😧 Investors Scramble to Get a Grip on Depth of Three Arrows’ Trouble

Hello Defiers! Here’s what we’re covering today:

News

Markets

DeFi Tutorials

Podcast

🎙Listen to the exclusive interview with Mati Greenspan episode here:

Video

Elsewhere

Inside a Corporate Culture War Stoked by a Crypto C.E.O.: The New York Times

Mark Cuban: Crypto Firms Sustained by 'Cheap, Easy Money' Will Disappear in Crash: Decrypt

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

ZetaChain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Bancor, the only DeFi trading and yield protocol with Single-Sided Liquidity & 100% Impermanent Loss Protection. A safer, more sustainable way to earn DeFi yields on your favorite tokens - start earning now!

DeFi Funds

😧 Investors Scramble to Get a Grip on Depth of Three Arrows’ Trouble

Details on Debt Woes in $10B Crypto Fund Are Hard to Come By

By Jason Levin

STRESS The fear is palpable. Six weeks after Terra collapsed and one week after Celsius, the embattled crypto bank, suspended withdrawals, investors are anxiously watching a $10B hedge fund cope with serious stress.

LOANS Three Arrows Capital is sitting on what are believed to be billions of dollars worth loans secured by cryptocurrencies. With the market down 56% this year in its worst bear market since 2018, investors believe the collateral no longer supports the loans. Now the fund is on the hook to start paying them back, and everyone is wondering whether it will default.

LIQUIDATION On Wednesday, The Defiant reported that Three Arrows sold at least $40M worth of staked Ether as part of an apparent liquidation. It is widely believed that co-founder Su Zhu has been aggressive in using leverage to maximize his potential investment returns.

SUPER CYCLE “If 3AC were to become insolvent, it would be catastrophic,” The DeFi Edge, an investor with 175,000+ followers on Twitter, told The Defiant. “Zhu believed in the super cycle and used a ton of leverage to increase their position size.If the firm cannot pay off its positions, it’ll force more liquidations.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Lending

🧊 MakerDAO Votes to Freeze Aave’s Direct Borrowing of DAI

MakerDAO Errs on Side of Caution as Credit Risks Mount

By Samuel Haig

DISABLED MakerDAO is taking no chances. As doubts about crypto credit rock the digital asset landscape, MakerDAO, the protocol behind the DAI stablecoin, voted on June 15 to temporarily disable Aave’s DAI Direct Deposit Module (D3M).

COLLATERAL The move is tied to the drama engulfing Celsius, the crypto bank that suspended deposit withdrawals last week. Aave is a leading DeFi money market project, with a market capitalization of $866M. Its module is a smart contract that provides trusted third-party lending protocols direct access to generate DAI to a specific pool without posting collateral.

DEBTS The D3M enables Aave to create DAI that can only be transferred to its DAI lending pool. Disabling the module will mean that Aave can no longer generate DAI at will, allowing it only to pay off existing debts. The change will be available for execution on June 17.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Liqd — Unlock the Value of Your NFTs Without Selling Them

Liqd is an NFT marketplace built to enable the lending and borrowing of blue chip NFTs. The platform enables individuals who hold blue chip NFT assets to unlock liquidity by borrowing against the value of their asset(s).

In turn, Liqd unlocks a peer-to-peer lending opportunity for crypto holding individuals to passively earn interest on their capital, backed by the value of the underlying NFT asset.

In times of volatility and market unrest, people need access to liquidity. Regardless of why this need for liquidity has arisen, you should never be forced to sell your NFTs. The Liqd platform empowers NFT holders by providing an alternative to selling at market price, helping protect a projects floor price.

With ZERO fees for the first month, now is the time to utilise Liqd and get liquidity on your favorite NFT’s.

Sign up for our newsletter for early access and hidden alpha... don't say we didn't warn you - Liqd NFT

Bear Market

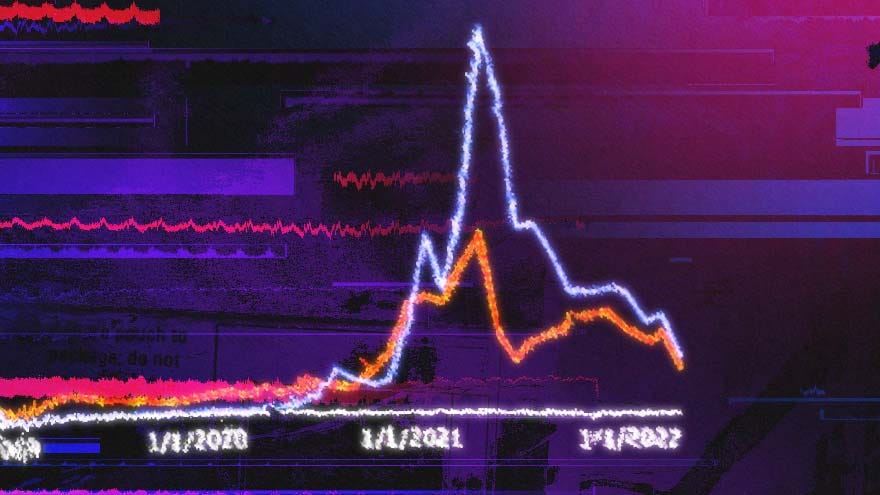

😬 Crypto Liquidations Spike to $480M in Last 24 Hours

By Samuel Haig

NEWS In a sign of the magnitude of the crypto crash, more than $1B worth of digital assets were liquidated on June 14, according to data from Coin Glass. Around $480M was wiped out on centralized exchanges over the past 24 hours. Ether represents 42% or $202M of margin calls, while $154.4 worth of BTC positions have been taken out.

MARGIN CALLS On-chain liquidations have also surged, with 370 margin calls driving more than 53M DAI on MakerDAO alone. By contrast, 401 liquidations worth $55.8M have taken place over the past 30 days. There are also an estimated $202M worth of positions at risk on top lending protocol Aave should the price of Ether slump below $1,009.

COLLATERAL Liquidation describes when a leveraged position is forcefully closed due to the value of the collateral assets backing it falling below the required margin threshold to keep it open.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

📈 Crypto Markets Sustain Rally After Monster Rate Hike

RALLY Crypto markets sustained the rally triggered Wednesday when the Federal Reserve raised benchmark interest rates 0.75%, the biggest hike since 1994.

PLUNGE ENDS Ether was up 9.2% in mid-morning trading U.K. time, and Bitcoin jumped 5.2% in the last 24 hours, according to data from CoinGecko. The platform’s DeFi index, comprising top names in the sector such as Solana and Uniswap, ended its recent plunge as its market capitalization jumped almost 5%.

RELIEVED Investors appeared to be relieved by the Federal Reserve’s action to dampen inflation, which hit 8.6% in May and tipped the S&P 500 into a bear market. The Fed signalled that rate hikes of this magnitude would not be commonplace going forward.

TRACKING STOCKS As they have for months, cryptocurrencies moved in line with stocks, which jumped after the U.S. Federal Reserve raised interest rates by 75 basis points, its largest increase since 1994. Fed Chairman Jerome Powell said another increase of this magnitude would not be likely at the Fed’s next meeting.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DEXs

🧐DEX Trading Volume is About to Drop Below CEX Volume for the First Time in Over a Year

By Owen Fernau

NEWS Decentralized exchanges have been one of the success stories of DeFi, beating out their centralized counterparts last year. Now, things are turning around.

MARKET SHARE The market share of decentralized exchanges (DEXs) has plunged to 55% from a record 80% in June 2021. That’s just marginally higher than trading volume on CEXs, according to a chart put out by Chainalysis. DEX trading volume climbed to as high as $240B at its peak, compared with approximately $100B in CEX volume at the time.

VOLUME If the trend of the last year or so continues CEXs will overtake DEXs as the bear market deepens. Granted, the comparison between transaction volume on both types of exchanges isn’t totally apples-to-apples — on-chain volume for CEXs refers to the value of the assets entering and exiting the exchanges, not specifically the trade volume which happens on off-chain orderbooks.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Web3 Social Media

📫 Nansen Bets Web3 Messaging Will Deter Hacks and Spa

By Jason Levin

PLATFORM Competition to become the go-to crypto native messaging platform is intensifying with data analytics platform Nansen joining the race.

TOKEN-HOLDERS Nansen launched a crypto-native messaging platform currently open in beta to their paid users as well as token-holders of select communities, the company said in an emailed statement.

HACKS The platform, Nansen Connect, was built as a reaction to the countless hacks, pump and dump groups, and spam that the crypto community experiences on Twitter and Discord. Nansen Connect is only open to paid Nansen Standard members and token-holders of NFT collections like Bored Ape Yacht Club, Hashmasks, and Doodles.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Guides

🛠 Bear Market Survival Guide: The Metrics You Need to Know in a Tough Market

By Claire Gu

STEPS TO TAKE Yes, it’s a bear market, and everything looks grim. But that doesn’t mean investors should despair. Indeed, there are number of steps you can take to evaluate the crypto market at this juncture.

METRICS That’s why The Defiant is launching a series of guides to help readers navigate this tricky period in the markets. In this debut installment, we look at some of the most important metrics investors should examine when sizing up a blockchain project.

TOKENOMICS The core concept of crypto tokenomics is supply and demand. These forces set prices. The number of tokens issued to the public is controlled by the project’s team or a pre-defined algorithm. Here’s a primer on the essentials of tokenomics:

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Hot Stuff: Coinbase Dumps 18% of staff, 3AC on the rocks

Elsewhere

🔗 Inside a Corporate Culture War Stoked by a Crypto C.E.O.: The New York Times

Jesse Powell, a founder and the chief executive of Kraken, one of the world’s largest cryptocurrency exchanges, recently asked his employees, “If you can identify as a sex, can you identify as a race or ethnicity?”

🔗 A Manhattan Landlord Listed His Office Building in ETH as an NFT. Then Its Price Dropped $12M: CoinDesk

A New York City office building went on sale for $29 million two weeks ago, but with a Web 3 twist: The rights to purchase the property are being sold as a non-fungible token (NFT) on OpenSea.

🔗 Mark Cuban: Crypto Firms Sustained by 'Cheap, Easy Money' Will Disappear in Crash: Decrypt

Billionaire owner of the Dallas Mavericks Mark Cuban has weighed in on the latest crypto crash, saying that projects with no “valid” business model will eventually die out.

Trending in The Defiant

🌪 Rumors Swirl About Financial Stress at Three Arrows On-chain data has prompted speculation that Three Arrows Capital, a crypto-focused, Singapore-based hedge fund, is insolvent and may become the latest high-flying company to crash in the bear market.

Truth Labs Revealed as Team Behind Goblintown Goblintown captured the imaginations of NFT collectors over the past month even as crypto markets burned.

Coinbase Leads Wave of Layoffs as Crypto Girds for Rough Stretch First came the market collapse. Now come the layoffs. When Coinbase announced it was laying off almost a fifth of its staff, or 1,100 employees, on Tuesday it was clear a tough period for the young cryptocurrency industry is about to get a whole lot tougher.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason Levin, DeFiDad, Aleksandar Gilbert, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Subscribers get full access, while free signups get only part of the content.

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).