⍺ DeFi Alpha: Venturing Into Degen Territory With Astroport, Aurigami & ThorSwap

DeFi Alpha is a weekly newsletter published every Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader. It aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms.

Motivation

Two years ago, DeFi investors could easily name every yield farming opportunity without much effort. It was a simpler time, where only a handful of teams had launched with any liquidity to trade, lend, borrow, provide liquidity, or even demonstrate new primitives such as no-loss savings by PoolTogether.

But times have changed! DeFi liquidity has grown to hundreds of billions of dollars across Ethereum with new burgeoning DeFi economies taking shape on EVM-compatible chains such as Polygon and Avalanche and non-EVM chains such as Terra and Solana. Any given day, a new DeFi or NFT project is launching. So after writing and creating countless DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a more detailed weekly guide on all you need to know to keep up with new and old yield earning opportunities.

This is DeFi Alpha by The Defiant.

We are sending this issue to all Defiant subscribers. If you want to keep receiving this newsletter going forward please subscribe here:

🙌 Together with:

Sperax USD, the FIRST Auto-yield stablecoin on Layer 2, connects you with modern money. Learn more!

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC, stablecoins, and other major tokens.

ETH - ThorSwap 50/50 LP for ETH/RUNE for a total of ~20% APR

This yield is issued in trading fees paid in ETH + RUNE.

Be aware there is impermanent loss, and for anyone using a single deposit of only ETH, the pool will still split a deposit of 100% ETH into 50/50 ETH/RUNE, meaning you’re no longer exposed to just the price of ETH, but also RUNE like in other AMMs.

For LPs who do deposit 2 tokens (ETH + RUNE), there is impermanent loss insurance, 1% more added each day as an LP, so LPs are 100% protected after 100 days.

To participate, go to the Pools tab on ThorSwap and search for “ETH” with Native showing. One will have to connect their Ethereum wallet to deposit 100% ETH, unless they hold RUNE on Thorchain to pair with ETH.

BTC - ThorSwap 50/50 LP for BTC/RUNE for a total of ~18% APR

This yield is issued in trading fees paid in BTC + RUNE.

Be aware there is impermanent loss, and for anyone using a single deposit of only BTC, the pool will still split a deposit of 100% BTC into 50/50 BTC/RUNE, meaning you’re no longer exposed to just the price of BTC, but also RUNE like in other AMMs.

For LPs who do deposit 2 tokens (BTC + RUNE), there is impermanent loss insurance, 1% more added each day as an LP, so LPs are 100% protected after 100 days.

To participate, go to the Pools tab on ThorSwap and search for “BTC” with Native showing. One will have to connect their Bitcoin wallet to deposit 100% BTC, unless they hold RUNE on Thorchain to pair with BTC.

AVAX - On YieldYak, you can earn compounding lending interest with AVAX on Benqi at 10.3% APY

This yield is issued in AVAX and is auto-compounding thanks to YieldYak

To participate, Deposit AVAX into the Yield Yak Benqi AVAX single-asset farm.

SOL - Lend stSOL with Francium on Solana to earn 5.17% APY (from Francium) + 5.8% APR from the underlying SOL staking rewards in stSOL

This yield is backed by borrowing interest paid by leveraged yield farmers on Francium as well as the 5.8% APR in staking rewards thanks to the liquid staking derivative stSOL by Lido.

To participate, go to the Francium dApp under Lend and deposit stSOL (by Lido).

LUNA - LP with LUNA-LunaX in TerraSwap to earn up to 50% APY in soon-to-launch SD tokens + trading fees

This yield is backed by auto-compounding LUNA staking rewards thanks to LunaX, trading fees on TerraSwap, and SD token rewards by Stader.

To participate on Terra, deposit 50% of LUNA into LunaX and then go here to TerraSwap to pair 50/50 LUNA<>LunaX as an LP and sit back to passively collect rewards.

The LunaX staking derivative alone is earning 9.86% APY.

ATOM - mint pATOM and stake the pATOMs on Ethereum to earn more pATOMs on pSTAKE at a rate of 12.02% APR

The yield earned is issued and claimable in pATOM and this yield is expected to hold steady for weeks/months unless pSTAKE changes their liquid staking model.

To participate, one must first mint a 1:1 representation of ATOM as pATOM on Ethereum by using the pSTAKE dApp under Deposit

Then, deposit/stake pATOMs to get stkATOMs and earn 7% APR

Stablecoins - earning 19.45% APY with UST on Anchor Protocol on Terra

This yield is issued in UST.

To participate, deposit UST into the Earn tab here on Anchor on Terra.

Here’s a great tutorial from a while back by Robin from our team at The Defiant.

🪂 Airdrop Alpha

In each DeFi Alpha guide, we update a list of the most obvious DeFi protocols that have yet to announce and/or launch a token.

Cosmos Ecosystem : Staking $ATOM and $OSMO usually makes one eligible for airdrops from new apps that launch on Cosmos. Staking guide here in a previous edition of DeFi Alpha.

Arbitrum - one of the leading L2 solutions for Ethereum with live dApps such as Uniswap, SushiSwap, Hop, and more, we expect a token to eventually launch so by depositing assets or transacting, one might earn a future airdrop

DeFi Saver - a one-stop dashboard for creating, managing and tracking DeFi positions across Aave, Compound, Maker, Liquity, and Reflexer

Element Finance - stake/lend to earn fixed interest with fixed terms on Ethereum

Euler Finance - a non-custodial protocol on Ethereum that allows users to lend and borrow almost any crypto asset, just launched but has yet to launch a token.

Francium - leveraged yield farming similar to Alpha Homora but on Solana, one can choose to simply lend single assets or hold leveraged LPs to potentially earn an airdrop here

Hop Protocol - become an LP to enable bridging instantly between Ethereum Mainnet, Polygon, Arbitrum, or Optimsm without waiting for long delays in withdrawals; DeFi Dad has a full-blown video tutorial on how to become a Hop LP and potentially earn a future HOP airdrop.

Optimism - one of the leading L2 solutions for Ethereum with live dApps such as Uniswap, Hop, Synthetix and more, we expect a token to eventually launch so by depositing assets or transacting, one might earn a future airdrop

Opyn - one of the OG decentralized options protocols on Ethereum, with major investors that signal a token has to be in their future. Buy/sell puts or call options to earn a possible future airdrop.

Polymarket - one of the strongest players in the DeFi prediction market vertical, bet on an outcome related to crypto, politics, sports and more or add liquidity

Set Protocol - one of the earliest DeFi protocols yet to launch a token for DeFi asset management, popular for TokenSets and known for powering IndexCoop indexes

Stader Labs - The SD token sale happened January 25th, and there’s still time to earn SD before the TGE by depositing LUNA into LunaX (a liquid staking equivalent of LUNA) and pairing LUNA<>LunaX as an LP here on TerraSwap.

Volmex - Volmex is a tokenized volatility protocol, similar to the VIX but ETHV

Yield Protocol - a newer protocol for fixed-term, fixed-rate lending in DeFi, backed by Paradigm, one might earn a future airdrop by lending DAI or USDC

Zapper - participate in Zapper trading, lending, providing liquidity, or yield farming; given the Zapper Quests and NFT Rewards program, it can be surmised that if Zapper ever releases a token, this is one way they might do a retro airdrop

Zerion - same can be said speculated about Zerion; if they ever release a token, they’re likely to reward those who interacted with their smart contracts swapping, lending, providing liquidity, or borrowing

🧑💻 Defiant Starter Tutorial

How to Earn Up to 125% as an LP on Terra’s Astroport AMM

Opportunity: Astroport is the newest AMM (automated market maker) to launch on Terra. It supports two liquidity pool types, Uniswap’s Constant Product formula pools and Curve’s StableSwap Invariant formula pools. Terra boasts about $23B TVL, second behind Ethereum’s $110B TVL today. A core dApp for any DeFi community is trading on an AMM, so Astroport brings much needed liquidity ($1.3B) to a space previously led by TerraSwap.

Before we get started, please exercise caution with such a new dApp, “written from scratch in Rust,” which translates to meaning a higher risk of unknown bugs than the battle-tested AMMs like Uniswap or Curve on Ethereum and EVM chains.

Time to Complete: 5 minutes if one already has a Terra wallet and liquidity on Terra

Estimated Length of Rewards Program: There’s no time limit to earning trading fees as an LP, but some of the ASTRO emissions for incentivized pools will likely get voted to new pools in the coming weeks/months.

Gas + Protocol Fees: Based on gas prices on Terra, one is likely to pay less than $1 in fees.

Fees: Other than network fees paid for Terra transactions, there’s no fees to becoming an LP, unless one needs to trade for tokens first, which would incur whatever trading fee on that pool (ie 0.3% or 0.05%).

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

Smart contract risk, oracle failure, and governance attacks in Astroport

Impermanent loss in the LP

Systemic risk in DeFi

Pegged assets such as stablecoins may de-peg

Tutorial:

First, assuming I have tokens on Terra in a wallet like the Terra Station browser wallet, I can go to the Pools tab on Astroport and connect my wallet.

After reviewing the pools, ranking by APR, and considering what I hold and if I’m willing to hold 50/50 exposure to a non-stable pair like LUNA-UST vs a like-asset pool such as stLUNA-LUNA where I’ll incur minimum impermanent loss, I decide I’d like to hold stLUNA-LUNA and earn an estimated 18.63% APR, on top of the underlying 7.4% APY earning with stLUNA.

If I need stLUNA, I can “bond” my LUNA for stLUNA here on Lido after connecting my Terra wallet.

Once I have LUNA and stLUNA in my wallet, I can return to the Pools tab on Astroport, and next to the stLUNA - LUNA LP is a purple Add Liquidity button to click.

Now, I can deposit however much stLUNA + LUNA in 50/50 ratio, the app auto-calculates how much of the other token when you specify an amount for either.

I am careful to be sure the green box is checked off for Stake LP Token.

Finally, I click Add Liquidity and then Confirm Adding Liquidity.

I follow the prompts on-screen until it shows I’ve confirmed adding liquidity and staked the LP token. I can confirm my LP is staked when it shows up under My Pools here.

🦍 Defiant Degen Tutorial

Pre-farming $PLY Tokens on Aurigami

Aurigami is the first money market protocol on Aurora, an Ethereum Virtual Machine (EVM) compatible blockchain built by NEAR Protocol.

The app launched on Aurora mainnet on Mar 2 with a liquidity pre-mining program for its upcoming $PLY token.

Users can deposit and borrow any of the supported assets (ETH, WBTC, WNEAR, USDC, and USDT) to earn interest and PLY tokens.

The program will run for a minimum of 4 weeks with 20M PLY tokens distributed each week.

Note that since PLY is not trading yet, the yield cannot be estimated as it’s a function of the token price. That being said, the protocol has attracted nearly $200M in assets and looks promising.

As always, do your own research before investing.

Let’s get started.

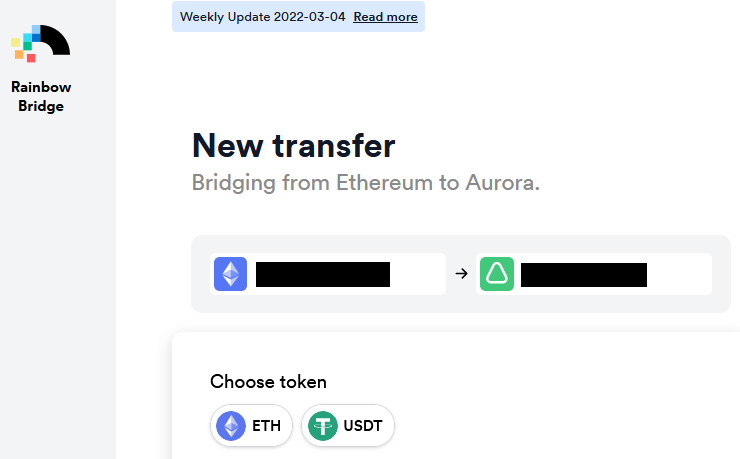

Step 1: Navigate to the Rainbow Bridge and transfer your assets from Ethereum to Aurora. When you connect to the bridge for the first time, you’ll be prompted to add the Aurora network to MetaMask.

Deposits arrive in around 10 minutes.

Step 2: You’ll need some ETH to pay for gas fees. You can get some for free by using this faucet.

Step 3: Once your assets have arrived on Aurora, head over to Aurigami.

Step 4: Deposit your assets to start pre-mining PLY tokens.

A more aggressive strategy is folding (depositing and borrowing the same asset) in order to maximize PLY rewards, but since borrow rates are higher than supply rates, you would be betting that the PLY rewards compensate for the interest differential.

Once you set up your position, confirm that you are accumulating PLY tokens on the rewards page.

That’s it! You’ll be able to claim your rewards once the PLY token goes live.

📰 Elsewhere on The Defiant

Tuesday Tutorial on The Defiant YouTube: This week, Robin dived into yield farming on Solidex, the new yield optimizer on Fantom. Learn how and subscribe to The Defiant on YouTube!

The information contained in this newsletter is not intended as, and shall not be understood or construed as, financial advice. The authors are not financial advisors and the information contained here is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided are accurate but neither The Defiant nor any of its contributors shall be held liable or responsible for any errors or omissions or for any damage readers may suffer as a result of failing to seek financial advice from a professional.