😳 MakerDAO’s Founder Ponders Move Away From U.S. Dollar

Hello Defiers! Here’s what we’re covering today:

News

NFT Roundup

DeFi Tutorial

Podcast

Video

Elsewhere

BlackRock launches private trust offering direct bitcoin exposure: The Block

Sam Bankman-Fried: 'Disappointing' Others Haven’t Helped Us Give Bailouts: Decrypt

Binance froze/recovered $450k of the Curve stolen funds, representing 83%+ of the hack: Binance

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

Stablecoins

😳 MakerDAO’s Founder Ponders Move Away From U.S. Dollar

Tornado Cash Sanctions Lead MakerDAO To Reconsider DAI’s Dollar Peg

By Jason Levin

ANGST Rune Christensen, the outspoken co-founder of DeFi stalwart MakerDAO, triggered a bout of angst in crypto after suggesting the protocol’s stablecoin, DAI, might drop its peg to the U.S. dollar.

REASON The reason: the Tornado Cash sanctions and recent USDC freezes that occurred this week after the U.S. Treasury executed the most significant enforcement action in crypto in memory.

DEPEG “I think we should seriously consider preparing to depeg from USD […] it is inevitable that it will happen and it is only realistic to do with huge amounts of preparation,” Christsensen wrote on August 11 in Discord.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Crypto Enforcement

👮♂️ Tornado-Linked Arrest in Europe Riles Crypto Mavens

Dutch Police Suspect Tornado Cash Involved in ‘Criminal Money Flows’

ARREST Dutch police have arrested an alleged developer of Tornado Cash, the cryptocurrency mixer popular with hackers and privacy-minded users, FIOD, the Netherlands’ financial crimes investigative unit, announced today.

SUSPECT More arrests could be forthcoming, FIOD said in a statement Friday. The 29-year-old suspect, who was arrested on Aug. 10, was not named. The case does not appear related to U.S. sanctions against Tornado Cash announced earlier this week. Dutch officials suggested it was the culmination of an investigation begun in June.

MIXING “He is suspected of involvement in concealment of criminal financial flows and facilitating money laundering through the mixing of cryptocurrencies through the decentralized Ethereum mixing service Tornado Cash,” the agency said in its statement.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Automate Your Layer 2 DeFi Positions

DeFi Saver launched on the two leading Layer 2 networks Arbitrum and Optimism, earlier this year with support for the Aave v3 protocol. Now the famous DeFi protocol aggregator continues to bring unique asset management features with its flagship automated leverage and liquidation protection feature available to users of both rollup networks.

Automation gives you peace of mind when managing positions in DeFi protocols. You just input your desired collateral to debt ratios, and it will automatically monitor your positions and make necessary adjustments, depending on the market conditions.

In adverse market conditions, automation will sell part of your collateral, deleverage, and keep your DeFi position safe from liquidation. In favorable, it will borrow and acquire more of the supplied asset increasing your leverage.

Optimism and Arbitrum support brings twofold benefits. Automation is no longer available only for sizable positions. You can now automate Aave v3 positions with just $500 of debt. And you can keep your positions safe from liquidation with drastically, up to 20x, reduced transaction fees.

Carefree DeFi management is live on Arbitrum and Optimism.

Automate your DeFi positions and stop worrying about liquidations with DeFi Saver.

Tornado Fallout

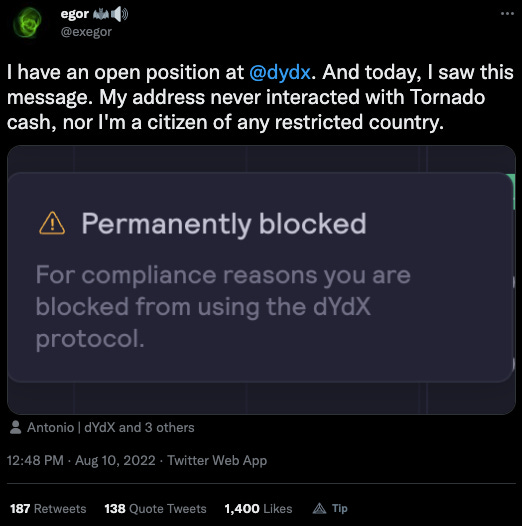

🌪 dYdX Bans Accounts In Wake Of Tornado Sanctions

Move Underscores the Centralization Prevalent In Crypto

By Owen Fernau

NEWS Contagion from the U.S. Department of the Treasury’s move to sanction privacy protocol, Tornado Cash, continues to spread.

BANNED dYdX, the derivatives trading protocol, said on Aug. 10 that it has banned certain blockchain addresses as a result of the Tornado sanctions levied on Aug. 8. Many of the banned addresses had never directly engaged with Tornado Cash, according to dYdX.

SCREENSHOT dYdX released the information roughly two hours after a banned user, egor, posted a screenshot showing that his account had been banned.

dYdX employs a compliance vendor which flags questionable addresses. The protocol went on to ban the flagged addresses before reinstating certain accounts which were actually in compliance, explained the dYdX team.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Roundup

🐧 Pudgy Penguins Waddle Higher After Unveiling Physical Toys

Old Friends Return to the Forefront This Week

By: yyctrader

REVOLT The penguins are back. Once on life-support before a community-led revolt led to the ouster of the founding team, the ever-popular NFT collection has seen its floor price surge 55% to 2.75 ETH ($5,200) in the past week.

TOYS On Aug. 10, the project revealed that some NFTs from the collection of 8,888 will be showcased in a physical toy collection, called Pudgy Toys.

HONORARIES Most of the chosen penguins belong to community contributors, leading one penguin holder to call them ‘pseudo honoraries’. Honoraries are NFTs usually awarded to community members for exceptional contributions, as in the case of BAYC Honorary Members. The collection generated over 575 ETH ($1.1M) in secondary sales on OpenSea in the past seven days, an increase of 329% over the previous week.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 The Metaverse goes Hollywood w/ Jessie Dickson-Lopez (MV3)

DeFi Explainers

🧐 What Are NFTs?

A Step-by-Step Guide to Understanding One of the Most Popular Apps in Crypto

MONKEY IMAGE Figuring out non-fungible tokens (NFTs) has become a joke. People are agog at how a .jpeg monkey image can cost the same as a mansion? By the end of this NFT tour, you will wonder how it was possible to ever be confused about NFTs.

UNIQUE NFTs are unique tokens. This is unlike an asset like Bitcoin, where 1 BTC is effectively the same as another bitcoin. It is the idea of non-fungibility that makes an NFT different from any other token of the same type. The unique properties of an NFT make it impossible to create a new token of the same type or modify its ownership record.

ARTWORK In other words, the asset’s attributes are so non-fungible that they must trigger value speculation. For centuries, physical artwork has triggered such speculation, often resulting in astronomically priced art pieces. This cannot happen with fungible assets like money, as one banknote holds the same value as any other equally denominated banknote.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 BlackRock launches private trust offering direct bitcoin exposure: The Block

Investment manager BlackRock has launched a private trust offering US-based institutional clients exposure to spot bitcoin.

🔗 In defence of stablecoins: The Financial Times

Crypto critics are using the collapse of dollar-pegged virtual currency TerraUSD as ammunition to attack stablecoins and the crypto industry as a whole.

🔗 Sam Bankman-Fried: 'Disappointing' Others Haven’t Helped Us Give Bailouts: Decrypt

Sam Bankman-Fried has handed out some $750 million in lifelines to BlockFi and Voyager after the two lenders went insolvent amid the current crypto crash, and he has made clear that more bailouts might be on the way from his companies FTX and Alameda Research.

Trending in The Defiant

Goerli and Cooling Inflation Drive Ether to Two-Month High Crypto markets have reversed earlier losses and are rallying after softer than expected Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics.

Inside Solana’s ‘Textbook’ Response to Exploit On the night of Aug. 7, Austin Federa was at dinner with friends when notifications started pouring in through the Slack messaging app. “I was like ‘Oh, no – I have to go,’” Federa, the Solana Foundation’s communications chief recalled in a recent interview.

MakerDAO May Execute ‘Emergency Shutdown’ If Sanctions Hit DAI Now it’s MakerDAO’s turn. The DeFi blue chip is the latest protocol to be struck by shock waves from the U.S. Treasury Department’s decision Monday to sanction Tornado Cash, a so-called “mixer” that lets crypto users anonymize their transactions.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s beinglt on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.