⚔️ Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community

Hello Defiers! Here’s what we’re covering today:

News

Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community

Messari Data Shows Flipping Airdrops is Twice as Profitable as Holding

Research

Podcast

🎙Listen to the exclusive interview with author Laura Shin in this week’s podcast episode:

Video

Links

Crypto firms under attack for sticking with Russia: Politico

Venture Forward gift launches initiative on blockchain and decentralization of power: Princeton

EBay Shows Investors Digital Wallet as It Explores Crypto and Other Payment Options: Decrypt

Handpicked by The Defiant Team

Crypto Community Relieved by Biden Order’s Balance Yet Wary as Oversight Regime Takes Shape

Polkadot’s Gavin Wood on Building a Layer 0 to Underpin the Entire Blockchain-Based Economy

EXCLUSIVE: Andrew Yang Urges Web3 Community to Rally and Shape Inevitable Regulation

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Verse Network by STP, is a Layer 2 for DAOs. Redefining value one DAO at a time.

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection

Unstoppable Domains, the #1 provider of NFT domains. Own your name on the internet and web3. With no renewal fees you own it for life. Get yours today!

DeFi Disputes

⚔️ Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community

By Samuel Haig

DIVIDED The Terra community is again divided on the future of the network’s leading protocol, Anchor. And the question of how it can maintain high yield payouts is at the heart of the matter.

YIELD Anchor is a decentralized yield protocol allowing users to earn a fixed annual percentage yield of about 20% on deposits in Terra’s native stablecoin, UST. The protocol ran into trouble in early February when a governance proposal called on the Luna Foundation Guard to inject $450M into the Anchor Yield Reserve in order to maintain the high yields.

RESERVE The proposal’s author warned that without the funds, Anchor’s reserve would only be able to support its high yields for roughly two weeks, but predicted that protocol revenues and its forthcoming v2 iteration will render the Anchor self-sufficient from November. The Luna Foundation Guard obliged, and Terra’s LUNA token resumed rallying toward new all-time highs. But questions regarding the sustainability of Anchor continue to linger.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

🧐 Messari Data Shows Flipping Airdrops is Twice as Profitable as Holding

By Owen Fernau

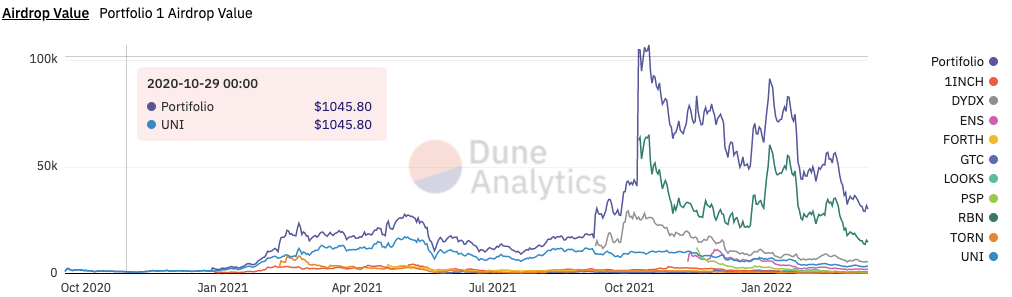

PROFIT It appears that profit-seeking web3 users would have been better off selling their airdrops rather than holding them. A new dashboard developed by Messari data scientist, Yule Andrade, has revealed that selling each of the 10 most significant Ethereum airdrops a week after receiving them would be twice as profitable — or 112.5%, to be precise — as holding them.

DASHBOARD The 10 airdrops included dYdX, Uniswap, LooksRare, Gitcoin, and Ethereum Name Service. Specifically, a user who received the median number of tokens for each airdrop and sold them would have earned $108,393, according to Andrade’s dashboard.

10 AIRDROPS A user who held the 10 airdrops until Mar. 10, would have a portfolio worth $30,349. A user who held the 10 airdrops until Mar. 10, would have a portfolio worth $30,349.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Blockchain Snafus

⚡️ Polygon Suffers Latest Multi-Hour Outage After Node Halts

By Samuel Haig

OUTAGE Polygon, a leading sidechain-based scaling solution for Ethereum, is suffering a multi-hour outage resulting from an issue with one of its nodes.

EIGHT HOURS On March 10, Polygon announced that its network had been experiencing downtime since 5:50pm UTC as a result of its Heimdall node halting. The last transaction successfully processed by the network occurred over eight hours ago as of 2am UTC on March 11.

LAYERS The Polygon team said the Heimdall node is used by one of the two layers of its Proof-of-Stake (PoS) chain for transactions relating to validators and bridging. Polygon is tentatively attributing the node’s outage to an earlier minor upgrade to the network’s state bridging module.

BUG “We suspect there may have been a bug in the upgrade which affected consensus, and caused different Heimdall validators to be on different versions of the chain, thereby not reaching 2/3 consensus,” Polygon said. They added that the Heimdall node will halt by design when consensus is not reached.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Research

🇺🇦 Exclusive DappRadar Report: How Russia’s War and the West’s Response is Impacting Crypto

DappRadar analyzes the global economic impact of Russia’s military aggression, and what it means for blockchain technologies.

SANCTIONS When Russia launched an unprovoked invasion of Ukraine, its neighbor and trading partner, the world reacted in horror and anger. The West, led by the U.S. and the E.U., immediately imposed severe sanctions on President Vladimir Putin’s regime, including barring its access to foreign reserves. The global economy has been impacted with soaring energy and commodities prices, and capital markets are grappling with the uncertainty and long-term effects of Putin’s aggression and the worst military tragedy on the European continent since World War II.

UTILITY The cryptocurrency community, too, has been roiled by this tragedy. Due to blockchain technology’s peer-to-peer nature, there are a number of questions about the utility of Bitcoin and other digital assets in the war zone, and in Russia itself, where ordinary citizens have lost purchasing power as the rouble craters and access to financial infrastructure such as the Swift system.

MACROECONOMIC In this report, we unpack the macroeconomic forces at work and analyze how blockchain-based solutions may come to play an important role as the war continues.

VALUE In a way not seen before, blockchain and web3 are demonstrating their value in contributing to the humanitarian effort to bring aid to Ukrainian refugees, and to providing support to Ukrainian citizens defending their country against the Russian military.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Coming of Age: Indices and the Phuture of DeFi

"Aiming for average" may not seem particularly exciting, but the rise of crypto indices that leverage the power of DeFi indicates at least three developing trends in crypto investing.

Index Funds Indicate Market Maturity

Index funds generated controversy when first proposed. Today, they don't seem particularly new or radical; funds like the Dow Jones Industrial Average are everyday names even to non-investors.

In this vein, the rise of crypto index funds demonstrates a maturing industry. DeFi is still only a small part of crypto - but it’s currently worth over $103 billion with room for growth.

Index Funds Encourage Stability

Aiming for average with an index fund brings much-needed stability to the world of crypto investing. Individual tokens may still be subject to wild swings in value, but larger swathes of the market remain stable. Projects like Phuture encourage stability by automatically rebalancing on the go and by boosting liquidity through token-incentivized programs.

The Phuture of Index Funds

Index funds mark a shift towards passive crypto investment vehicles, tools that open the DeFi and crypto worlds to a broader audience. The Phuture model leverages both approaches, with the goal of launching macro index products that will be relevant for years. The result is a sophisticated, hands-off approach to crypto investing in line with similar approaches to the stock market.

The Tube

📺 SuperMassive NFT Show: Think Bigger: Conscientious NFT Projects

Links

🔗 Former ENS director of operations remains at foundation after voting against his own removal: CoinTelegraph

Brantly Millegan will be staying on as the director of the Ethereum Name Service Foundation after casting more than 363,300 votes against a decentralized autonomous organization proposal to remove him.

🔗 Crypto firms under attack for sticking with Russia: Politico

As more banks and payment systems cut off service to ordinary Russians in response to the conflict, digital asset firms are being forced to navigate the same reputational minefields as traditional financial institutions.

🔗 Venture Forward gift launches initiative on blockchain and decentralization of power: Princeton

Princeton University is launching an initiative on blockchain and its potential to disrupt and redistribute power in society.

🔗 EBay Shows Investors Digital Wallet as It Explores Crypto and Other Payment Options: Decrypt

The CEO of online marketplace eBay, Jamie Iannone, has been toying with the idea of adding cryptocurrency payment options to the ecommerce site for a while.

Handpicked by The Defiant Team

Crypto Community Relieved by Biden Order’s Balance Yet Wary as Oversight Regime Takes Shape Whew! The cryptocurrency community is breathing a sigh of relief after President Biden issued his hotly anticipated executive order for digital assets on Wednesday.

Polkadot’s Gavin Wood on Building a Layer 0 to Underpin the Entire Blockchain-Based Economy Gavin Wood’s crypto journey started with Ethereum – he was one of the eight original founders and the project’s CTO in the early days.

EXCLUSIVE: Andrew Yang Urges Web3 Community to Rally and Shape Inevitable Regulation If there was ever a time when the crypto community believed it would operate unfettered by state rules it’s over. Regulation is coming, and time is running out for DeFi to influence and shape this looming regime.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)