😵💫 Digital Beauty, Asset Flipping, and a Bad Case of the Shakes: Inside the Chase for Art Blocks NFTs

Hello Defiers! Here’s what we are covering today,

News

Harmony Opens the Throttle on Layer 1 with $300M Fund for Myriad Projects

Terraform Labs Creates $150M Fund to Advance Inter-blockchain Communication

Opolis Deal Deepens Venture Capitalists’ Love Affair with DAOs

Weekend Read

Research

Video

Podcast

🎙Listen to this week’s podcast episode with SuperRare’s John Crain:

Links

101 Bored Apes NFT auction at Sotheby's closes at more than $24M: CoinTelegraph

European Finance Regulator Calls Crypto ‘Volatile,’ but Innovative: CoinDesk

Fidenza artist Tyler Hobbs: NFTs are 'going to play a huge role in the art world': The Block

Sushi Co-founder @0xMaki will be speaking at @MessariCrypto’s #Mainnet2021 summit in NYC: SushiSwap\

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at this link.

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Layer 1 Fundraising

🏎 Harmony Opens the Throttle on Layer 1 with $300M Fund for Myriad Projects

NEWS The Layer 1 blockchain Harmony unveiled a $300M ecosystem fund today to back startups working on applications and protocols.

CHAINS There are many large blockchains now, but to a certain degree each one is a bit of a walled garden, Stephen Tse, Harmony’s founder told The Defiant, via a spokesperson. “Harmony was purpose-built so that developers who build on Harmony can easily bridge to other chains and thus fulfill the promise of seamless, affordable, and permissionless commerce and interoperability between chains,” Tse said.

BUDGET The fund aims to take advantage of Harmony’s facility for reaching other chains. The budget for the fund is broken down in detail on the Harmony website, explaining how it plans to spend the funds. It aims to deploy $180M by the third quarter of 2022, with $300M going out over 4 years.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Blockchain Infrastructure

📡 Terraform Labs Creates $150M Fund to Advance Inter-blockchain Communication

PROJECT DAWN Blockchain communities may never get along on Crypto Twitter, but that doesn’t mean the blockchains themselves can’t. Striving towards a world where all blockchains can seamlessly communicate, Terraform Labs has put forward $150M worth of its LUNA tokens. They are calling the fund Project Dawn.

SO WHAT Terraform Labs (TFL) is behind the Terra blockchain, which makes stablecoins that track the price of various fiat currencies. Its blockchain was built with Tendermint, the native architecture for the Cosmos ecosystem of blockchains. Cosmos was created so that each application could have its own blockchain that easily communicates with others. Taking that a step further, Cosmos was also created to facilitate communication across all blockchains, Tendermint and otherwise.

TRUTH “At every bull run, the crypto industry relearns an uncomfortable truth: a single global computer shared by all apps is untenable,” Do Kwon, a co-founder of Terraform Labs, told The Defiant over Telegram.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Deep Dive

❤️ Opolis Deal Deepens Venture Capitalists’ Love Affair with DAOs

In this Deep Dive, contributing writer Sydney Lai delves into the cross pollination of DAOs and venture capital.

COOPERATIVE You probably missed it. It was a deal that didn’t involve a big NFT marketplace or a new decentralized crypto exchange. Yet the vote by members of Opolis, a digital employment cooperative, to launch a DAO is significant. Why? Because it’s the latest instance of venture capitalists’ love affair with decentralized autonomous organizations. It also shows the rapid financial maturation of this innovative new business model.

VOTING RIGHTS Opolis raised $5.5M earlier this year from a community of angels and syndicate DAOs including Metacartel Ventures, Senary Ventures, and Clemens Wan, a solutions architect at ConsenSys. Under the terms, the VCs did not receive voting rights and only members of the cooperative can vote. The community DAO has now launched a liquidity pool to bring Opolis’s WORK tokens on an exchange. The DAO members have contributed $300K to date with a target of $1M in pool collateral. This economic collaboration is a huge feat of self-directed social participation

MAVENS The Opolis deal is just the latest in a string of venture-backed moves into Decentralized Autonomous Organizations, as the Opolis Commons is a registered co-operative. This summer, BitDAO, a newly formed entity that plans to take DeFi mass-market, raised $230M in a private sale from Peter Thiel, Pantera Capital, and Dragonfly Capital. It wasn’t just tech mavens piling into the venture — British billionaire Alan Howard, the founder and former CEO of a major hedge fund, Brevan Howard, also came aboard.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Weekend Read

In this feature, Bailey Reutzel embarks on a quest to buy the latest works on Art Blocks, the red hot NFT auction site, without losing her sanity. Along the way she talks at length to Snowfro and addresses pressing questions about the strange economics and market mania driving the NFT art story.

😵💫 Digital Beauty, Asset Flipping, and a Bad Case of the Shakes: Inside the Chase for Art Blocks NFTs

CHASE I started chasing Art Blocks NFTs on Aug. 25 during Radix’ Eccentrics 2: Orbits drop. That may sound like gobbledygook to some, but others, including Art Blocks founder Erick Calderon, AKA Snowfro, will know that I picked the worst time to begin my quest to mint generative digital art NFT on the platform.

DEGEN But three months ago I’d minted an Art Blocks piece and its value has skyrocketed by 5,000%. Needless to say, that made me emboldened to become a real degen, to become a flipper. It wasn’t about the art at all this time.

ABSURDITY Legions of collectors have poured into Discord servers and hit the auction circuit as NFTs envelop crypto. While this hype cycle might have started with art — Beeple’s $69M sale via Christie’s left jaws on the floor — it’s now engulfed electronic gaming, professional sports, fine art museums, the mainstream media, and even Hollywood. And for sure, it feels more and more like the ICO boom every day. But even as detractors have laughed at the absurdity of million dollar JPEGs, Art Blocks has emerged as a sensible yet edgy platform for digital forms of expression that truly exploit the properties of technology.

AUCTION Which is great, but I was taking the plunge at the precise moment everyone else had twigged onto Art Blocks and sent its economics to the stratosphere. And it wasn’t just in the Curated drops — those collections carefully selected by the Art Blocks team to best represent the vision of the platform. The hysteria was also shaping Playground drops and Factory drops, two other slates Art Blocks uses to organize and auction NFTs.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Market Intelligence

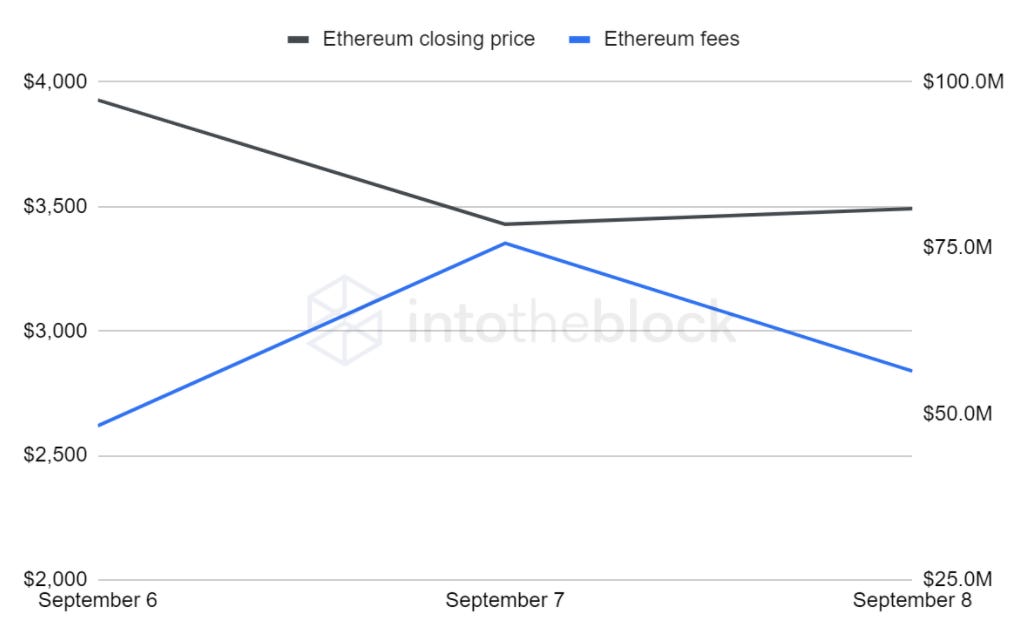

This week, Juan Pellicer of IntoTheBlock produces an on-chain markets update analyzing the ripple effects of the recent crash.

📉 A Deep Dive on the Lessons and Surprises of the Recent Crash

THE GIST DeFi protocols, apps and their stablecoins are a key area of the whole crypto markets. Even though the average daily trading values of DeFi are 80 times lower than in centralized exchanges, their smart contracts enable open financial services that impact the whole market by providing key functionalities like price stability and liquidity. This is thanks to primitives like lending, borrowing or trading protocols.

SO WHAT For this reason it is worth taking a look at the data available to quantify the reaction within the blockchain with the biggest stake in DeFi, Ethereum, and some of its key DeFi protocols during highly volatile episodes like the ones of Sept. 6.

CRASH In this piece, we’ll focus particularly on the effects the crash had on fees and total value locked (TVL). A variation in fees can explain how profitable each of these different DeFi protocols or even Ethereum are during these types of rapid price moves. Additionally, TVL variations besides being mostly affected by price, can be used to estimate the impact in allocation and thus confidence that traders deposit in a DeFi protocol.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Video

📺 Jam Session #6: TradFi to DeFi

📆 Sanctor Turbo Announces Demo Day, Revealing the First Cohort of Blockchain Projects to Graduate from Its Mentorship Program

Sanctor Capitala blockchain-focused investment firm will be hosting its first Demo Day to showcase the inaugural cohort of projects graduating from its custom-tailored mentorship program, Sanctor Turbo. At the live streamed event taking place on September 14th between 2:00pm - 5:00pm Eastern, the founding teams from Koii, Synchrony, and ThorSwap will present their market-ready dApps and platforms, which span the domains of decentralized content ownership, cross-chain DeFi and on-chain asset management. Sign up to attend here.

Links

🔗 101 Bored Apes NFT auction at Sotheby's closes at more than $24M: CoinTelegraph

The auction of Yuga Labs’ 101 Bored Ape Yacht Club (BAYC) collection has smashed through expectations with a winning bid of $24.39 million.

🔗 European Finance Regulator Calls Crypto ‘Volatile,’ but Innovative: CoinDesk

Crypto assets and distributed ledger technology (DLT) topped the European Securities and Markets Authority’s (ESMA) 2021 financial innovation scoreboard, according to a new report published by the institution.

🔗 Fidenza artist Tyler Hobbs: NFTs are 'going to play a huge role in the art world': The Block

Generative artist Tyler Hobbs, like many of his peers, is still trying to adjust to his newfound fame. “This has already been a really big reality shift for me so I’m trying to give myself a little bit of time to adjust to it,” said Hobbs.

🔗 Solidity, Blockchain, and Smart Contract Course – Beginner to Expert Python Tutorial: freeCodeCamp.org

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Brady Dale, Juan Pellicer, and edited by Bailey Reutzel and Edward Robinson. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr

TheDefiant - Here's a weird NFT Timebomb development we could use your help with - A bizarre use of NFTs which is jeopardizing blockchain and crypto...

I am fighting for a patent-free & open-source code in blockchain, crypto, & fintech. My company is one of 15 U.S. companies targeted with a weird and unexpected use for NFTs.... an NFT-Patent litigation in a box scheme (see opensea.io link below). More recently, the landscape has become more complicated with a Robinhood Markets matter too. These lawyers are auctioning granted and active US patents in an NFT wrapper encouraging anyone with tradeable crypto to tangle with our most important fintech companies - that "anyone" includes disruptive foreign Chinese or Russian actors.

In the wrong hands, a rogue core patent could cost our industry 100s of $billions in value disruption. We understood that Square-Dorsey-COPA were looking into this matter...however, we are now uncertain.

My institution(s) are treating the #797 NFT patent as a no-go-zone / 3rd rail because (i) we don't know the actual trading/dealing price and bidding on the NFT could signal perceived exposure, and (ii) we have at least 1 patent in a vulnerable appeals process, and somehow management thinks attention to this matter jeopardizes a successful appeal at the USPTO.

This NFT is essentially selling a litigation package (!) that is targeted at our blockchain software company(even though we operate to avoid any "legal" US corporate nexus). Fourteen other companies are implicated in this NFT - many U.S. We believe that 15 companies makes this NFT auction a public policy matter.

Patents don't belong in our industry, and we're trying to raise media awareness.

Unfortunately our resources are limited and our U.S. securities law expertise is very limited, so we believe your coverage would shine a light on this unhelpful NFT development.

The blockhain/defi auction is here:

https://opensea.io/assets/us-number-10025797

The NFT claims "unlockable content" (attached), and using an intermediary, we were able to secure a number of documents including patent “charts” which appear to lift materials from our marketing and technical materials.There's lots of background, "charts", and tables that we are unfamiliar with.

Best,

Dan