🏦 DeFi Blue-Chips are Becoming Financial Middleware

Hello Defiers! Here’s what we are covering today…

News:

and more ;)

🎙Listen to the interview in this week’s podcast episode here:

💸 Gitcoin Grants Round 10 is Live!! Remember to contribute to The Defiant!

The Defiant is building the leading information platform at the intersection of tech and finance. We are the only news platform focusing on decentralized finance, creating objective, unbiased, professional journalism, for degens and newbies to keep track of this money revolution.

Everything we raise on this round will be used towards gifting Defiant subscriptions. Nominate subscribers here.

*The financial system is being rebuilt and this revolution needs quality journalism.*

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at https://balancer.finance/!

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

Kyber DMM (Dynamic Market Maker), a next-gen AMM designed to maximize the use of capital by enabling high capital efficiency and dynamic fees to optimize returns for liquidity providers.

🐞 Bug in Alchemix’s New ETH Vault is Allowing Borrowers To Withdraw Their Collateral

TLDR A bug has just been discovered in the Alchemix Finance alETH contract. Alchemix Finance recently launched alETH, a synthetic yield derivative that lets DeFi users borrow 1 alETH for every 4 ETH pledged as collateral. The ETH collateral is deployed into Yearn vaults, and the resulting yield is used to automatically pay off the outstanding alETH debt over time.

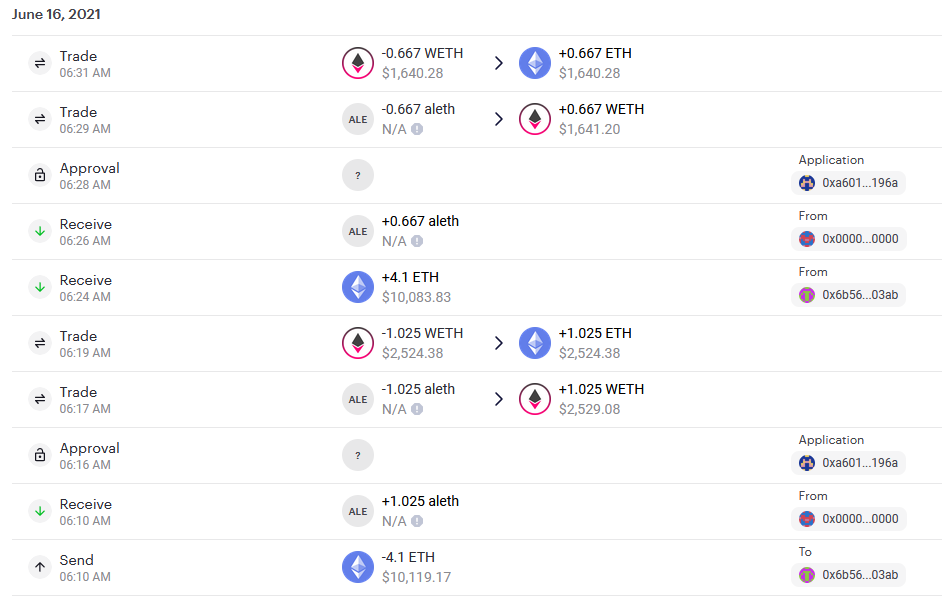

WITHDRAW But today some users have reported they were able to withdraw their ETH collateral despite having outstanding debt, as can be seen in this series of transactions below:

The Alchemix team has already paused further borrowing of alETH as they investigate the issue, according to the project’s Discord. The team has announced that user funds are safe. As there was a borrowing cap of 2,000 alETH in place, the protocol seems well placed to withstand any potential losses.

👉 READ THE FULL STORY IN THE DEFIANT.IO 👈

😎 Synthetix-Based Exchange Declares Independence

TLDR Kwenta, an exchange interface for Synthetix’s derivatives, has declared itself an “independent project operating outside of the Synthetix core contributors,” according to an announcement post.

BOOTSTRAP The project will also issue a token, KWENTA, that will be used to participate in governance and to “bootstrap the community and fuel an early development team.” It’s a sign that interfaces are beginning to establish their own token, rendering the protocol upon which they run something akin to financial middleware.

SO WHAT This matters because protocols like Uniswap, Yearn, and Synthetix, which DeFi users often think of as “blue chips,” all now have or will have, developers building on top of them, making them less of a consumer-facing product.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

🕸 The World Wide Web Is Now an NFT

TLDR The source code for the World Wide Web is being turned into an NFT.

PYTHON Created by World Wide Web inventor Sir Tim Berners-Lee, the NFT is composed of four elements: the time-stamped files containing the source code, a moving visualization of the code, a letter written by Berners-Lee reflecting on the code’s creation, and a digital poster of the full code created from the original files using Python.

AUCTION The NFT, called “This Changed Everything,” will be auctioned off on June 23 by Sotheby’s, the art auction house that’s been dabbling in NFT artwork recently. The auction will run through June 30, with proceeds benefiting initiatives supported by Berners-Lee and his wife.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

🔗 Sushi (SUSHI) now available in iTrustCapital Crypto IRA / 401k Retirement Accounts: iTrust Capital

“Sushi being available in iTrustCapital Crypto IRA / 401k retirement accounts is history made. This requires reflection on what has brought us here. It all started with the notorious DeFi “Food Coins” which seemingly appeared out of nowhere during the Summer of 2020.”

🔗 Mark Cuban Invests in Decentralized Data Marketplace dClimate: CoinDesk

It seems Mark Cuban has his finger on the pulse of the ongoing bitcoin sustainability debate. The billionaire investor has joined dClimate, a decentralized network for climate data, as an investor and strategic advisor.”

🔗. Michael Saylor is not just a Bitcoin maximalist: ‘There’s a place for everybody’: CoinTelegraph

“MicroStrategy chief Michael Saylor has room in his heart for other cryptocurrencies aside from Bitcoin, the billionaire revealed on an episode of CNBC’s Fast Money, in which he aired his views on the industry and where he sees things going in the future.”

🔗 Panini America Using Powerful Prizm Basketball Brand to Unveil First Pack-Based NFT Product: Panini

“Panini America made history in the digital collecting space in January of 2020 by becoming the first company to introduce NFT blockchain trading cards. Later this month, Panini America will make history once again with its first pack-based NFT release: 2020-21 Prizm Basketball NFT Blockchain.”

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Dan Kahan, Owen Fernau, and edited by Edward Robinson and Bailey Reutzel. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).