🚀 Layer 1 Boom Drives Terra’s LUNA Token to the Moon

Hello Defiers! Here’s what we are covering today,

News

Decentralized Domain Name Sales Jump 300% Amid Budweiser’s Buy of “Beer.eth”

Can Anyone Say Exponential? OpenSea Doubles NFT Sales for Second Straight Month

Opinion

Video

Podcast

🎙Listen to the interview in this week’s podcast episode here:

Links

Into the Chef’s Jacket with Mudit-San: Head of Exploit Prevention & Spicy Tweets: SushiSwap

Crypto soars to account for 73% of trading commissions on eToro in Q2: CoinTelegraph

Facebook Considering NFT Support in Novi Digital Wallet: CoinDesk

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Markets

🚀 Layer 1 Boom Drives Terra’s LUNA Token to the Moon

SKYROCKET And you thought Solana was hot. Well, it is, but Terra’s LUNA token has eclipsed SOL in the last month. LUNA has skyrocketed about 265% in the last 30 days compared to SOL’s 150% performance, according to CoinGecko. While Avalanche’s AVAX token has more than tripled in value in that period one thing seems clear amid all this froth — investors love Layer 1 protocols.

LOWERING PRICES These platforms enable users to use DeFi apps built with smart contracts. Yet they tend to be much cheaper to use than apps on Ethereum such as Compound Finance and MakerDAO. Layer 1s achieve the lower fees through different means. Some like Binance Smart Chain process more transactions per block, and the higher supply lowers prices. Others such as Polkadot run many data structures, usually blockchains, in parallel, which also increases transaction throughput, lowering prices.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Domains

🍻 Decentralized Domain Name Sales Jump 300% Amid Budweiser’s Buy of ‘Beer.eth’

TLDR Anheuser-Busch InBev now owns the Web3 domain “beer.eth.” Meanwhile, no one is doing anything with Web 1.0’s beer.com. Beer.eth sold for 30 ETH on August 12, and AB InBev, which owns Budweiser, Bud Lite and many other major beer brands, confirmed to CoinDesk Wednesday that it was the buyer.

SPREE The news seems to have set off a .eth domain purchasing spree. Resales of such domains are up more than 300% over the last 24 hours, according to OpenSea data.

SO WHAT The purchase may represent a bet on the future of a decentralized internet. The “.eth” address is a top-level domain governed by the Ethereum Name Service. It represents a way to trustlessly create a pointer on the internet to a website, much like traditional “.com” and “.net” addresses do. ENS addresses are tracked using the non-fungible token (NFT) standard, and are bought and sold on OpenSea and other NFT marketplaces.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Jam Session

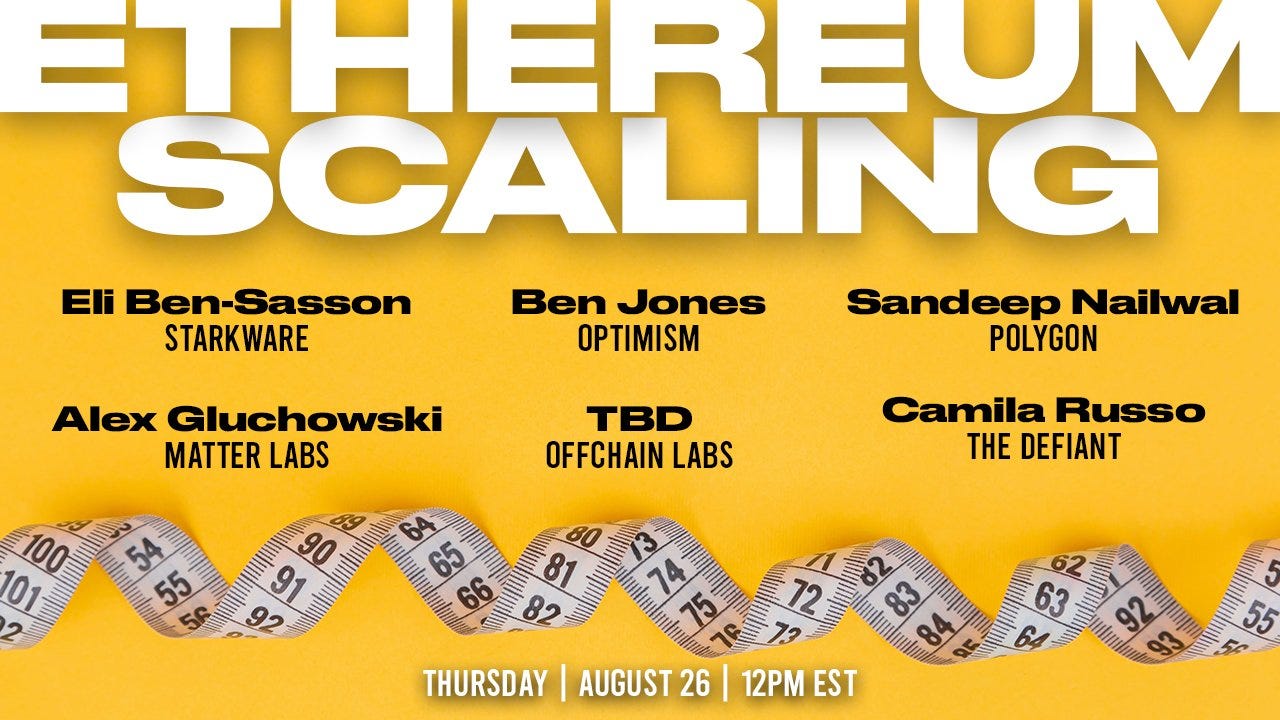

📺🎙🗯 Join us for a live jam session on #Ethereum Scaling, hosted by @CamiRusso

NFT Boom

📈 Can Anyone Say Exponential? OpenSea Doubles NFT Sales for Second Straight Month

It wasn’t too long ago — two-and-a-half weeks, to be precise — that Nate Chastain urged restraint. The NFT market had yet to reach an inflection point, the head of product at OpenSea told The Defiant’s Camila Russo in her weekly podcast. There was still plenty of room to run.

Well, it looks like we’ve hit that point. On Aug. 25, OpenSea recorded one million sales, more than double the 458,052 in July, which was itself twice as much as the level in June. The word exponential is rapidly becoming relevant at the NFT marketplace.

The growth has been a long time coming. OpenSea’s first registered user joined the platform in January 2018. Now volume is multiplying at a feverish clip. More than two thirds of its $3B in cumulative transaction volume has been recorded in August, according to OpenSea software engineer Rex Asabor.

SPONSORED POST

Molly Wintermute Releases Hegic V8888: 0% Trading Fees and Gas Fee-Free Options Trading

Hegic V8888 is live in mainnet:

https://www.hegic.co/

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum. With Hegic, DeFi and crypto users can trade 24/7 American, cash-settled, on-chain ETH and WBTC call / put options with no KYC or registration required for trading.

Hegic was founded 1.5 years ago in February, 2020. Hegic V888 (the previous version) was live for 10 months. The results achieved by V888:

● $492,075,000 total volume

● $22M record daily volume

● 6,450 options traded

● 2,825 unique users

● $10,415,000 earned by HEGIC staking lots holders

Introducing Hegic V8888

Trading Options on Hegic V8888

● 0% trading fees: pay only a premium

● 100% gas fee-free options trading

● The lowest prices for ETH and WBTC call / put options

● Auto-exercising of in-the-money options

● Tokenized options for trading on the secondary market

● 90 days is the new maximum period of holding options

Earning Yield on Hegic V8888

● Zero-loss options selling pools with auto-hedging

● x2 higher capital efficiency with flexible collateralization

● Independent pools for selling call and put options

● Individual lock-ups for each liquidity tranche deposited

● Pools’ unrealized profits front-running prevention

● Real-time data on pools APY and P&L per each option sold

Use Hegic now:

https://www.hegic.co/

Essay

✊🏼 Resist Hierarchy and Protect Financial Freedom: A Metaverse Manifesto

We’ve seen a rapid escalation of metaverse projects and build-outs this year — even Mark Zuckerberg is glomming onto the idea of using parallel digital spaces to change the way platforms like Facebook interact with users. In this essay for The Defiant, Shreyansh Singh goes to the barricades and calls for an all-out campaign to make sure the metaverse doesn’t fall prey to the command-and-control ethos of corporates, or any other hierarchical force. It’s a cri de coeur for our time.

INTERFACE While I don’t agree that we are already in the metaverse, it is true that we are staring v1.0 in the face. Humans have already surrendered a portion of their existence and autonomy to the digital world. That includes algorithms that govern our lives the same way a law of nature might, as well as communication, social interaction, and survival skills. We depend on our digital extensions to interface with the world.

AUTONOMOUS It is very easy to imagine what v2.0 might look like. A true metaverse should be a persistent destination where users can go to experience a parallel “reality”. It would need to be highly interoperable between existing major platforms, as self-sufficient as possible, and with clear ground rules and protections that could not be broken. Essentially, it would be an autonomous zone for users to explore and create. No individuals or organizations should have leverage over the operations, or the people.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Video

📺 First Look: Dollar Cost Average any ERC20 with Mean Finance

Links

🔗 Crypto soars to account for 73% of trading commissions on eToro in Q2: CoinTelegraph

Crypto grew to represent 73% of trading commissions on popular retail trading app eToro in the second quarter.

🔗 Facebook Considering NFT Support in Novi Digital Wallet: CoinDesk

Facebook is “definitely thinking about” using its Novi digital wallet to support non-fungible tokens (NFTs), said David Marcus, the company’s head of financial services, in an interview with Bloomberg.

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Brady Dale, Owen Fernau and Juan Pellicer, and edited by Camila Russo, Bailey Reutzel and Edward Robinson. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).