🌎 DeFi Has a First World Problem: Few EM Users

Hello Defiers! Here’s what we’re covering today,

Developing nations are dominating DeFi

Curve Finance authorized fork Ellipsis launches on BSC

Alpha Finance maps out its tokenomics

StarkWare and Covalent announce funding rounds

💗 The Defiant Gitcoin Grant

Also, please consider contributing to our Gitcoin grant! We’re using everything raised on this round towards gifting Defiant subscriptions. You can nominate whoever you think would benefit the most from full access to the best DeFi information and journalism out there —including yourself!

📺 Quick Take: Uniswap V3

📺 Tuesday Tutorial: Earn Fixed Interest on UST

🎙Listen to this week’s podcast episode with Antonio Juliano here:

🙌 Together with:

Zerion, a simple interface to access and use decentralized finance

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Casper, an enterprise-focused blockchain which aims to introduce unprecedented security, speed and scale for businesses

EMERGING MARKETS

🌎 DeFi Has a First World Problem: Too Few EM Users

BOTTOM LINE It’s become a consensus view that the use case for cryptocurrencies becomes stronger in emerging markets, which are more often plagued with authoritarian regimes and devaluing currencies than developed nations. If that’s the case, then DeFi builders aren’t reaching the audience that needs them most.

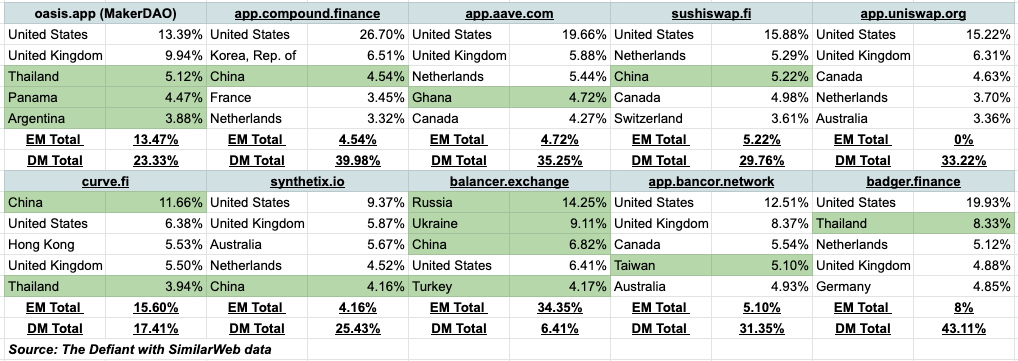

THE DATA Developing nations made up only 10% of the biggest DeFi dapps’ top traffic sources on average last month, compared with 28% for developed nations, according to data from SimilarWeb. We tracked the top five traffic sources in the 10 biggest DeFi protocols by value locked ranked in DeFi Pulse.

MOST AND LEAST Balancer had the highest number of users coming from emerging markets, at 34%, and Uniswap had the lowest, as all of the top traffic sources came from developed nations.

DEFI IS TRENDING While more users are coming from developed nations, Google trends point to rising interest in emerging markets. Nigeria and Thailand are the two countries with the most searches for “decentralized finance” over the last 12 months, at the time of writing.

NIGERIA Nigeria’s devaluing currency and young population has sparked interest in DeFi, said Ugochukwu Aronu, founder of Xend Finance, a platform which supports the operations of credit unions and cooperatives in the African nation and beyond.

LOCAL BITCOINS Additionally the use of Bitcoin peer-to-peer networks like LocalBitcoins.com continue to see increased adoption among emerging markets, with local currency volume in Colombia, Mexico, Kenya, and Egypt at or near records. Increasing Bitcoin adoption should be a leading sign of DeFi adoption, as the largest cryptocurrency is often the gateway into other cryptocurrencies and dapps.

MOBILE FIRST The DeFi revolution in EM may be mobile-first. The reach of smartphones with internet connections is soaring in underbanked populations. According to a GSMA report, by 2025, smartphone penetration will reach 80% globally, and the countries contributing to the increase include India, Indonesia, Pakistan and Mexico. India has the cheapest mobile broadband prices in the world, according to the BBC.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

BINANCE SMART CHAIN

🍴 Curve Finance Fork Ellipsis Launches on BSC

TLDR Ellipsis Finance, an authorized fork of Curve Finance, launched yesterday on Binance Smart Chain (BSC). The protocol is an exchange for stablecoins and its launch doc promises traders “very low slippage and minimal fees.”

ELLIPSIS TOKEN As the protocol is an “authorized fork,” holders of veCRV, Curve’s governance token which earns trading fees and liquidity provider rewards, will receive 25% of Ellipsis token, called EPS, over the next 12 months. They will need to claim the tokens on BSC with their Ethereum address.

“As we don’t have BSC plans it seemed like it could be a fun idea to give them our blessing in exchange for rewards for our DAO participants,” Charlie Watkins, project lead at Curve, told The Defiant

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

TOKENOMICS

🌟 Alpha Finance Lab Launching ALPHA Tokenomics

TLDR Alpha Finance Lab will be launching its ALPHA tokenomics system “in the coming days,” allowing token holders to earn fees from staking across all of ALPHA’s products, including Alpha Homora on Ethereum, Alpha Homora on Binance Smart Chain, and Alpha Homora v2.

👉 READ THE FULL STORY HERE, IN THEDEFIANT.IO 👈

🔗 Announcing our $75M Series B: @StarkWareLtd

🔗 Covalent Closes $2 Million Strategic Funding Round: Covalent

Covalent, a unified API for blockchain data, has closed a $2 million strategic funding round led by Hashed with participation from Binance Labs, Coinbase Ventures, Delphi Ventures, Hypersphere Ventures, and other ecosystem partners. The new funding will accelerate product timelines to launch a decentralized version of the market leading Covalent API.

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Owen Fernau and Dan Kahan, and edited by Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($10/mo, $100/yr).