🌪 Flashbots Blacklists Wallets Swept Up in Tornado Imbroglio

Hello Defiers! Here’s what we’re covering today:

News

Exploits

NFT Roundup

Video

Elsewhere

The Chopping Block: Did OFAC Overstep by Sanctioning Tornado Cash? Unchained

'No Current Plans' for Scrapped V1 CryptoPunks NFTs, Says Yuga Labs: Decrypt

How a Third-Party SMS Service Was Used to Take Over Signal Accounts: Vice

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

Tornado Fallout

🌪 Flashbots Blacklists Wallets Swept Up in Tornado Imbroglio

U.S. Sanction of Crypto Mixer Prompts MEV Defense Platform to Open Source

By Samuel Haig

BLACKLIST On Aug. 17, Hasu, the strategy lead at crypto firm Flashbots, confirmed the project is blacklisting wallets sanctioned by the U.S. Treasury Department, sparking outcry from the Ethereum community.

OPEN SOURCING On the same day, Flashbots announced it would hasten open-sourcing some of its code in response to the U.S. Treasurys sanction of the Tornado Cash protocol last week.

MEV Flashbots specializes in addressing MEV, or Maximal Extractable Value, a maneuver in which validators manipulate the order of on-chain transactions to pocket profits by taking advantage of price differences. Its an arbitrage trading strategy made possible by decentralized blockchains.

SANCTIONS Flashbots open-sourced some of its MEV-Boost code in response to the sanctions, highlighting that its U.S.-based team must comply with the legislation. Flashbots said the move will encourage competitions and mitigate a potential single point of failure.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Lending

💦 Solend Cranks Up The Risk with Liquidity Pools For All

Solana-based Lender Says Beware of its Own Offering

By Jason Levin

NEWS In a move that’s bound to raise eyebrows, Solend just launched “permissionless liquidity pools” that lets anyone play banker.

BORROW FUNDS Solend, an algorithmic lending protocol that operates on the Solana blockchain network, lets users deposit crypto tokens into a liquidity pool in exchange for earning interest and the opportunity to borrow funds.

BE CAREFUL Yet in a break from past practice, Solend is not creating the pools but rather is letting anyone set them up. Like a regular liquidity pool, permissionless pools share fees with the creator. Because anyone from a well-meaning DeFi investor to the most degenerate of degens can create a liquidity pool, Solend advises users to “be careful about which pool you interact with”.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Klaymakers22 global hackathon is now open for registration

Buidl your way to over US$1 million in prizes at Klaymakers22, Klaytn’s global flagship hackathon.

With 5 tracks across Klaytn Core+, Metaverse & NFTs, DAO, Fi+, and Public Good, plus Sponsors’ Challenges from our ecosystem partners, Klaymakers22 aims to showcase the creativity and diversity of Web3 developers around the world.

If you think you’ve got the skills to rise as a pioneering Klaymaker, here’s your chance to prove it—register now to compete for over US$1 million across a prize pool of $300,000, sponsors’ challenge prizes, grant funding, and incubation opportunities.

Plus, the first 200 teams to register will receive $50 worth of AWS credits upon submission of a buidl for Klaymakers22!

Crypto Regulation

🏛 Fed Instructs Banks To Report Crypto Activity

U.S. Central Bank Says Large Scale Adoption Of Stablecoins Could Pose A Severe Risk To Financial Stability

EIGHT DAYS Regulators just cant get enough of crypto. Just eight days after the U.S. Treasury sanctioned Tornado Cash, the Federal Reserve is asking all regulated banks to keep it informed about all crypto-related activities.

LAWS According to the Aug. 16 letter, banks should assess if the crypto-asset activities they engage in are legally permissible under state and federal laws. In addition, banks are asked to notify the Fed before starting any new crypto activities.

CRITICAL The Fed highlights a myriad of risks inherent to crypto, calling the technology “nascent and evolving” while being particularly critical of “open, permissionless networks.” “Crypto-assets can be used to facilitate money laundering and illicit financing. Some crypto-assets have limited transparency, making it difficult to identify and track ownership.” the letter says.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Airdrops

💸 Safe Proposes Airdrop for 22K Users

Early Users Have Been Allocated 5% Of The SAFE Supply

AIRDROP Safe, the protocol recently rebranded and spun off from parent company Gnosis, announced plans to airdrop its SAFE token to almost 22,000 crypto wallets.

FEEDBACK The average user to receive SAFE tokens will get a little more than 2,200, according to the proposal published Thursday. Its author, Safe co-founder Tobias Schubotz, has called for community feedback before putting the proposal to a vote.

SIGNATURES The protocol allows users to create Safes — smart contract crypto wallets that require multiple signatures to verify transactions. Such redundancy makes it less likely an individual would compromise their crypto holdings or that a rogue employee could make off with the assets in a company’s treasury.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Exploits

🦹🏻♂️ Crypto Hackers Bagged $2B This Year as Exploits Jumped 58%: Report

Chainalysis Found DeFi ‘Uniquely Vulnerable’ to Exploits

By Claire Gu

NEWS Crypto may be slumping but its a bull market for hackers and other bad actors who stole $1.9B worth of assets from projects this year, according to a report released this week by Chainalysis.

JUMP That marks a 58% jump in the ill-gotten gains, the blockchain analysis group found. Almost all of the crypto assets stolen in the first quarter were taken from DeFi protocols compared to 72% in 2021.

SURGE The surge in exploits poses a critical test for decentralized finance. The industry is striving to overcome the bear market and establish its protocols as a viable alternative to traditional finance. If protocols cannot safely protect their customers assets then its safe to say its brand as a truly innovative proposition will be tarnished.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Roundup

📈 Demand for Ethereum Domain Names Surges

ETH Addresses and a Gold Bored Ape Bright Spots in a Rough Stretch for NFTs

By yyctrader

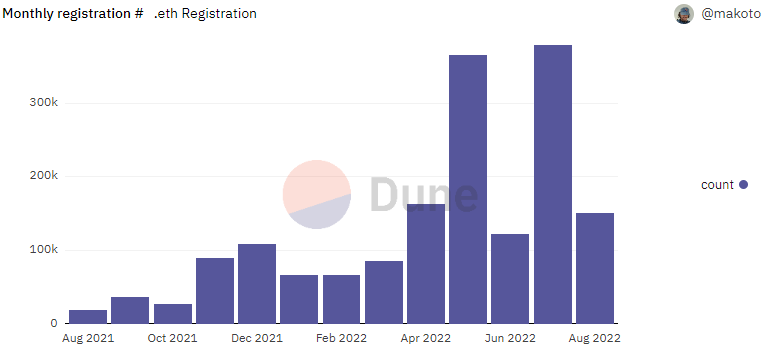

MILESTONE Demand for .eth addresses shows no sign of slowing down. On Aug. 16, the Ethereum Name Service (ENS) crossed the milestone of 2M registered domains as the blockchain-based protocol recorded 378,804 purchases in July.

CRAZE The craze kicked off in May with the 10K Club, which consists of four-digit names from 0000.eth to 9999.eth. Collectors have since moved on to other combinations of letters and numbers, including non-English characters. Male and female first names are the flavour du jour, according to ENS.Vision.

BASKETS In the latest twist, crypto exchanges KuCoin and MEXC have fractionalized baskets of ENS domains. KuCoin has issued 1M HIENS4 tokens for each 4-digit name, which are up 97% in the past 24 hours.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 The Defiant Weekly: The Great Tornado Cash Debate

Elsewhere

🔗 The Chopping Block: Did OFAC Overstep by Sanctioning Tornado Cash? Unchained

Welcome to The Chopping Block! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra chop it up about the latest news in the digital asset industry. In this episode, Laura Shin, host of Unchained and author of The Cryptopians, also joined the conversation.

🔗 'No Current Plans' for Scrapped V1 CryptoPunks NFTs, Says Yuga Labs: Decrypt

The revival of scrapped “V1” CryptoPunks NFTs from Larva Labs’ original bug-ridden 2017 rollout has added a wrinkle to the debate over provenance, ownership, and artists’ intent in the Web3 world.

🔗 How a Third-Party SMS Service Was Used to Take Over Signal Accounts: Vice

Last week, hackers broke into the systems of Twilio, a cloud communications company that provides infrastructure to other companies to automate sending text messages to their users.

Trending in The Defiant

Dev Estimates Exact Timing Of The Merge First, it was the third quarter. Then it was sometime in September. Now, we know that The Merge, the most sweeping upgrade in Ethereums history, will likely take place on Sep. 15.

‘Real Yield’ Emerges As A New DeFi Trend Whether its DeFi 2.0 or ultrasound money, crypto loves its narratives. The latest one is “real yield,” which, like the DeFi trends before it, is being touted in both substantive and vaporous ways.

Growing List Of DeFi Apps Ban Tornado Cash Users Several dapps on Ethereum have started to ban users in the wake of sanctions levied on Tornado Cash. Major protocols currently include Circle, dYdX, Aave, Uniswap, and Balancer.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

Free signups to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

Prime defiers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

You can start a prime membership for free right now with this link. You’ll get full access for 7 days. It’s 100% risk-free.