🔥 EXCLUSIVE: Head to Head with Andre Cronje || a Defiant SPECIAL

Hello Defiers! Here’s what we’re covering today:

News

The Defiant Saga

Research

Podcast

🎙Listen to the interview with Synthetix Founder Kain Warwick:

Video

EXCLUSIVE: Head to Head with Andre Cronje || a Defiant SPECIAL

Real Vision vs. The Defiant: CAN DEFI WITHSTAND BIG LIQUIDATIONS? w/ RAOUL PAL

Links

Fireblocks raises $550 million in Series E funding, now valued at $8 billion: the Block

Genesis is exploring institutional hedging and liquidity products for NFTs: The Block

White House reportedly preparing executive order on crypto: CoinTelegraph

Trending in The Defiant

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down 93% and Called a ‘Ponzi’

Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Step Finance is the portfolio management dashboard for Solana users to visualise, analyse, execute and aggregate transactions across all Solana contracts in one place. Get started now!

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Cryptex Finance (CTX) the fully decentralized creators of TCAP, The World’s First Total Crypto Market Cap Token.

Concordium is made for the future economy. It’s the first fully compliant blockchain with Layer 1 ID, predictable fees valued in FIAT and private and public transactions. Discover more.

Defiant Scoop

📺 EXCLUSIVE: Head to Head with Andre Cronje || a Defiant SPECIAL

DeFi Drama

🌪 Frog Nation Rocked by CFO Scandal as TIME Token Plummets

NEW HEIGHTS Just weeks ago, Daniele Sesta was hailed as one of DeFi’s golden boys. His Frog Nation, a collective of multi-chain DeFi projects like Abracadabra, Wonderland and Popsicle Finance, was scaling new heights, and Abracadabra’s innovative UST Degenbox strategy was the place to be for stablecoin yields.

REVELATIONS Earlier this week, Frog Nation made headlines by adding SushiSwap to its ecosystem and Sesta vowed to “clean up” the struggling exchange. Now, he’s getting death threats from angry investors in the wake of revelations that Frog Nation’s CFO was a co-founder of defunct Canadian crypto exchange QuadrigaCX, which collapsed in 2019 causing at least $190M in investor losses.

FALLEN January hasn’t been kind to rebase tokens, with OlympusDAO and its many forks suffering massive drawdowns amid the crypto sell-off. Wonderland was no exception, and by Jan. 24, it’s TIME token had fallen to $800 from $3500 at the beginning of the year.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Headline Risk

📉 Frog Nation Tokens Tumble on News that Its CFO is Allegedly a Former QuadrigaCX Co-Founder

NEWS Sifu, the chief financial officer at the Daniele Sesta-led network of DeFi projects known as Frog Nation, is out, per a statement by Sesta on Thursday. Sesta has confirmed his real identity is that of Michael Patryn, a co-founder of failed Canadian crypto exchange QuadrigaCX.

SCREENSHOTS The news first surfaced on Twitter when user zachxbt shared screenshots of a conversation with Sesta.

EVIDENCE “I think it is what it is. I preferred to confirm and cut the bull*#it. Even though I know Zach didn’t have hard evidence, it’s better that the community knows the truth and votes on it,” Sesta told The Defiant over Twitter DM. Sifu has since posted a statement in the Wonderland Discord server.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Grift

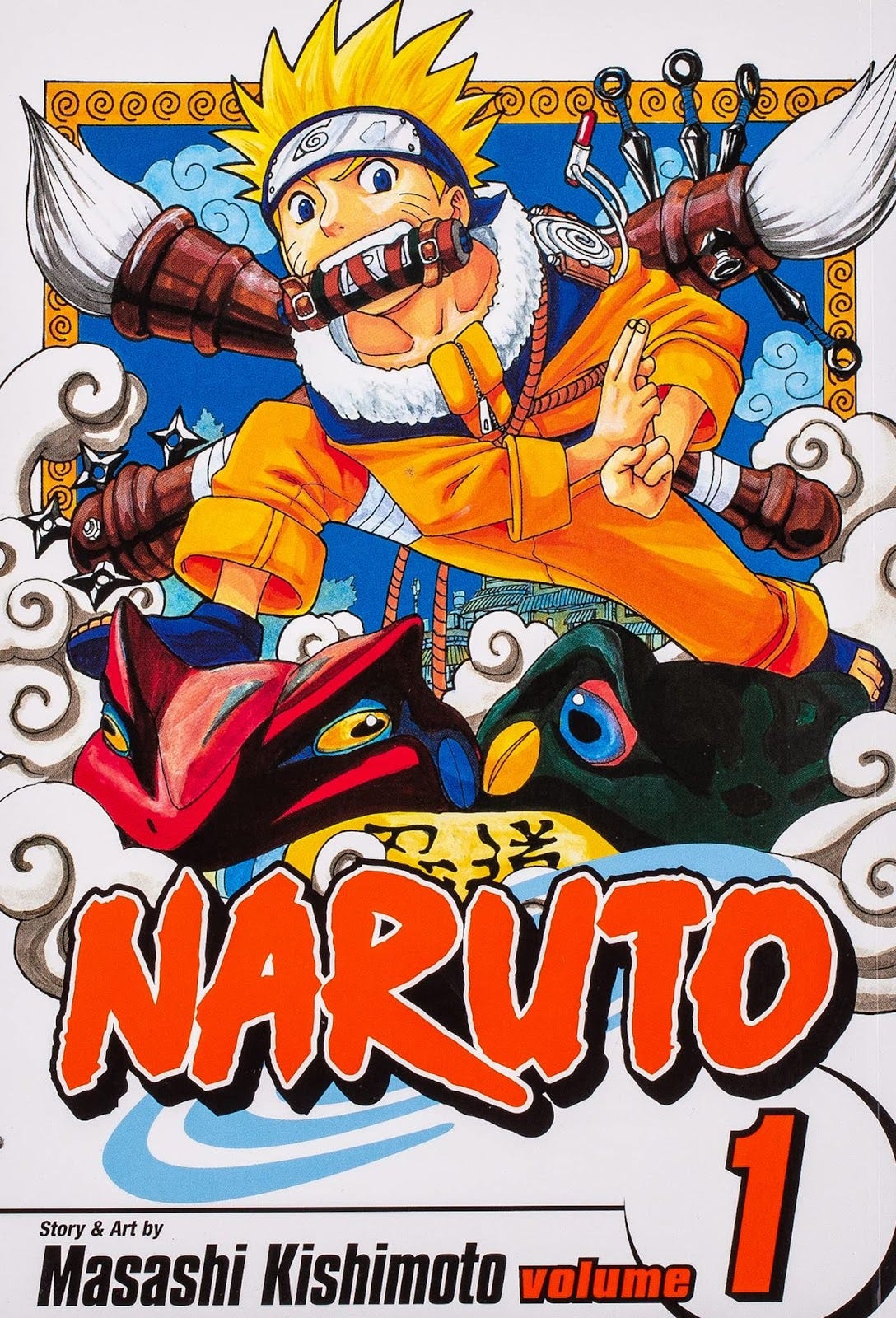

🥷🏻 ‘Believe It!’ How a Manga-Loving Geek Exposed the Scam Targeting Naruto NFTs

In this exclusive feature for The Defiant, Dan Kahan reveals how he uncovered a copyright scam targeting one of the most beloved mangas of the last quarter century.

A CULT “It’s almost like they joined a cult. The more I question, the more they think I’m hating. I just want to protect them.”

GUT FEELING By the time I received this message on Dec. 30, I’d already spent a month investigating Bejutsu — a massively hyped NFT project claiming to hold the official license for intellectual property from Naruto, one of the most popular manga series ever published. Fueled by a lifelong passion for anime and manga and a gut feeling, I was convinced Bejutsu was a scam. But I couldn’t prove it beyond a shadow of a doubt.

MESSAGE Until now. The message came from a friend of one of the artists working for Bejutsu. Suspicious about the project’s legitimacy, he sent me a copy of Bejutsu’s purported licensing agreement. As soon as I saw the contract—an elusive piece of evidence that, by this point, I’d been hunting down for days—I knew I’d found Bejutsu’s smoking gun.

CRYPTIC Nearly everyone I spoke to who was involved with the project asked me to wait before going public. That included artists, staff, and Clay Taylor, Bejutsu’s self-assured co-founder. They gave me the same cryptic response: Bejutsu’s proof will come on Jan. 7. Just wait until Jan. 7.

HYPE But in the hype-fueled NFT space, even unknown projects can sell out within minutes of an unannounced stealth launch. Naruto sits at the intersection of pop culture nostalgia and rabid anime fandom. Officially licensed Naruto NFTs possessed the potential to skyrocket. And Bejutsu was designed to turn its characters and imagery into NFTs that would sell for millions. At least, that was the plan. And Clay’s instincts were spot on — Bejutsu attracted 40,000 followers to its Twitter account before it even launched. And 10,000 users flooded its Discord server within a minute of opening. I wanted to stop the scam before it reached wider audiences.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Research

🖼 Exclusive DappRadar Report: Why are NFTs Sidestepping the Crypto Crash?

It’s one of the most intriguing wuestions in the market during this turbulent period. Our friends at DappRadar unpack the forces that are charting a separate course for NFTs.

HOSTILE ENVIRONMENT In recent weeks, a combination of macroeconomic events has shaken the markets, reminding everyone about the industry’s latent risks and ubiquitous volatility. The problems in Kazakhstan around Bitcoin mining made waves. With a new COVID outbreak, the unease about a likely rise in the interest rates by the Federal Reserve and the latest political issues in Ukraine created a hostile environment dragging capital markets down.

CORRELATION The correlation between crypto and traditional markets made the effect widely felt in blockchain assets, with Bitcoin and Ethereum’s ETH losing half their value since all-time highs in November. The same goes for BNB, ADA, SOL, AVAX, SAND, MANA, GALA, and several other cryptocurrencies performing well historically. The total crypto market cap shrunk to $1.6T from $2.9T in that period.

FEAR Without question, the crypto market is currently experiencing a challenging period. The sentiment in the market signals fear. However, the metrics related to the performance of specific blockchain verticals like NFTs might suggest otherwise.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Unstoppable Domains is The #1 provider of NFT domains. With endings like .crypto, .x and .nft you can replace your long complex wallet addresses, verify ownership of your NFTs, login into web3 apps and join 10’s of thousands of people using them as their Twitter usernames. Better yet, with Unstoppable domains you don't have to worry about gas or renewal fees, YOU OWN IT. Get your name for as low as $5 here.

The Tube

Real Vision vs. The Defiant: CAN DEFI WITHSTAND BIG LIQUIDATIONS? w/ RAOUL PAL

Links

🔗 Urgent Considerations of Impact on Blockchain/DeFi of the SEC's Proposed Regulation ATS Amendment: Substack

The SEC's new securities exchange / ATS amendment proposal has been published, alongside a strenuous dissent from Commissioner Hester Peirce.

🔗 Fireblocks raises $550 million in Series E funding, now valued at $8 billion: the Block

Fireblocks, an institutional crypto custody provider, has raised $550 million in a mega Series E round and is now valued at $8 billion.

🔗 Launch Aave V3 on Metis Andromeda: Snapshot

Proposal for the deployment of Aave V3 on Metis Andromeda Mainnet.

🔗 Genesis is exploring institutional hedging and liquidity products for NFTs: The Block

The institutional market for non-fungible tokens is heating up, with Genesis Global confirming that it wants to build out its own platform to address the needs of large traders in this fast-growing corner of the crypto market.

🔗 White House reportedly preparing executive order on crypto: CoinTelegraph

Joe Biden’s White House is expected to issue an executive order in the coming weeks about actions the U.S. government will take regarding digital assets.

Trending in The Defiant

Anchor Protocol Burns Through Its Reserves As Deposits Pile Up Terra’s DeFi protocol for savers is burning through its savings account.

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down 93% and Called a ‘Ponzi’ OlympusDAO held so much promise when it exploded on the DeFi scene in 2021.

Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance Uniswap, the leading decentralized exchange by trade volume, now processes more ETH/stablecoin volume than any centralized crypto trading venue.

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)