⍺ DeFi Alpha: Supercharged Stablecoin Yields With Concentrator & FiatDAO

Yields: 116% APR on Stablecoins, 21-56% on ETH and BTC

Starter Tutorial: Earn Up to 67.99% vAPR on Stablecoins with FiatDAO

Degen Tutorial: veToken Liquid Lockers from Stake DAO

DeFi Alpha is a weekly newsletter published for our premium subscribers every Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader. It aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms.

Motivation

Two years ago, DeFi investors could easily name every yield farming opportunity without much effort. It was a simpler time, when only a handful of teams had launched with any liquidity to trade, lend, borrow, provide liquidity, or even demonstrate new primitives such as no-loss savings by PoolTogether.

But times have changed! Before the current bear market took hold, DeFi liquidity had grown to hundreds of billions of dollars across Ethereum with new burgeoning DeFi economies taking shape on EVM-compatible chains such as Polygon and Avalanche and non-EVM chains such as Cosmos and Solana. Any given day, a new DeFi or NFT project is launched.

So, after writing and creating countless DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a more detailed weekly guide on all you need to know to keep up with new and old yield earning opportunities.

This is DeFi Alpha by The Defiant.

Any information covered in DeFi Alpha should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

🙌 Together with:

Oasis.app allows you to borrow Dai against your favorite crypto assets, Multiply your exposure and Earn, all in the most trusted way.

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC, stablecoins, and other major tokens.

Stablecoins - Earn 116.5% APR with the Curve DOLA LP staked in Concentrator

This yield is accrued in mostly CTR + Curve trading fees, due to an Initial Farming Offering (IFO) taking place to distribute 2.5M CTR (50% of total supply).

To participate, one must first deposit DOLA, USDC, DAI and/or USDT into this Curve DOLA LP and then stake the LP here in Concentrator -> IFO Vaults -> DOLA.

Caution: CTR is still very illiquid, and priced at $5.79 on Balancer. Be mindful of the volatility of any new reward token and how that price affects estimated yields.

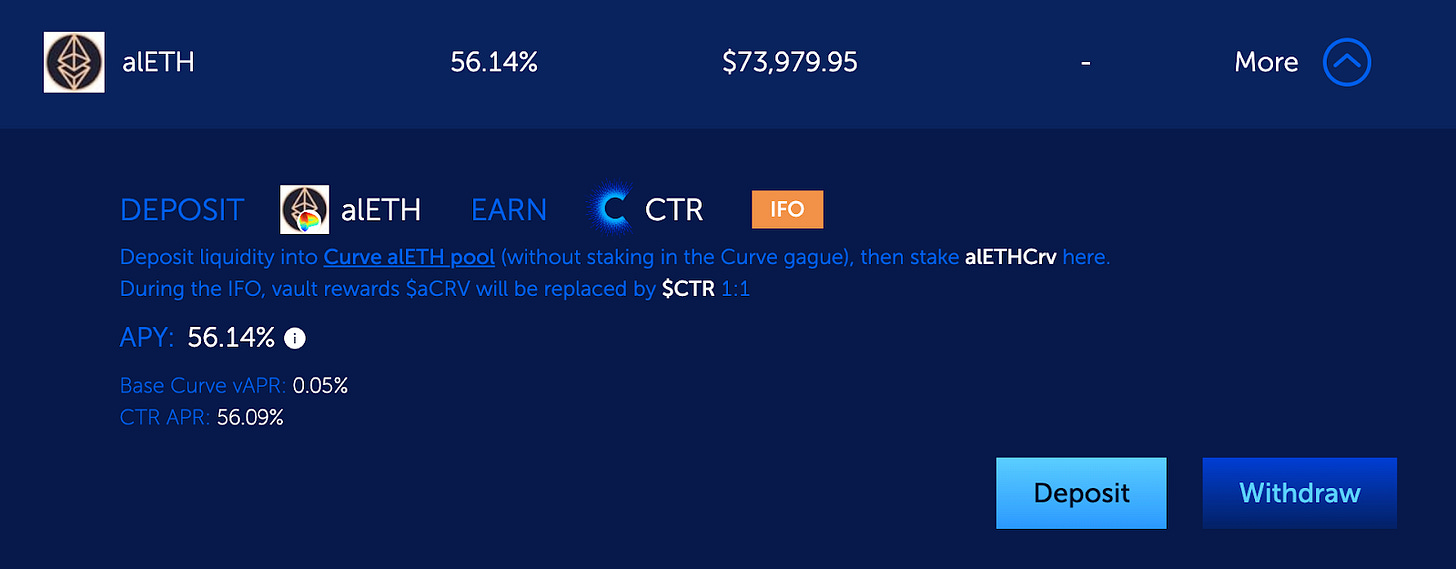

ETH - Earn 56.14% APR with the Curve alETH LP staked in Concentrator

This yield is accrued in mostly CTR + Curve trading fees, due to an Initial Farming Offering (IFO) taking place to distribute 2.5M CTR (50% of total supply).

To participate, one must first deposit ETH or alETH into this Curve alETH LP and then stake the LP here in Concentrator -> IFO Vaults -> alETH.

WBTC - Earn 21.06% APR with the Curve sbtc LP staked in Concentrator

This yield is accrued in mostly CTR + Curve trading fees, due to an Initial Farming Offering (IFO) taking place to distribute 2.5M CTR (50% of total supply).

To participate, one must first deposit WBTC, renBTC, and/or sBTC into this Curve sbtc LP and then stake the LP here in Concentrator -> IFO Vaults -> sbtc.

AVAX - Lend AVAX to the sAVAX/AVAX pool on Platypus via Vector at 13.8% APR

This yield is issued in VTX, PTP, QI, and AVAX.

To participate, one must deposit into the AVAX Stake option here on Vector.

SOL - Lend SOL to leveraged farmers on Tulip Protocol at 4.21% APY + 5.4% APR from the underlying SOL liquid staking rewards issued to stSOL holders

This yield is backed by interest paid by borrowers on Tulip + staking rewards.

To participate, one must deposit stSOL in the Tulip lending tab.

To obtain stSOL, one can trade on a DEX or mint it here on Lido.

MATIC - stake MATIC with MaticX and LP MaticX-MATIC on QuickSwap for 17% APY

The yield is backed by validator rewards using the MaticX liquid staking derivative + trading fees on QuickSwap + dQUICK rewards + SD rewards.

To participate on Polygon, I use the Stader MaticX dApp to mint MaticX.

Then, I deposit into the 50/50 MaticX-MATIC pool on QuickSwap and stake the LP here.

ATOM - mint pATOM and stake the pATOMs on Ethereum to earn more pATOMs on pSTAKE at a rate of 13.5% APR

The yield earned is issued and claimable in pATOM.

To participate, one must first mint a 1:1 representation of ATOM as pATOM on Ethereum by using the pSTAKE dApp under Stake

Then, deposit/stake pATOMs to get stkATOMs and earn 13.5% APR

FTM - stake with sFTMx by Stader, earning 13% APY

The yield is issued in FTM rewards, as sFTMX is earning FTM via validator rewards to support Fantom’s PoS network.

To participate, one must deposit FTM to receive sFTMX here on Stader.

HBAR - stake with the first HBAR liquid staking derivative by Stader, earning 37.8% APY

The yield is issued in HBAR rewards, as HBARX is earning validator rewards.

To participate, deposit HBAR to receive HBARX here on Stader.

Caution: This is in beta and withdrawals will not be possible until July 2022 or later.

Keep reading with a 7-day free trial

Subscribe to WE'VE MOVED TO thedefiant.io to keep reading this post and get 7 days of free access to the full post archives.