🌪 Do Kwon Humbled as LUNA Spirals and UST Suffers ‘Lehman Moment’

Hello Defiers! Here’s what we’re covering today:

Terra Crisis

News

💰 Coinbase Will Keep Customer Balances in Event of Bankruptcy

🐄 MakerDAO’s Real World Push Gains Moo-mentum with Aussie Beef Play

Opinion

Podcast

🎙Listen to the exclusive interview with Diego Fernandez:

Video

Elsewhere

Luna Foundation Guard seeks more than $1 billion to shore up UST stablecoin: sources: The Block

Will Optimism’s OP Token Draw People Back to Layer 2s on Ethereum?: Unchained

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Chainalysis, the leading blockchain data platform. Sign up now for access to their free API to quickly screen against sanctioned crypto wallet addresses. Get free access now!

Hashflow, the first to provide bridgeless cross-chain swaps, lets you trade seamlessly across chains with guaranteed execution, MEV-resistance and the lowest gas fees in DeFi. Try it now!

dYdX Grants is powering the future of dYdX through community grants. Join us to build on top of the largest decentralized perpetuals exchange!

Acquisition Royale is an M&A-themed battle royale P2E game by prePO (the pre-IPO & pre-token trading platform). Unlock exclusive prePO items and rewards by playing now!

Terra Crisis: Do Kwon

🌪 Do Kwon Humbled as LUNA Spirals and UST Suffers ‘Lehman Moment’

Terra Struggling to Stabilize Crisis as Investors Flee

By Jason Levin

72 HOURS “I understand the last 72 hours have been extremely tough on all of you,” Do Kwon tweeted Wednesday morning. “Extremely tough” will be an understatement for users who trusted their savings on a stablecoin – emphasis on the word “stable” – to now own only a small fraction of their initial holdings. Rarely has such a high-flying crypto project fallen so far, so fast, even in this volatile asset class.

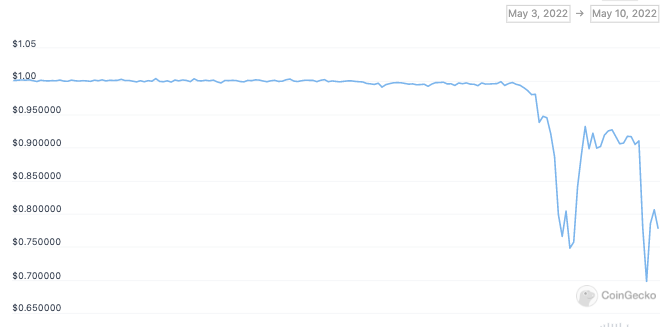

PEG Investors woke Wednesday morning to see that Terra’s native token, LUNA, is trading at $1.55. That’s down 97.5% from its all-time high of $119.18. Moreover, UST, Terra’s flagship stablecoin, which slipped its peg on Monday, has continued its slide after briefly rebounding Tuesday, to touch as low as $0.29 in early trading New York time on Wednesday.

REPERCUSSIONS LUNA, which stormed out of nowhere last year to notch a $41B market value and foment an entire crypto ecosystem, is now worth $1.8B, according to CoinMarketCap. Even worse, Terra’s meltdown may have repercussions outside of its ecosystem, impacting the entire blockchain industry. UST’s faceplant has triggered a regulatory crackdown in Washington, and delivered a heavy blow to the credibility of algorithmic stablecoins.

BAILING While Do Kwon and his team are scrambling to shore up their stricken tokens, investors are bailing en masse. It’s hard to see how Terra and its system can recover. “I understand the last 72 hours have been extremely tough on all of you,” Do Kwon tweeted Wednesday morning. “Extremely tough” will be an understatement for users who trusted their savings on a stablecoin – emphasis on the word “stable” – to now own only a small fraction of their initial holdings. Rarely has such a high-flying crypto project fallen so far, so fast, even in this volatile asset class.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Terra Crisis: Markets

📉 Terra’s LUNA Crashes 95% As Investors Mull Recovery Plan

By yyctrader

HEAVY SELLING Yesterday was a bad day for the Terra ecosystem. Today is worse. Heavy selling ensued as LUNA crashed 97% to a low of $0.69 before bouncing to $2.50 in midday trading New York time.

CRISIS A crisis of confidence in UST, Terra’s native stablecoin, has escalated after founder Do Kwon tweeted a recovery plan that would increase daily minting capacity from $293M to $1.2B in an attempt to absorb excess UST supply more quickly.

CENTS UST, which rebounded to $0.93 yesterday, reversed course and hit a low of $0.22. It’s currently trading around fifty cents on the dollar.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

"Liquidation-free long-term leveraged tokens. That's what is coming fresh out of Tracer DAO's Perpetual Pools.

Deployed on Arbitrum, you can take long or short positions with leverage to trade anything - commodities, cryptocurrencies, equities; even NFTs.

Dive into Perpetual Pools at tracer.finance and learn more about this exciting release with The Voyage - a 6-week journey in Tracer’s Perpetual Pools to earn TCR rewards and explore the potential.

Head over to tracer.finance today and take a look for yourself.”

Terra Crisis: Washington

🏛 UST’s ‘Reckless’ Run Triggers Crackdown on Stablecoins

Terra Draws the Ire of Crypto Community as Regulators Circle

By Owen Fernau

URGENT If the crypto industry was looking to prove the merits of stablecoins, May 9 did it no favors. Janet Yellen, the U.S. secretary of the treasury, said new legislation to regulate stablecoins the day after the meltdown of UST, the algorithmic stablecoin supported by Terra.

RISKS “[Stablecoins] run risks which could threaten financial stability,” Yellen testified in a Senate Banking Committee hearing. “Risks associated with the payment system and its integrity, and risks associated with increased concentration if stablecoins are issued by firms that already have substantial market power.”

FLAGSHIP TOKEN Terra certainly had market clout going into this week. Its flagship token, LUNA, boasted a $40B market capitalization in April. And Do Kwon, Terra’s leader and self-styled “Master of Stablecoin,” had emerged as a DeFi superstar as LUNA skyrocketed.

PEG But Terra’s pledge to redeem 1 UST for $1 worth of LUNA was a thin reed to support such a weighty proposition. And when LUNA cratered amid the crypto selloff, well, all bets were off for UST and it slipped its peg by an astonishing 40% on Monday.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Crypto Exchanges

💰 Coinbase Will Keep Customer Balances in Event of Bankruptcy

Bearish Market Takes Toll on Financials in First Quarter

By Samuel Haig

BANKRUPT Coinbase will take your coins if it goes bankrupt. That was the rather jarring message in the first quarter earnings release for the leading U.S.-based centralized exchange. It says customers balances will be considered Coinbase’s property in the event it files for administration. The disclosure highlights the custodial risks of holding crypto assets on the exchange.

CUSTODY “Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings… and such customers could be treated as our general unsecured creditors,” Coinbase said in the May 10 filing.

NO MONEY BACK In traditional finance, unsecured creditors such as bond holders are typically out of luck if a company declares bankruptcy. So, too, are stockholders. Essentially, Coinbase is informing customers that they shouldn’t expect to get all or even some of their money back if the concern goes belly up.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Real World DeFi

🐄 MakerDAO’s Real World Push Gains Moo-mentum with Aussie Beef Play

Deal Shows Utility of DeFi in a Rough Week

By Samuel Haig

BEEF It ain’t crypto, but MakeDAO is making strides in its push to finance off-chain business activities. On May 9, one of the project’s vaults was used to finance a shipment of Australian beef to Hong Kong.

PARTNERSHIP The transaction was executed in partnership with Centrifuge, a Polkadot and Ethereum-based protocol allowing users to finance the activities of real-world businesses with DAI. ConsolFreight, a trade finance provider operating on Centrifuge, minted DAI via Centrifuge’s Maker vault to finance the transaction.

MINTED ConsolFreight also minted an NFT containing the shipment and invoice data for the transaction. The shipment and transaction are also being tracked using Mastercard’s blockchain traceability solution, Provenance.

REAL WORLD The venture demonstrates the real world application of smart contracts and a stablecoin in an industry that is ripe for innovation: supply chains. It comes two months after Maker expanded the use of its DAI stablecoin as a vehicle to finance businesses operating with real-world assets (RWAs) to hedge against a potential crypto bear trend. MakerDAO’s project is a bright spot for stablecoins in a week when the UST disaster is dragging down the whole sector.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Lending

🪄 Abracadabra Enables Leveraged Yield Farming On Stargate

By yyctrader

NEWS DeFi lender Abracadabra has launched a new Degenbox strategy that will allow users to leverage up their yields on Stargate, an omni-chain liquidity protocol.

SEVEN NETWORKS Stargate facilitates cross-chain native asset swaps, meaning that users can transfer assets across blockchains without using a bridge. The protocol does this by incentivizing stablecoin liquidity on its supported chains. It operates on seven networks — Mainnet, BNB Chain, Avalanche, Polygon, Arbitrum, Optimism and Fantom — and offers yields of 3% to 4.5% on USDC, USDT and BUSD.

YIELD Total Value Locked (TVL) peaked at around $4B in April and has since fallen to $1.3B after a drop in the price of STG, Stargate’s native token. Abracadabra’s new offering has the potential to drive liquidity back to Stargate. Yield farmers are piling in even though rewards will not be live for a few days.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Quick Take: The UST depeg and LUNA crash + Azuki founder confession

Opinion

🖼 How NFTs Will Revolutionize Intellectual Property

Crypto's Killer App Fuels the 'Passion Economy'

Guest writer Jake Fraser lays out the utility of NFTs for artists and entrepreneurs.

COLLABORATIONS In January 2022, Prada, the Italian luxury fashion brand Prada and Adidas, the giant sportswear manufacturer, teamed up to create a groundbreaking NFT project. By bringing in credibility and authenticity, NFTs are poised to redefine collaborations and create a safe space where all the collaborators can equally benefit from the partnership.

RARITY This, combined with the inherent rarity of NFTs, could give rise to an era of meaningful collaborations where the contributions of each collaborator are recognized, stored, and accounted for on the blockchain.

AUCTION They asked people to submit unique artwork and photographs and selected 3,000 of them. They were compiled and featured in digital artist Zach Lieberman’s larger NFT and went up for auction on SuperRare. About 80% of the proceeds from the auction went to a non-profit organization Slow Factory. This project shows how NFTs unite brands, artists, creators, and social organizations around the world.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Luna Foundation Guard seeks more than $1 billion to shore up UST stablecoin: sources: The Block

The Luna Foundation Guard (LFG), a Singapore-based non-profit that supports the Terra blockchain ecosystem, is looking to raise more than $1 billion to shore up the UST algorithmic stablecoin after it lost parity with the US dollar, according to three sources familiar with the situation.

🔗 Terra ‘rescue plan’ still at large as LUNA falls below $5, Bitcoin spikes to ‘$138K’ in UST: CoinTelegraph

Panic appeared to set in on crypto markets overnight on May 11 as Blockchain protocol Terra failed to steady its bleeding crypto assets.

🔗 Will Optimism’s OP Token Draw People Back to Layer 2s on Ethereum?: Unchained

Kain Warwick, founder of Synthetix, and Ben Jones, cofounder and chief scientist at Optimism Foundation, discuss the current state of Ethereum Layer 2s, Optimism’s new governance structure, why Synthetix chose to build on Optimism, and more.

Trending in The Defiant

Terra’s Stablecoin Structure Unravels on a Wild Day The vulnerability in UST was plain to see from the outset. It was staring the market in the face. The stablecoin’s promise to redeem 1 UST for $1 worth of LUNA invited trouble.

LUNA Loses Half its Value in 24 Hours as DeFi Tokens Crater DeFi assets are taking a beating. The combined capitalization of DeFi tokens has fallen below $100B for the first time since last August as cryptocurrencies crater.

Compound Treasury Draws a Rating From S&P in Groundbreaking Move The capital markets, including crypto, may be a train wreck at the moment. That hasn’t stopped DeFi protocols from seeking deeper integration with the financial world, and vice versa.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, Jason, Levin, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Signest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)