📊 DeFi is Deleveraging After Liquidations

Hello Defiers, here’s what we’re covering today,

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, a capitalization-weighted index that tracks the performance of selected DeFi assets across the market.

🎙Listen to this week’s podcast episode with Do Kwon from Terra here:

Be Sure to Check Out This Week’s Video Content👇

📺 First Look: EPNS, Ethereum Push Notification Service

📺 Quick Take: Redeem Money from the Future with Flashstake

📺 Tutorial: How to Join the Gyroscope Testnet

On-Chain Markets Update by IntoTheBlock

📊 DeFi is Deleveraging After Liquidations

TLDR Decentralized lending markets experienced tumultuous action during the weekend. On-chain activity points to markets deleveraging and investor repositioning from lenders to yield aggregators amid the crash.

LIQUIDATIONS Compound experienced $5.6 million worth of liquidations on April 18. Even though this is meager in comparison to the liquidations in derivatives, it is one of the five highest liquidating days in the Compound protocol.

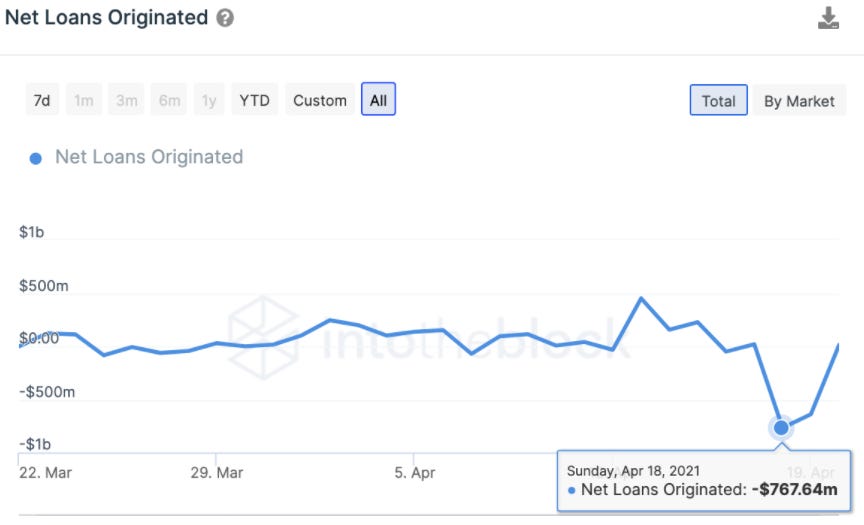

LOANS ORIGINATED DECLINE Net loans originated in Compound dropped sharply on Sunday. The number of loans repaid was $767 million greater than the loans taken out on April 18, a much higher amount than the $5 million of forced repayments through liquidations.

On April 19, net loans originated were still over $600 million, despite under $50,000 being liquidated. This trend points to investors closing out loans and deleveraging in light of the recent correction.

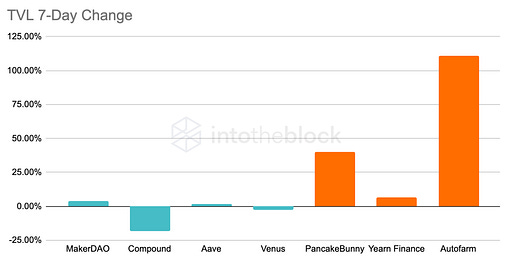

FROM LENDER TO YIELD AGGREGATORS Investors are reallocating their positions. This pattern can be observed in TVL shifting from lending platforms into yield aggregators. One hypothesis to explain this trend is that traders in crypto are moving out of leveraged investing into passive earning. Potentially, this could suggest less of a risk-on stance as investors forego leveraged speculation for autopilot returns. It is also worth noting the high liquidity mining rewards provided by yield aggregators in BSC is likely incentivizing the TVL increase in PancakeBunny and Autofarm.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

SPONSORED POST

Don't Miss Kuneco Today

Tune into Kuneco, the Celo community's most celebrated virtual conference–bringing together industry leaders, investors, enthusiasts, and builders all of who are innovating on money with Celo. Starting Wednesday, April 21 and continuing through today and Thursday, April 22– the conference starts at 7am PT for 4 hours of discussions, presentations, and fireside chats each day.

Speakers include Reid Hoffman, Naval Ravikant, Morgan Beller, Charles Eisenstein, Zaki Manian, Sep Kamvar, Robert Leshner, and others. You'll also hear from the Grameen Foundation, Mercy Corps, and Emerging Impact on how they are leveraging mobile-firstDeFi to make a real impact in the real world.

Some of what you'll see at Kuneco:

Boosting Local Economies Through Payments

How Compound Scales to a Multi-Chain World

Ecology of Currencies: Tooling, Incentives and Design

Mobile-Native Apps in Emerging Economies

Discussion: Celo versus Ethereum

Recapitalizing Earth's Treasury with Regenerative Economics

Whether you're coming for one of the sessions or staying for both days, we already know Kuneco has something for you! View the full agenda and speaker list at kuneco.celo.org. Tune into the livestream on Twitter or YouTube on April 21-22 from 7-11am PT.

🏴☠️ EasyFi Loses Over $60M in Admin Key Hack

TLDR EasyFi, a Compound Finance fork launched directly on the Polygon Layer 2 Network, suffered a major hack on Monday, losing over $60M of the project’s EASY tokens and also $6M of users’ provided liquidity.

CONTEXT The hacker gained access to the project’s admin key, which allows developers to make changes to their protocol. The attack is the latest in a series of exploits to DeFi protocols and highlights yet another potential security flaw users should take into account when depositing their funds.

ADMIN KEY ACCESS In a “pre-post mortem” EasyFi co-founder Ankitt Gaur said the hacker gained access to the computer which held the admin key remotely and transferred 2.89M of EASY tokens to their Ethereum wallet where they have been swapping the tokens primarily for the USDC stablecoin.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🧛 Synthetix to Add Tokens Linked to FAANG Stocks

TLDR Synthetix, the synthetic derivatives protocol, will launch its Alnilam update tomorrow which includes three Synthetix Improvement Proposals (SIPs) and adds support for eight new assets, including tokens tracking prices for FAANG stocks –– Facebook, Amazon, Apple, Netflix and Google

FAANG SYNTHS SIP-114 adds sFB, sAMZN, sAAPL, sNFLX, and sGOOG synthetic assets to Synthetix. The derivatives’ addition will give DeFi participants another avenue to gain exposure to big-name US equities regardless of where in the world they are based. Terra’s Mirror also issues crypto assets tied to traditional equities, and so does FTX, though on a centralized platform.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

💰 Injective Protocol Raises $10M at $1B Valuation

TLDR Injective Protocol, a decentralized derivatives exchange, said it raised a $10M at a $1B valuation from investors including Pantera Capital, BlockTower, Hashed, Cadenza Ventures (formerly BitMex Ventures), among others. Dallas Mavericks owner Mark Cuban also participated, while Cumberland, DRW’s crypto arm, disclosed its investment in the company.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 Ethereum settled $1.5 trillion in transactions in Q1 2021: @RyanWatkins

🔗 Dharma’s Fiat to DeFi Available in All 50 States: @Dharma_HQ

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).