** Apologies for the double email and please disregard the previous one **

Hello Defiers! Here’s what we are covering today,

News

Own a .ETH Address? $ENS Tokens Are Headed Your Way in Major Airdrop

DeFi Lending Hub Goldfinch Fuses NFTs and User IDs to Attract Wary Investors

Gary Vaynerchuck Warns New York NFT Fans to Do Their Own Homework

Avalanche Joins Layer 1 Funding Boom with $200M War Chest for Devs

Marc Andreessen and Winklevoss Twins Back Sfermion’s $100M NFT Fund

Deep Dive

Research

Opinion

Video

Podcast

🎙Listen to the interview in this week’s podcast with Eric Wall of Arcane Assets:

Links

ConsenSys AG Shareholders Readying Legal Action Over Share Valuation: CoinDesk

Quentin Tarantino to offer seven uncut scenes from ‘Pulp Fiction’ as NFTs: CNBC

We are proud to announce our new strategic collaboration with @SushiSwap: Tempus

Most Read in The Defiant

Own a .ETH Address? $ENS Tokens Are Headed Your Way in Major Airdrop

Governance of DeFi Giant Curve in Flux as Smaller Convex Exerts Control

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).air

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at this link.

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

Airdrops

💸 Own a .ETH Address? $ENS Tokens Are Headed Your Way in Major Airdrop

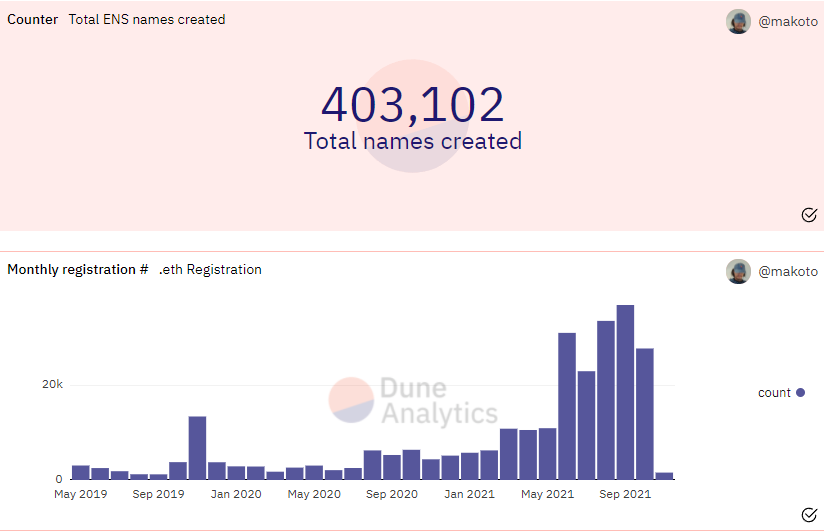

NEWS ENS Domains, the protocol that issues and manages domain names on the Ethereum blockchain, has announced plans to issue a token and form a DAO to govern the future of the protocol.

AIRDROP A snapshot of all .ETH address holders was taken on Oct. 31 and $ENS tokens will be claimable next week, according to the announcement published on Nov. 1. More details about the size and scope of the airdrop are expected in the coming days.

BUDWEISER Demand for ENS domains has been growing steadily this year. Activity jumped after Budweiser’s purchase of beer.eth in August.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

SPONSORED POST

Polkadot parachain slot auctions start Nov. 11th - Get a piece of Acala’s DeFi network before launch

Acala is building the DeFi and liquidity hub of Polkadot, poised to become the primary destination for Ethereum-compatible DeFi applications and high-yield generation for its fintech integrations like Current. The network will support an economy of applications in categories like trading, loans, derivatives, and payments and can continue to be customized and upgraded over time without forks.

Acala has backing from top venture capital firms like Coinbase Ventures and Polychain Capital, and now you can also get a share with the Acala Crowdloan. Crowdloans are crypto’s latest innovation for launching new projects. By supporting Acala in the Crowdloan, you are helping to strengthen Acala’s bid in the upcoming ‘parachain slot auctions’ on Polkadot. Once Acala wins the auction, the network will launch on Polkadot to gain its security and interoperability.

Here’s how to get involved:

First, you simply lock up DOT during the Crowdloan in support of Acala.

In return, you earn Acala’s ACA token, giving you a share of the network.

After the parachain slot lease ends, you get all your original DOT contribution back, and the ACA stays with you.

To get started, sign up to earn a 7% bonus in the Acala Crowdloan.

Blockchain KYC

🦜 DeFi Lending Hub Goldfinch Fuses NFTs and User IDs to Attract Wary Investors

USERS’ IDENTITIES There’s been NFTs for original artworks, sports stars’ game highlights, and a wide variety of apes, penguins, and punks. Now Goldfinch is creating NFTs for a potentially more impactful purpose — establishing users’ identities to satisfy Know-Your-Customer requirements.

HOW IT WORKS On Nov. 1, Goldfinch, an unsecured loan protocol that lives in the Ethereum blockchain, released an offering called a Unique Identity (UID). The idea is that users can use this program to establish their bona fides with financial firms that conduct so-called KYC and anti-money laundering checks. These measures are de rigueur in traditional finance and are becoming more prevalent in DeFi as the space matures.

DECENTRALIZED IDENTIFICATION The move comes as decentralized identification is picking up momentum as a new application on Ethereum and its ilk. “Decentralized identity solutions help users, amongst other things, to control their digital identity without the input of intermediaries,” Humpty Calderon, the head of community at Ontology, wrote in The Defiant last month. “The prominence of decentralized identity solutions within and outside the blockchain and crypto industry is likely to grow exponentially in the coming years.”

OFF-CHAIN Goldfinch’s offering isn’t entirely decentralized, though. The venture tapped an identity verification firm called Persona to conduct the KYC process. While users can maintain a KYC-approved identity on the blockchain, the supporting personal data resides off-chain on a conventional server.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Players

🖼 Gary Vaynerchuck Warns New York NFT Fans to Do Their Own Homework

Serial entrepreneur Gary Vaynerchuck is completely sold on non-fungible tokens (NFTs) but he still sees the red flags.

“I believe there is 100% chance of a massive dip,” Vaynerchuck said, because he’s watching folks “ape in,” flipping tokens and jumping from project to project, only chasing gains. “I don’t know what’s going to happen but I know why it’s happening. Money blinds people like a motherfucker,” Vaynerchhuck said.

NFT 42 founder Jimmy McNelis and serial entrepreneur and author Gary Vaynerchuck at 3.2.1. Blast Off in Tribeca New York, Nov. 1, 2021. Credit: @NFTsanonymous, used by permission

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Development Funds

💰 Avalanche Joins Layer 1 Funding Boom with $200M War Chest for Devs

NEWS Lots of Layer-1 blockchains have announced large developer funds to encourage more applications in their ecosystems. Avalanche is the latest.

FUNDING Today, probabilistic consensus blockchain Avalanche announced over $200M in available funding for entrepreneurs, with backing from Polychain Capital, Three Arrows Capital and, of course, Avalanche Foundation and Ava Labs.

BLIZZARD The new fund is called Blizzard, continuing with Avalanche’s snow and winter theme. Avalanche was founded by Cornell University professor Emin Gün Sirer. This deal follows a $230M investment made by Polychain and Three Arrows in Avalanche in September.

WAR CHESTS Blizzard is looking for projects in decentralized finance, NFTs, enterprise, and culture. Avalanche follows several other base layer blockchains that have announced giant war chests to encourage the development of new products for their technology, including Harmony ($300M), Algorand ($300M) and Near ($800M).

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Funds

⚡️ Marc Andreessen and Winklevoss Twins Back Sfermion’s $100M NFT Fund

ALL-STAR LINEUP As if NFTs needed any more buzz. An all-star lineup of angel investors and venture capitalists has plowed more than $100M into a fund raised by a firm called Sfermion. Among the big names in the fundraise: Marc Andreessen, the Winklevoss twins, British billionaire Alan Howard, and Matthew Roszak, the chairman and co-founder of Bloq, the Chicago-based blockchain infrastructure firm.

TOKENOMICS The fund, Sfermion’s second, is designed to back ventures that will accelerate the development of the metaverse, the virtual space that’s become a testing ground for using NFTs as a form of tokenomics, the firm said in a statement today.

METAVERSE The metaverse had rapidly become a household term in crypto even before Mark Zuckerberg announced last week that Facebook was changing its corporate name to Meta as part of a strategic shift.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Symbiosis

🗳 Governance of DeFi Giant Curve in Flux as Smaller Convex Exerts Control

In this Deep Dive, Brady Dale unpacks the extraordinary interdependency of Curve and Convex and reports how a new proposal could tighten the latter’s grip on the stablecoin giant’s governance forum.

THE LEAD Even fairly sophisticated DeFi watchers might be baffled why so many are so obsessed with Curve, the automated market maker known for trading stablecoins.

LINKED What’s so exciting about stablecoins after all? But the market gets it. Curve‘s token is up 50% over the last month. And Curve has become, crucially for what’s to follow, inextricably linked to another product built to work atop it: Convex Finance.

DISRUPT Convex’s CVX token is up roughly as much. Convex exists to help Curve liquidity providers maximize their returns, so the two products have always been symbiotic. But now they’ve grown so interdependent that the pair are poised to effectively merge, and to do so in such a way that no other team could ever disrupt Convex again.

LIQUIDITY “Our view with Convex and Curve, whoever controls this stuff essentially controls the liquidity of stablecoins,” said Sam Kazemian, founder of the algorithmic stablecoin protocol Frax Finance.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Research

🏭 Balancing Crypto’s Carbon Footprint with Its Social Utility is Key to Sustainable Finance

In its latest dispatch, Global Digital Finance lays out how the crypto climate change issue is more nuanced than many assume.

TLDR The extraordinary growth that we have seen in the crypto and digital asset sector throughout this year has brought with it much attention from across media platforms, not all of which has been positive.

INSIGHT AND RESEARCH With the industry in the spotlight, our global community has a welcome opportunity to communicate the nuances of the crypto-energy consumption debate, as well as the broader social utility of digital assets. For our report, Digital Assets: Laying ESG Foundations, we asked the members of Global Digital Finance to contribute their insight and research to help deepen the wider understanding of the role of digital assets in building sustainable financial systems.

CLIMATE DISASTER We were privileged to include the Cambridge Centre for Alternative Finance’s observations on Bitcoin’s carbon footprint. Michel Rauchs and Alexander Neumueller call for those on both sides of the debate to raise the level of public discourse: neither the argument that Bitcoin is a climate disaster, nor that it has no environmental impact, holds up well in the face of the available data.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion

🏦 Don’t Dis TradFi —It Shows Good Ways to Manage Risk and Open DeFi to Newbies

In this guest column, Danny Chong, writes that traditional finance offers valuable lessons for making DeFi more accessible and less risky.

IMMENSE OPPORTUNITY The DeFi market has captured the imagination of investors after multiplying in value 18 times in the last 12 months, reaching $244B in total value locked (TVL) on Nov. 1, according to DeFi Llama. Traditional investors are now seeing the immense opportunity that DeFi has to offer as well as the returns.

RED TAPE But there is a lot of work to be done. The DeFi projects have to match the sophistication of traditional financial services in risk diversification and eradicate the red tape and bias toward the wealthy that has long plagued traditional finance (TradFi).

LIBERATING First off, DeFi is not just TradFi 2.0. There are core differences, which is one reason I stepped away from my TradFi job as the Head of FX & EM sales to set up Tranchess, a decentralized yield-enhancing protocol with varied risk-returns solutions. One key reason is that DeFi is truly liberating.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 How to get started in the Metaverse | Decentraland ($MANA) tutorial

Links

🔗ConsenSys AG Shareholders Readying Legal Action Over Share Valuation: CoinDesk

A group of former employees and shareholders of Ethereum development firm ConsenSys are alleging that the ConsenSys AG, led by billionaire Joseph Lubin, improperly valued key assets in its portfolio prior to an asset transfer involving banking giant JPMorgan.

🔗 Quentin Tarantino to offer seven uncut scenes from ‘Pulp Fiction’ as NFTs: CNBC

Quentin Tarantino is breaking into NFTs. Announced Tuesday, the award-winning director and writer is auctioning off seven uncut scenes from “Pulp Fiction” as nonfungible tokens, also including original handwritten scripts from the film and exclusive audio commentary from Tarantino himself.

🔗 Commonwealth Bank to enable crypto trading for 6.5M Aussies, ‘other banks will follow’: CoinTelegraph

The CBA stated that it will support 10 crypto assets in its banking app, including Bitcoin, Ether, Bitcoin Cash and Litecoin.

🔗 ENS DAO: Call For Delegates: ENS

ENS is decentralizing governance and accepting applications for DAO delegates.

Most Read in The Defiant

DappRadar Exclusive Report: Play-to-Earn Revolution Leaps Beyond Axie Infinity with New Games and Tokens Generating income while playing a game sounds like a utopia for most of us. However, thanks to the play-to-earn movement, that scenario is not far from reality.

Own a .ETH Address? $ENS Tokens Are Headed Your Way in Major Airdrop ENS Domains, the protocol that issues and manages domain names on the Ethereum blockchain, has announced plans to issue a token and form a DAO to govern the future of the protocol.

Governance of DeFi Giant Curve in Flux as Smaller Convex Exerts Control Even fairly sophisticated DeFi watchers might be baffled why so many are so obsessed with Curve, the automated market maker known for trading stablecoins.

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Samuel Haig, DeFiDad and yyctrader, and edited by Edward Robinson, Bailey Reutzel, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).

Look at this VLX_WAG APY on Wagyu platform which is 2,373 🚀