😬 DeFi Investors Brace for Liquidations as MakerDAO and Aave Call in Collateral

Hello Defiers! Here’s what we’re covering today:

News

DeFi Investors Brace for Liquidations as MakerDAO and Aave Call in Collateral

Cancel Your Old OpenSea Listings Or Risk Your Precious NFTs Being Spirited Away

Startup Aims to Give Crypto Investment Clubs a Web3 Makeover

Polymarket Shuts Out U.S. Traders to Comply with CFTC Settlement

Podcast

🎙Listen to the interview with Synthetix Founder Kain Warwick:

Video

Links

Fantom Becomes Third-Largest DeFi Protocol by Value Locked: CoinDesk

The great renaming: what happened to Eth2?: Ethereum Foundation

JPMorgan Chase closes Uniswap founder's bank accounts: The Block

5 reasons to be excited for the bear market [LITE]: Bankless

Maker Protocol Changes DIRECT-AAVEV2-DAI debt ceiling: 133.815M → 183.815M DAI: MakerDAO

Trending in The Defiant

Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down 93% and Called a ‘Ponzi’

LooksRare Surges to $7B Valuation as Torrid Volumes Fuel Staking Rewards

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Step Finance is the portfolio management dashboard for Solana users to visualise, analyse, execute and aggregate transactions across all Solana contracts in one place. Get started now!

Zerion Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Cryptex Finance (CTX) the fully decentralized creators of TCAP, The World’s First Total Crypto Market Cap Token.

Concordium is made for the future economy. It’s the first fully compliant blockchain with Layer 1 ID, predictable fees valued in FIAT and private and public transactions. Discover more.

DeFi Markets

😬 DeFi Investors Brace for Liquidations as MakerDAO and Aave Call in Collateral

LEVERAGE Now comes the liquidation phase. As crypto investors reckon with a 45% plunge in the value of the crypto market since November’s all-time high, the focus is now turning to the impact on leverage many investors use to amplify their earnings. Key platforms are liquidating the collateral users put up to secure borrowings, usually made in a stablecoin like DAI.

SPIKED Liquidations spiked to 1,692 on Aave, DeFi’s largest protocol, on Jan. 23. That’s the highest since the crash in late May 2021, according to data from The Defiant Terminal.

MAXED OUT MakerDAO, another of DeFi’s largest protocols, had its own local high of 95 liquidations which came on Jan. 22. Like Aave, that was the highest mark since late May for the protocol. While the number of Aave liquidations outpaced Maker’s, the reverse was the case for USD-denominated value of the liquidations — Maker hit $118.8M in liquidations on Jan. 21, while Aave maxed out in terms of daily highs at $61.13M on Jan. 22, according to The Defiant Terminal.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Marketplaces

🪲 Cancel Your Old OpenSea Listings Or Risk Your Precious NFTs Being Spirited Away

BUG A ‘bug’ discovered a few weeks ago in OpenSea, the leading NFT marketplace, enabled more than $1M worth of non-fungible tokens to be bought at huge discounts on Jan. 24.

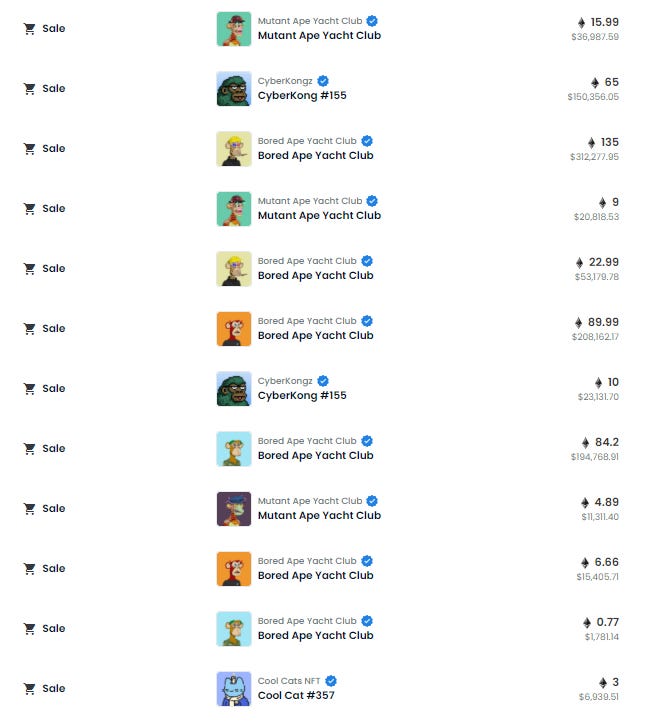

COOL CAT A user who goes by jpegdegenlove managed to acquire two Bored Apes, two Mutant Apes, one Cyberkongz Genesis and a Cool Cat for a total of 57.31 ETH ($137K). Quite the feat, considering the cheapest Bored Ape NFT currently costs 93 ETH ($223K).

SOLD All six NFTs were subsequently sold for 390 ETH ($936K), netting a profit of over $700K.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Web3

🪜 Startup Aims to Give Crypto Investment Clubs a Web3 Makeover

NEWS People are teaming up all over crypto, but, according to the founders of Syndicate Protocol, investors lack web3 native ways to do so. “I’ve been an investor for eight years in the crypto and fintech space, and I’ve come to realize that literally builds the world,” Ian Lee, co-founder of Syndicate, told The Defiant in a phone call.

FRICTION If it’s too expensive to get an investing group started or if the tools are too cumbersome, that friction will prevent people from getting involved who otherwise might have done so. “If this is the next internet, we need more people to participate in investing and building that internet for the world,” Lee said.

COMPLIANCE To that end, Syndicate released its first product on Tuesday: A platform for easily and simply setting up an investment club in a web3-native way. It is designed to keep track of all the club’s accounting and compliance needs while giving members around the clock visibility to its performance.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Regulators

🚪Polymarket Shuts Out U.S. Traders to Comply with CFTC Settlement

U.S. TRADERS Polymarket has shut U.S. traders out of its bets, but the prediction market remains live everywhere else. That’s the company’s solution following its recent settlement with the Commodity Futures Trading Commission (CFTC).

PENALTY Polymarket is a prediction market that came out of stealth in June 2020. Calling it an “event-based binary options market” the CFTC brought suit against the company that runs Polymarket, which is based in New York City. It was settled with a $1.4M penalty and an agreement to cease its violations of various rules cited in the order. The order stipulated that Polymarket would certify that it had ceased offering such products by Jan. 24.

REGULATED The company first informed its users that it would block users in the United States on Jan. 12. In a message from Autumn Communications on behalf of Polymarket, the company announced that it was working on a regulated product for the U.S. market.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Unstoppable Domains is The #1 provider of NFT domains. With endings like .crypto, .x and .nft you can replace your long complex wallet addresses, verify ownership of your NFTs, login into web3 apps and join 10’s of thousands of people using them as their Twitter usernames. Better yet, with Unstoppable domains you don't have to worry about gas or renewal fees, YOU OWN IT. Get your name for as low as $5 here.

The Tube

📺 The Defiant Weekly: DeFi 2.0 is dead, its spirit lives on in Fantom ve(3,3)

Links

🔗 Fantom Becomes Third-Largest DeFi Protocol by Value Locked: CoinDesk

Fantom overtook Binance Smart Chain (BSC) over the weekend to become the third-largest decentralized finance (DeFi) ecosystem by total value locked, data from analytics tool DeFiLlama showed.

🔗 The great renaming: what happened to Eth2?: Ethereum Foundation

Ethereum is a protocol undergoing significant changes. Client teams are upgrading the protocol to scale to meet global demand while improving security and decentralization.

🔗 JPMorgan Chase closes Uniswap founder's bank accounts: The Block

Uniswap founder Hayden Adams tweeted Sunday that JPMorgan Chase has closed his bank accounts without notice or explanation.

🔗 5 reasons to be excited for the bear market [LITE]: Bankless

Many of my friends got into crypto in 2021, and all of them just want prices to go up… I mean, of course, they do!

Trending in The Defiant

Uniswap Crosses Milestone With Greater ETH/Stablecoin Volume than Coinbase or Binance Uniswap, the leading decentralized exchange by trade volume, now processes more ETH/stablecoin volume than any centralized crypto trading venue.

OlympusDAO Created a Breakthrough DeFi Model – Now It’s Down 93% and Called a ‘Ponzi’ OlympusDAO held so much promise when it exploded on the DeFi scene in 2021.

LooksRare Surges to $7B Valuation as Torrid Volumes Fuel Staking Rewards LooksRare, the upstart NFT marketplace that airdropped its $LOOKS token to NFT traders on Jan. 9, is having a stellar run.

🧑💻 ✍️ Stories in The Defiant are written by Brady Dale, Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)