🌌 NFT Fund Starry Night Goes Dark on SuperRare

Hello Defiers! Here’s what we’re covering today:

News

Podcast

🎙Listen to the exclusive interview with Mati Greenspan episode here:

Video

Elsewhere

'Few are Feeling OK': Celsius Investors Unlikely to Fund Bailout: Report: Decrypt

Ethereum price flash crashes to $950 on Uniswap as whale dumps 93K ETH: CoinTelegraph

Convicted scammer Anna Sorokin says she is now selling NFTs: NBC News

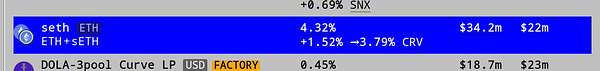

Apparently sETH pool is doing really well on those synth swaps: Curve Finance

Trending in The Defiant

NFT Funds

🌌 NFT Fund Starry Night Goes Dark on SuperRare

SINGLE WALLET In another sign of distress at Three Arrows Capital, an affiliated fund that had scooped up dozens of high-priced NFTs has moved much of its multimillion-dollar collection into a single wallet, prompting speculation of an upcoming fire sale.

ENTIRE COLLECTION That fund, Starry Night Capital, launched last summer with backing from Three Arrows. Famed NFT collector Vincent Van Dough was brought on as a partner and curator of the collection. As of Wednesday, its entire collection on NFT marketplace SuperRare had been moved into a new wallet and was no longer listed on the site.

LOSSES The moves prompted speculation Starry Night was planning on selling its collection to cover massive losses incurred by Three Arrows during this bear market.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Terra Collapse

🧐 Two Traders Targeting 3Pool Poleaxed Terra: Report

Chainalysis Finds 150M UST Withdrawal from Curve Pool Triggered Chain Reaction

By Samuel Haig

TERRA’S FATE The fall of Terra may feel like ancient history now. Two more major crypto ventures — Celsius and Three Arrows — have seized the attention of investors as they struggle to avoid Terra’s fate.

TWO TRADERS Yet fathoming precisely what went wrong at Terra is still under way, and earlier this month Chainalysis, a blockchain intelligence firm, says in a June 9 report that just two traders were responsible for the initial break of UST’s peg that precipitated the death of UST and the entire Terra Classic chain.

VOLATILITY The report notes that on May 7, Terraform Labs, the company behind Terra, withdrew 150M UST from Curve’s 3pool — a liquidity pool comprising various stablecoins designed to facilitate efficient exchange between the tokens — making it susceptible to volatility.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Liqd is an NFT marketplace built to enable the lending and borrowing of blue chip NFTs. The platform enables individuals who hold blue chip NFT assets to unlock liquidity by borrowing against the value of their asset(s).

In turn, Liqd unlocks a peer-to-peer lending opportunity for crypto holding individuals to passively earn interest on their capital, backed by the value of the underlying NFT asset.

In times of volatility and market unrest, people need access to liquidity. Regardless of why this need for liquidity has arisen, you should never be forced to sell your NFTs. The Liqd platform empowers NFT holders by providing an alternative to selling at market price, helping protect a projects floor price.

With ZERO fees for the first month, now is the time to utilise Liqd and get liquidity on your favorite NFT’s.

Sign up for our newsletter for early access and hidden alpha... don't say we didn't warn you - Liqd NFT

The Merge

👀 Merge Update: Devs Advance Closer to Eth2 With Major Step Next Week

By Samuel Haig

PROGRESS Despite the bear market, the Ethereum community still has The Merge to look forward to. And Ethereum’s devs are making significant progress.

TESTNET The first public testnet merge took place in late May on the Ropsten network, with all necessary fixes having since been deployed. The Eth2 Beacon Chain will next be launched on the Sepolia testnet on June 20, paving the way for Ethereum’s second public testnet chain-merge soon after.

EXECUTION Ethereum’s chain-merge will transition the network’s consensus layer from Proof-of-Work Proof-of-Stake, and unify it with the existing execution layer. The upgrade will abandon miners in favor of stakers validating transactions, delivering a more than 99% reduction in energy consumption and 90% drop in new Ether created.

REWARDS Coupled with base transaction fees being burned since August, the transition is tipped to result in more ETH being removed from supply than is created through validator rewards, known as deflationary issuance.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Stablecoins

💶 USDC Issuer Circle Announces Euro-Backed Stablecoin

Euro Coin Will be Available to Mint and Redeem on June 30

EURO COIN Circle, the issuer of USDC, will launch a new stablecoin pegged to the euro, the company announced Thursday. Dubbed Euro Coin, the token is “100% backed by euros held in euro-denominated banking accounts,” the company claims, “so that it’s always redeemable 1:1 for euros.”

SECOND-BIGGEST Euro Coin is the company’s second stablecoin. In partnership with US crypto exchange Coinbase Circle launched USD Coin, or USDC, in 2018. USDC was the second-largest stablecoin by market capitalization Thursday, with $54.6B in circulation, according to data from CoinGecko.

MINT Euro Coin (EUROC) will be available to mint and redeem on June 30th, CEO Jeremy Allaire tweeted, and will be listed on the Binance, Bitstamp, FTX and Huobi crypto exchanges.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Head to head with Sam Kazemian of Frax Finance

Elsewhere

🔗 'Few are Feeling OK': Celsius Investors Unlikely to Fund Bailout: Report: Decrypt

Embattled crypto lending platform Celsius Network is not on the brink of a bailout, according to a Wall Street Journal report citing people familiar with the matter.

🔗 Ethereum price flash crashes to $950 on Uniswap as whale dumps 93K ETH: CoinTelegraph

ETH managed a sharp rebound after falling to $950. But the ETH/USD bearish continuation setup could have it revisit it.

🔗 Convicted scammer Anna Sorokin says she is now selling NFTs: NBC News

Anna Sorokin, known for taking hundreds of thousands of dollars from friends and businesses while posing as a German heiress, said she's trying to move away from the "scammer persona" and plans to launch a collection of NFTs.

Trending in The Defiant

Investors Scramble to Get a Grip on Depth of Three Arrows’ Trouble

The fear is palpable. Six weeks after Terra collapsed and one week after Celsius, the embattled crypto bank, suspended withdrawals, investors are anxiously watching a $10B hedge fund cope with serious stress.

MakerDAO Errs on Side of Caution as Credit Risks Mount MakerDAO is taking no chances. As doubts about crypto credit rock the digital asset landscape, MakerDAO, the protocol behind the DAI stablecoin, voted on June 15 to temporarily disable Aave’s DAI Direct Deposit Module (D3M).

Rumors Swirl About Financial Stress at Three Arrows On-chain data has prompted speculation that Three Arrows Capital, a crypto-focused, Singapore-based hedge fund, is insolvent and may become the latest high-flying company to crash in the bear market.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason Levin, DeFiDad, Aleksandar Gilbert, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).