DeFi Alpha is a weekly newsletter published every Friday, contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader. It aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms.

Motivation

Two years ago, DeFi investors could easily name every yield farming opportunity without much effort. It was a simpler time, when only a handful of teams had launched with any liquidity to trade, lend, borrow, provide liquidity, or even demonstrate new primitives such as no-loss savings by PoolTogether.

But times have changed! DeFi liquidity has grown to hundreds of billions of dollars across Ethereum with new burgeoning DeFi economies taking shape on EVM-compatible chains such as Polygon and Avalanche and non-EVM chains such as Terra and Solana. Any given day, a new DeFi or NFT project is launching. So after writing and creating countless DeFi guides and tutorials since 2019, we at The Defiant agreed it’s time we publish a more detailed weekly guide on all you need to know to keep up with new and old yield earning opportunities.

This is DeFi Alpha by The Defiant.

We are sending this issue to all Defiant subscribers. If you want to keep receiving this newsletter going forward please subscribe here:

🙌 Together with:

Sperax USD, the FIRST Auto-yield stablecoin on Layer 2, connects you with modern money. Learn more!

Taraxa is a public ledger platform purpose-built for audit logging of informal transactions with upcoming applications in social Web3. Run a Taraxa node to earn top-block producer rewards, or stake with 20% APY!

📈 Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC, stablecoins, and other major tokens.

ETH - Earn 9.41% APR with Instadapp Lite’s ETH vault for leveraging stETH ~3X

This yield is accrued by borrowing ETH against stETH collateral in Aave, then converting ETH to stETH to gain an increased amount of ETH POS staking rewards.

To participate, go to the Instadapp Lite dApp (ETH) to deposit ETH or stETH.

BTC - Curve’s oBTC LP staked on Convex Finance for 9% vAPR

This yield is issued in trading fees, CRV, CVX, and BORING tokens.

To participate, deposit into this Curve oBTC pool.

Then, stake the Curve LP here on Convex under obtc.

AVAX - Lend AVAX on Aave via Yield Yak (on Avalanche) at 7.1% APY

This yield is issued in interest paid in borrower interest.

To participate, see the AVAX lending for Aave here on YieldYak.

SOL - Lend stSOL with Tulip Protocol on Solana to earn 7.68% APY (from Tulip) + 5.8% APR from the underlying SOL staking rewards in stSOL

This yield is backed by interest paid by borrowers on Tulip as well as the 5.8% APR in staking rewards thanks to the liquid staking derivative stSOL by Lido.

To participate, check out the Lending tab on Tulip under stSOL.

LUNA - LP with LUNA-LunaX by Stader in TerraSwap to earn a net ~30.8% APY

This yield is backed by auto-compounding LUNA staking rewards thanks to LunaX by Stader earning 7.45% APY, trading fees on TerraSwap, and 27.1% APY in SD token rewards.

To participate on Terra, deposit 50% of LUNA into LunaX and then go here to TerraSwap to pair 50/50 LUNA<>LunaX as an LP and passively collect trading fees, staking rewards, and claimable SD tokens, without impermanent loss.

MATIC - stake MATIC with Lido stMATIC at 11.47% APR

The yield is backed by validator rewards using a MATIC liquid staking derivative.

To participate on Polygon, https://app.claystack.com/stake/polygon on Claystack.

ATOM - mint pATOM and stake the pATOMs on Ethereum to earn more pATOMs on pSTAKE at a rate of 12.02% APR

The yield earned is issued and claimable in pATOM and this yield is expected to hold steady for weeks/months unless pSTAKE changes their liquid staking model.

To participate, one must first mint a 1:1 representation of ATOM as pATOM on Ethereum by using the pSTAKE dApp under Deposit

Then, deposit/stake pATOMs to get stkATOMs and earn 12.02% APR

Stablecoins - Earn up to 41% APR with a USDC-DEI LP on Beethoven-X on Fantom

This yield is issued in trading fees + BEETS + DEUS tokens.

To participate, one must enter the LP here and then stake the LP (aka BPT) here.

🪂 Airdrop Alpha

In each DeFi Alpha guide, we update a list of the most obvious DeFi protocols that have yet to announce and/or launch a token.

Arch Finance - a protocol for comprehensive indices that provide access to differentiated sources of market risk.

Arbitrum - one of the leading L2 solutions for Ethereum with live dApps such as Uniswap, SushiSwap, Hop, and more. A token may be imminent, according to this tweet. Vote TODAY on Snapshot (no guarantee of an airdrop).

Concentrator - an app for boosting Curve LP yields by harvesting and auto-compounding rewards earned via Convex

DeFi Saver - a one-stop dashboard for creating, managing and tracking DeFi positions across Aave, Compound, Maker, Liquity, and Reflexer

Element Finance - Congrats if you tried Element! They just announced ELFI tokens to claim here.

Edge Protocol - the first money market on Terra, looks like Aave or Compound

Euler Finance - a non-custodial protocol on Ethereum that allows users to lend and borrow almost any crypto asset, just launched but has yet to launch a token.

Francium - leveraged yield farming similar to Alpha Homora but on Solana, one can choose to simply lend single assets or hold leveraged LPs to potentially earn an airdrop here

Hop Protocol - become an LP to enable bridging instantly between Ethereum Mainnet, Polygon, Arbitrum, or Optimsm without waiting for long delays in withdrawals; DeFi Dad has a full blown video tutorial on how to become a Hop LP and potentially earn a future HOP airdrop.

Katana DEX - Farm/stake the AXS/WETH LP or SLP/WETH LP on this forked AMM on Ronin to earn WRON (wrapped RON), so this is a guaranteed reward but for a token not yet trading

Jupiter - The leading DEX aggregator by trading volume on Solana

Magic Eden - The leading NFT marketplace by trading volume on Solana

Optimism - one of the leading L2 solutions for Ethereum with live dApps such as Uniswap, Hop, Synthetix and more, we expect a token to eventually launch so by depositing assets or transacting, one might earn a future airdrop

Opyn - one of the OG decentralized options protocols on Ethereum, with major investors that signal a token has to be in their future. Buy/sell puts or call options to earn a possible future airdrop.

Polymarket - one of the strongest players in the DeFi prediction market vertical, bet on an outcome related to crypto, politics, sports and more or add liquidity

Polynomial - A newer DeFi derivatives vault creator, built on Optimism

Set Protocol - one of the earliest DeFi protocols yet to launch a token for DeFi asset management, popular for TokenSets and known for powering IndexCoop indexes

Socket (formerly Movr) - their bridge aggregator Bungee moves assets between chains, finding the cheapest, fastest route

Terraswap - One of the most popular AMMs on Terra

Volmex - Volmex is a tokenized volatility protocol, similar to the VIX but ETHV

Wormhole - a cross-chain messaging protocol known for bridging between Solana, Terra, Polygon, BSC, Avalanche, Fantom, and Oasis

Yield Protocol - a newer protocol for fixed-term, fixed-rate lending in DeFi, backed by Paradigm, one might earn a future airdrop by lending DAI or USDC

Zapper - participate in Zapper trading, lending, providing liquidity, or yield farming; given the Zapper Quests and NFT Rewards program, it can be surmised that if Zapper ever releases a token, this is one way they might do a retro airdrop

Zerion - same can be said speculated about Zerion; if they ever release a token, they’re likely to reward those who interacted with their smart contracts swapping, lending, providing liquidity, or borrowing.

🧑💻 Defiant Starter Tutorial

How to Earn 80.5% APY with HBAR Liquid Staking on Stader

Disclosure: DeFi Dad wanted to disclose that his team at 4RC invested in Stader Labs. This is not a recommendation or endorsement to invest in any tokens mentioned below. 4RC and DeFi Dad do not hold HBAR but are vesting in Stader’s native token SD.

Stader is a non-custodial smart contract-based liquid staking platform. Launched back in November 2021 to support decentralized liquid staking for LUNA on the Terra network, their LunaX product grew to just shy of $1B in liquidity before the LUNA/USD market correction a few weeks ago. As of this writing, Stader remains the second largest liquid staking protocol in DeFi, behind Lido, with another newly launched liquid staking derivative for HBAR on the Hedera network called HBARX. Having also launched MATIC liquid staking recently, it’s worth noting Stader is building key staking middleware infrastructure for other PoS networks such as Fantom.

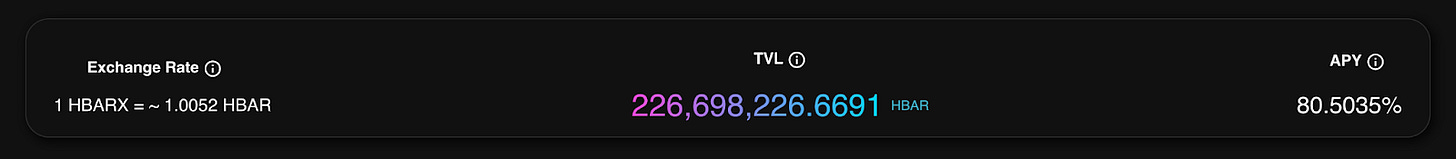

With the current value of HBAR at $0.20 as well as 226,698,226 HBAR staked in HBARX by Stader, we can estimate an annualized yield of 80.5035% APY for HBARX holders. For HBAR holders, I’ll walk through how I might earn yield staking HBAR as HBARX.

Caution: Before staking HBAR, please be aware that unstaking and withdrawals features will not be launched, until the Stader V2 platform goes live, expected around July 2022.

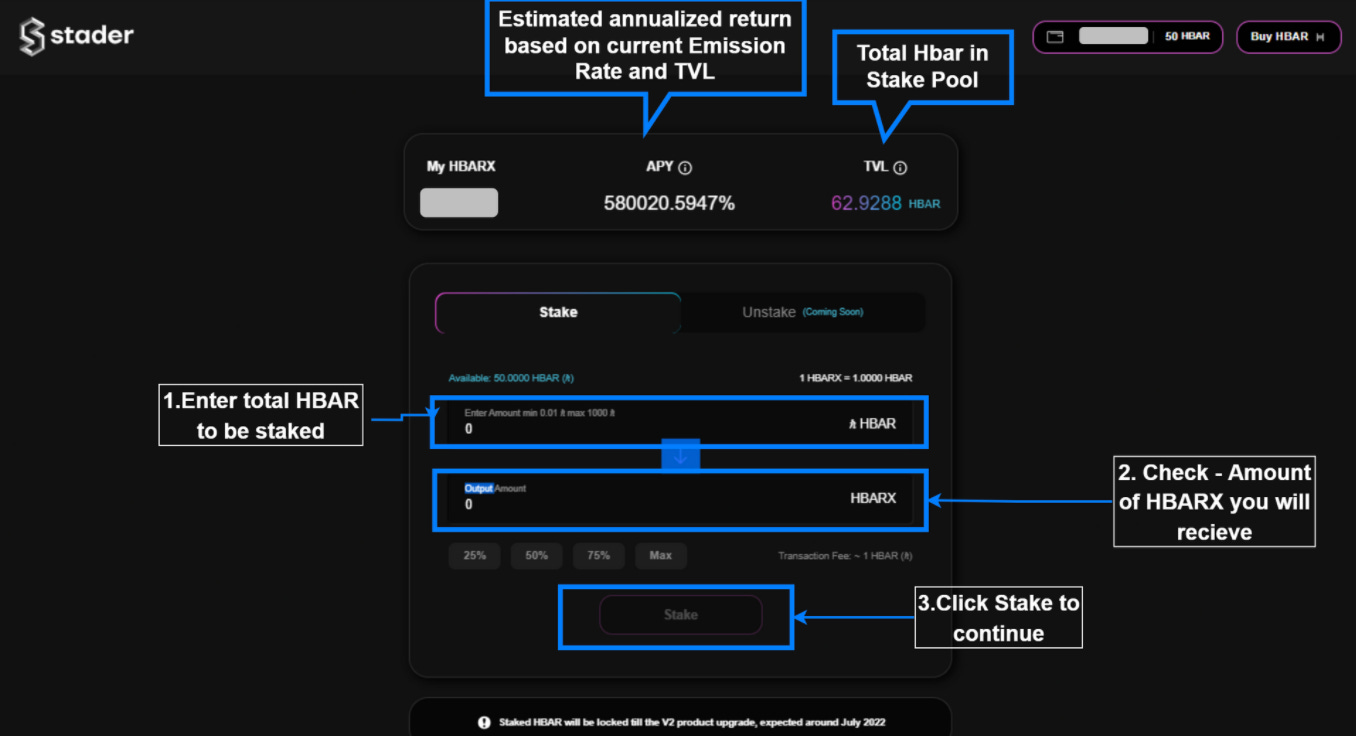

Step 1: First, I will need a Hedera extension wallet for Chrome such as Hashpack. I can download it here. Then I can go to the Stader Hedera HBARX staking dApp here and connect my wallet.

Step 2: Then, I specify how much HBAR to stake and click Stake to continue.

Step 3: Lastly, I follow the prompts on my Hashpack wallet and Approve the transaction to deposit HBAR. Shortly after, the transaction will confirm and the Stader dashboard will update to show my HBARX balance.

That’s it! I’m earning the maximum staking rewards on HBAR liquid staking with HBARX by Stader.

🦍 Defiant Degen Tutorial

Update 4/17: Beanstalk has been hit by a flash loan exploit. Please do not deposit assets!

264% APY on BEAN/3crv LP with Beanstalk

gm degens!

This week, we’re going to look at an algo-stable that’s been gaining traction lately.

Warning: Uncollateralized algo stablecoins carry a far higher risk of de-pegging than incumbents like USDT and USDC. Ape at your own risk.

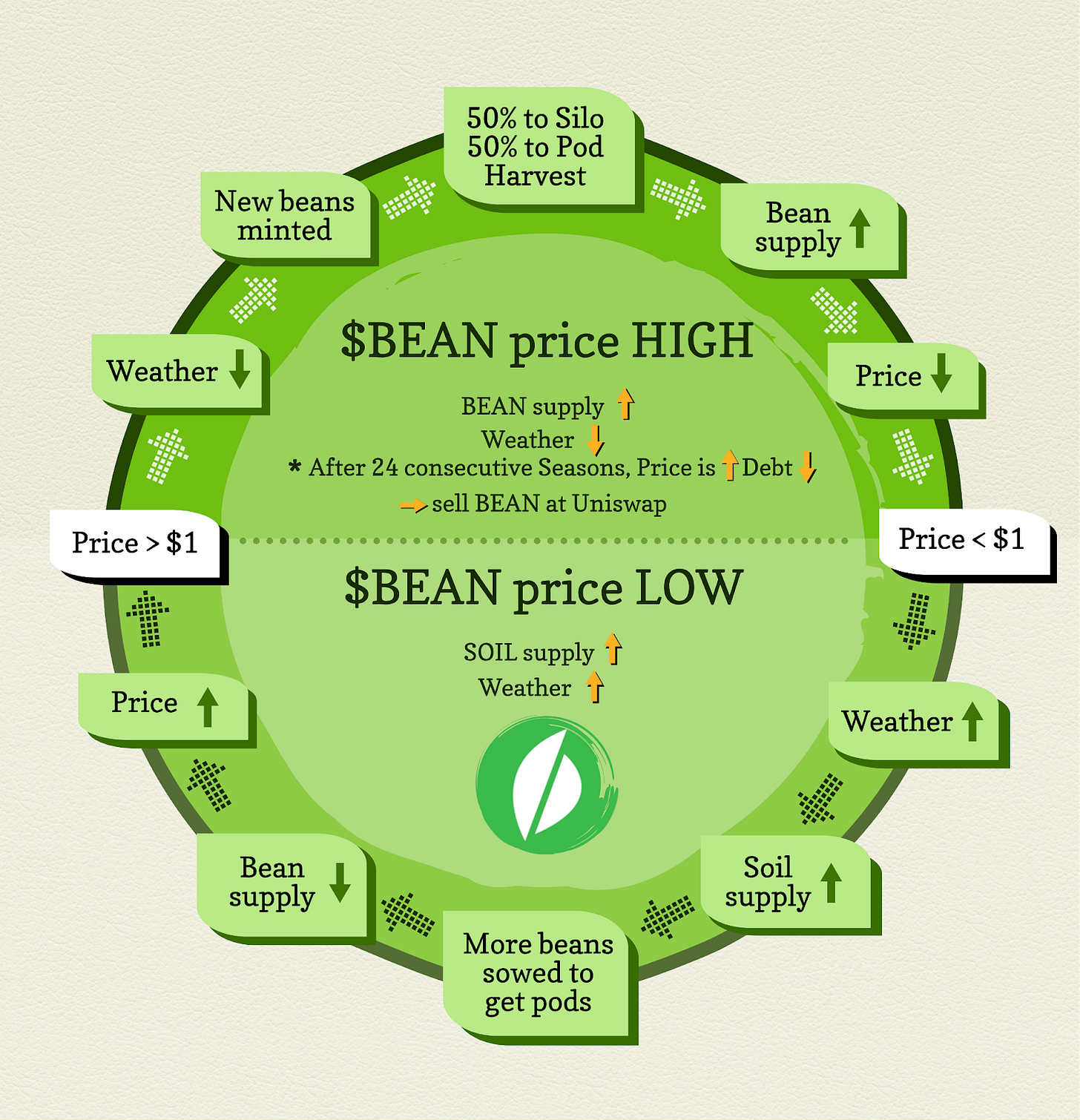

Beanstalk is a credit-based stablecoin protocol that aims to address the scaling limitations of collateralized stablecoins. It’s a refinement on the Basis Cash and Empty Set Dollar models from 2020 and is similarly uncollateralized, relying on financial incentives to maintain its dollar peg.

$BEAN is the stablecoin and $STALK is the seigniorage token that carries governance rights over the protocol. Pods are the debt assets issued by the protocol when BEAN is trading under $1 that incentivize the contraction of BEAN supply and a return to peg.

Farmers who were around for Algo Season 1.0 may recognize the 3-token system that was used by a plethora of ultimately unsuccessful projects. However, Beanstalk has made some major changes that have allowed it to maintain its peg quite well since launching in August 2021.

After the usual initial volatility, it’s successfully gone through multiple debt cycles and recovered its peg. Here’s a diagram of how it works:

By far the biggest change from Basis/ESD is the introduction of a dynamic debt marketplace, where users can trade Pods, the debt asset. A FIFO method is used for debt redemptions, encouraging lenders to act quickly. A comparison to other algo-stables can be found here.

In this tutorial, we’re going to provide liquidity to the BEAN/3crv Curve pool and stake our LP tokens in the Beanstalk Silo. Please review the protocol’s documentation before proceeding.

Step 1: Add liquidity on Curve. You can add any proportion of BEAN/DAI/USDC/USDT. If you’re starting with ETH, swap first using the integrated Uniswap widget.

https://curve.fi/factory/81/deposit

Step 2: Stake your Curve LP tokens in the Silo.

https://app.bean.money/silo/bean-3crv

That’s it! You’re now earning a share of all new BEAN minted. In addition, you will also receive 4 Seeds for every Bean deposited, which earn 0.0004 Stalk every season (every hour).

Note that Stalks and Seeds are forfeited upon withdrawal, and all withdrawals are locked for 24 seasons (1 day).

For further reading, here’s Beanstalk’s most recent roadmap.

We wish you and your families a very Happy Easter!

Disclaimer: Degen farms carry higher risks. Deposit only what you can afford to lose.

📰 Elsewhere on The Defiant

Tuesday Tutorial on The Defiant YouTube: This week, Robin covered everything you need to know to get started on Layer-1 blockchain Near Protocol.

Learn how and subscribe to The Defiant on YouTube!

Did you enjoy this edition of DeFi Alpha? Click on the button below to subscribe!

The information contained in this newsletter is not intended as, and shall not be understood or construed as, financial advice. The authors are not financial advisors and the information contained here is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided is accurate but neither The Defiant nor any of its contributors shall be held liable or responsible for any errors or omissions or for any damage readers may suffer as a result of failing to seek financial advice from a professional.