🌪 Optimism Airdrop Turns ‘Turbulent’ After Demand Overload

Hello Defiers! Here’s what we’re covering today:

News

Liquid Staking Derivatives Pose ‘Significant Risks’ to Ethereum 2.0: Report

El Salvador Struggles to Adopt Bitcoin Despite Government Push

Optimism Airdrop

Podcast

🎙Listen To The Exclusive Interview With Yoni Assia:

Video

Elsewhere

Dogecoin’s parents are fighting: Musk and Jackson Palmer exchange barbs: CoinTelegraph

Marc Andreessen & Chris Dixon of a16z | Reinventing the Internet: Bankless.

FTX says farmers don't need to worry about its US derivatives proposal: The Block

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Bancor, the only DeFi trading and yield protocol with Single-Sided Liquidity & 100% Impermanent Loss Protection. A safer, more sustainable way to earn DeFi yields on your favorite tokens - start earning now!

Airdrops

🌪 Optimism Airdrop Turns ‘Turbulent’ After Demand Overload

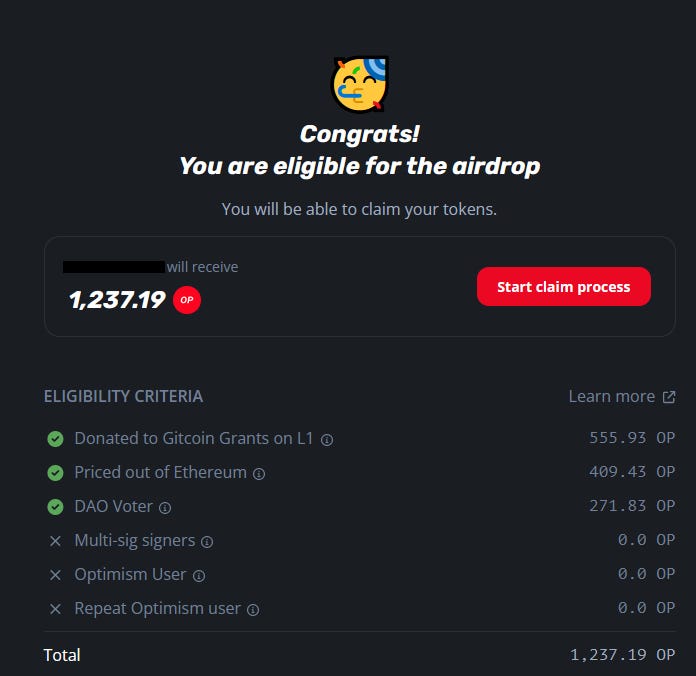

By Samuel Haig

NEWS The first phase of Optimism’s debut airdrop took place on May 31, but it was overwhelmed by demand and the project scrambled to fulfill claims on a “turbulent” day. Optimism, an Ethereum Layer 2 scaling solution, set up the airdrop to distribute OP tokens to reward users that have helped it to grow and to entice newcomers to join the network.

FARM TOKEN But some onlookers were not convinced Optimism is worth the trouble. “I see no reason for [$OP] to exist apart from it being a farm token for ecosystem rewards,” said Wangarian, an angel investor and former principal with DeFiance Capital.

WALLETS Optimism doled out tokens to 248,699 wallet addresses across the Ethereum and Optimism networks. Eligible users had to meet a variety of criteria, including being on the Optimism chain, voting on proposals or signing multisig wallets for top DAOs within the Ethereum ecosystem, and Gitcoin donors.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

LSD

💦 Liquidity Staking Derivatives Pose ‘Significant Risks’ to Ethereum 2.0: Report

LSD Protocols May Make Ethereum Vulnerable to Abuses of Power After Shift to PoS

By Aleksandar Gilbert

INTEGRITY Protocols that offer liquid staking derivatives, like Lido and Rocket Pool, could undermine the integrity of Ethereum after its transition to proof-of-stake, according to a researcher at the Ethereum Foundation.

DANGERS If any protocol were to stake a majority of the Ether in circulation, it would become vulnerable to censorship demands and other abuses of power blockchain technology was developed to circumvent, researcher Danny Ryan wrote in a blog post titled “The Dangers of LSD.”

POOLED CAPITAL “Liquid staking derivatives (LSD) such as Lido and similar protocols are a stratum for cartelization and induce significant risks to the Ethereum protocol and to the associated pooled capital when exceeding critical consensus thresholds,” the report said.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

DeFi users, you no longer need to pay expensive and unpredictable interest rates on your ETH-backed loans. Liquity is an immutable, governance-free borrowing protocol that allows you to borrow interest-free against ETH as collateral. Loans are paid out in LUSD — a USD pegged stablecoin, and need to maintain a minimum collateral ratio as low as 110%.

Outside of borrowing, users can deposit LUSD to the Stability Pool to earn LQTY rewards and participate in collateral liquidation events — purchasing ETH at a discount when liquidations occur. Lastly, users can stake LQTY to earn protocol revenue, which recently crossed >$28M since Liquity’s launch in April 2021. To learn more, head over to liquity.org to get started and get the most out of your borrowing needs today!

Market Action

😬 DeFi’s TVL Fell 40% in May But Bright Spots Emerge

By Samuel Haig

TVL DROP Should we even look? DeFi protocols recorded a May to forget. The Total Value Locked (TVL) across the sector plummeted more than 40% in the month to $111.4B, according to data from DeFi Llama.

TERRA The primary cause, of course, was the collapse of Terra and its UST stablecoin. Its demise evaporated $28B from the markets in May. The Ethereum network network also shed nearly $40B.

AVALANCHE As for alternative Layer 1 networks offering cheap smart contracts, they also suffered declines in TVL ranging from 30% to 55%. Avalanche lost $5B, and Binanace Smart Chain dropped by $3B.

STABLECOINS No surprise, protocols targeting stablecoins were among the hardest hit, with the fallout from UST’s failure prompting many investors to exit or redeem positions.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Bitcoin Adoption

🇸🇻 El Salvador Struggles to Adopt Bitcoin Despite Government Push

Taking Stock Of Crypto Adoption In The Americas

By Jason Levin

TWO ROUTES Every country does crypto differently. El Salvador’s government incentivized Bitcoin usage whereas Argentina’s crypto boom has been largely organic. The two routes – top-down and bottom-up – are quite distinct in their approaches and outcomes.

ADOPTION It’s too early to tell which approach has better chances for long term success, but so far, it looks like the bottom-up approach is working better for crypto adoption in a nation.

PAYMENTS When El Salvador made Bitcoin legal tender, all businesses were compelled to accept BTC for payments. To incentivize Bitcoin adoption, the Salvadoran government released a custodial digital wallet, gave its users $30 of free Bitcoin, and subsidized transaction fees.

FIAT CURRENCY Despite these incentives, researchers from the University of Chicago found that only 4.9% of all sales in El Salvador are conducted in Bitcoin. Researchers also found that 88% of businesses exchange Bitcoin revenue for fiat currency.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Tutorial: Do Kwon's folly - Dai was never going to die. Here's why:

Optimism Airdrop

💸 $OP is Live! A Guide To Claiming the Airdrop

By yyctrader

AIRDROP Layer 2 season is upon us. Optimism’s OP token is live and eligible users can claim the first phase of the airdrop. Optimism is an Ethereum scaling solution based on optimistic rollup technology. The official token contract was unearthed by Crypto Twitter sleuths last week.

Here’s how to claim:

Step 1: Check your eligibility at https://app.optimism.io/airdrop

Details about qualifying criteria and tokenomics were released last month.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Dogecoin’s parents are fighting: Musk and Jackson Palmer exchange barbs: CoinTelegraph

The world’s richest man and the co-founder of Dogecoin are sparring over whether the latter actually has a Python script that could put a huge dent in Twitter bot activity.

🔗 Marc Andreessen & Chris Dixon of a16z | Reinventing the Internet: Bankless.

The two pro-crypto VCs on what comes next.

🔗 FTX says farmers don't need to worry about its US derivatives proposal: The Block

As FTX looks to convince market participants to get on board with its proposal to launch crypto-tied derivatives in the US, there's one unusual group the exchange operator is looking to assuage: American farmers.

Trending in The Defiant

New Terra Launches – LUNA Dumps, LUNC Pumps It’s been a traumatic couple of weeks in crypto and the drama continued last week with the Ethereum beacon chain suffering a 7 block reorg when some but not all nodes failed to upgrade the validator software in time.

New LUNA Coin Surges While Terra Controversy Escalates Trending in The Defiant

Crypto Markets Rebound After Bitcoin’s Record Losing Streak Crypto bulls went to work as U.S. financial markets remained closed for Memorial Day.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason Levin, DeFiDad, Aleksandar Gilbert, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).