DeFi Alpha is a weekly newsletter published every Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader. It aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms.

Motivation

Two years ago, DeFi investors could easily name every yield farming opportunity without much effort. It was a simpler time, when only a handful of teams had launched with any liquidity to trade, lend, borrow, provide liquidity, or even demonstrate new primitives such as no-loss savings by PoolTogether.

But times have changed! DeFi liquidity has grown to hundreds of billions of dollars across Ethereum with new burgeoning DeFi economies taking shape on EVM-compatible chains such as Polygon and Avalanche and non-EVM chains such as Cosmos and Solana. Any given day, a new DeFi or NFT project is launching. So after writing and creating countless DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a more detailed weekly guide on all you need to know to keep up with new and old yield earning opportunities.

This is DeFi Alpha by The Defiant.

Any information covered in DeFi Alpha should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

We are sending this issue to all Defiant subscribers. If you want to keep receiving this newsletter going forward please subscribe here:

🙌 Together with:

Nexo: With Nexo, you can borrow against your crypto at rates starting from 0% APR. Borrow from $50 to $2M in cash or stablecoins and choose one or multiple assets to secure your credit. Get started now!

Hashflow, the first to provide bridgeless cross-chain swaps, lets you trade seamlessly across chains with guaranteed execution, MEV-resistance and the lowest gas fees in DeFi. Try it now!

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC, stablecoins, and other major tokens.

Stablecoins - Earn up to 35.3% APR with oUSDC-oUSDT LP in Meshswap on Polygon

This yield is issued in trading fees + MESH rewards.

To participate, one must deposit into the oUSDC-oUSDT LP here and then stake the LP token.

A step-by-step guide was provided in last week’s DeFi Alpha.

ETH - Earn 33% APY with Yearn’s vault for the Curve stETH/WETH LP

This yield is accrued from trading fees + LDO and CRV sold for profits and redeposited into the LP.

To participate, one must deposit into this Yearn vault.

Note that there are currently some concerns around the stETH peg. Please be aware before depositing assets.

BTC - stake the oBTC-sbtcCrv LP in Convex Finance for 19.9% vAPR

This yield is issued in CRV, CVX, and BOR tokens.

To participate, one must deposit into this Curve LP and stake the LP here.

AVAX - Lend AVAX on Aave using Yield Yak for leveraged lending at 9.2% APY

This yield is issued in AVAX, paid by borrowers on Aave.

To participate, one must deposit into this YieldYak farm.

SOL - Lend SOL to leveraged farmers on Tulip Protocol at 9% APY

This yield is backed by interest paid by borrowers on Tulip.

To participate, one must deposit into the SOL option in the Tulip lending tab.

MATIC - stake MATIC with Stader’s MaticX at 8.53% APY

The yield is backed by validator rewards using a MATIC liquid staking derivative.

To participate on Polygon, check out the Stader MaticX dApp.

ATOM - mint pATOM and stake the pATOMs on Ethereum to earn more pATOMs on pSTAKE at a rate of 12.02% APR

The yield earned is issued and claimable in pATOM.

To participate, one must first mint a 1:1 representation of ATOM as pATOM on Ethereum by using the pSTAKE dApp under Deposit

Then, deposit/stake pATOMs to get stkATOMs and earn 12.02% APR

FTM - stake with sFTMx by Stader, earning 13.5% APY

The yield is issued in FTM rewards, as sFTMX is earning FTM via validator rewards to support Fantom’s PoS network.

To participate, one must deposit FTM to receive sFTMX here on Stader.

HBAR - stake with the first HBAR liquid staking derivative by Stader, earning 50% APY

The yield is issued in HBAR rewards, as HBARX is earning validator rewards.

To participate, deposit HBAR to receive HBARX here on Stader.

Caution: This is in beta and withdrawals will not be possible until July 2022 or later.

🪂 Airdrop Alpha

In each DeFi Alpha guide, we update a list of the most obvious DeFi protocols that have yet to announce and/or launch a token.

Arch Finance - a protocol for comprehensive indices that provide access to differentiated sources of market risk.

Arbitrum - one of the leading L2 solutions for Ethereum with live dApps such as Uniswap, SushiSwap, Hop, and more. A token may be imminent, according to this tweet.

DeFi Saver - a one-stop dashboard for creating, managing and tracking DeFi positions across Aave, Compound, Maker, Liquity, and Reflexer

Francium - leveraged yield farming similar to Alpha Homora but on Solana, one can choose to simply lend single assets or hold leveraged LPs to potentially earn an airdrop here

Hop Protocol - Congrats if you earned the HOP airdrop announced this week! Learn more here.

Jupiter - The leading DEX aggregator by trading volume on Solana

LI.FI - A cross-chain bridge and DEX aggregator protocol

Magic Eden - The leading NFT marketplace by trading volume on Solana

Nested - a crypto social trading platform built on Ethereum and other chains

Optimism - Congrats if you followed our guide betting on a hunch that Optimism would release a token! On Apr 26th, they announced their OP token coming in May with the 1st of 4 retroactive airdrops. Learn more here.

Opyn - one of the OG decentralized options protocols on Ethereum, with major investors that signal a token has to be in their future. Buy/sell puts or call options to earn a possible future airdrop.

Polymarket - one of the strongest players in the DeFi prediction market vertical, bet on an outcome related to crypto, politics, sports and more or add liquidity

Polynomial - A newer DeFi derivatives vault creator, built on Optimism

Set Protocol - one of the earliest DeFi protocols yet to launch a token for DeFi asset management, popular for TokenSets and known for powering IndexCoop indexes

Socket (formerly Movr) - their bridge aggregator Bungee moves assets between chains, finding the cheapest, fastest route

Volmex - Volmex is a tokenized volatility protocol, similar to the VIX but ETHV

Wormhole - a cross-chain messaging protocol known for bridging between Solana, Terra, Polygon, BSC, Avalanche, Fantom, and Oasis

Yield Protocol - a newer protocol for fixed-term, fixed-rate lending in DeFi, backed by Paradigm, one might earn a future airdrop by lending DAI or USDC

Zapper - participate in Zapper trading, lending, providing liquidity, or yield farming; given the Zapper Quests and NFT Rewards program, it can be surmised that if Zapper ever releases a token, this is one way they might do a retro airdrop

Zerion - same can be said speculated about Zerion; if they ever release a token, they’re likely to reward those who interacted with their smart contracts swapping, lending, providing liquidity, or borrowing

zkSync is a Layer 2 scaling solution for Ethereum that uses zero-knowledge proofs to enable scalable low-cost payments. Bridge some assets and do some swaps for a potential airdrop. Guide here.

🧑💻 Defiant Starter Tutorial

How to Earn with IL-Protected LPs on the New Bancor v3

Bancor is one of the oldest original DeFi protocols built on Ethereum. As an early automated market maker (AMM), Bancor helped to pioneer the concept of spot swaps on-chain, before DeFi was even known as DeFi.

Recently on May 11th during this week’s market meltdown, DeFi enthusiasts were welcomed with some good news–Bancor v3 shipped! The new version of Bancor offers some long-awaited improvements to its signature single-side liquidity provisions (LPs).

Back in Fall 2020, Bancor launched single-sided LPs which allowed LPs to earn with guaranteed compensation for any impermanent loss incurred, as long as they remained in the pool for 100 days. These original single-sided LPs had deposit limits and only allowed for certain tokens, but they quickly filled up to capacity thanks to LPs who wished to escape the pain of IL that had long been a challenge to LPs in volatile markets. The popularity of single-sided LPs catapulted Bancor from a once dying AMM with under $100M in liquidity to as high as $2.4B TVL by May 2021.

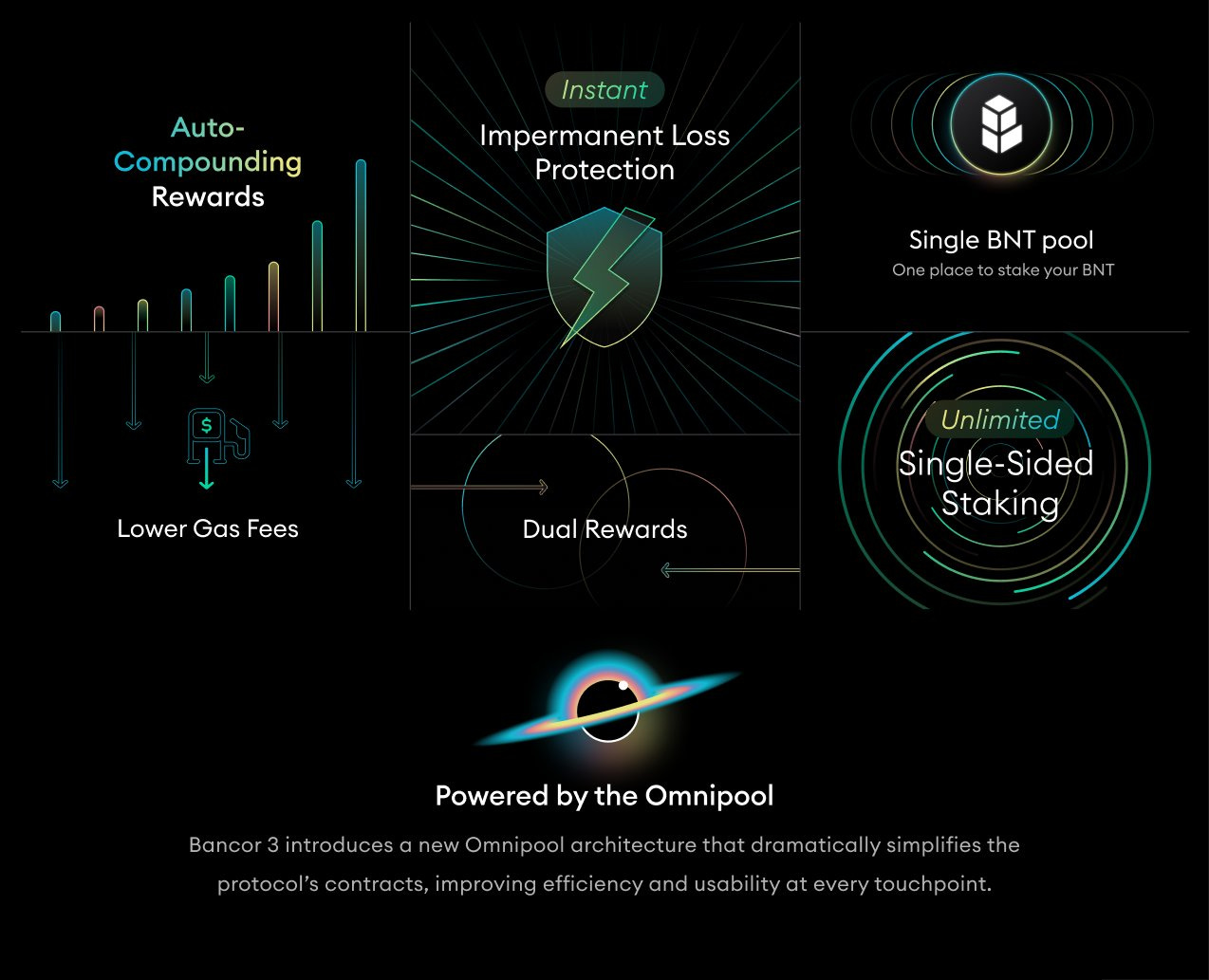

The new Bancor v3 offers several improvements over the previous design for single-sided LPs:

Unlimited single-sided staking, meaning no more capacity limits

Instant IL-protection with a 7-day cooldown, removing the previous 100-day requirement

Single BNT pool staking, compared to the previous version where BNT stakers had to pick and choose where BNT might earn them the highest yield

Auto-compounding rewards, meaning LPs never have to claim rewards as they auto-compound their LP in the pool, and deepen liquidity

Dual rewards, meaning third-party DAOs and/or Bancor can add tokens to pools for new LP mining rewards, while allowing those reward tokens to sit within the same pool, deepening liquidity vs the traditional concept of tokens sitting unused in a separate contracts until LPs claim them

Omnipool architecture allows better gas efficiency, meaning cheaper gas fees for LPs and traders

Today, I’ll show how I am using this first phased launch of Bancor v3 to earn up to 13% net annualized as an ETH LP, by depositing only ETH.

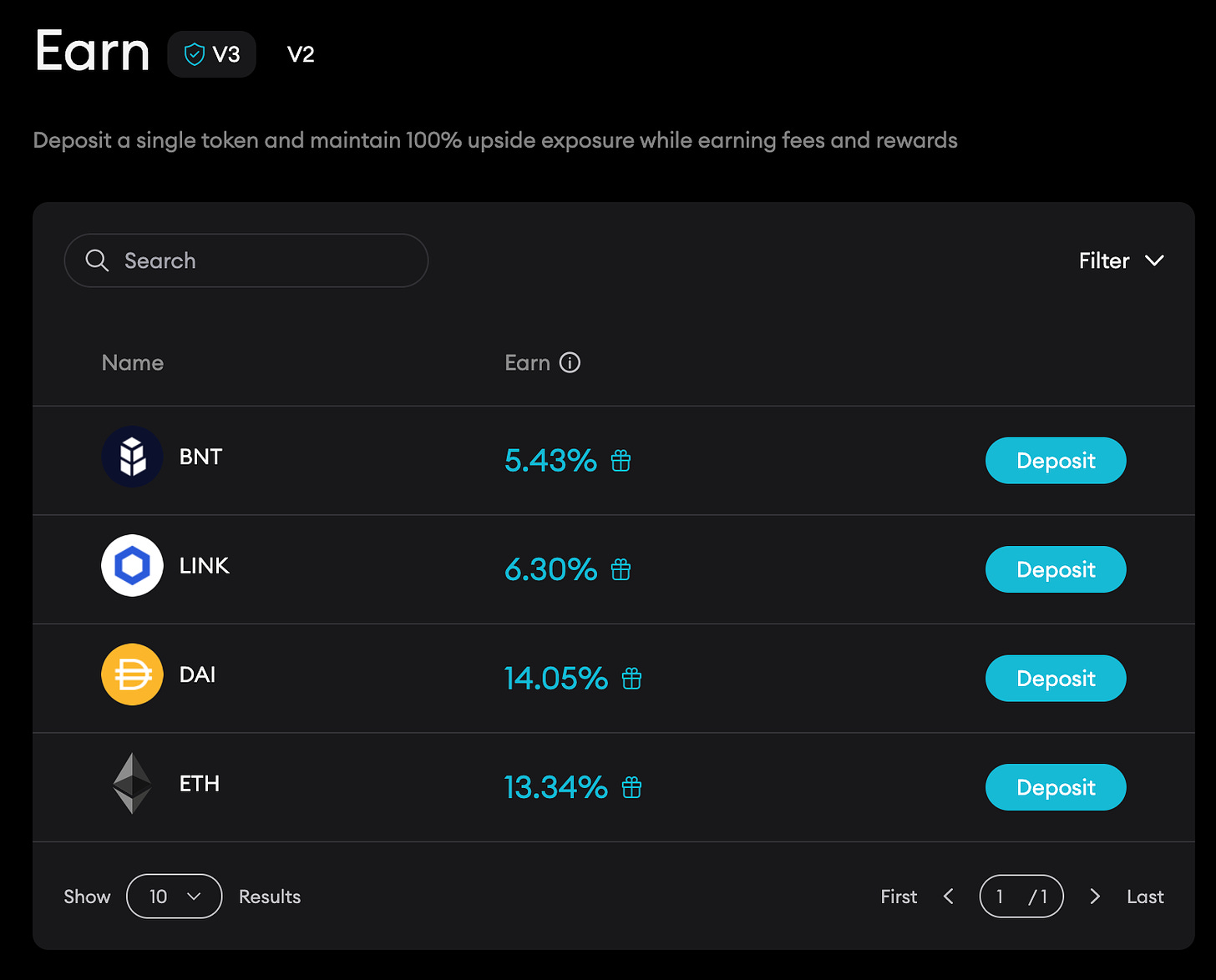

Step 1: First, I go to the Bancor v3 Earn tab and check which of the initial 4 pools I’d like to participate in. Let’s assume I want to earn 13.34% lending ETH as a single-sided LP.

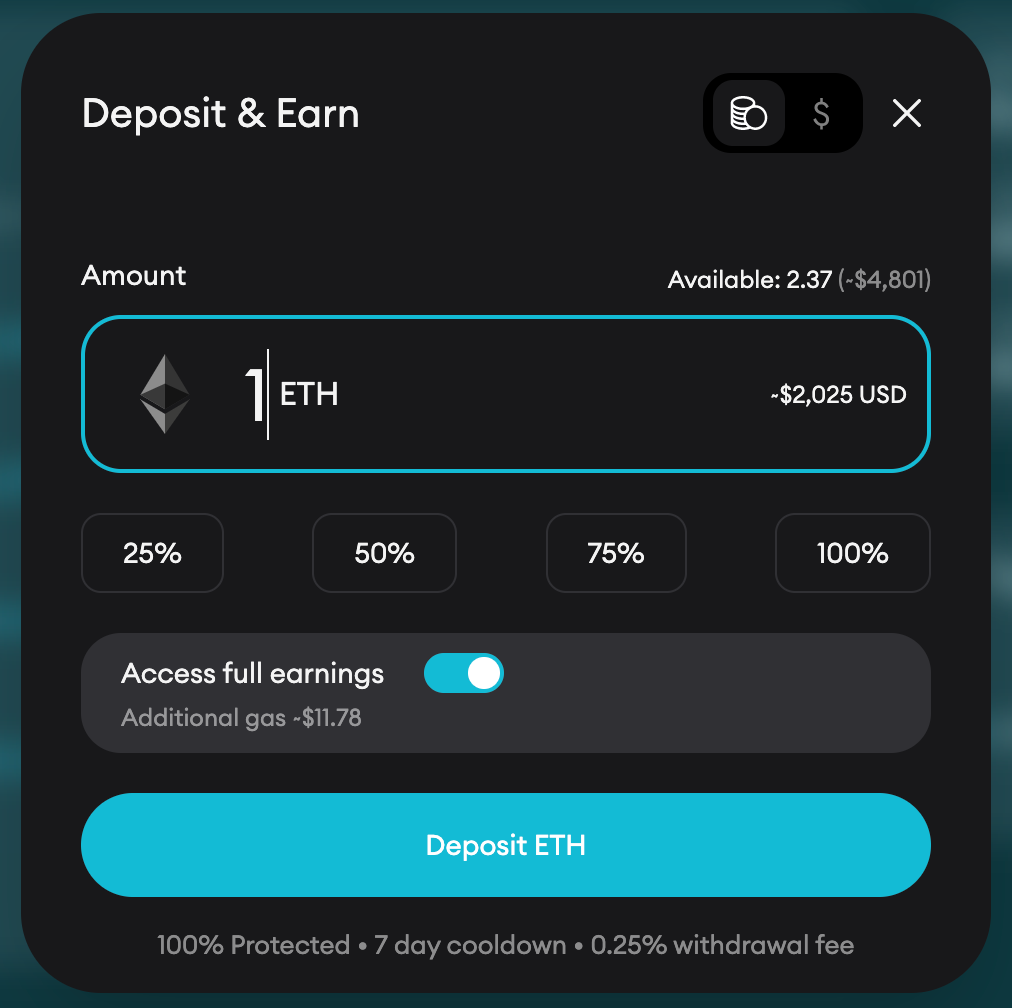

Step 2: Next, I connect my Ethereum wallet in the top right corner.

Step 3: Then, I click the Deposit button next to the ETH option and follow the prompt to specify how much ETH I’ll deposit. (Caution: I note that the withdraw fee = 0.25% and there’s a 7-day cooldown period whenever I return in the future to withdraw my ETH.)

Step 4: I follow the prompts on my Ethereum wallet to confirm the single transaction. At 40 Gwei, I’ll pay about $20-$30 in transaction fees to deposit. That’s it! I can return here in the future to withdraw both my initial ETH deposit with trading fees earned + BNT rewards (minus a 0.25% withdraw fee).

🦍 Defiant Degen Tutorial

Testing StarkNet For A Potential Airdrop

gm degens!

With the markets on shaky footing, I thought it best to avoid degen farms this week. Instead, we’re going to use some StarkNet protocols on the test network in the hopes of qualifying for a future airdrop.

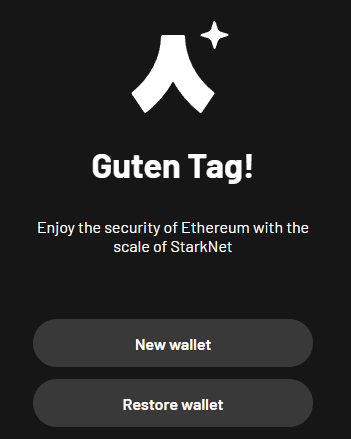

StarkNet is a Layer-2 scaling solution for Ethereum that utilizes zero-knowledge proofs. It was created by StarkWare, an Israeli startup backed by the likes of Sequoia, Paradigm, and Coinbase Ventures. StarkNet has over $1.16B in TVL, 145M total transactions, and includes clients like dYdX, Sorare, and Immutable. MakerDAO recently announced a deployment there.

The network is yet to launch a token and is encouraging users to test out the various protocols being built on it.

It’s completely free, so nobody should have an excuse for missing out if StarkNet does drop a token in the future.

Let’s get started.

Step 1: Set Up Argent X Wallet - StarkNet is not compatible with Metamask, so you’ll need to install Argent X, a browser-extension wallet.

Download the Chrome extension here.

Create a new wallet. You’ll be asked to choose a password.

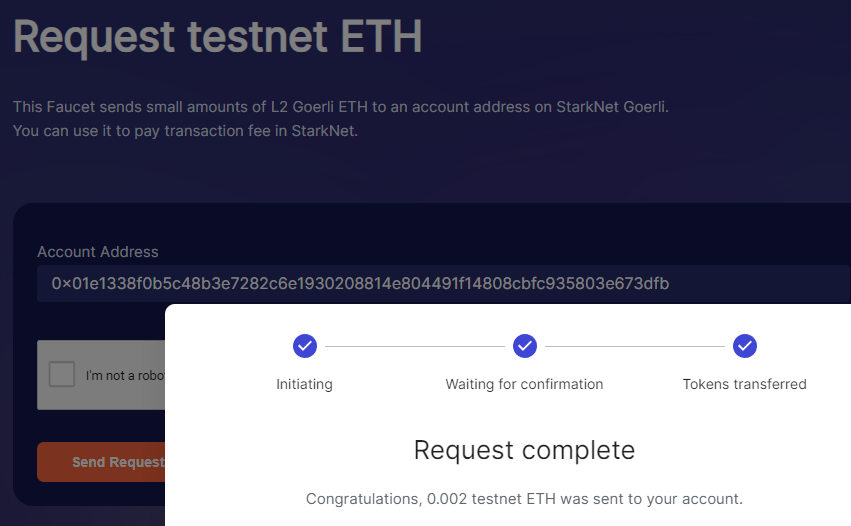

Step 2: Get some Goerli testnet ETH - You’ll need test ETH to pay for gas on StarkNet. Use this faucet.

Step 3: Mint some test tokens on StarkSwap and swap between them.

Faucet: https://www.starkswap.co/app/faucet

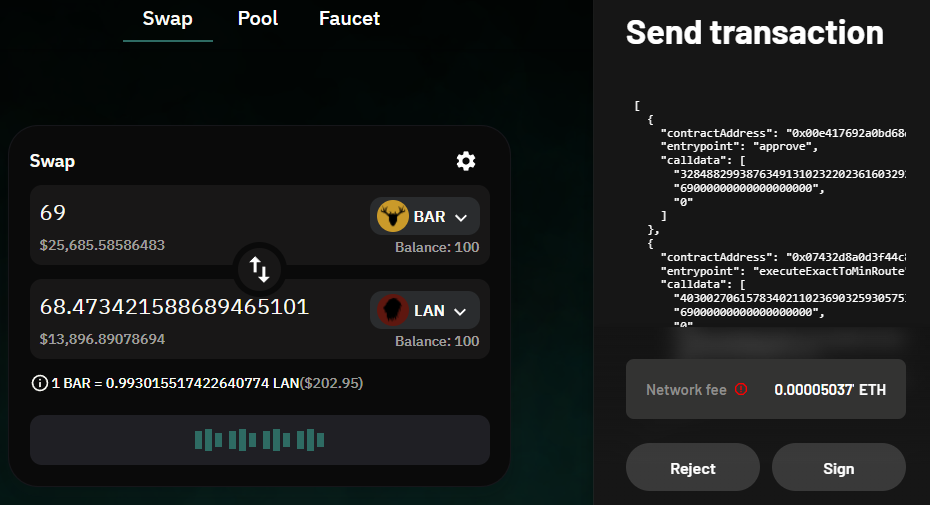

Swap: https://www.starkswap.co/app/swap

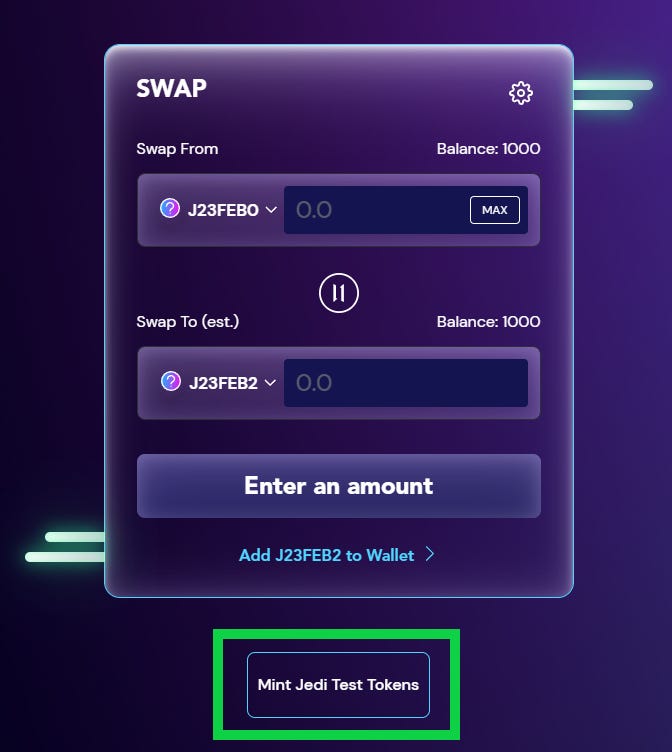

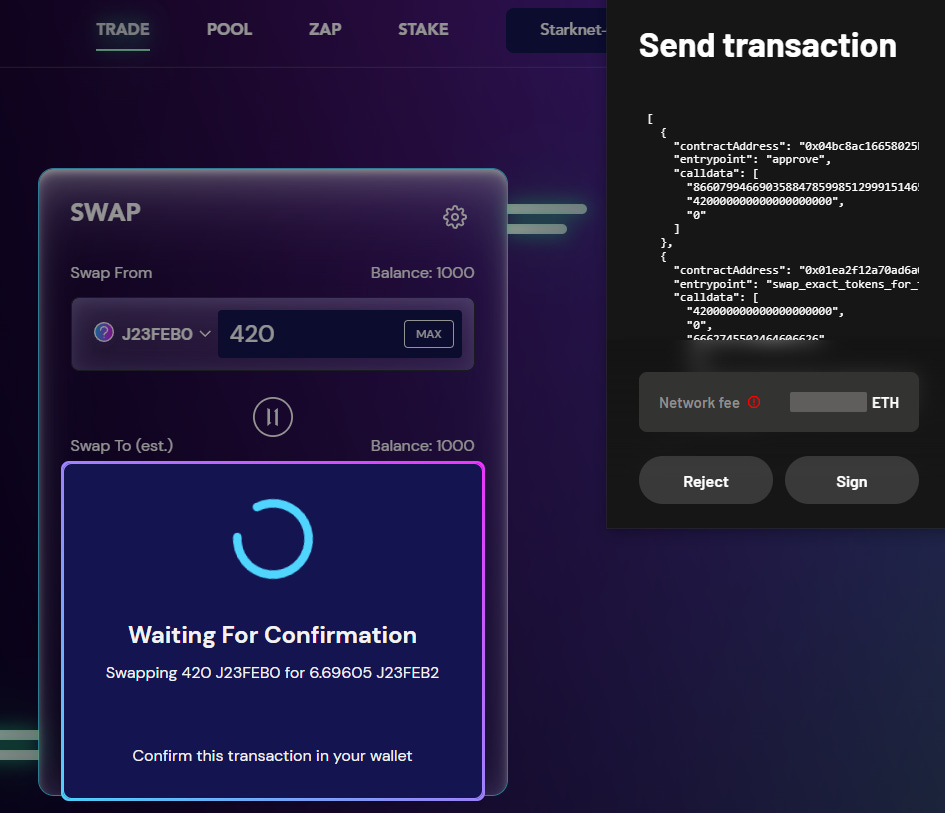

Step 4: Head over to JediSwap and mint some test tokens.

https://app.testnet.jediswap.xyz/#/swap

Swap between the test tokens a few times.

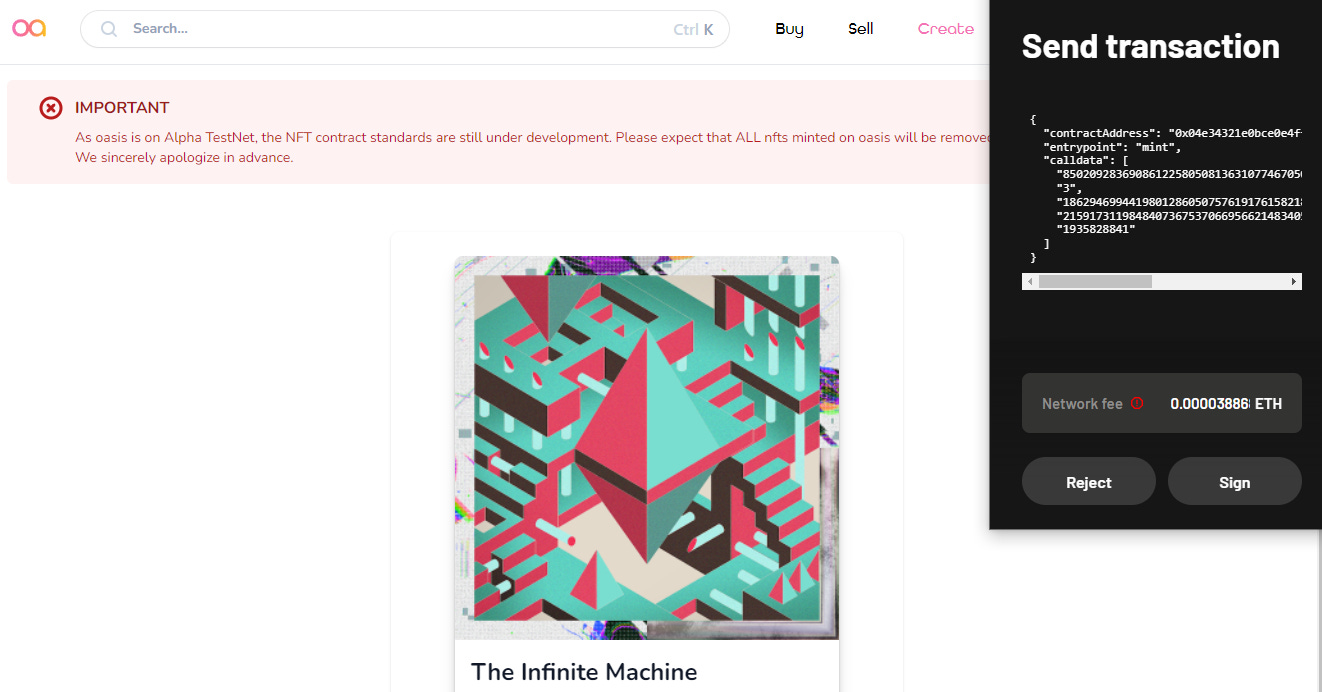

Step 5: Mint an NFT on PlayOasis - You can upload any image and mint it as an NFT.

https://testnet.playoasis.xyz/create

Step 6: Deposit and Borrow Assets on xBank

Xbank is a money market building on StarkNet. Participate in their alpha release by following this guide.

That’s it! Make sure to follow the official StarkWare Twitter account to track and participate in new protocols as they are announced.

Did you enjoy this edition of DeFi Alpha? Click on the button below to subscribe!

The information contained in this newsletter is not intended as, and shall not be understood or construed as, financial advice. The authors are not financial advisors and the information contained here is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided is accurate but neither The Defiant nor any of its contributors shall be held liable or responsible for any errors or omissions or for any damage readers may suffer as a result of failing to seek financial advice from a professional.