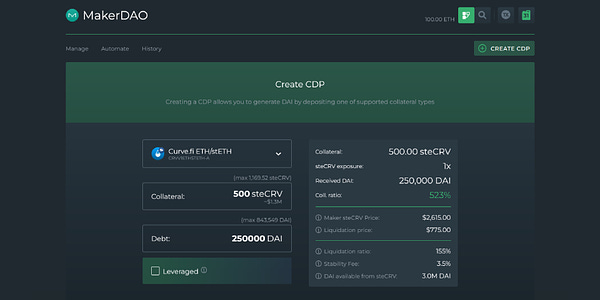

PRICE Now there’s a new proposal kicking around Maker’s forums that aims to do something about this disparity. While it isn’t explicitly designed to increase MKR’s price, the idea may shake up the project’s oft-criticized tokenomics, according to monetsupply, the proposal’s author.

STAKING At a high level the proposed change entails adding a staking functionality for MKR tokens. So when a user stakes MKR, they will get stkMKR, a token which will accrue fees in the form of additional MKR.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Ethereum 2.0

🏆 Ethereum’s Passes Major Test in Shift to Proof of Stake

By Samuel Haig

UPGRADE The Ethereum community has a lot to look forward to. On March 15, The Ethereum Foundation announced that The Merge was successfully completed on Kiln — the final merge testnet before the upgrade will be deployed on Ethereum’s public testnets.

MERGE Ethereum’s highly anticipated chain merge will combine the Eth2 Beacon Chain with the existing Ethereum mainnet, transitioning the network from Proof of Work to Proof of Stake-based consensus.

BURNING The move to Proof-of-Stake will usher a dramatic reduction in ETH issuance. Combined with the network burning base transaction fees since EIP-1559 went live last August, many analysts prophesize Ethereum will become deflationary after The Merge. That means more ETH will be destroyed faster than new Ether is created, which should bolster its value.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Fundraising Rounds

🌪 ConsenSys Notches $7B Valuation Amid Flurry of Legal Challenges

By Samuel Haig

CONTROVERSY For the last few months the headlines around ConsenSys, the trailblazing blockchain lab and Ethereum dev shop, have smacked of controversy.

AUDIT In January, the firm’s former investment chief accused it of maintaining a “toxic” work environment and sought $30M in damages in a lawsuit. Earlier this month a group of former employees petitioned Swiss authorities for a special audit of the venture’s books to investigate alleged irregularities.

VALUATION On Tuesday, ConsenSys managed to report decidedly more welcome news: It’s raised $450M in a Series D raise that brings its valuation to more than $7B. The funding punctuates impressive growth for its core infrastructure products. The monthly user base for ConsenSys’s MetaMask wallet exceeded 30M in January, marking a 42% increase in MetaMask users over four months. Its Infura Ethereum API also hosts 430,000 developers and facilitated more than $1T worth of annualized on-chain ETH transactions.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion

🧐 It’s Called Incompossibility, It’s a Big Problem, and Liquid Staking Protocols Can Solve It

Guest writer Tushar Aggarwal digs into a big challenges in DeFi.

ISSUES Bitcoin and Ethereum, the two largest cryptocurrencies in terms of market cap, have led the nascent crypto sector to a valuation of $1.63T. Yet their Proof-of-Work (PoW) consensus mechanism carries fundamental issues.

ENERGY INTENSIVE For starters, Ethereum entails exorbitant fees for transactions that are relatively slow and very energy-intensive. Innovations like the Bitcoin Lightning Network and Ethereum 2.0 are trying to address the issues but it will take time. On the other hand, many blockchain networks have embraced the Proof-of-Stake (PoS) consensus mechanism to overcome the aforementioned challenges.

ON-CHAIN Replacing the energy-intensive PoW miners, PoS token holders stake (lock) their assets on-chain to help validate transactions and receive governance rights. Since decision-making and on-chain transaction settlements depend on proportional staking, PoS networks no longer require massive computational power.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Lithium Finance is the first collective-intelligence pricing oracle that provides precise and timely pricing information on private and illiquid assets. Our protocol leverages crowd wisdom and proprietary mechanisms to provide pricing on private and illiquid assets.

Unlike most blockchain oracles that source data from 3rd party providers, the Lithium Oracle is the only on-chain protocol that generates first-party pricing for illiquid assets across a broad spectrum that includes digital games, crypto tokens, and more. Lithium’s use-case spans protocols in the DeFi, NFT, and traditional investing space (e.g., Hedge funds/Private Equity).

Learn more about at www.lith.finance

The Tube

📺 Tutorial: Is this the cheapest way to swap on Ethereum?

The Defiant - Referral - The Defiant

Enter your email to unlock your referral link. Help your friends keep up to date with the latest DeFi News and win rewards.

Links

🔗 Bored Ape startup plans virtual land sales, APECoin token to kickstart metaverse gaming project: The Block

Yuga Labs, the business behind the heavily hyped Bored Ape Yacht Club NFT collection, is hoping to raise hundreds of millions of dollars by selling off virtual plots of land.

🔗 Kiln Testnet Merge viewing: Ethereum Foundation

The Kiln testnet is the first public testnet for the Ethereum merge. The Ethereum merge takes the Execution layer from the existing Proof of Work layer and merges it with the Consensus Layer from the Beacon chain.

🔗 Wildlife’s Hit Mobile Game Castle Crush to Add Avalanche NFTs, Tokens: Decrypt

Trending in The Defiant

Degen Who Slammed Terra as ‘Ponzi’ Dares Founder to Bet $1M on LUNA — and He Did On March 14, ‘Sensei Algod’, a pseudonymous degen and investor who’s called Terra a ponzi scheme, made the project’s community an offer it shouldn’t refuse: a cool $1M if the price of LUNA is higher in 12 months.

Buying Real World Assets By Leveraging Crypto A lot of people say crypto has no “real-world use cases”. “What can you buy with it?” someone will ask, at which point the other person will shrug back “JPEGs on the internet?”

Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community The Terra community is again divided on the future of the network’s leading protocol, Anchor. And the question of how it can maintain high yield payouts is at the heart of the matter.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)