⚔️ DEXs Sliding into Price War as Uniswap and dYdX Slash Trading Fees

Hello Defiers! Here’s what we’re covering today:

News

DEXs Sliding into Price War as Uniswap and dYdX Slash Trading Fees

Cronje and Sesta Reveal Details of ‘Solid Swap’ Project to Spur Fees

Twitter Enables Ownership Verification of Profile Picture NFTs – For a Price

Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance

DeFi Saga

Markets

Podcast

🎙Listen to the interview in this week’s podcast episode here:

Video

Real Vision vs. The Defiant: WALMART MOVES INTO THE METAVERSE

SuperMassive NFT Show: Loomdart, Irene Zhao, So-col, Vector Meldrew & Peaceful Groupies - NFT Show

Links

Facebook's parent company Meta is looking to launch NFT marketplace: Report: The Block

Solana-based 'move-to-earn' startup STEPN raises $5 million in SAFT sale: The Block

Tales from the crypto: lira crisis fuels Bitcoin boom in Turkey: The Guardian

Trending in The Defiant

Sappy Seals and Other NFT Communities Band Together in ‘Pixelverse’ and Take on Giants

Multichain Recovers Some Stolen ETH After Hit by $1.9M Exploit

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Step Finance is the portfolio management dashboard for Solana users to visualise, analyse, execute and aggregate transactions across all Solana contracts in one place. Get started now!

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Cryptex Finance (CTX) the fully decentralized creators of TCAP, The World’s First Total Crypto Market Cap Token.

Concordium is made for the future economy. It’s the first fully compliant blockchain with Layer 1 ID, predictable fees valued in FIAT and private and public transactions. Discover more.

DEX Fees

⚔️ DEXs Sliding into Price War as Uniswap and dYdX Slash Trading Fees

NEWS It had to happen: Rising competition amid a souring market is pushing decentralized exchanges to lower their fees.

BENCHMARK When Uniswap, the leading DEX, went live, it had a 30 basis point fee for all trades, which went to its liquidity providers. This fee set the benchmark across the industry, so that exchanges largely competed on selection, execution and features. However, exchanges are now starting to compete on fees.

FEES Uniswap, with its v3, introduced the option for liquidity providers to open pools at three different fee tiers; 1%, 0.3% and 0.05%. In October, the protocol’s governance closed a proposal to add a new tier, of just one basis point (0.01%). dYdX on Tuesday announced it was experimenting with vastly lower fees depending on the size of trade, which will persist until at least mid-April. “The fee changes were made to better compete with the fee schedule of top crypto exchanges, both centralized and decentralized,” the announcement stated.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Duo

🧐 Cronje and Sesta Reveal Details of ‘Solid Swap’ Project to Spur Fees

PROJECT Details are beginning to emerge regarding the highly anticipated project from star DeFi devs Andre Cronje of Yearn Finance and Daniele Sesta of Wonderland and Abracadabra.

SOLID SWAP Cronje and Sesta appeared together on the Jan. 20 episode of the Frog Radio podcast to discuss the upcoming project. Dubbed Solid Swap, the protocol will aim to incentivize fee generation, rather than total value locked (TVL) as is currently popular in the DeFi sector. Long-term token locks and voting participation will also be rewarded.

TEASED Solid Swap was teased in early January, with Cronje tweeting on Jan. 1 that he would deploy “a new experiment on Fantom” by February. Four days later, Sesta revealed that he and Cronje were collaborating on the project. The protocol has been informally referred to as “ve(3,3)” on social media recently.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Social Media NFTs

🤑 Twitter Enables Ownership Verification of Profile Picture NFTs – For a Price

NEW FEATURE Twitter Blue, the social network’s subscription service, finally has a feature that some users want: NFT verification. Twitter first announced NFT verification along with a slew of other crypto integrations in Sept. 2021, but the new feature rolled out today, first announced in a story in the Wall Street Journal.

PROFILE Users that pay $2.99 per month for the service and use Twitter on iOS (for now) will be able to verify ownership of an NFT in their crypto wallet and then display it on their profile as a verified NFT. Supported wallets initially are Coinbase Wallet, Rainbow, Metamask, Ledger Live, Argent and Trust Wallet.

COMMUNITY “This is just still very early days for us, but we wanted to build something that was a utility for this community that they could start interacting with right now,” Twitter’s Esther Crawford told the WSJ.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DEXs

🦄 Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance

VOLUME Uniswap, the leading decentralized exchange by trade volume, now processes more ETH/stablecoin volume than any centralized crypto trading venue.

MILESTONE The development marks a milestone for Uniswap, which resided in relative obscurity for a period after its launch in November 2018. DEXes emerged as leading exchanges with the launch of Uniswap v2 and ‘DeFi-summer’ of 2020.

PAIRINGS In a Jan. 20 tweet, Uniswap inventor Hayden Adams said the protocol’s combined 24-hour volume from Ether pairings against USD Coin, Dai, and Tether was $1.25B. By contrast, the combined volume from Ether pairings against USDC, DAI, USDT, and fiat USD drove $1B on Binance and $500M on Coinbase. FTX was $430M.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Markets

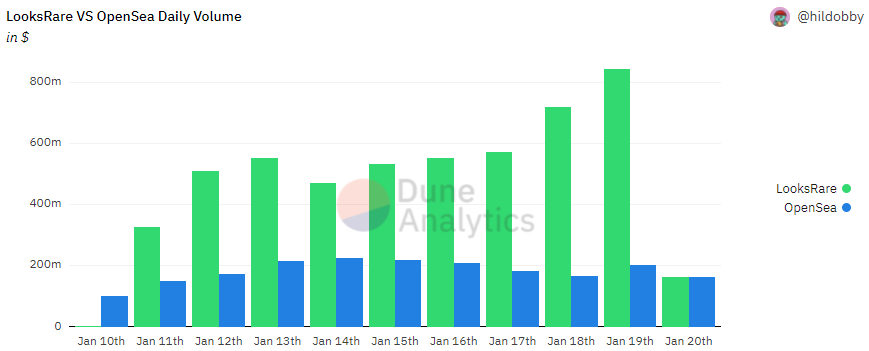

📈 LooksRare Surges to $7B Valuation as Torrid Volumes Fuel Staking Rewards

STELLAR LooksRare, the upstart NFT marketplace that airdropped its $LOOKS token to NFT traders on Jan. 9, is having a stellar run.

VOLUME Over $5B worth of NFTs have been traded on the marketplace since the platform launched just ten days ago, and trading volume has consistently surpassed that of OpenSea, the NFT marketplace leader. (Source: @hildobby Dune Analytics)

SELL-OFF $LOOKS briefly traded north of $7 on Jan. 20, giving the project a fully diluted valuation of $7.1B. The token has since fallen to $5, in line with the broader market sell-off. OpenSea closed its latest Series C funding round at a valuation of $13B.

LEADER Is LooksRare really worth half as much as the industry leader in less than two weeks? Or could something else be going on here? Let’s dive in.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Saga

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down 93% and Called a ‘Ponzi’

OlympusDAO held so much promise when it exploded on the DeFi scene in 2021.

The project set out to do nothing less than provide a new decentralized infrastructure for finance, and even better, it would be community-driven. At its heart, OlympusDAO offered a solution to one of the thorniest problems in DeFi — providing sustainable liquidity for projects’ native tokens.

DeFi degens loved what they saw. Within four weeks of its introduction in March, OlympusDAO’s token, OHM, skyrocketed to $1,415 and its market capitalization hit an all-time high of $4.4B in November. This wasn’t just another hot crypto play that drew speculators. Olympus was heralded for its breakthrough protocol-owned liquidity (POL) model, and it became the standard-bearer of the “DeFi 2.0” movement and a brave new era in open finance.

Now Olympus is being rocked by doubts. OHM has cratered 93% since its high on Oct. 24r and is trading at about $97 in mid-day trading New York time, CoinGecko data shows. In comparison, ETH has skidded about 30% in that period.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Former Merrill Lynch CFO joins the first Decentralized ETF as Advisor

The Decentralized ETF, an ERC-20 based exchange-traded fund established to simplify and enable investors broad exposure to the crypto market.

The D-ETF is completely self-operating by a DAO, which automatically executes the successfully voted proposals. Token holders can suggest token swaps, and participate in voting in token proposals.

Besides being a price speculative asset, the D-ETF protocol offers a 1.5% accumulating yield to token holders, coming from all daily transaction volume. Another 1.5% is added to a treasury to purchase more intrinsic value. These percentages are generated from transaction fees, incentivizing token holders to stay in the protocol and generating passive yields without locking up their tokens.

The D-ETF protocol has already started to add intrinsic value, with familiar tokens such as WOO Network, Fantom, Wrapped Luna, Chainlink, Wrapped Bitcoin, and ThorChain.

The D-ETF team has recently onboarded former Merrill Lynch CFO Peter Olden to assist the team with reaching better FIAT on-ramp opportunities via traditional fund structures to onboard institutional clients.

The D-ETF has not officially launched yet, but their tokens can be purchased pre-IDO on their website.

The Tube

📺 Real Vision vs. The Defiant: WALMART MOVES INTO THE METAVERSE

📺 SuperMassive NFT Show: Loomdart, Irene Zhao, So-col, Vector Meldrew & Peaceful Groupies - NFT Show

Links

🔗 Facebook's parent company Meta is looking to launch NFT marketplace: Report: The Block

Meta, Facebook's parent company, is reportedly drawing up plans to allow users to create and display NFTs on their profiles along with a prototype feature for minting tokens in the pipeline.

🔗 Solana-based 'move-to-earn' startup STEPN raises $5 million in SAFT sale: The Block

STEPN, a Solana-based "move-to-earn" startup that rewards users for exercising, has raised $5 million in a seed funding round.

🔗 Tales from the crypto: lira crisis fuels Bitcoin boom in Turkey: The Guardian

In the offices of AltCoin, a cryptocurrency hub tucked away in a sidestreet in Istanbul’s bustling Kadıköy neighbourhood, two wall-mounted TV sets showed the live value of currencies bitcoin and Ethereum, both graphs sloping downwards.

🔗 Bank of Russia Calls for Full Ban on Crypto: CoinDesk

Russia must ban cryptocurrencies, the country's central bank said in a report released Thursday.

Trending in The Defiant

Cosmos Connects to Ethereum Via the Osmosis DEX Ethereum is now connected to the Cosmos network, courtesy of the Osmosis decentralized exchange and the Gravity Bridge.

Sappy Seals and Other NFT Communities Band Together in ‘Pixelverse’ and Take on Giants We very seldom see collaborations across websites on the normal internet, where different companies are extremely possessive of their visitors. Attention is the currency of the web, and no one gives it away.

Multichain Recovers Some Stolen ETH After Hit by $1.9M Exploit Multichain, the cross-chain bridge formerly known as Anyswap, has suffered a seven-digit exploit, the project’s team reported on Jan. 18.

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)