🔥 EIP-1559 is Live — ETH is Already Burning

Hello Defiers! Here’s what we are covering today,

News

Video

Links

Remarks Before the Aspen Security Forum: SEC Chair Gary Gensler

DeversiFi launches first Layer 2 bridge between Polygon for instant transfers: DeversiFi

The Evolution of Yearn with Tracheopteryx and Facu: ZeroKnolwedge

French Fund Manager Unveils EU-Regulated Bitcoin-Stocks ETF: Bloomberg

Podcast

🎙Listen to the interview in this week’s podcast episode here:

🔥 Also, EIP-1559 went live today! Catch up with our coverage:

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

EIP-1559

🔥 EIP-1559 is Live — ETH is Already Burning

Ethereum today implemented its London hard fork, with its most anticipated update: EIP-1559. ETH is already burning at each block.

EIP-1559 will change Ethereum’s gas mechanism in an effort to make gas fees more predictable. The Ethereum protocol now has a base fee, which fluctuates with demand, so it won’t necessarily lower transaction costs, but it now means users won’t have to outbid others to get their transactions approved; if you pay the base fee, your transaction will go through.

Notably, the base fee gets burned, reducing the supply of ETH in the market. If the amount of ETH burned from transactions exceeds the amount of ETH issued, then Ethereum’s cryptocurrency could become deflationary.

Over 100 ETH has been burned in under two hours after the update went live, according to ethburned.info. ETH is little changed at $2,617 at the time of writing, after rallying 14% in the seven days leading up to the upgrade.

Image source: https://ethburned.info/

Livestream Debate

✊🏼 SEC’s Peirce Takes “Liberty-Loving” Perspective after Gensler Calls for Tighter Crypto Regulation

NEWS SEC Commissioner Hester Peirce is taking a “liberty-loving perspective” when it comes to cryptocurrency and DeFi, contrasting with statements by the agency’s chairman on Tuesday.

TRUST For Peirce, who joined a panel hosted by The Defiant and DeFi Watch on Aug. 4, if users are voluntarily deciding to trust the code over a company then they accept the risks and government regulators shouldn’t need to clamp down on the industry.

PEIRCE “They’re dealing directly with one another and they’re selecting to choose to trust the code and not to trust a centralized intermediary,” said Peirce. “I tend to approach things from a pretty liberty-loving perspective, which is that if two people decide they want to enter into a transaction, and they’re doing so voluntarily, with full information, that should be fine.”

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

⚔️ Governance Wars Break Out Over Proposal to List BOND on Aave

UNEXPECTED RESISTANCE Supporters of the tokenized risk protocol BarnBridge are upset as a proposal to list the project’s BOND token as collateral on lending platform Aave has been met with unexpected resistance from a handful of large token holders in the final stretch of the on-chain vote.

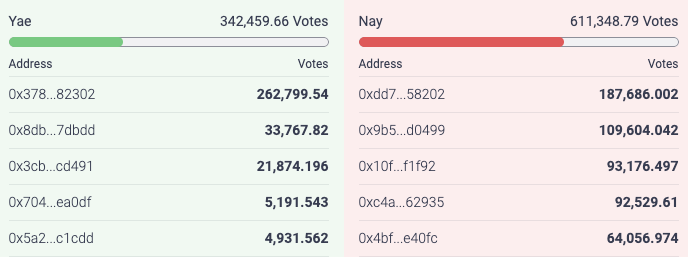

HANDFUL OF WALLETS Currently, there are 611K “nay” votes from AAVE and StkAAVE holders, who cast votes on Aave Improvement Proposals (AIP). And those outnumber “yae” votes by almost two to one. What’s more, 99.9% of the nay votes have come from only six wallets.

DEFIANCE Crypto asset fund Defiance Capital controls the top two no-voting wallets, 48.6% the no-votes, according to analytics platform, Nansen.

“Our reason for voting no is very simple, BOND liquidity is too low for it to be added as collateral right from the beginning,” tweeted Arthur Cheong, founder of the fund.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Video

📺 Livestream: DeFi Transparency x The Defiant & DeFiWatch

📺 First Look: Alchemy NFT - the remix layer for NFTs

Links

🔗 Remarks Before the Aspen Security Forum: SEC Chair Gary Gensler

Thank you for that kind introduction. It’s good to join the Aspen Security Forum. As is customary, I’d like to note that my views are my own, and I’m not speaking on behalf of the Commission or the SEC staff.

🔗 DeversiFi launches first Layer 2 bridge between Polygon for instant transfers: DeversiFi

Fuelling the speedy movement of assets between layer 2’s and sidechains, users will be able to seamlessly and quickly transfer funds between ecosystems without paying gas!

🔗 The Evolution of Yearn with Tracheopteryx and Facu: ZeroKnolwedge

This week, Anna and Tarun host Tracheopteryx and Facu, two core devs at Yearn.finance, to take an introductory dive into the past and present of Yearn.

🔗 French Fund Manager Unveils EU-Regulated Bitcoin-Stocks ETF: Bloomberg

Paris-based alternative investment manager Melanion Capital received regulatory approval for an exchange-traded fund seeking to track the Bitcoin price and which satisfies key European Union rules.

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Dan Kahan and YYC Trader, and edited by Bailey Reutzel and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).