📢 DeFi Alpha by The Defiant & DeFi Dad: Step-by-Step Guides on How to Earn Yield in DeFi

A new weekly newsletter

DeFi Alpha is a weekly newsletter published every Friday, authored by DeFi Dad, advisor to The Defiant Advisor and investor at 4RC, and our Degen in Chief yyctrader. DeFi Alpha aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, and provide primers and guides about its emerging platforms.

Motivation

Two years ago, DeFi investors could easily name every yield farming opportunity without much effort. It was a simpler time, where only a handful of teams had launched with any liquidity to trade, lend, borrow, provide liquidity, or even demonstrate new primitives such as no-loss savings by PoolTogether.

But times have changed! DeFi liquidity has grown to over $250B across Ethereum with $171B with new burgeoning DeFi economies on EVM-compatible chains such as Polygon and Avalanche and non-EVM chains such as Terra and Solana. Any given day, a new DeFi or NFT project is launching. So after writing and creating countless DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a more detailed weekly guide on all you need to know to keep up with new and old yield earning opportunities.

This is DeFi Alpha by The Defiant.

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC and stablecoins.

ETH - staking Curve stETH LP in Convex Finance for a projected 6.78% APR

This yield is backed by trading fees, plus CRV, CVX, and LDO rewards.

Additionally, the underlying LP is made up of 50% stETH earning 4.8% APR in Ethereum 2.0 staking rewards, denominated in ETH.

To participate, zap/deposit ETH first into the Curve stETH LP via Zapper here and then stake Curve stETH LP here on Convex.

WBTC - stake Curve ibBTC / crvsBTC LP in Badger Finance for 37.45-125% APR

This yield is backed by trading fees, plus CRV, CVX, and boosted Badger rewards.

The quoted range of ROI is designed to allow participants to increase rewards from competing for a higher boost–a clever way to gamify earning yield in Badger. The more liquidity you provide, the more of a “boost” you receive earning higher yield in that range of 37.45-125% APR.

To participate, deposit wibBTC, renBTC, wBTC , and/or sBTC into this Curve factory pool on Ethereum and then stake the Curve LP token here on Badger Finance into the ibBTC / crvsBTC LP Sett Vault on Ethereum.

Stablecoins - deposit DAI, USDC, or USDT into a variety of lossless prediction markets on EntropyFi on Polygon to earn 16-61% APY in ERP tokens

Deposited stablecoins are used to earn interest in Aave and other protocols and the interest is awarded to the winners of the prediction market (imagine if PoolTogether and Augur had a baby).

Those depositing stablecoins into the Sponsorship tab give up the chance to win the prediction market/game but in turn, are paid out a distribution of ERP tokens for helping bootstrap rewards.

To participate, connect to the Matic Mainnet and deposit DAI, USDC, or USDT depending on the Deposit Asset and estimated yield on the Sponsorship tab in the EntropyFi app here. Then, stake the Sponsor LP token on the Stake tab here.

🪂 Airdrop Alpha

Each week, we’ll do our best to highlight the most obvious DeFi protocols that have yet to announce or distribute a token, but we believe are likely to airdrop a token in the future. By participating in these DeFi applications, we believe there’s a chance but not a guarantee one can earn tokens.

Element Finance - stake/lend to earn fixed interest with fixed terms on Ethereum

DeFi Saver - a one-stop dashboard for creating, managing and tracking DeFi positions across Aave, Compound, Maker, Liquity, and Reflexer

Set Protocol - one of the earliest DeFi protocols yet to launch a token for DeFi asset management, popular for TokenSets and known for powering IndexCoop indexes

Goldfinch Finance - lend permissionlessly to institutional borrowers without collateral

Hop Protocol - become an LP to enable bridging instantly between Ethereum Mainnet, Polygon, Arbitrum, or Optimsm without waiting for long delays in withdrawals; DeFi Dad has a full blown video tutorial on how to become a Hop LP and potentially earn a future HOP airdrop.

Francium - leveraged yield farming similar to Alpha Homora but on Solana, one can choose to simply lend single assets or hold leveraged LPs to potentially earn an airdrop here.

Opyn - one of the OG decentralized options protocols on Ethereum, with major investors that signal a token has to be in their future. Buy/sell puts or call options to earn a possible future airdrop.

Polymarket - one of the strongest players in the DeFi prediction market vertical, bet on an outcome related to crypto, politics, sports and more or add liquidity

Zapper - participate in Zapper trading, lending, providing liquidity, or yield farming; given the Zapper Quests and NFT Rewards program, it can be surmised that if Zapper ever releases a token, this is one way they might do a retro airdrop

Zerion - same can be said speculated about Zerion; if they ever release a token, they’re likely to reward those who interacted with their smart contracts swapping, lending, providing liquidity, or borrowing.

🧑💻 Defiant Starter Tutorial

How to Earn Up to 10% APR Lending to Aave or Compound with Zapper Save

Opportunity: Lend single assets and earn interest + AAVE or COMP rewards

Time to Complete: 10 minutes if paying the recommended HIGH gas price or higher on the Etherscan gas tracker.

Estimated Length of Rewards Program: There’s no start or end date to these lending pools.

Gas + Protocol Fees: Based on gas prices between 100-200 Gwei on Ethereum, it should cost $100-$200 of ETH to deposit. We’re hopeful Zapper will launch lending on Polygon, Avalanche and more in the near future.

Fees: There is no fee taken by Zapper, Compound, or Aave to lend.

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

Smart contract risk in Compound, Aave, and/or Zapper

Oracle failure

Liquidity crisis--if more seniors exited a pool while you were down, you might have no chance to ride out a position in future weeks

Systemic risk in DeFi

Pegged assets such as WBTC or stablecoins could de-peg, which would cause issues for all the collateral deposited in Aave or Compound

Tutorial:

First, I go to Zapper Save and connect my Ethereum wallet (ie MetaMask). Aside from tracking my DeFi portfolio, Zapper also offers helpful tools for participating in DeFi protocols such as Aave and Compound.

Then, I can rank the lending opportunities across Compound and Aave by APY or I can search for a specific token like CRV that I already hold and which to lend.

When I find a lending opportunity, I click Deposit and can choose to either i) deposit with that token (ie CRV into a CRV lending pool) or ii) deposit with another token and Zapper will trade/swap my tokens for the appropriate pool tokens at the best market rate using DEX aggregator APIs like 1inch or Paraswap.

After following the prompts to Approve spending an ERC20 token or simply Confirm depositing ETH, I’ll be able to then track my lending position in my Zapper portfolio

Degen Tutorial: How to Gain Non-Liquidatable 10X Leverage Exposure to ETH/USD

Disclaimer: All opinions expressed by DeFi Dad are solely his own and do not reflect the opinion of 4RC or The Defiant. DeFi Dad disclosed 4RC led the seed round in BarnBridge, in case he has any bias writing about them. This is not an endorsement or recommendation to buy BOND. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

🦍 Defiant Degen Tutorial

How to Get 10x Leverage in ETH/USD With BarnBridge

Each week, we’ll aim to publish a more “degen-level” tutorial for advanced users. It’s important these are always viewed as opportunities uncovered by our team and not recommendations to invest or trade.

Opportunity: This week, due to the crypto market drawdown along with recent demand to hedge against ETH/USD downside pressure, BarnBridge SMART Alpha’s WETH/USD pool has presented a DeFi-native opportunity to get over 10X leverage to ETH/USD. Because SMART Alpha pairs seniors who seek volatility-muted exposure (and hence downside protection) with juniors who seek non-liquidatable leverage exposure, we don’t know the final leverage estimate until Mondays at 10 am EST. At the time of this writing, BarnBridge SMART Alpha for WETH/USD is showing 11.366X upside leverage for juniors. Caution: That number could go up or down before Monday at 10 am EST when the new weekly epoch kicks off and new junior/senior liquidity enters for 1 week lock-up while some other liquidity may exit.

Time to Complete: 10 minutes if paying the recommended HIGH gas price or higher on the Etherscan gas tracker.

Estimated Length of Rewards Program: There’s no start or end date to this opportunity, but the 11.366X leverage could go up (if the pool fills with more senior liquidity) or go down (if the pool fills with more junior liquidity).

Gas + Protocol Fees: Based on gas prices between 100-200 Gwei on Ethereum, it should cost $100-$200 of ETH to participate.

Fees: There is no fee taken by BarnBridge to participate at this time.

Risks: As always, this is not financial advice and you should do your own research. The following are risks I incur when participating in this opportunity.

Smart contract risk in BarnBridge despite audits and a history of no exploits

Oracle failure

Liquidity crisis--if more seniors exited a pool while you were down, you might have no chance to ride out a position in future weeks

Systemic risk in DeFi

Tutorial:

First, I go to the BarnBridge dApp to the WETH/USD SMART Alpha pool here

The deadline to deposit is Monday at 10 am EST so I might choose to wait until 9 am EST on Monday to see how many more deposits have entered and what the estimated exposure for juniors will be.

Let’s assume it’s Monday and I am happy with the 11.366X upside leverage for juniors in the WETH/USD pool and I’m willing to take the risk of paying away my principal to seniors seeking downside protection if WETH/USD goes down in price the next week so I click Deposit.

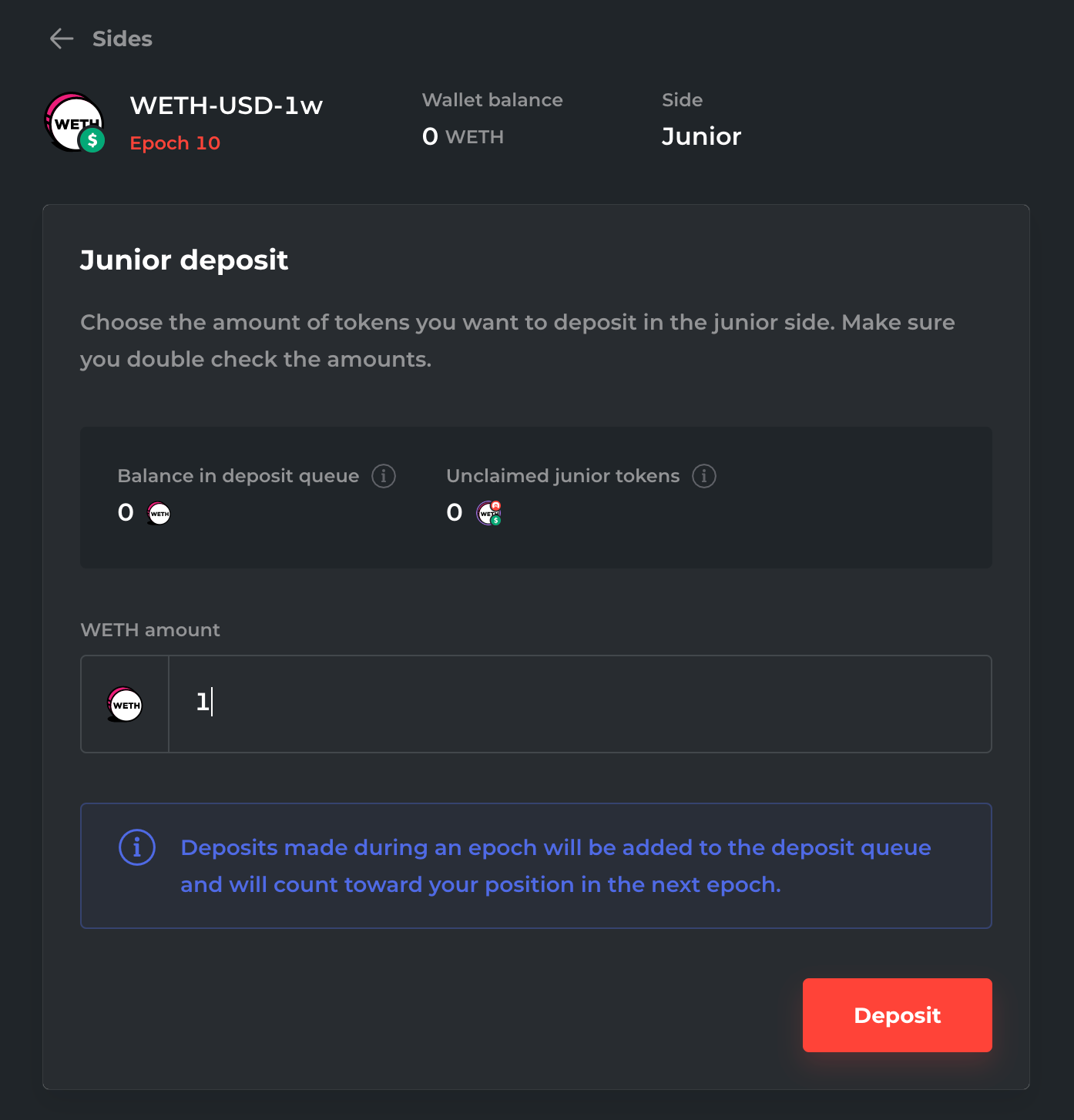

I choose Junior side to get non-liquidatable leveraged exposure to WETH/USD.

I have to already have WETH on hand or wrap my ETH and then choose to Enable (Approve) spending my WETH (1 MetaMask transaction).

I then specify how much WETH to deposit and click Deposit (1 MetaMask transaction).

I’m done! I can return to monitor the performance of my Junior tokens in the WETH/USD SMART Alpha pool in BarnBridge and signal withdrawing my liquidity anytime before 10 am EST next Monday, or choose to let my position continue to auto-enroll week-to-week.

📰 Elsewhere on The Defiant

Ape Diaries: Gasless Yield Farming on Aurora, NEAR’s EVM-Compatible Blockchain: The first yield farm is live on Aurora, an Ethereum Virtual Machine (EVM) compatible blockchain built by NEAR Protocol. The best part? Zero gas fees as a gesture of goodwill to early adopters.

Tuesday Tutorial: This week, Robin covered how Visor Finance allows DeFi participants to utilize NFT Smart Vaults for liquidity provisioning and active liquidity management on Uniswap v3. Learn how and subscribe to The Defiant on YouTube!