👀 Double-Digit Yields on Stables With Notional, Orion Saver and Abracadabra

DeFi Alpha is a weekly newsletter published every Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, as well as our Degen in Chief yyctrader, which aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms.

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC and stablecoins.

ETH - staking Premia LP for selling ETH call options in Premia Finance for a total annualized return = 134% APR

This yield is backed by 97% from option premiums + 37% PREMIA mining rewards

Keep in mind as a Premia LP selling ETH call or put options, you can quickly see that performance drop if the market moves against you.

If you don’t understand selling options, avoid this.

To participate, deposit WETH into the Pools tab under WETH Call pool

WBTC - stake Premia LP for selling WBTC call options in Premia Finance for a total annualized return = 157%

Similar to the ETH call options, this yield is backed by 87% from option premiums + 70.7% PREMIA mining rewards

Keep in mind as a Premia LP selling WBTC call or put options, you can quickly see that performance drop if the market moves against you.

If you don’t understand selling options, avoid this.

To participate, deposit WBTC into the Pools tab under WBTC Call pool

Stablecoins - deposit alUSD, FEI, or FRAX stablecoins in the new Vesper Finance Orbit pools to earn an annualized rate as high as 58%

Go to the Vesper Finance Orbit dApp

Choose a pool based on the asset to deposit (ie alUSD)

The yield is backed by an underlying vault strategy, which Vesper classifies as “Aggressive” in terms of risk level, but the larger yield is backed by VSP rewards.

Be mindful there’s a 0.6% withdrawal fee and 20% performance fee. 95% of those fees go into a treasury which buys back VSP from the open mark and distributes it to VSP stakers.

To participate, deposit into the alUSD, FEI, or FRAX pools (2 transactions) and return whenever to claim VSP, which can be restaked here in the VSP governance pool earning another 28% in VSP

🪂 Airdrop Alpha

Airdrop Hunting Alpha: Each week, we’ll do our best to update a list of the most obvious DeFi protocols that have yet to announce and/or launch a token. In most cases, we believe these projects are likely to airdrop a token in the future. By participating in these DeFi applications, there’s a chance but not a guarantee one can earn token rewards.

(New!) Ronin Blockchain - by depositing assets on the Ronin blockchain or playing Axie on this Ethereum sidechain built specifically for blockchain games, we speculate you’ll earn the future RON token. RON will be used to pay gas fees and secure the network for both Axie Infinity and future games/products hosted on the chain.

(New!) Katana DEX - Farm/stake the AXS/WETH LP or SLP/WETH LP on this forked AMM on Ronin to earn WRON (wrapped RON), so this is a guaranteed reward but for a token not yet trading

Element Finance - stake/lend to earn fixed interest with fixed terms on Ethereum

DeFi Saver - a one-stop dashboard for creating, managing and tracking DeFi positions across Aave, Compound, Maker, Liquity, and Reflexer

Set Protocol - one of the earliest DeFi protocols yet to launch a token for DeFi asset management, popular for TokenSets and known for powering IndexCoop indexes

Goldfinch Finance - lend permissionlessly to institutional borrowers without collateral

Hop Protocol - become an LP to enable bridging instantly between Ethereum Mainnet, Polygon, Arbitrum, or Optimsm without waiting for long delays in withdrawals; DeFi Dad has a full blown video tutorial on how to become a Hop LP and potentially earn a future HOP airdrop.

Francium - leveraged yield farming similar to Alpha Homora but on Solana, one can choose to simply lend single assets or hold leveraged LPs to potentially earn an airdrop here.

Opyn - one of the OG decentralized options protocols on Ethereum, with major investors that signal a token has to be in their future. Buy/sell puts or call options to earn a possible future airdrop.

Polymarket - one of the strongest players in the DeFi prediction market vertical, bet on an outcome related to crypto, politics, sports and more or add liquidity

Zapper - participate in Zapper trading, lending, providing liquidity, or yield farming; given the Zapper Quests and NFT Rewards program, it can be surmised that if Zapper ever releases a token, this is one way they might do a retro airdrop

Zerion - same can be said speculated about Zerion; if they ever release a token, they’re likely to reward those who interacted with their smart contracts swapping, lending, providing liquidity, or borrowing.

🚀 Token Launch Alpha

Each week, we also do our best to highlight new DeFi-related token launches, as long as they use permissionless DeFi launchpads such as Copper Launch, Deversifi Launch Market, or SushiSwap Miso. As with all the rest of the content in The Defiant, there is no pay-to-play here. We are more likely to highlight projects that already have a thriving community delivering on their stated mission. Please do not interpret this as a recommendation or endorsement to buy tokens. This is purely for informational purposes about new tokenized communities.

HumanDAO is a new p2e guild aiming to support new players in emerging economies. HumanDAO notably skipped a private investor round to maximize allocating rewards to their community. The DAO already supports 100 Axie scholars and claims part of the token launch is the bootstrapping needed to scale the DAO’s intention to own more in-game assets and support more players. HDAO’s token sale is currently 2.5 days into a 5 day auction on Copper Launch on both Polygon and Ethereum.

CRE8R DAO is a decentralized DeFi content agency, with some long time DeFi content creators such as Gabriel Haines who have received Gitcoin Grants previously for their content creation and our very own Alp Gasimov. CRE8R will govern the CRE8R DAO 2.0 GOD MODE, which also involves $BRICK (a version of OHM), where those holding CRE8R will get a share of the $BRICK that is minted as profit every time a bond is purchased. CRE8R’s token sale is 3 days into a 6 day auction on Copper Launch on Ethereum.

Are you liking all this alpha? Then you know what to do:

🧑💻 Defiant Starter Tutorials

How to Earn Up to 16% APR Lending Stablecoins to Notional Finance

Opportunity: Lend DAI, ETH, USDC, or WBTC to earn variable interest + NOTE rewards

Time to Complete: 5-10 minutes if paying the recommended HIGH gas price or higher on the Etherscan gas tracker.

Estimated Length of Rewards Program: There’s no end date to these lending pools.

Gas + Protocol Fees: Based on gas prices between 100-200 Gwei on Ethereum, it should cost $150-$300 of ETH to deposit (if you prefer Polygon, there’s an Orion Saver tutorial in this guide!).

Fees: Borrowers and lenders pay a small transaction fee that's split between the protocol and the liquidity providers. The rate shown on the Notional UI includes that fee.

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

Smart contract risk, oracle failure, and governance attacks in Notional Finance v2 which are all covered if one buys Nexus Mutual Protocol Cover for about 1.3% APR

Liquidity crisis

Systemic risk in DeFi

Pegged assets such as WBTC or stablecoins could de-peg

Tutorial:

First, I go to the Notional Finance dApp and Connect Wallet on Ethereum.

Under Provide Liquidity, I choose which asset to deposit based on projected APY.

I specify how much to deposit and follow the prompts to Approve spending (if any token but ETH or simply Confirm depositing ETH).

It will require 2 MetaMask transactions at most.

Once done, I can return to the dApp in the future to claim my earned NOTE and withdraw my assets whenever.

How to Earn Up to 15% APR Lending Stablecoins to Orion Saver on Polygon

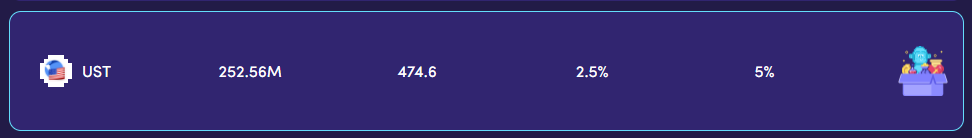

Opportunity: Lend UST, DAI, USDC, or USDT to earn a stable rate of 15% APY thanks to the Anchor Rate on Terra but facilitated by a cross-chain dApp Orion Money

Time to Complete: 5-10 minutes if one has stablecoins already on Polygon

Estimated Length of Rewards Program: There’s no end date to this program and expected to last for years at 15% APY or higher.

Gas + Protocol Fees: Based on 30 Gwei gas prices on Polygon, it should cost pennies to transact.

Fees: If you were to deposit UST on the Terra blockchain to Anchor, the rate is about 19.5% APY but the convenience of Orion is you can avoid the hassle of a Terra wallet and bridging money vs staying on Polygon lending stablecoins cross-chain. But it’s worth noting, Orion yields 15% APY on stablecoins while the underlying Anchor Rate on Terra is about 19.5% APY.

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

Smart contract risk, oracle failure, and governance attacks in Orion Money (Polygon), Curve (Polygon) and Anchor (Terra)

Liquidity crisis

Systemic risk in DeFi

Pegged assets such as WBTC or stablecoins could de-peg

Tutorial:

First, I go to the Orion Saver dApp and Connect Wallet on Polygon.

Under Saver, I can choose to deposit UST, USDT, USDC, or DAI.

I click Deposit.

Then, I specify which token and how much to deposit.

Click Approve & Deposit and follow the prompts on MetaMask (2 transactions).

Once done, I can return to the dApp in the future to track my deposit + earned interest!

6. Degen Tutorial: Each week, we’ll aim to publish a more “degen-level” tutorial for advanced users. It’s important these are always viewed as opportunities uncovered by our team and not recommendations to invest or trade.

🦍 Defiant Degen Tutorial

The Degen Savings Portfolio Featuring Abracadabra, Anchor, Curve and Convex

Curve is now the largest DeFi protocol with $22B in Total Value Locked across seven blockchains. We’ve covered the Curve Wars extensively and the consensus among investors seems to be that Curve will consolidate and build on its position as the leader in stablecoin swaps. Convex Finance makes it possible for yield farmers to obtain boosted $CRV yields without locking any $CRV tokens themselves.

In this week’s advanced tutorial, yyctrader shows you how to maximize your $CRV and $CVX earnings through leveraged yield farming on Abracadabra, a collateralized lending platform and issuer of the Magic Internet Money (MIM) stablecoin.

He’ll also show you how you can earn triple-digit yields on stablecoins by leveraging the fixed yield offered by Terra’s Anchor protocol using Abracadabra.

50% APR on Stablecoins, Bitcoin and Ether with Abracadabra + Convex

Whether you’re looking to build a position in $CRV and $CVX through yield farming or just looking for a good yield on your crypto assets, you can use Abracadabra to leverage your position based on your risk tolerance.

It’s a straightforward process, but we’ve put this tutorial in the advanced section since it involves the use of leverage.

A few things to note before we get started:

As these protocols are on Ethereum, setting up these positions will cost a significant amount in ETH gas fees. In addition, a borrowing fee is charged at inception. However, the strategies require little maintenance once in place and are intended to be longer-term positions.

Leverage introduces liquidation risk.

Taking advantage of multiple money legos is great but also introduces additional smart contract risk.

Let’s begin!

Step 1: Head over to Abracadabra. You can see the available collateral options on the ‘BORROW’ page. We’re interested in the two Convex pools shown below.

The base yield for the pools can be found on the Convex website and is comprised of $CRV and $CVX tokens.

Step 2: Add Liquidity on Curve Finance.

Stablecoin farmers can earn up to 8x the base Convex yield by leveraging 3pool LP tokens. As the pool is made up of established stablecoins only, higher leverage can be used with minimal risk of liquidation.

3pool is Curve’s main stablecoin pool comprised of DAI, USDC and USDC in equal proportions. You’ve probably seen it referred to as 3crv when paired with other DeFi tokens.

You can deposit a single asset or a combination of stablecoins here.

Important: Make sure you click on Deposit and DO NOT stake your LP tokens in the Curve gauge. We’ll be depositing the Curve LP tokens into Convex through Abracadabra.

Step 3: Wrap your Curve 3crv LP tokens for cvx3crv using the Abracadabra interface.

Click on ‘Deposit’ and confirm the transaction. You’ll be asked to approve spending your Curve LP tokens before you can wrap your tokens. The ‘Nothing to Do’ button will change to ‘WRAP’ when you have a non-zero token balance.

Step 4: Once you’ve obtained your cvx3crv tokens, you can set up your leveraged farming position in a single transaction. Click on the ‘Change Leverage’ button and move the slider to customize your position.

As this is purely a stablecoin pool, you can potentially go up to 8x with a low risk of liquidation barring a Black Swan event.

Once you’ve selected the amount of leverage you wish to use, confirm the transaction. The recursive deposit-borrow-deposit loops are handled behind the scenes and you are done!

Step 5: Claim your $CRV and $CVX rewards periodically from the Convex Finance website. You’ll find your rewards under Abracadabra. You also have the option to claim and stake your rewards in a single transaction using the toggle pictured below.

For the more adventurous degens out there, the process is exactly the same for the tricrypto pool, which provides exposure to Bitcoin, Ether and USDT in equal ratios.

Deposit assets here and follow Steps 3-5 for cvxtricrypto.

The USDT component acts as a valuable cushion during times of excessive volatility, and since collateral is added asymmetrically in the last borrow-deposit loop, leverage can be employed relatively safely.

Please note that the risk of liquidation is far higher when using tricrypto as collateral since volatile assets are involved! Choose your leverage accordingly.

100% APR on UST with Abracadabra + Anchor

Anchor Protocol is the dominant money market on the Terra blockchain and forms an integral part of that ecosystem. We’ve covered it on our Youtube channel and it’s become quite popular with Defiers for its fixed 20% yield on UST, Terra’s dollar-pegged stablecoin.

Thanks to Terra’s partnership with Abracadabra, you can now leverage that juicy Anchor yield all the way into triple-digits, based on your risk tolerance.

As an added bonus, there’s no need to claim rewards periodically. Simply set up the position, sit back, and watch your UST balance go up.

Step 1: Obtain UST on Ethereum. Curve is usually the best option for swapping from other stablecoins, but there is also liquidity on Uniswap V3.

Step 2: Head over to Abracadabra and check for availability of MIM. As this is a new and extremely popular product, the periodic replenishments of MIM are quickly snapped up.

You can follow this Twitter account to know exactly when new MIM is made available.

Step 3: Once you have confirmed that MIM is available to be borrowed, navigate to the UST cauldron and set up your position. Click on ‘Change Leverage’ and adjust the slider until you reach your desired level of leverage.

Confirm the transaction and you are done!

This strategy is extremely lucrative but Defiers should be aware that:

UST and MIM are both relatively new stablecoins. While they have been stable around their $1 pegs, there is always the risk of an unforeseen de-pegging as UST saw in May during extreme market conditions.

Abracadabra charges a 1% borrow fee on MIM. This means that you should only use this strategy if you plan to stick around for a while, as it will take you approximately a month to recover your entry costs.

Disclaimer: All opinions expressed by yyctrader in this tutorial are solely his own and do not reflect the opinion of The Defiant. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

Disclosure: yyctrader holds SPELL tokens and has leveraged positions on Abracadabra.

📰 Elsewhere on The Defiant

Tuesday Tutorial: This week, Robin covered how Bancor v2 allows for single-sided LPs. Learn how to LP with no impermanent loss! Additionally, Robin just covered how to unify your NFT transactions across all NFT projects and blockchains, get a comprehensive understanding of your NFT investments, and understand the real time values of your NFTs in the wallets. Learn how and subscribe to The Defiant on YouTube!