💸 Defiant Data Dive: Airdrops are Mostly Fool’s Gold…But They Have Their Uses

Hello Defiers! Here’s what we’re covering today:

News

Defiant Data Dive: Airdrops are Mostly Fool’s Gold…But They Have Their Uses

SushiSwap Pay Package for New ‘Head Chef’ Sparks Outcry as Community Votes

Harmony Strikes Discord With Plan to Mint Tokens in Response to $100M Hack

Velodrome Surprises Investors with Surge on Optimism Blockchain

Opinion

DeFi Explainers

Podcast

Video

Elsewhere

Why the Messy 3AC, Celsius, and Voyager Bankruptcies Will Drag on for Years: Unchained

Treasury Investigating Kraken for Alleged Iran Sanctions Violations: Report: Decrypt

What Happens to Celsius Creditors if Crypto Prices Recover?: CoinDesk

Great news for our European friends, @AngleProtocol has just deployed on Arbitrum!: Arbitrum

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Thirdweb: Build web3 apps easily, for free, with easy smart contract deployment, powerful SDKs and UI components from thirdweb. Create NFT drops, marketplaces, social tokens, DAOs and more on Ethereum, Polygon, Avalanche, Fantom, Arbitrum and Optimism.

Airdrops

💸 Defiant Data Dive: Airdrops are Mostly Fool’s Gold…But They Have Their Uses

Data From Nine Major Airdrops Show That Rewarding Core Users Has Delivered The Best Results

By Jason Levin

EASY MONEY Who doesn’t love free money? Airdrops have become one of the most popular features of crypto. By giving away free tokens to investors, they epitomized the easy money to be made in the blockchain world. Airdrops also became a potent way to draw users and build critical mass on platforms.

DOWNSIDE Yet there is a downside no one is talking about. Many of crypto’s brightest minds suspect airdrops create buzz but fail to create long-term value and attract real customers to web3 protocols instead of tourists.

TOOL “Airdrops are effectively an expensive customer acquisition tool that hasn’t proven to lead to long-term users,” Messari analyst Dustin Teander told The Defiant.

PUMP-AND-DUMP More worrisome, airdrops have been criticized as being little more than pump-and-dump schemes. Rabbithole, a web3 education platform, recently airdropped NFT NYC attendees an NFT that said “Airdrops are killing web3”.

FOCUS “We need to focus on the long term with web3 with high value contributors – not necessarily scaling via mass airdrop,” Brennen Schlueter, Head of Marketing at Rabbithole, told The Defiant.

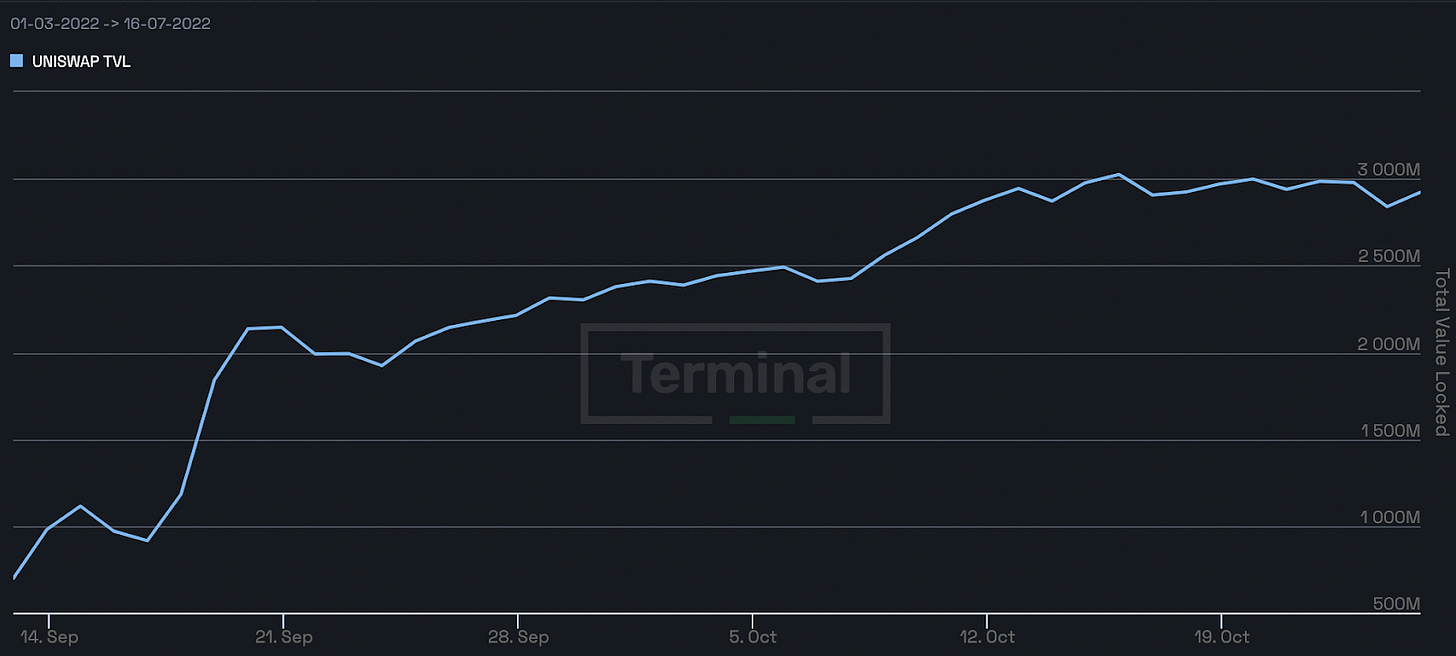

Uniswap TVL. Source: The Defiant Terminal

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Governance

😲 SushiSwap Pay Package for New ‘Head Chef’ Sparks Outcry as Community Votes

Nominee Jonathan Howard Vows to Bolster Dev Team and Improve NFT Marketplace

By Samuel Haig

HEAD CHEF In an effort to resolve a leadership crisis, SushiSwap, the fifth-largest decentralized exchange by capital locked, is currently polling its community on a candidate to take over as its new “head chef”.

UNHAPPY But its community is unhappy with the proposed compensation for the incoming culinarian. On July 26, the Sushi team nominated Jonathan Howard, a software engineer who previously founded four startups including NFT studio, Bighead Club.

VESTING If elected, Howard will receive $800,000 in stablecoins annually plus 600,000 SUSHI tokens (currently worth $1.29 each) over a four-year vesting period, with an additional 350,000 SUSHI set aside for bonuses to be awarded as new products are shipped.

MILESTONES A further 1.2M SUSHI will be issued to Howard should SUSHI’s price rise above various milestones under his leadership, with the payouts increasing if SUSHI’s price rises above $3, $5, $7, $9, and $11.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Card-based onramps only work 30% of the time. Ratio works 100% of the time.

How?

Ratio is a direct connection between any crypto wallet and bank account. Now, instead of high decline rates and high processing fees, your users can buy crypto directly from their bank account using ACH, direct deposit, or a linked debit card. There are no processing fees for ACH and direct deposit.

Give it a try.

Sign up directly at ratio.me.

Use their API to offer the new standard.

Ratio is setting a new standard for onramp user experience. If you are a wallet provider looking to improve user activation, retention, and monetization, reach out to their CEO at jeremy@ratio.me. Your team can integrate their white label API in just a few weeks.

Exploits

😠 Harmony Strikes Discord With Plan to Mint Tokens in Response to $100M Hack

Users Decry 'Massive Supply Increase' of ONE Coins

MINTED Users of Harmony, a Layer 1 blockchain, are fuming over its leaders’ proposed solution to last month’s $100M hack. Harmony has proposed reimbursing users whose money was stolen with the blockchain’s native ONE token over a three year period. To create the ONE coin, though, Harmony has proposed adding newly minted tokens to the existing supply, a decision that has infuriated users who believe the move will dilute their ONE holdings.

BLOWBACK Anticipating blowback, the Harmony team explained its logic in an online forum detailing the proposal. “We decided against using the foundation treasury in the interest of the longevity and well being of the project,” Harmony wrote, “as reimbursing from the treasury would greatly hinder the foundation’s ability to support the growth of Harmony and its ecosystem.”

SUPPLY INCREASE The proposal struck a discordant note among Harmony’s users. “This is a massive supply increase,” wrote Jimbo_JRC on the Harmony governance forum. “This will in no uncertain terms be paid for by those of us who hold large amounts of one by the value of the token absorbing the cost of the hack through dilution,” they wrote.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DEXs + Layer 2s

🚴♀️ Velodrome Surprises Investors with Surge on Optimism Blockchain

By Owen Fernau

OPTIMISM Velodrome, a decentralized exchange deployed on the Optimism blockchain, is giving Uniswap a run for its money. Velodrome’s trading pairs held four of the top ten slots in terms of 24-hour volume on Optimism as of July 26, according to DEX Screener.

TOP 10 PAIRS Those four pairs accounted for $16.88M in volume in the past day. That’s good for 39.1% of the $43.21M of volume generated by those top 10 trading pairs on Optimism, which is a Layer 2 network designed to improve the transaction speed and efficiency of Ethereum.

BOOTSTRAPPED Optimism hit $54M in total 24-hour volume on July 26. Uniswap leads and accounts for the other 60.9% of volume of the top 10 trading pairs on the Layer 2. Still, Velodrome is showing surprising strength for a project boostrapped with a $150,000 grant, according to Gabagool.ETH, a member of Information Token, a venture studio which incubated a project which would then pivot to become Velodrome.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion

🏗 There’s No Time Like a Bear Market to Build Breakthroughs

Heed the Lessons of the Web2 Boom Following the Dotcom Crash

Guest writer Hatu Sheikh urges Defiers to bear down and focus on their projects during this challenging period.

BUBBLE In the 1990s, the dot-com bubble drove a five-fold jump in the value of technology stocks and the Nasdaq index. But the bubble burst in 2000, leading to a crack up that felt like the end of the great dream of the internet.

AFTERMATH But it was only the beginning. The dot-com crash, and more importantly, its aftermath, taught us essential lessons about the challenges and opportunities of a bear market. Companies such as Dell, Cisco, Intel, Amazon.com, and eBay not only weathered the storm, they reaffirmed the conviction that promising technology sustains itself in the long run, weeding out unnecessary frills.

SCENARIO In many ways, the dot-com bubble is similar to the current scenario in the blockchain-cryptocurrency industry. There’s no doubt the crypto industry is going through a terrible phase. The market has lost $2T, about 67% of its value, since all-time highs in November.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Tutorial: Zapper is now the frontpage of Web3. About time...

DeFi Explainers

🧐 What Is Yield Farming?

QUEST It could be said that yield farming is a quest for lifelong fulfillment. One doesn’t have to go farther than to remember the quote from the billionaire investor Warren Buffett: “If you don’t find a way to make money while you sleep, you will work until you die.”

ASSETS As sayings go, they are always easier said than done. However, blockchain assets within the decentralized finance (DeFi) continuum offer yield farming opportunities like never before in history. Terra and Celsius Network may have gone down the toilet, but one should keep in mind that they were CeFi lending platforms, not DeFi.

YIELDS The likes of Aave, Curve, and Uniswap, in addition to Ethereum staking, still offer yields that overshadow the average savings account rate of 0.1%. This yield farming guide covers everything a passive income seeker needs to know to get started.

PASSIVE INCOME What is understood by yield farming is any process that locks in crypto assets for passive income generation. This income is commonly represented as APY percentage — Annual Percentage Yield, sometimes referred to as EAR (Effective Annual Rate). It measures a future gain from an initial investment.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 Why the Messy 3AC, Celsius, and Voyager Bankruptcies Will Drag on for Years: Unchained

Two crypto law experts, Wassielawyer and Adam Levitin, analyze the bankruptcies of 3AC, Celsius, and Voyager.

🔗 Treasury Investigating Kraken for Alleged Iran Sanctions Violations: Report: Decrypt

Unnamed sources told the New York Times that Kraken is suspected of allowing users in Iran to use its exchange despite federal sanctions.

🔗 What Happens to Celsius Creditors if Crypto Prices Recover?: CoinDesk

Suppose bitcoin’s (BTC) price doubles over the coming months. Would the hundreds of thousands of customers whose cryptocurrency assets are frozen within stricken lending platform Celsius Network come out ahead, or just break even?

Trending in The Defiant

Voyager Rejection of FTX Buyout Leaves Investors Searching for Answers Thanks but no thanks. That was the message Voyager Digital, a bankrupt crypto lender and exchange, delivered to FTX and Alameda Ventures on Sunday.

zxEVM- Who’s Announced What and WTF is it? Three projects announced zkEVM updates, Polygon, Scroll and zkSYNC last week.

Lido DAO Rejects Token Sale To Dragonfly With help from an anonymous whale, Lido rejected a proposed deal with Dragonfly Capital on Monday. In an attempt to cushion itself against an extended crypto winter, Lido’s leadership had proposed selling 10M LDO to Dragonfly Capital for stablecoins at $1.45 per token. LDO, the governance token of crypto’s largest liquid staking protocol, was trading at $1.60 on Sunday night in New York.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Claire Gu, Samuel Haig, Jason Levin, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content.Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr.